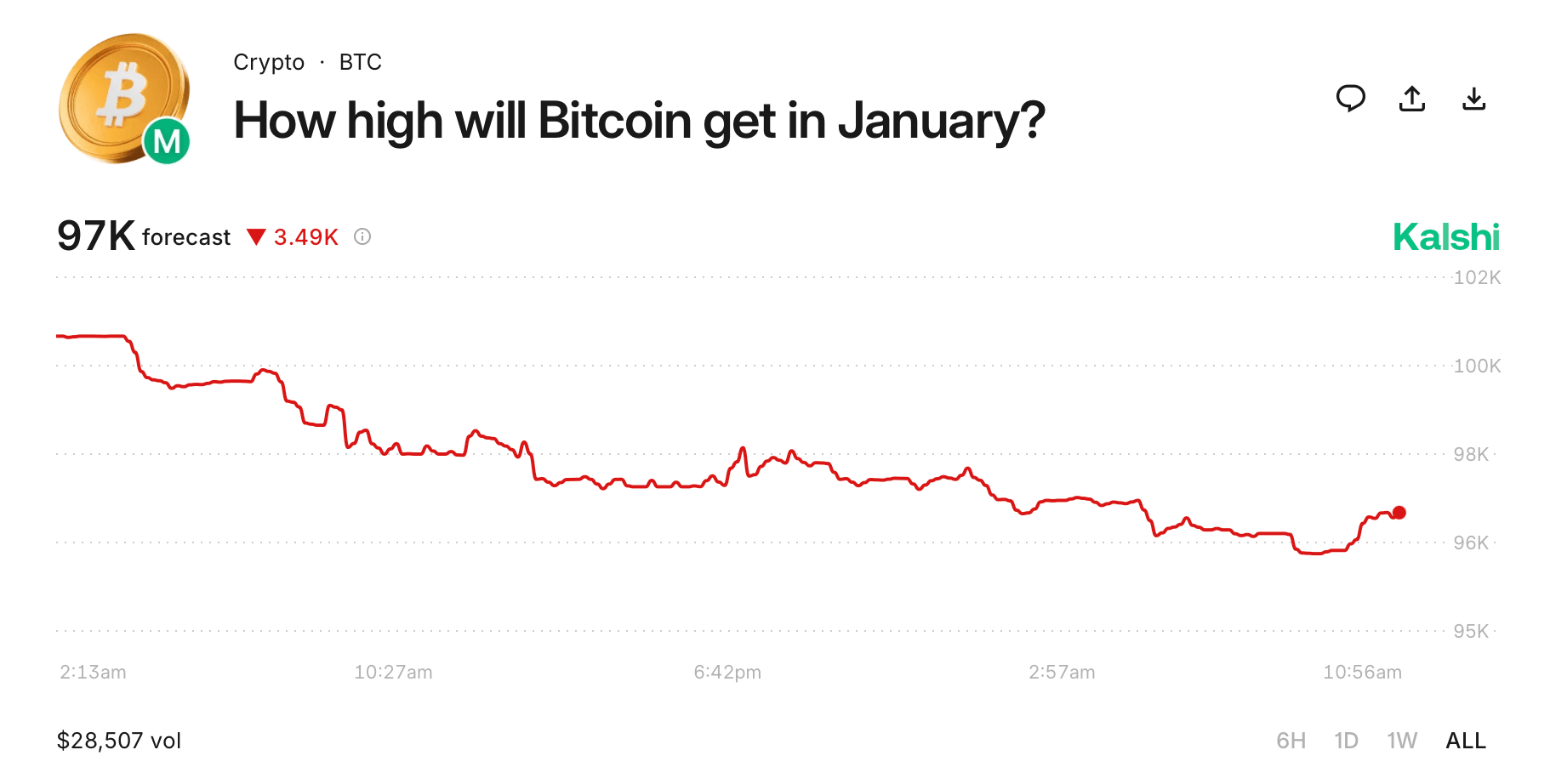

Across major prediction platforms, traders have been steadily dialing down the odds that bitcoin will reclaim—or exceed—key psychological price levels before month’s end. Data from Kalshi, Polymarket, and Myriad show sentiment drifting away from bullish extremes following the latest downside test.

On Kalshi, the probability of bitcoin trading above $95,000 in January currently stands at 64%, down sharply from earlier readings. Odds drop quickly at higher thresholds, with just a 27% chance assigned to a move above $100,000 and a mere 14% probability for prices above $105,000. Levels north of $110,000 are effectively priced as long shots, with implied probabilities hovering in the low single digits.

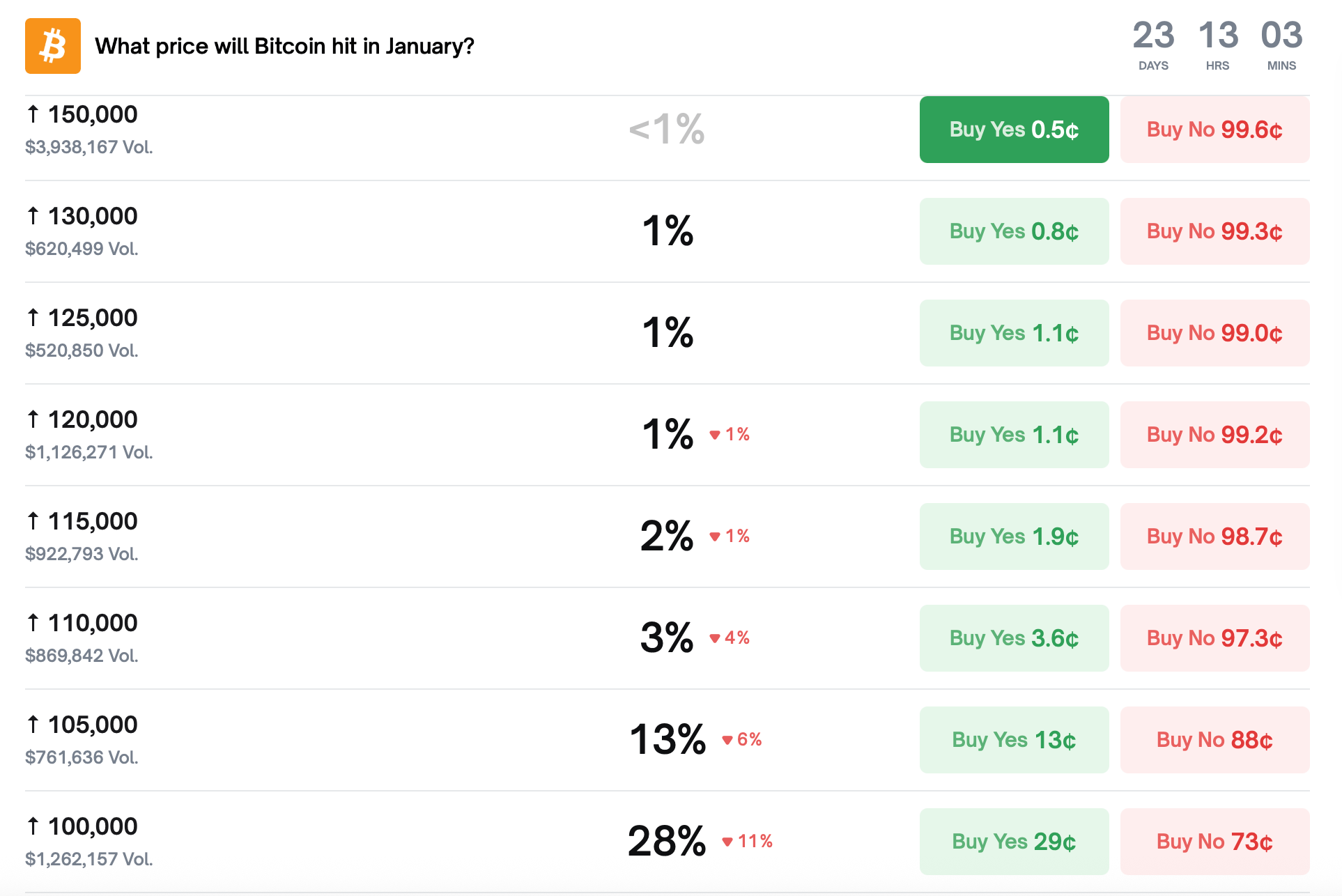

Polymarket’s January ladder paints a similar picture, though with heavier trading volume reinforcing the signal. The platform’s bettors assign a 57% chance that bitcoin reaches $95,000 this month, while the odds fall to 28% for $100,000. Beyond that, conviction fades fast: $105,000 carries a 13% probability, $110,000 sits at 3%, and targets above $120,000 are priced near statistical noise.

Downside protection remains visible, but it is far from dominant. Polymarket data shows a 47% chance that bitcoin trades down to $85,000, while the probability of a drop to $80,000 declines to 22%. Odds of deeper slides below $70,000 shrink into the low single digits, suggesting traders see risk but not panic.

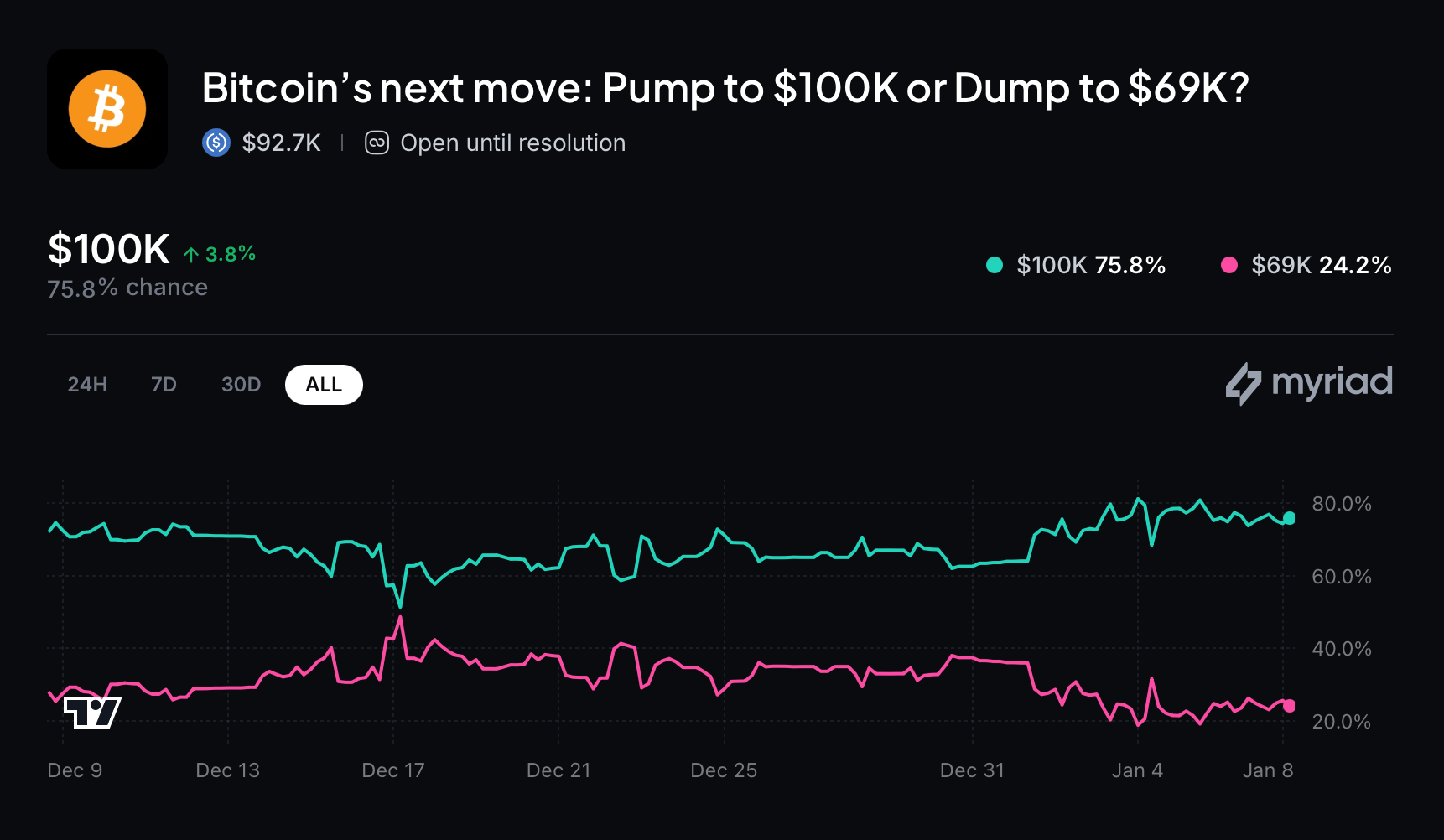

Myriad’s binary framing captures the broader mood shift. Its market asking whether bitcoin’s next decisive move is a push to $100,000 or a drop toward $69,000 currently favors the upside, with roughly 76% probability assigned to $100,000. Still, that figure has softened compared with earlier January levels, mirroring the broader cooling seen elsewhere.

The pullback in probabilities comes as bitcoin struggles to regain traction after losing the $95,000 handle earlier this week. Thursday’s dip below $90,000 briefly tested sentiment before buyers stepped in, but the rebound lacked the urgency that previously fueled aggressive upside bets.

Also read: Babylon Secures $15M Funding From A16z Crypto to Expand Bitcoin Lending

Notably, trading volumes on Polymarket remain substantial across multiple price bands, indicating that conviction is being actively repriced rather than abandoned. The $95,000 and $100,000 contracts alone have attracted millions of dollars in combined volume, highlighting that January expectations are still very much in play.

What stands out is the growing gap between near-term optimism and longer-shot enthusiasm. Traders appear comfortable betting on stabilization or modest recovery but increasingly hesitant to price in explosive upside within the remaining weeks of the month.

For now, prediction markets are sending a clear message: January still has room for bitcoin to rebound, but the runway for dramatic upside is narrowing. With each failed attempt to reclaim higher ground, the bar for belief gets a little higher—and the probabilities a little lower.

- Why are prediction markets lowering January bitcoin odds?

Recent price weakness and failure to reclaim key resistance levels have pushed traders to reprice near-term expectations. - What is the current chance of bitcoin hitting $100,000 in January?

Most prediction markets now place the probability between roughly 25% and 30%. - Do traders expect a major bitcoin crash in January?

Markets assign relatively low odds to deep downside moves below $80,000. - Which platforms track these bitcoin price probabilities?

Kalshi, Polymarket, and Myriad all host active January bitcoin prediction markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。