撰文:zhou, ChainCatcher

2025年是全球资产市场剧烈分化的一年。

地缘政治冲突、通胀反复、AI技术爆发以及央行大规模买入,推动传统硬资产强势回归,而加密货币则在机构预期与宏观现实的拉锯中承压。

2025年全球前十大资产变化:黄金霸榜、白银崛起,比特币冲高回落

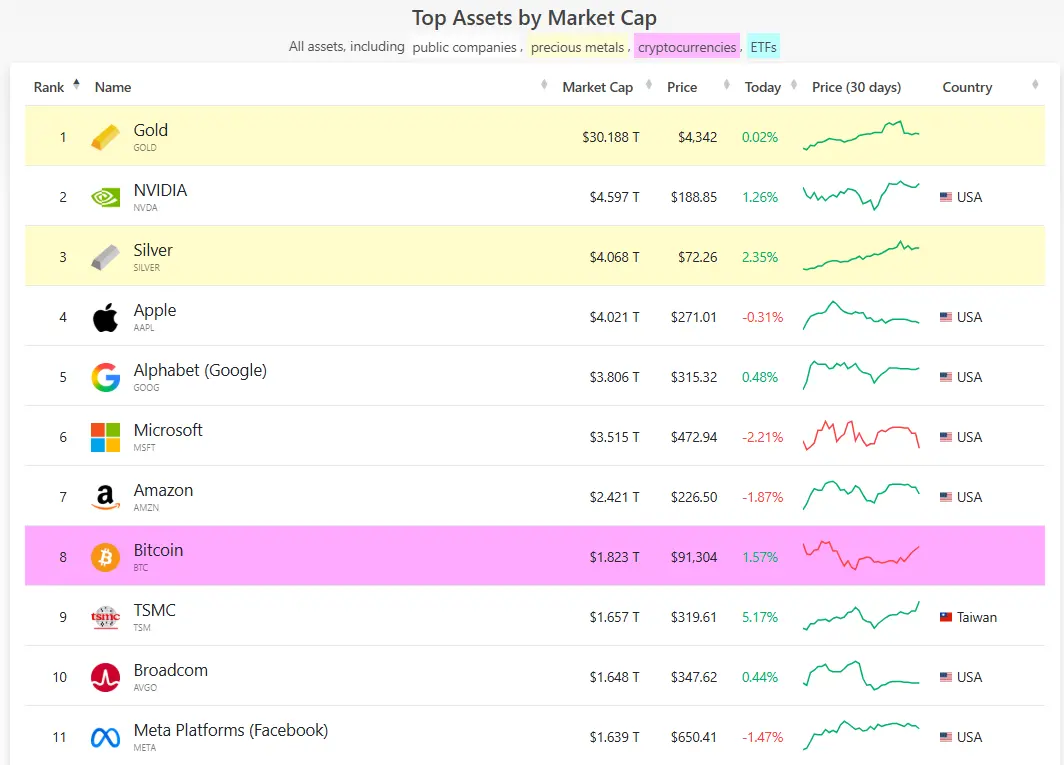

根据CompaniesMarketCap数据,2025年全球前十大资产排名呈现出深刻的结构性调整。黄金以约30万亿美元的理论市值遥遥领先,白银市值逼近4万亿美元并跻身前三。科技股占据了排行榜中段,而比特币市值约为1.8万亿美元,排名滑落至第八位。

硬资产黄金与白银主导全年叙事

作为避险王者,金价从年初2630美元飙升至年末4310美元,超过65%的涨幅创下46年来之最。在央行增持与地缘避险的推动下,其市值几乎翻倍并碾压所有上市公司总和。白银则成为全年最大黑马,价格从年初29美元暴涨至72美元,以150%的涨幅远超黄金。除了避险属性,光伏与AI算力等工业需求的爆发式增长,促使白银从边缘资产强势杀入全球前三。

AI相关科技股强势但进入消化期

英伟达作为芯片龙头市值增长30%达到4.6万亿美元,年内一度突破5万亿美元大关。台积电与博通则受益于算力需求,市值双双从1万亿美元攀升至1.6万亿美元,涨幅均达60%。尽管AI板块整体创下历史新高,但增速趋于稳健,反映出市场对生产力兑现的评估更趋审慎。

比特币冲高回落相对疲软

虽然比特币在年中一度冲上12.6万美元,市值短暂跻身全球前五,但四季度的闪崩与震荡使其年末价格回到8.8万美元附近。全年负8%的回报率,这是比特币首次在减半周期的次年录得负收益。

老牌科技巨头表现稳健但普遍缺乏爆发力

Alphabet凭借Gemini AI的整合录得52%的涨幅,市值升至3.8万亿美元。亚马逊、微软与苹果的涨幅则处于14%至33%之间,尽管它们在搜索、云计算及消费电子领域仍具统治力,但整体增长已显著放缓。Meta凭借Llama模型和社交平台的创纪录互动量,市值增至1.67万亿美元,在年末与博通焦灼竞争第十名。

值得一提的是,在2025年资产排名洗牌中,多家传统巨头被挤出前十。其中,此前凭借减肥药红利领先的Eli Lilly(礼来制药),因AI题材的虹吸效应导致涨幅放缓,滑落至第15名左右。此外,Tesla和Saudi Aramco等公司在年初接近或短暂进入前十,但受EV竞争加剧、油价波动以及科技/贵金属资产爆炸式增长影响,全年排名下滑至前15-20位。这一系列变化凸显了全球资金在AI算力底座与硬资产避险需求之间的结构性偏移。

总体而言,2025年全球资产市场的转折点在于硬资产市值对科技股的压制。科技股在历史高位面临泡沫担忧,而比特币则在高开低走中经历了从狂热到疲惫的转变,成为这一年的相对输家。

比特币表现为何不如往年?叙事从狂热到疲惫

比特币在2025年的表现呈现出典型的先扬后抑。年初在亲加密政策预期、机构ETF大规模流入以及宏观宽松政策的推动下,其价格自9万美元关口起步,并于10月触及12.6万美元的历史高点,市值一度突破2.4万亿美元。

然而局势在第四季度急转直下,一场剧烈的闪崩将价格打压至8.4万美元低点,最终比特币以约8.8万美元收尾,全年录得约8%的负收益。相比于黄金70%和白银超过140%的涨幅,比特币的相对疲软反映出其在复杂宏观环境下的脆弱性。

造成这一表现的原因来自多个维度。

首先,宏观流动性收紧与资金的重新分配压力。下半年美联储降息步伐不及预期,加之日本央行维持加息姿态,导致全球流动性趋紧。资金被迫从高波动资产撤出,流向避险属性更强的黄金、白银或生产力导向的权益市场。同时,比特币与美股的相关性从年初的0.23一路飙升至年末的0.86以上,逐渐失去了其作为独立配置资产的吸引力。

其次,长期持有者的出货与杠杆清算放大了市场波动。2025年老鲸鱼群体创纪录地卖出了160万枚比特币,形成了持续的供给压力。10月10日的闪崩在极短时间内抹去了数月涨幅,引发了衍生品市场的连锁反应。Matrixport指出,自2025年10月阶段性高点以来,BTC与ETH期货未平仓合约规模对应的杠杆已累计出清近300亿美元,过度杠杆化使得市场在暴跌后难以迅速修复信心。

再者,机构采用进度的放缓进一步加剧下行压力。虽然全年比特币ETF维持净流入,但第四季度出现了数十亿美元的资金撤出。企业端的增持力度也显著受限,随着部分持有数字资产的公司(DAT)股价下跌,市场出现阶段性抛售比特币的行为。机构情绪的降温直接压制了岁末的市场表现,导致比特币在2025年未能延续往年的辉煌。

比特币的未来?

尽管2025年比特币录得负收益并打破了传统的四年周期预期,但机构层面的共识依然乐观。市场普遍认为这一年的深度调整是在为未来更可持续且由机构驱动的上涨行情铺路。

随着2026年的到来,全球宏观流动性逐步改善以及监管环境进一步明朗,比特币有望结束当前的震荡期并重返增长轨道,甚至可能挑战新的历史高点。

根据多家媒体汇总,目前公开预测显示Tom Lee、渣打银行(Standard Chartered)和伯恩斯坦(Bernstein)等分析师普遍看涨,但也存在分歧。

主流目标价多落在14万至17万美元附近,例如:

J.P. Morgan基于波动率调整的金比模型,推算出约17万美元的理论公允价值,认为比特币仍有显著上行空间。

Standard Chartered和Bernstein将2026年底目标设定在15万美元左右,强调ETF流入、企业国库采用放缓后的结构性支撑,以及机构资本的长期流入将主导周期。

Grayscale将2026年定义为机构时代的黎明,预计比特币将在上半年创下新历史高点,终结传统四年周期,转向由持续机构需求驱动的稳健上行。

Bitwise认为ETF将吸收超过新供给的100%,进一步强化价格支撑,并预测2026年将属于多头。花旗给出的基线情景为14.3万美元,牛市情景可达18.9万美元。

在这些主流观点之外也存在更为激进的视角,例如Cardano创始人Charles Hoskinson预计比特币价格可达25万美元,理由是比特币固定供给与机构需求持续增长将产生强大推力。

然而,市场中也存在显著的看空声音。Bloomberg Intelligence的Mike McGlone最为悲观,他认为在通缩的宏观环境下,比特币可能回落至5万美元甚至1万美元,并特别强调了投机资产面临的均值回归风险。

Matrixport则认为2026年将是高波动的一年而非平稳的趋势。受美联储领导层更替、劳动力市场疲软以及选举年政策风险的影响,市场将迎来密集的风险事件窗口。该机构提醒投资者需要保持灵活性并主动管理仓位,在关键政策事件前后精准把握市场敞口。

总体而言,尽管预测数据存在明显分歧,但主流机构普遍认同2026年将是比特币的结构性反弹之年。ETF作为永久性需求引擎、监管清晰化以及企业/机构配置加速,将成为核心催化剂。短期内,比特币价格可能在8万至10万美元区间筑底,但随着宏观转向和资金回流,向上突破的概率正在显著增大。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。