Original Title: Crypto's Constructive Start to 2026

Original Author: Tanay Ved, Coin Metrics State of the Network

Original Translator: Luffy, Foresight News

TL;DR

· At the beginning of 2026, the crypto market regained upward momentum. Despite escalating geopolitical uncertainties, Bitcoin's price rose to $94,000, and the total market capitalization of cryptocurrencies approached $3.3 trillion.

· The spot Bitcoin ETF reversed the trend of capital outflow at the end of the year on January 5, with a net inflow of approximately $400 million; whale selling behavior has subsided, while retail investors are actively increasing their holdings.

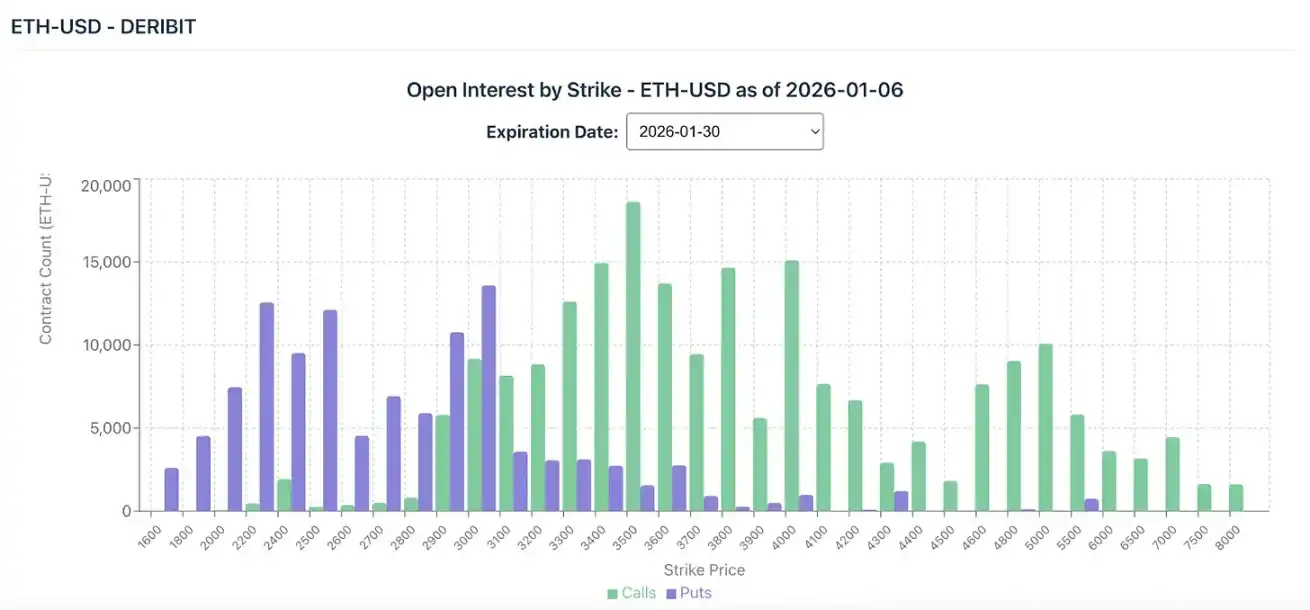

· The derivatives market shows a cautiously bullish stance. As of the end of January, open interest in Bitcoin call options is concentrated at the $100,000 strike price, while Ethereum call options are concentrated at the $3,500 strike price.

A Green Start to 2026

After several weeks of range-bound fluctuations during the holiday season, the crypto market kicked off the new year with strong momentum. Bitcoin's price surged to $94,000, and the total market capitalization of cryptocurrencies neared $3.3 trillion.

Despite the U.S. military actions against Venezuela escalating geopolitical tensions, the cryptocurrency market remained resilient. As the prices of precious metals like gold and silver soared at the end of the year, crypto assets gradually regained lost ground. Additionally, the strength of certain altcoins signaled a warming of market risk appetite; however, due to the evolving geopolitical situation, significant volatility in global markets may still occur in the short term.

Data Source: Coin Metrics and Reference Rates

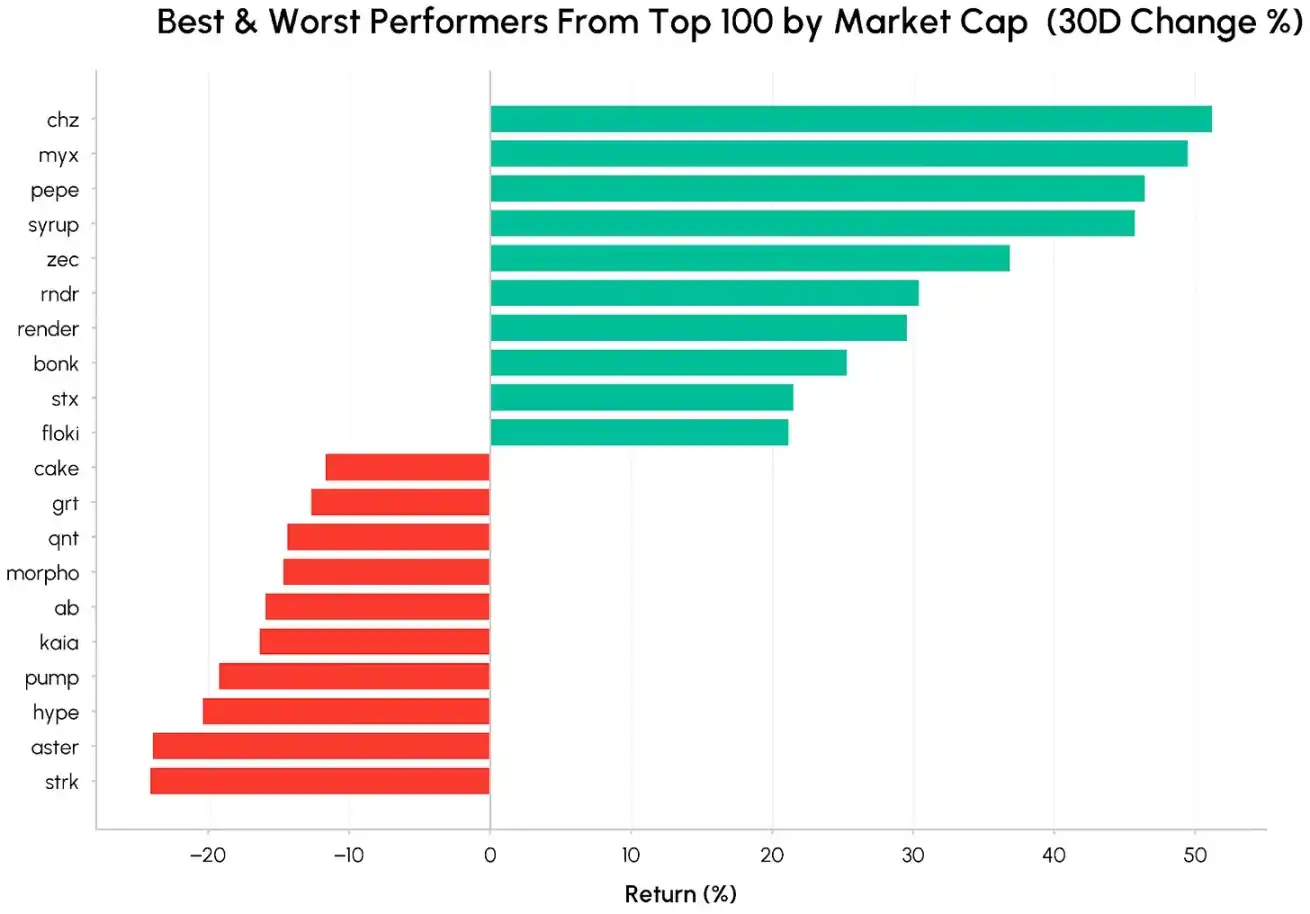

In the past month, standout cryptocurrencies included Memecoins like PEPE and BONK, privacy-focused Zcash (ZEC), and the institutional credit platform Maple Finance (SYRUP). This phenomenon indicates a resurgence of market interest in Memecoins, privacy coins, and DeFi tokens with clear profit-sharing mechanisms and visible cash flow growth.

In contrast, Hyperliquid (HYPE) and Aster (ASTER) underperformed. The reason lies in the market's attention being diverted within the decentralized perpetual contract trading platform sector, following the token airdrop of Lighter (LIT), a decentralized perpetual contract trading platform based on zero-knowledge Rollup technology. During this period, the decentralized lending protocol Aave (AAVE) also saw a decline, as the community engaged in intense debates regarding token holder rights, profit distribution models, and Aave Labs' role within the decentralized autonomous organization, initiating multiple rounds of governance voting. This controversy reflects a broader trend in the DeFi industry: leading protocols like Uniswap and Aave are re-evaluating the pathways for value return to token holders.

Institutional Capital Returns, Whale Selling Cools

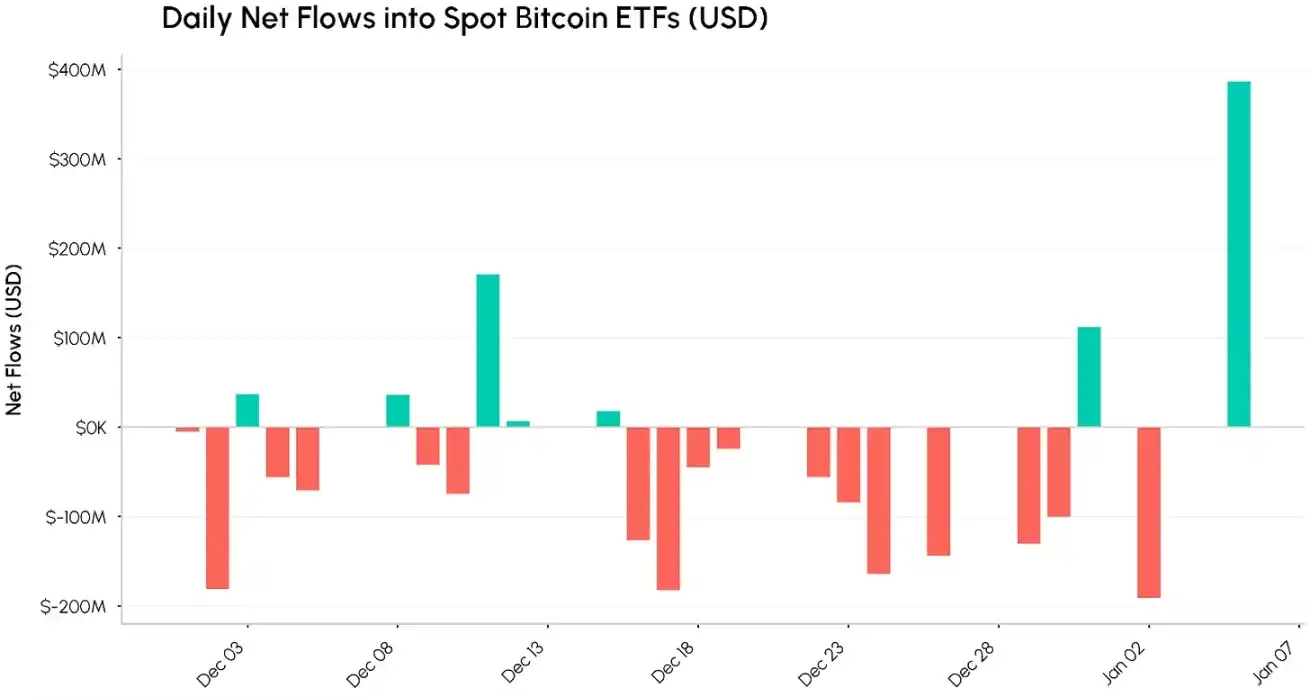

The spot Bitcoin ETF reversed the trend of capital outflow at the end of the year, with a net inflow of over $350 million on January 5, marking the return of institutional capital to the crypto market. In the days surrounding New Year's Day, the spot Bitcoin ETF had recorded over $320 million in net outflows. This trend reversal suggests that as the first quarter of 2026 begins, institutional investors' interest in allocation is warming up.

The scale of institutional crypto asset reserves is also continuously expanding: the U.S. Strategic Bitcoin Reserve added 1,287 Bitcoins, bringing the total holdings to 673,783 Bitcoins; Bitmine increased its Ethereum reserves to 4.14 million, accounting for approximately 3.4% of the total Ethereum supply.

Data Source: Coin Metrics

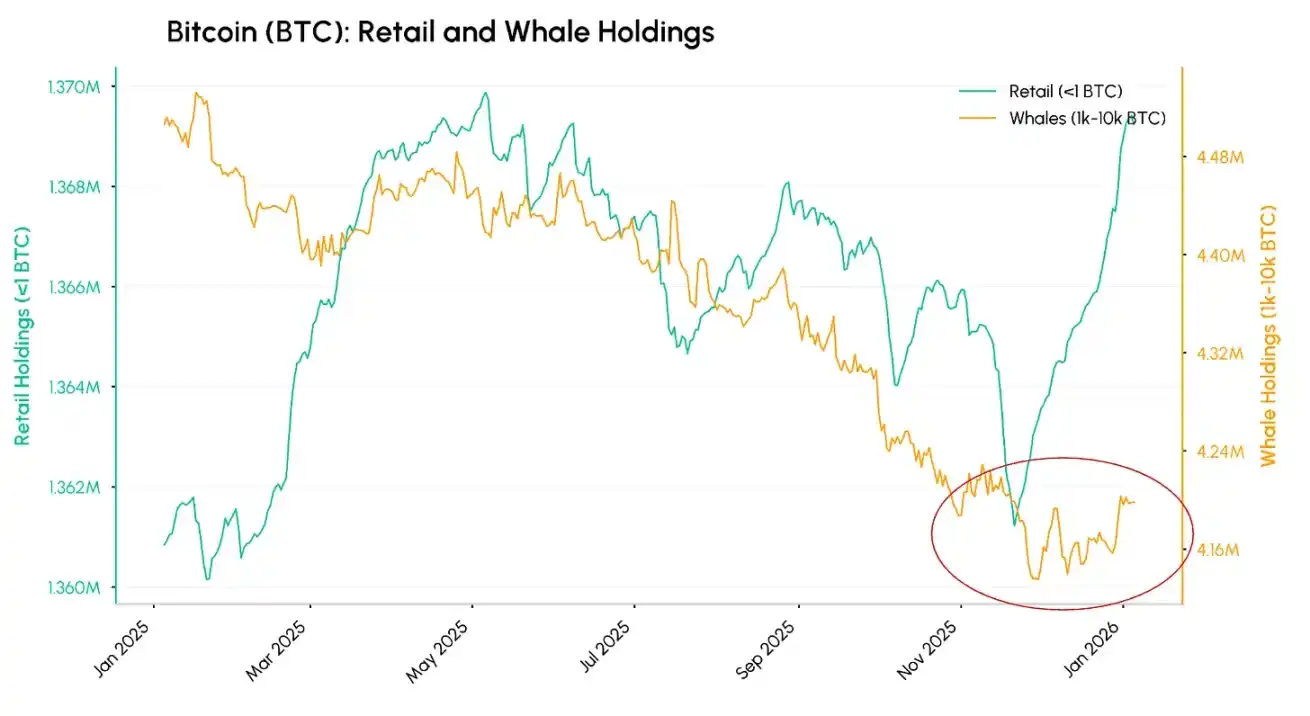

On-chain data shows that since January, the token selling behavior of whale wallets holding 1,000-10,000 Bitcoins has significantly subsided, indicating that selling pressure from this group is weakening. Meanwhile, retail investors holding less than 1 Bitcoin have been accelerating their accumulation since mid-November last year. As cryptocurrency prices have retreated from their highs and consolidated, retail investors are taking advantage of the dips. The reduction in whale selling combined with ongoing retail buying has created a favorable market environment.

Data Source: Coin Metrics

Derivatives Market Signals Cautious Optimism

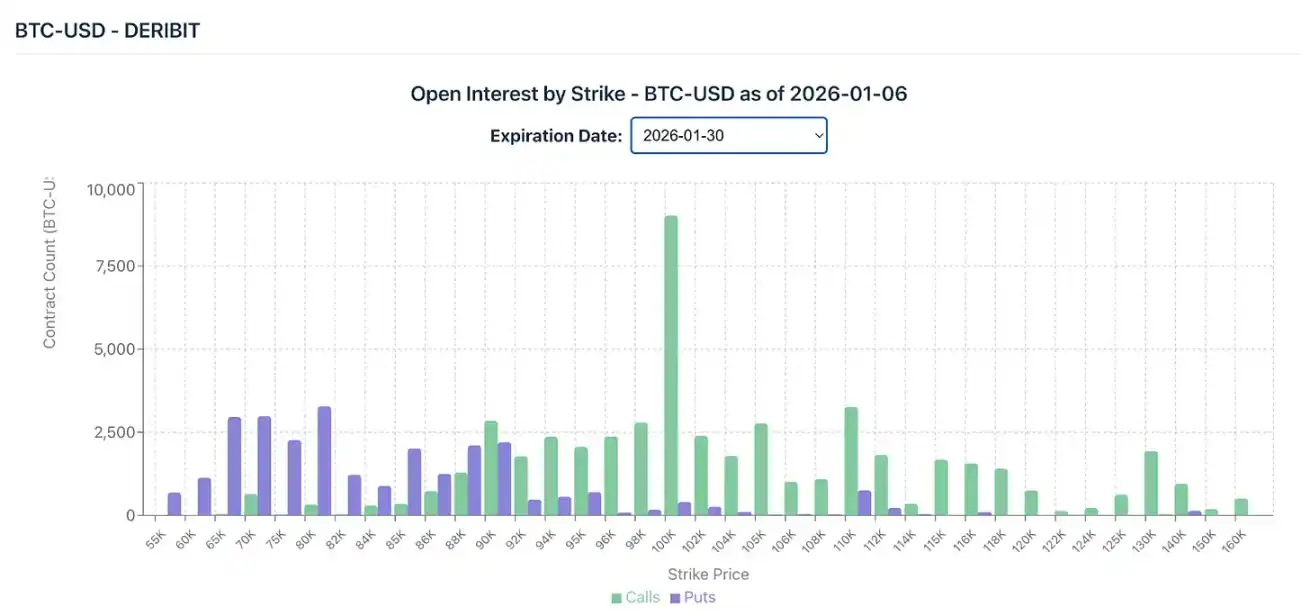

Positions in the derivatives market indicate a cautiously optimistic outlook for the first quarter of 2026. The following two charts display the open interest in Bitcoin and Ethereum options contracts expiring on January 30, 2026, categorized by strike price, visually reflecting the betting direction of options traders on short-term market trends.

Data Source: Coin Metrics

Options market data shows that among contracts expiring on January 30, a large number of open interest in Bitcoin call options is concentrated around the $100,000 strike price, while Ethereum call options are concentrated around the $3,500 strike price. This indicates that traders are betting on short-term upward potential for cryptocurrencies, but without exhibiting excessive exuberance. The market's downside protection mechanism is also in effect: open interest in Bitcoin put options is concentrated between $70,000 and $90,000, with the overall open interest structure still leaning towards the bullish side.

Data Source: Coin Metrics

The futures market conveys similar signals. At the end of the year, the open interest in Bitcoin and Ethereum futures contracts slightly declined but quickly rebounded in January, with the nominal open interest on major trading platforms nearing the highs of December last year. In late December, due to widespread deleveraging in the market, the funding rates for Bitcoin and Ethereum perpetual contracts briefly fell into negative territory; however, they have now returned to positive levels, with Ethereum's funding rate significantly outperforming Bitcoin's. Overall, the market is in a cautiously bullish state, without signs of excessive saturation.

Stablecoin Capital Flows and On-Chain Activity

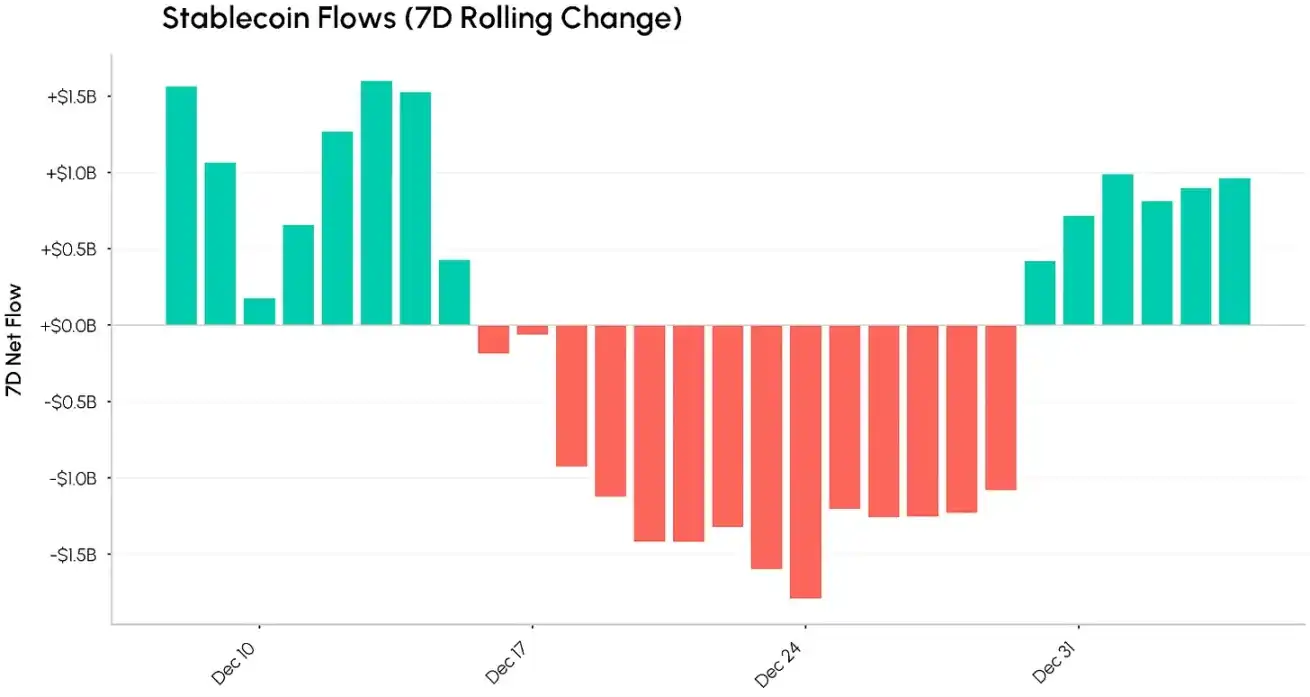

The flow of funds in stablecoins is an important indicator for observing capital inflows and outflows in the crypto market. In early December last year, the stablecoin market recorded continuous net inflows, but as the year-end approached, the flow turned negative, with a weekly net outflow exceeding $1 billion. Entering January 2026, stablecoin capital flows have stabilized and returned to net inflows. If this trend continues, it will provide strong support for the sustained rise of the crypto market.

Data Source: Coin Metrics

On-chain activity data further corroborates the positive market assessment. Following the Ethereum Fusaka upgrade in December last year, the daily transaction volume on the Ethereum mainnet reached a historic high of 2.23 million transactions, with the number of active addresses also nearing historical peaks. Meanwhile, the on-chain transfer volume of stablecoins in December also set a new record, indicating that the funds flowing into the crypto market are not idle but are actively circulating within the ecosystem.

Conclusion

The market data from the first week of 2026 paints a cautiously optimistic picture, as the cryptocurrency market gradually stabilizes. The return of institutional capital, the cooling of whale selling, and the optimistic signals from the derivatives market, combined with high on-chain activity and the return of stablecoin capital to net inflows, collectively support the upward movement of the market. However, it is essential to remain vigilant regarding the geopolitical developments between the U.S. and Venezuela, as they may pose potential risks for triggering volatility in global markets in the short term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。