The turn of the calendar brought a noticeable reset across U.S. spot crypto ETFs, as investors rotated back into bitcoin while selectively maintaining exposure to altcoin funds. Shortened holiday trading did little to dampen conviction, especially on the BTC side.

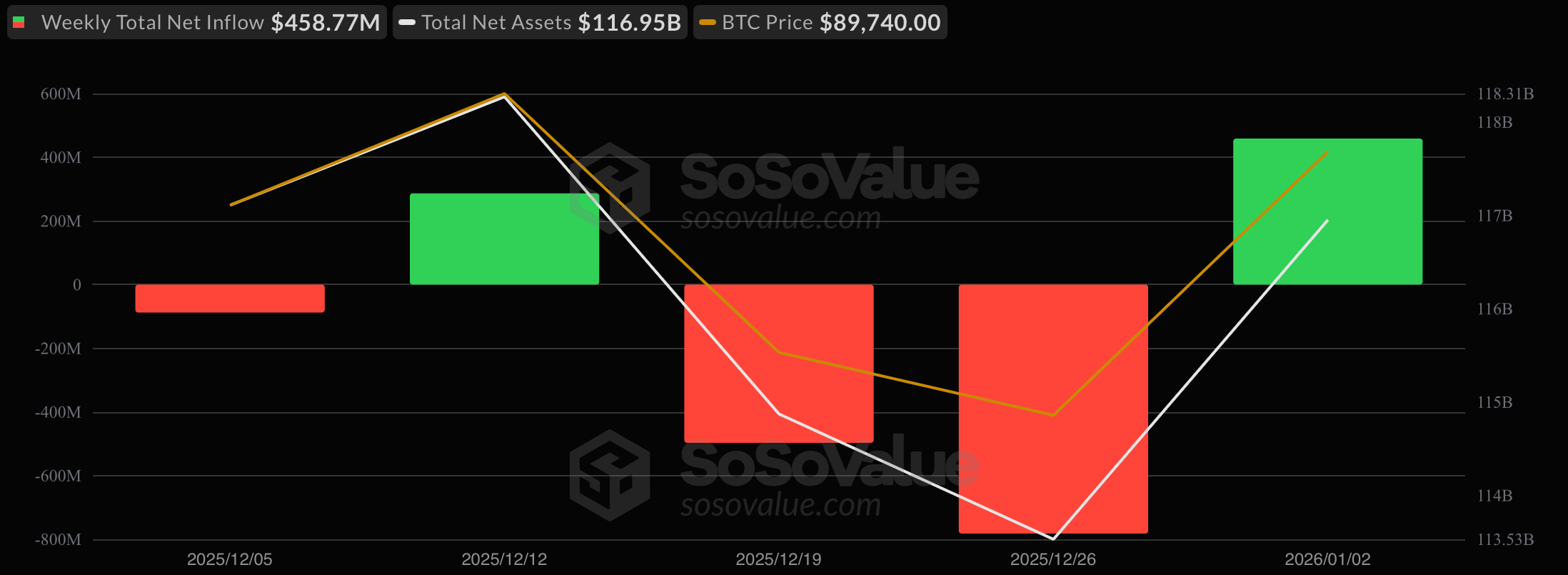

From Dec. 29 to Jan. 2, U.S. spot bitcoin ETFs recorded a combined net inflow of $458.77 million, snapping the late-December outflow streak. Blackrock’s IBIT was the clear anchor, pulling in $324.15 million for the week. The remaining inflows were distributed across the complex.

Fidelity’s FBTC finished the week modestly positive with $105.78 after offsetting earlier December losses, while Bitwise’s BITB and Ark & 21shares’ ARKB saw steady additions of $41.60 million and $33.08 million, respectively. Grayscale’s GBTC and Bitcoin Mini Trust saw combined outflows of $54.2 million, suggesting selling pressure eased but did not fully reverse across legacy products.

Bitcoin ETFs start 2026 strong after choppy December (Weekly flows)

Ether ETFs also ended the week in positive territory, posting $161 million in net inflows, marking a tentative stabilization after several volatile weeks. Grayscale’s ETHE captured the majority of the weekly inflows with a $103.78 million entry for the week, while its Ether Mini Trust added $32 million.

Bitwise’s ETHW and Blackrock’s ETHA added $18.99 million and $12.37 million each for the week, adding to the big inflows from the Grayscale funds. Fidelity’s FETH and Vaneck’s ETHV saw incremental additions that pointed to cautious re-engagement rather than aggressive repositioning.

XRP ETFs continued to extend their post-launch momentum. The group brought in $43.16 million in weekly inflows, with Franklin’s XRPZ ($21.76 million) leading allocations once again. Bitwise’s XRP also finished the week higher with $17.27 million, while smaller products such as 21Shares’ TOXR and Grayscale’s GXRP contributed marginally. The steady, fund-wide participation reinforced XRP ETFs’ status as one of the more consistent performers among newly launched products.

Read more: XRP ETFs’ 2025 Launch: Rapid Inflows and a Strong Institutional Debut

Solana ETFs added $10.43 million over the week, maintaining their gradual accumulation trend. Bitwise’s BSOL ($6.23 million) and Fidelity’s FSOL ($2.53 million) accounted for most of the inflows, while Grayscale’s GSOL and Vaneck’s VSOL saw lighter but still positive contributions. Notably, all SOL ETFs remained net positive for the period, underscoring stable demand despite quieter volumes.

Overall, the week marked a clean transition into 2026. Bitcoin reclaimed leadership with conviction, ether showed early signs of balance, and both XRP and Solana quietly strengthened their foothold, setting a measured but optimistic tone for Q1 2026.

- What drove U.S. crypto ETF flows into early 2026?

U.S. spot bitcoin ETFs pulled in $458.77 million from late December into early January as investors rotated back into BTC at the start of 2026. - How did ether ETFs perform during the same period?

U.S. ether ETFs posted $161 million in net inflows, signaling tentative stabilization after choppy trading in late 2025. - Are XRP ETFs still attracting institutional demand?

XRP ETFs added $43.16 million for the week, extending steady post-launch inflows across multiple U.S.-listed funds. - What trend is emerging for Solana ETFs in 2026?

Solana ETFs remained net positive with $10.43 million in weekly inflows, reflecting gradual accumulation rather than aggressive positioning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。