加密收入并不像看起来那么简单。

成本结构同样重要,因为这揭示了业务的实际健康状况。

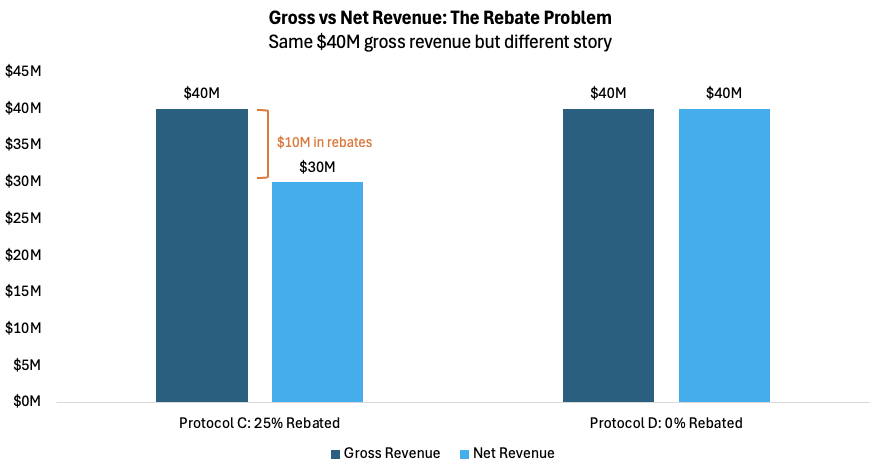

对于永久去中心化交易所(Perp Dexs)来说,市场做市商的返利是大多数人忽视的关键变量。

这些并不是像薪水或服务器成本那样的运营费用,而是直接从总收入中扣除,这意味着这笔钱从未触及协议的资产负债表。

协议A产生了4000万美元的总收入,返利为0%。这意味着有4000万美元可用于再投资、回购、产品开发和应对市场状况。

协议B同样产生了4000万美元的总收入,但返利为50%。这使得可用于上述所有用途的资金仅剩2000万美元。

两个协议报告的“收入”数字相同,但一个拥有双倍的资源来复利和增长。

依赖返利来吸引流动性的协议面临持续的利润压力,因为这些资本往往流向最佳可用利率。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。