Author: Xiao Jing, Tencent Technology

Editor: Xu Qingyang

The recently concluded year of 2025 witnessed an unprecedented "tech ice and fire show" in the capital markets.

On one side, the newly listed tech darlings saw their stock prices plummet like kites with broken strings. Once hot star companies experienced a market value evaporation of tens of billions of dollars within months, with many suffering declines exceeding 50%. The "chill" in the market quickly spread, causing a large number of planned IPOs from star companies to be postponed repeatedly out of fear.

On the other side, the "eagerness" of capital burned fiercely.

A brand new "trillion-dollar club" is gathering outside the doors of the capital market. From Elon Musk's space empire SpaceX to Sam Altman's OpenAI, and the poised Anthropic, these giants are preparing for the largest super IPO in tech history, with valuations reaching hundreds of billions to trillions.

Cold and hot, disillusionment and celebration, retreat and advance.

This tempering of ice and fire marks the beginning of the market's return to rationality, or is it the prelude to extreme polarization of capital? The bell for 2026 has already rung; will the logic behind this "ice and fire" continue, and has the future flow of capital already changed?

01. Review of 2025 Tech IPOs: The Cold of Price Drops and Crashes

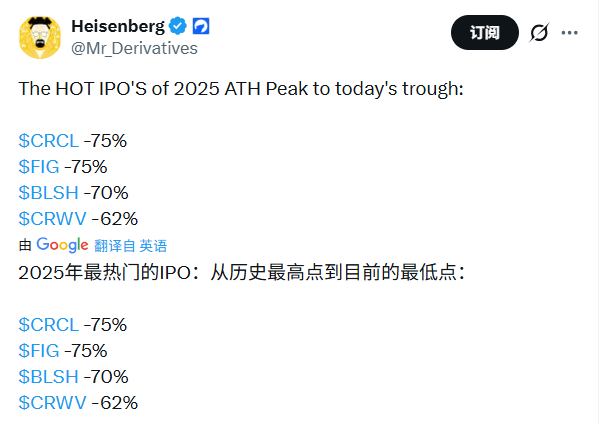

In 2025, although there were signs of recovery in the number of tech companies going public (about 23, a significant increase from 2024), the overall performance was bleak: more than two-thirds of companies saw their stock prices fall below the issue price, with a median decline of 9%, significantly underperforming the nearly 18% rise of the S&P 500 during the same period.

However, after a brief frenzy, tech stocks fell back to the cold reality.

- Among many star startups, Circle (a stablecoin issuer) became one of the few survivors: benefiting from favorable policies, its stock surged on the first day of trading and, despite some pullback, it remains the only winner firmly holding its gains.

- In contrast, the performance of other unicorns was disappointing. Figma sparked discussions at its IPO but has seen its stock price plummet significantly from its peak due to intensified AI competition and slowing growth. Companies like Klarna (installment payment), StubHub (ticketing platform), and Navan (business travel software) collectively lost tens of billions in market value post-IPO, exposing the secondary market's rejection of the "loss for growth" model.

- The worst performer was cryptocurrency exchange Gemini. Hit by financial report losses and regulatory pressures, its stock price has been "halved" from the issue price, crashing by 58%.

Image: Stock performance of tech companies that went public in 2025

On the other hand, capital is engaging in an unprecedented patient game of "scarcity." Although small and mid-cap tech stocks are struggling due to insufficient liquidity and extended trust cycles, the entry of super giants like SpaceX, OpenAI, and Anthropic is expected to reignite market enthusiasm.

This extreme polarization indicates that the aesthetic of the secondary market has shifted: investors are no longer paying for "growth stories," but are instead rushing into a very small number of "must-have" leading sectors at any cost.

In contrast, small and mid-sized listed tech companies, with an average market cap of about $8.3 billion, face higher valuation thresholds, liquidity issues, and prolonged trust-building cycles, making it difficult to attract sustained attention from index funds and retail investors.

This situation reflects a serious "trust gap." On one hand, company founders and venture capital firms are reluctant to lower valuations for IPOs; on the other hand, public investors, under the shadow of the AI bubble, have become extremely sensitive to companies' profit prospects and internal cash-outs. Coupled with banks attributing pricing difficulties to environmental turmoil, the multi-party game has reached a stalemate, ultimately leading to an awkward situation where no one benefits.

This chill is rapidly spreading to companies planning to go public in 2026. For instance, the business travel software Perk (formerly TravelPerk) has postponed its IPO plan to 2027, and if market sentiment does not improve significantly in 2026, a large number of potential IPO candidates may find themselves "waiting in line but afraid to ring the bell."

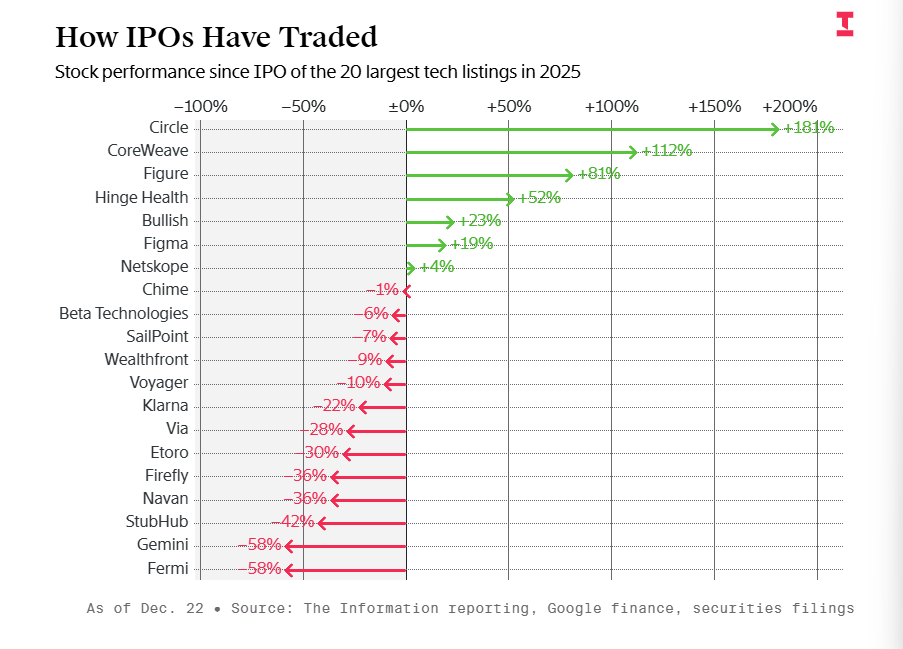

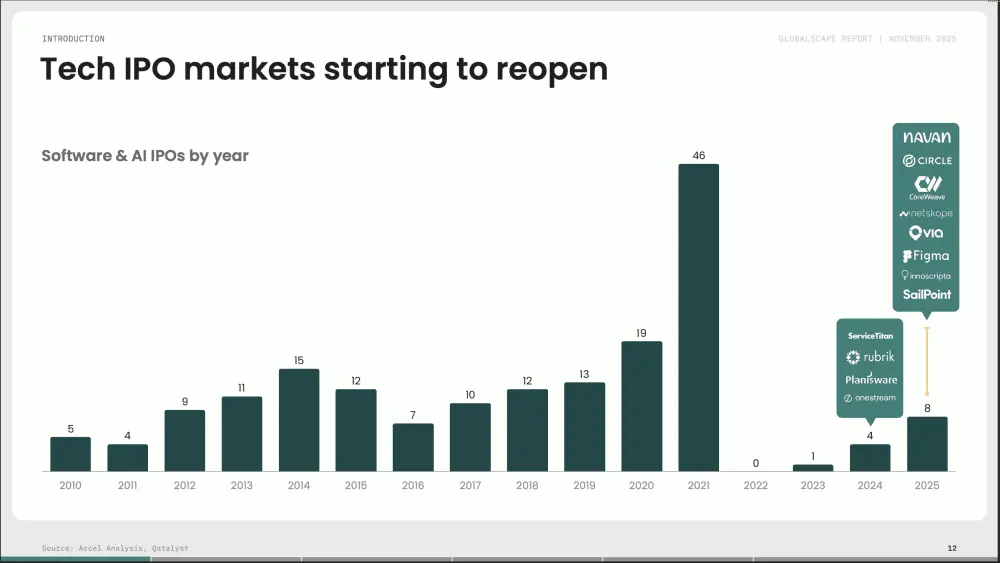

From a historical perspective, the recovery in 2025 is still far from reaching a prosperous level. Data from Accel Analysis and Qatalyst show that the number of IPOs in the software and AI sectors peaked in 2019-2021, with 13, 19, and 46 respectively. This was followed by a collapse period in 2022-2023, with zero and one IPOs, entering a recovery phase in 2024-2025 (4 and 8 IPOs).

Image: Number of software and AI IPOs from 2010 to 2025

However, the number of software and AI IPOs in 2025 was only about half of the peak in 2021, falling below the "normal" benchmark of 9-10 per year from 2010-2018. This indicates that the tech IPO market is still a long way from a true return to normalcy.

Image: Return situation of 8 software and AI IPOs in 2025

Analysis of Failed Cases: The Collision of Overvaluation and Market Reality

Navan's experience is quite typical.

This business travel management platform went public in October 2025, with a valuation trajectory resembling a parabola: from a peak of $9.2 billion during its G round financing in 2022, it was reduced to an IPO pricing of $6.2 billion ($25 per share); on the first day of trading, it closed below the issue price, with the stock price dropping to $20, leaving a market value of only $4.7 billion.

Ironically, Navan is not a shell company. It has an annual rolling revenue of $613 million (growing 32%) and over 10,000 corporate clients, indicating a solid business scale and real cash-generating ability. However, the market's pricing logic has undergone a significant change: the same company could easily obtain a price-to-sales ratio (P/S) of 15-25 in 2021, but in the 2025 environment, even a 10 times valuation is considered "too expensive."

The core issue behind this cold reception lies in the failure of the "40 rule." Although Navan has a 30% revenue growth, it is offset by a net profit margin of about -30%, resulting in a score close to 0. According to this golden criterion for measuring the health of software companies, only a sum of growth rate and profit margin ≥ 40% is considered to have achieved a balance between "expansion" and "efficiency."

Image: Stock performance of Figma and Navan post-IPO

Figma's experience is a microcosm of the violent fluctuations in tech stocks. Although it surged 2.5 times after its IPO in July, its stock price plummeted 60% after releasing a report with slowed guidance. Its volatility mainly stems from two points: first, structural imbalance, with only 8% of the float at the IPO creating artificial scarcity, while the release of a large number of unlocked shares in September triggered a sell-off; second, overvaluation, as its 31 times P/S ratio is more than four times that of Adobe, making the premium space vulnerable in the face of slowing growth.

The chill in the market is spreading comprehensively. From the ticketing platform StubHub (down 42%) to commercial space company Firefly (down 36%), from transportation software Via (down 28%) to fintech Klarna (down 22%), companies with "high valuations and low profits" are collectively facing brutal market corrections.

The Dilemma of Investment Banks: The Halo of Goldman Sachs and Morgan Stanley Dims, Who Will Pay for the Overvaluation Bubble?

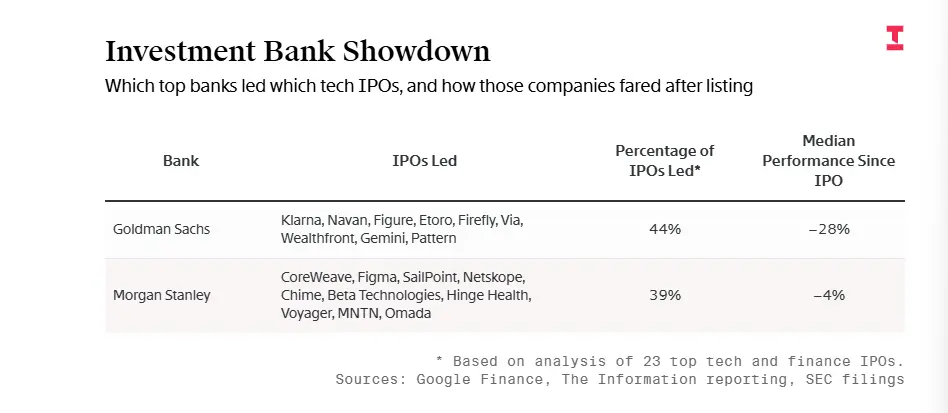

The poor performance of IPOs in 2025 puts investment banks like Goldman Sachs and Morgan Stanley, which dominate the majority of tech stock listings, in an awkward position.

The median drop for IPO projects led by Goldman Sachs (such as Via and Firefly) is about 28%, underperforming the overall market. Morgan Stanley, responsible for transactions like Figma and CoreWeave, saw the median drop of IPO stock prices it underwrote by about 4%, better than the overall median, but each company has already seen significant declines from their peaks.

Image: Performance of IPO projects led by Goldman Sachs and Morgan Stanley

Analysts point out that part of the poor performance is due to factors beyond the banks' control. Public investors believe that many companies currently trying to go public are not outstanding, while some of the strongest companies remain private.

Samantha Liu, Chief Investment Officer of the small and mid-cap growth stocks at the AllianceBernstein Group, noted that she had tried to tell bankers working on IPOs for companies like Navan to maintain reasonable pricing, especially if they did not expect significant retail interest. "People's expectations have completely gotten out of control," she said.

02. The Rise of Giants: The Heat of Record IPO Preparations by SpaceX and OpenAI

While many tech newcomers are facing a "winter" baptism in the public market, a distinctly different wave of heat is surging from the other end of the market. In stark contrast to those companies that broke below their issue prices upon listing are a few super tech giants that have established absolute advantages and are seen as "must-have."

SpaceX: Aiming for the Largest IPO in History

According to insiders, SpaceX is actively advancing its IPO plan, targeting to raise over $30 billion, aiming for a valuation of $1.5 trillion. This scale is close to the IPO record set by Saudi Aramco in 2019.

In terms of scale, if SpaceX successfully issues 5% of its shares at a $1.5 trillion valuation, the $40 billion issuance size will break the $29 billion record held by Saudi Aramco, becoming the largest IPO in history.

Unlike Saudi Aramco's extremely low float ratio, if SpaceX can successfully complete the issuance at this scale, it will completely reshape the landscape of global hard tech investment. The management is currently inclined to go public in mid to late 2026, but it may also be postponed to 2027 depending on market fluctuations.

SpaceX's accelerated IPO confidence stems from explosive business growth: Starlink has become a core revenue pillar, and the "direct-to-phone" service has greatly expanded market boundaries; at the same time, progress on the Starship in lunar and Mars exploration provides immense imaginative space.

Financial data shows that the company's revenue is expected to reach $15 billion in 2025, with a potential leap to $22 billion to $24 billion in 2026. In addition to its core aerospace business, funds raised from the IPO will also be invested in new areas led by Musk, including the development of space-based data centers and related chips.

Musk recently confirmed via social platform X that SpaceX has achieved positive cash flow for several years and provides liquidity to employees and investors through regular buybacks. He emphasized that the valuation surge is a natural result of technological breakthroughs in the Starship and Starlink projects. Currently, SpaceX's shareholder lineup is extremely prestigious, including top institutions like Founders Fund, Fidelity, and Google.

OpenAI: A Trillion-Dollar IPO Reshaping the AI Capital Landscape

It is reported that OpenAI is also preparing for a significant IPO, aiming to raise at least $60 billion, with a valuation reaching $1 trillion. Insiders say that OpenAI is considering submitting an IPO application to securities regulators as early as the second half of 2026.

At the same time, OpenAI is engaged in negotiations for a financing round of up to $100 billion, which could raise its valuation to $830 billion.

The company's goal is to complete this financing round by the end of the first quarter of next year and may invite sovereign wealth funds to participate in the investment.

The background of this financing is that OpenAI has committed to investing trillions of dollars and has reached multiple cooperation agreements globally to maintain its leading position in the AI technology race.

The core logic of the financing targets computational power hegemony, as OpenAI needs to invest over $38 billion in the coming years to build data centers and server clusters. Potential investors are forming four major camps: tech giants (Amazon, NVIDIA, Microsoft, and Apple seeking business ties), sovereign wealth funds (Middle Eastern and Singaporean funds demanding technology localization and industrial return), Wall Street investment institutions (J.P. Morgan and others securing pre-IPO positions), and innovative financing models (government energy cooperation, special debt instruments, etc.).

Notably, geopolitical factors have deeply embedded themselves in the financing negotiations: multiple rounds of investment from the UAE's MGX fund, potential conditions from Saudi Arabia for localizing data centers, and indirect participation by the U.S. government through infrastructure cooperation have made this financing transcend commercial boundaries, becoming a microcosm of great power technological competition.

If the financing is successful, OpenAI will set a historical record for a single company's financing scale exceeding the annual technology budget of most countries.

In addition to SpaceX and OpenAI, AI startups like Anthropic have also entered the "hot" camp with valuations exceeding $300 billion. The rise of these super giants sharply contrasts with the cold reception of most tech IPOs in 2025.

Overall, 2026 may usher in a wave of high-valuation unicorn IPOs, with potential candidates including:

- Super Giants: SpaceX, OpenAI, Anthropic. The IPOs of these companies will redefine the scale of the IPO market.

- AI and Infrastructure: AI companies seeking funding for expansion, such as chip manufacturer Cerebras, and data center providers Lambda, Crusoe, and Nscale.

- Fintech and Software: Motive, supported by Index Ventures, selling safety technology for truck drivers; PayPay, a Japanese fintech company supported by SoftBank; and other mid-sized tech companies.

- Companies that have postponed or are on hold: Such as Perk, which has postponed its IPO plan to 2027, and a large number of candidates "waiting in line but afraid to knock."

Jeff Claw, a senior managing partner at Norwest Venture Partners, said, "There is a batch of potential IPOs waiting to go public, but if the market's acceptance of IPOs does not improve in 2026, no one will be eager to act."

Notably, B2B industry leaders like Stripe and Ramp, with annual recurring revenues exceeding $1 billion, are currently opting for large-scale private financing or equity buyout offers instead of going public.

Payment giant Stripe recently completed an equity buyout offer, with the company's valuation reaching $91.5 billion. The State Street Private Equity Index now represents a valuation exceeding $5.7 trillion, more than five times the $110 billion of committed capital when it was launched in 2007. Abundant private capital alleviates the pressure on companies from the scrutiny of quarterly earnings calls and the increased regulatory burden of going public.

Tim Leven, CEO of Europe's largest fintech fund Augmentum Fintech, believes, "The possible exit routes for many of our portfolio companies will be mergers and acquisitions, rather than choosing IPOs."

Jeff Claw, a senior managing partner at Norwest Venture Partners, also stated that his venture capital firm has seen "a better M&A atmosphere," with three companies in its portfolio recently acquired by large tech firms.

03. The Rules of the Game for Tech Stock IPOs Have Changed

Looking ahead to 2026, the global IPO market is at a critical juncture transitioning from "valuation winter" to "cautious optimism." Improvements in macroeconomic indicators, more predictable monetary policies, and the commercialization dividends of AI technology are collectively catalyzing the repair of market sentiment.

A diversified global listing reserve is forming, and if market volatility can be effectively controlled, the listing momentum accumulated in 2025 is expected to erupt in 2026.

However, the road to recovery is not smooth, as the market faces severe entry challenges:

● Severe IPO Backlog: Hundreds of "old" unicorns originally scheduled to go public in 2022-2023 are still in line, with more mature sizes and more urgent funding needs.

● Significantly Raised Entry Barriers: The market performance in 2024-2025 has proven that current buyers no longer accept "marginal cases." Typical candidate companies need to have about $50 million in annual recurring revenue (ARR), 50% growth, and strong unit economics.

● Complex Macro Game: The pace of listings in 2026 will heavily depend on the stability of monetary policy, the easing of geopolitical tensions, and the robustness of the labor market.

Image: Possible factors affecting tech company IPOs in 2026

The severe fluctuations since 2025 are essentially a painful repair of the market transitioning from irrational prosperity to a return to value, with the public market almost closing its doors to mediocre companies, except for a few top giants. Investors are no longer paying for "expected growth," but are instead scrutinizing profitability and sustainability with unprecedented rigor.

For entrepreneurs, the rules of the game may have permanently changed; paths to profitability, strategic clarity, and unit economics have become the passport to survival.

Special thanks to Jin Lu for contributions to this article.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。