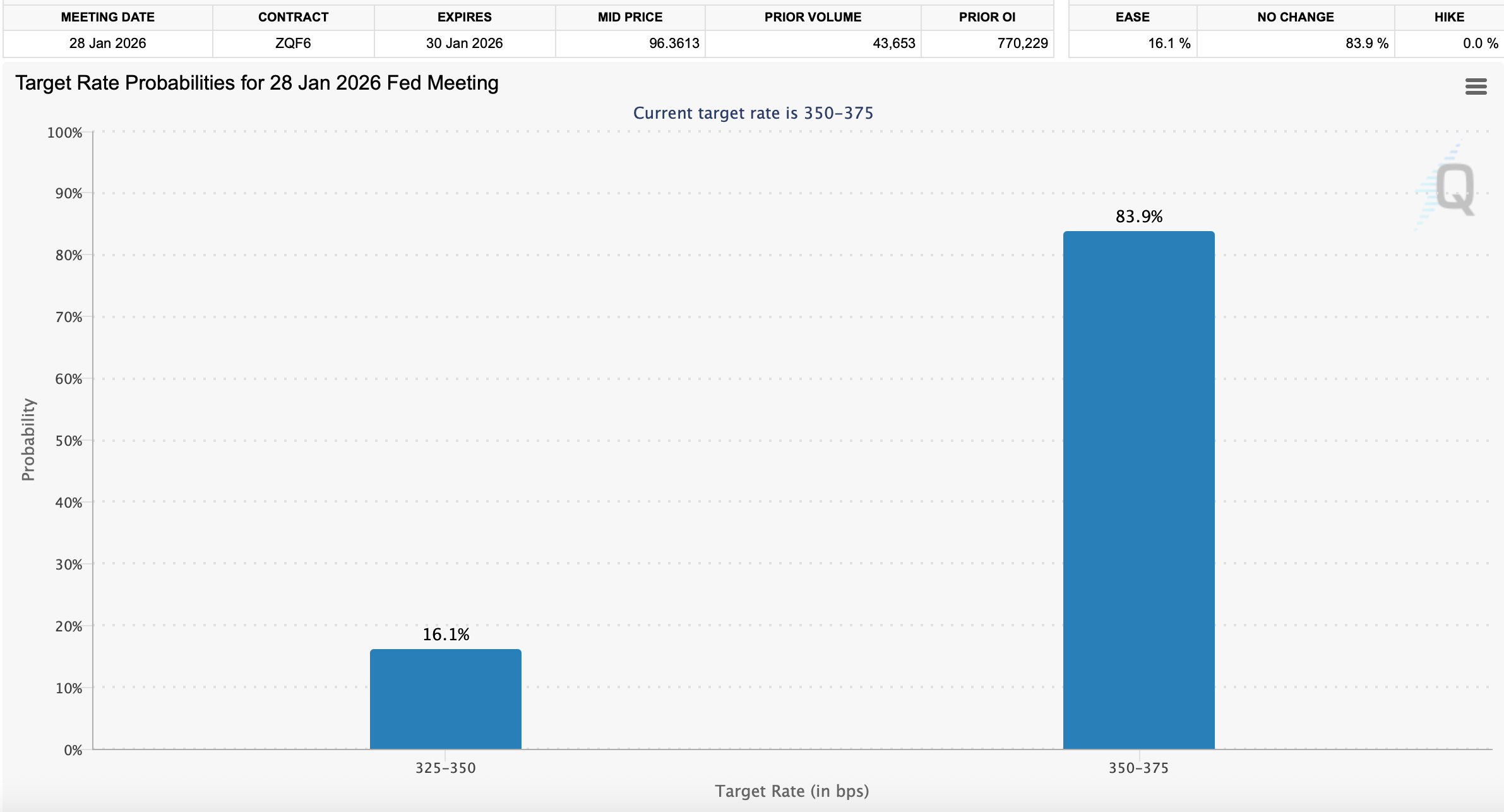

According to CME Fedwatch data derived from federal funds futures pricing, the market assigns an 83.9% probability that the benchmark rate remains unchanged at 3.50% to 3.75% following the January FOMC meeting. Only 16.1% of pricing implies a 25-basis-point reduction, while odds of a hike are effectively nonexistent.

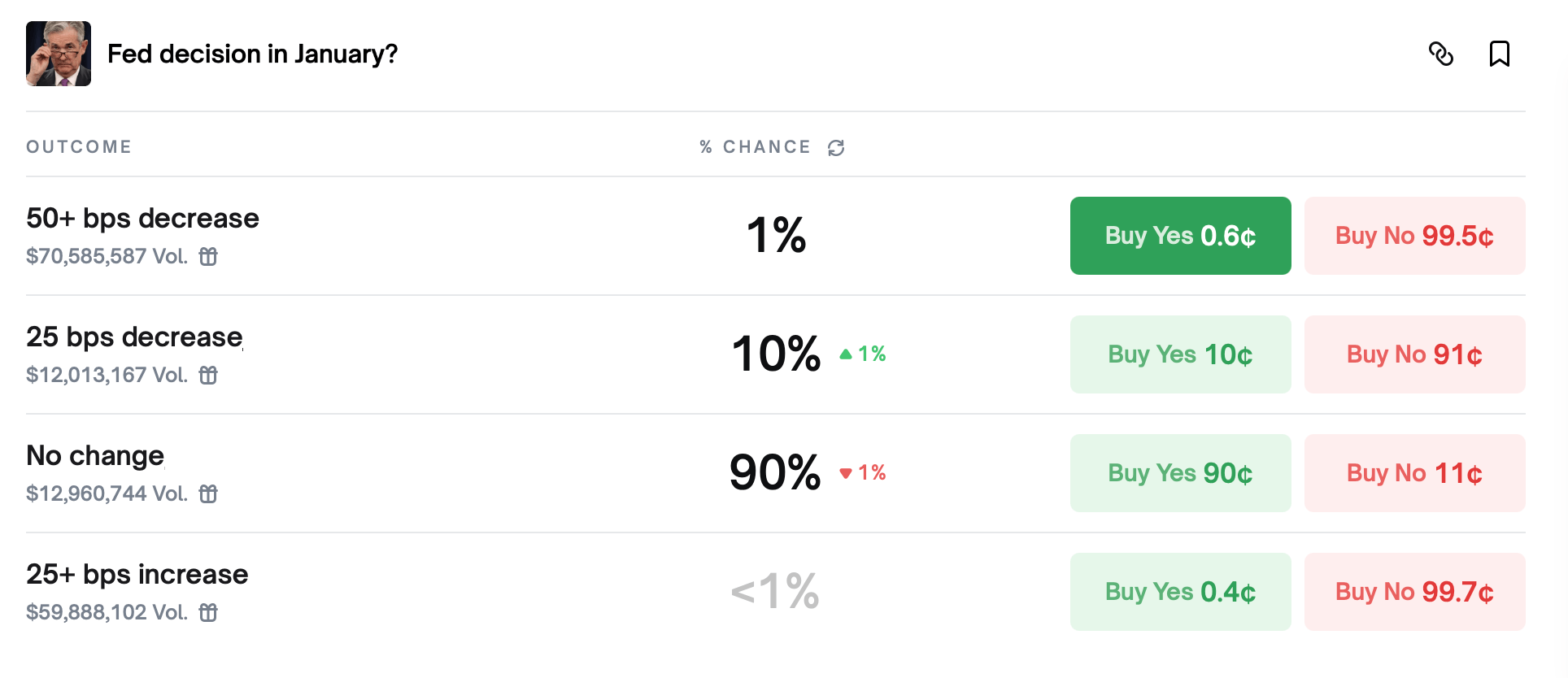

That caution is echoed across prediction markets. On Tuesday via Polymarket, bettors place a roughly 90% chance on no change in January, with just 10% pricing in a 25-basis-point cut and negligible odds assigned to deeper easing. Meanwhile, Kalshi shows a nearly identical distribution, with traders giving an 88% probability to the Fed holding steady.

CME Fedwatch tool on Jan. 6, 2026.

The convergence across futures and prediction markets is notable given how aggressively the Federal Reserve moved late last year. The central bank reduced rates three times in 2025, beginning in mid-September, continuing in late October, and culminating with a December cut that brought the target range down to 3.50% to 3.75%.

That December 2025 decision marked the third 25-basis-point reduction of the year and pushed the federal funds rate to its lowest level since 2022. It followed a late-October cut to a 3.75% to 4.00% range and an earlier September move that formally launched the latest easing cycle.

Markets, however, appear unconvinced that the momentum carries into January. CME futures pricing suggests traders see the Fed pausing to assess the cumulative effects of last year’s reductions rather than extending the cycle immediately.

Political pressure is unlikely to fade. Donald Trump has repeatedly called for continued rate cuts, arguing lower borrowing costs would further stimulate economic activity. The market, at least for January, seems to believe those appeals will fall short.

Fed leadership has remained measured. Jerome Powell and several colleagues have emphasized the need for data confirmation before committing to additional easing, particularly after the series of cuts compressed into the final months of 2025.

Notably, analysis out of the San Francisco Federal Reserve Bank suggests that Trump’s tariffs could, counter to common expectations, exert downward pressure on inflation. On top of that, Federal Reserve Governor Stephen Miran has said he would like to see a full percentage point in rate cuts this year.

Also read: Tether Pushes Fractional Gold Payments With New Scudo Unit

Truth be told, markets have not meaningfully encountered restraint from Powell. “Chair Powell helped orchestrate three 25-basis-point rate cuts in a row. It’s not as if he was standing in the way of the FOMC cutting rates,” Kathy Bostjancic, chief economist at Nationwide, told CNBC’s Jeff Cox this week.

The prediction marketplace Polymarket on Jan. 6, 2026.

The timing matters. January meetings rarely deliver surprises, and traders appear wary of betting against that historical rhythm—especially with inflation trends stabilizing and labor data offering mixed signals rather than urgency.

Volume data reinforces that restraint. CME futures tied to the January meeting show heavy open interest clustered around a hold scenario, suggesting institutional participants are positioned for continuity rather than change.

All in all, the message is clear. While the Fed spent some of 2025 dialing rates lower, markets now appear content to wait. January may be less about action and more about confirmation—confirmation that last year’s easing did its job, or at least bought policymakers time.

For now, the intrigue lies not in what the Fed will do in January, but in how long this pause might last. Of course many suspect that a whole lot more Fed easing is coming to a theater near you.

FAQ ❓

- What does CME FedWatch show for January 2026?

CME futures imply an 83.9% chance the Fed holds rates at 3.50% to 3.75%. - How do prediction markets view the January meeting?

Polymarket and Kalshi both price roughly a 90% probability of no rate change. - When did the Fed last cut rates?

The Fed last reduced rates in December 2025, following earlier cuts in October and September. - Is political pressure affecting market expectations?

Despite President Trump’s calls for cuts, markets expect Fed leadership to stay cautious in January.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。