Market nerves often surface when geopolitical flashpoints erupt, and Venezuela has reentered the spotlight. As speculation swirls, crypto traders are watching for signs of stress beneath the surface, according to a report shared by Cryptoquant on Jan. 5. Early on-chain signals suggest tension, but not panic.

The analysis, conducted by XWIN Research, a Japan-based crypto research institution, expands beyond Venezuela by examining how bitcoin exchange netflows behaved during multiple past geopolitical shocks. The firm explained:

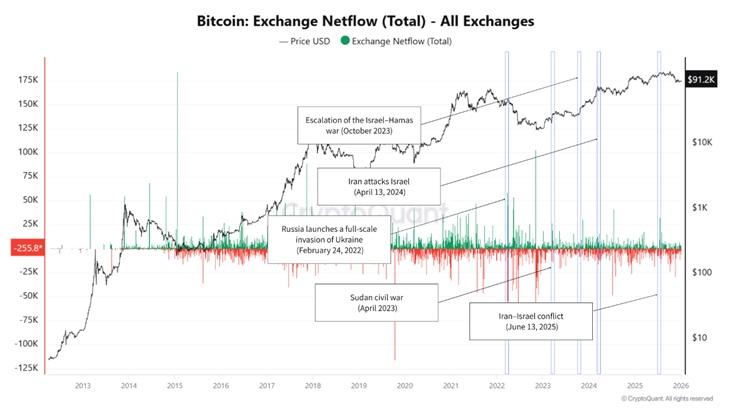

The most useful metric here is Exchange Netflow, which tracks whether bitcoin is moving into or out of exchanges. Rising inflows typically indicate preparation to sell, while continued outflows suggest holding behavior.

Using this metric, the study reviews events such as Russia’s full-scale invasion of Ukraine in February 2022, the Sudan civil war in April 2023, the escalation of the Israel-Hamas war in October 2023, Iran’s attack on Israel in April 2024, and the Iran-Israel conflict in June 2025. Across those episodes, bitcoin prices experienced short-term volatility, yet exchange netflows rarely showed sustained inflow spikes, signaling that investors did not engage in prolonged panic selling.

The report also observed a structural change in behavior, noting: “Since 2023, the market has become more resilient to localized military conflicts, with initial reactions fading quickly.” That resilience is now unfolding as bitcoin trades near $93,055, holds a market capitalization of about $1.85 trillion, and posts daily trading volume of $38.07 billion, reflecting active engagement rather than defensive withdrawal.

Read more: Maduro’s Fall Turns Long-Shot Polymarket Bets Into Overnight Wins

When applied to Venezuela, the firm finds the current pattern consistent with those earlier conflicts. The report detailed:

So far, the Venezuela situation fits this pattern. Despite some price sensitivity, there is no sign of large-scale bitcoin inflows to exchanges. Panic selling is absent, suggesting the market is cautious but not fearful.

Technical structure supports that view, with bitcoin holding above $90,000, forming higher lows, and consolidating near $93,000 instead of breaking down. The report contrasts this muted reaction with periods of stronger on-chain stress tied to structural economic confrontations such as U.S.–China trade tensions, regulatory crackdowns, or capital movement restrictions, which directly affect global liquidity.

The firm concluded: “Whether Venezuela becomes a broader economic issue remains uncertain. For now, Exchange Netflow suggests the market is watching, not fleeing.” Together, the historical comparisons and current data depict a bitcoin market that increasingly distinguishes between headline-driven geopolitical risk and events that materially disrupt the global financial system.

- How are geopolitical tensions like Venezuela impacting bitcoin investor behavior?

On-chain exchange netflow data shows heightened caution but no panic selling, indicating investors are monitoring risk without exiting positions. - What does exchange netflow signal to investors during geopolitical shocks?

Historically, even during major conflicts, sustained bitcoin inflows to exchanges have been limited, suggesting investors largely avoid prolonged panic-driven selloffs. - Why is bitcoin considered more resilient to localized conflicts?

Data from multiple geopolitical events shows initial volatility fades quickly, reflecting a structurally more mature market that differentiates headlines from systemic risk. - What should investors watch to assess whether Venezuela becomes a broader market risk?

Investors should monitor exchange netflows and liquidity-related signals, as only events that disrupt global financial systems have historically triggered deeper crypto stress.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。