Coinglass数据显示,比特币期货的总未平仓合约为587.4亿美元,代表着643,670 BTC的未结合同。在过去24小时内,总未平仓合约上升了3.99%,这表明市场出现了新的头寸,而不是安静的平仓。短期变化仍然温和,表明交易者在有意图地增加风险敞口,而非恐慌性交易。

在期货交易场所中,币安以119亿美元的未平仓合约在名义价值上领先,占市场的20%以上。CME以98亿美元紧随其后,继续扮演机构重磅角色,而Bybit和Gate各自持有超过50亿美元的未平仓合约。OKX以36.4亿美元的未平仓合约位列前列。

短期期货流动性在各交易所显示出混合信号。CME在过去四小时内略有下滑,而币安和OKX也记录了轻微的回调。与此同时,Bybit、Gate和MEXC在24小时内的增幅更强,表明投机兴趣正在向其他交易场所迁移,而不是完全消失。

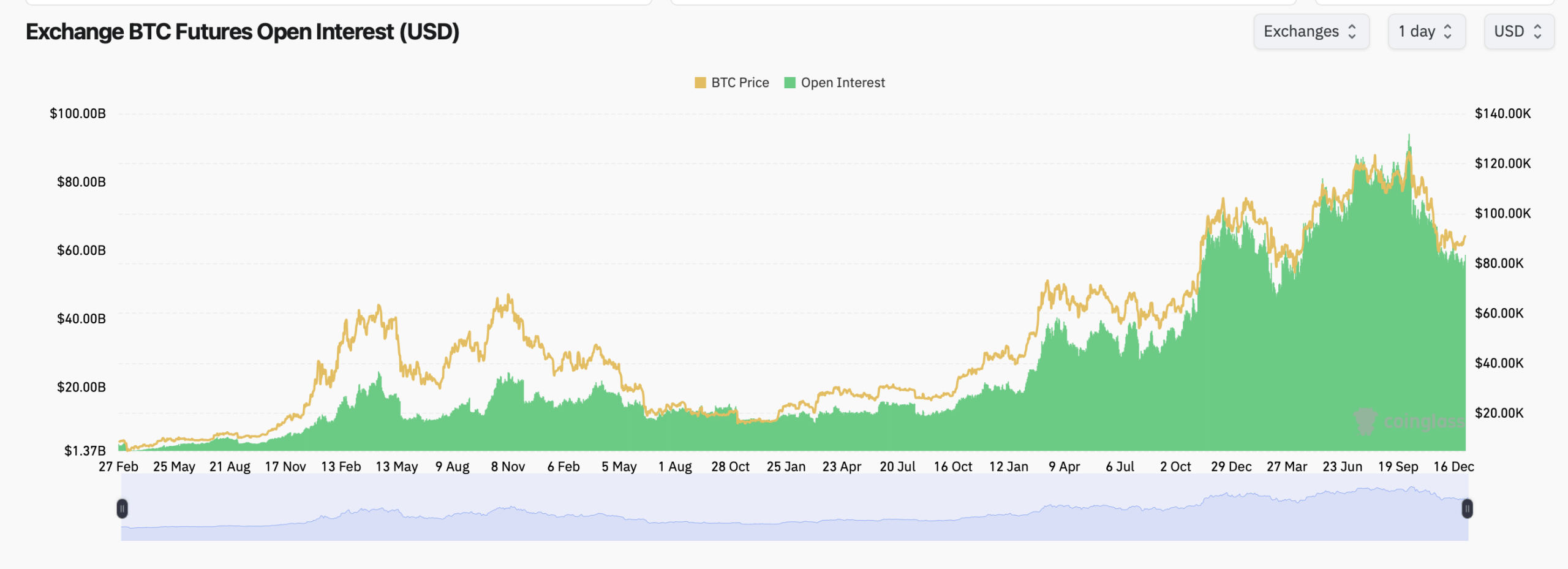

长期期货数据表明,头寸已经变得相当高。自2024年中期以来,比特币期货的未平仓合约大幅扩张,价格上涨的同时,即使在最近的整合期间也保持历史高位。这种持续性表明杠杆并没有被有效清除,使市场对价格的剧烈波动保持敏感。

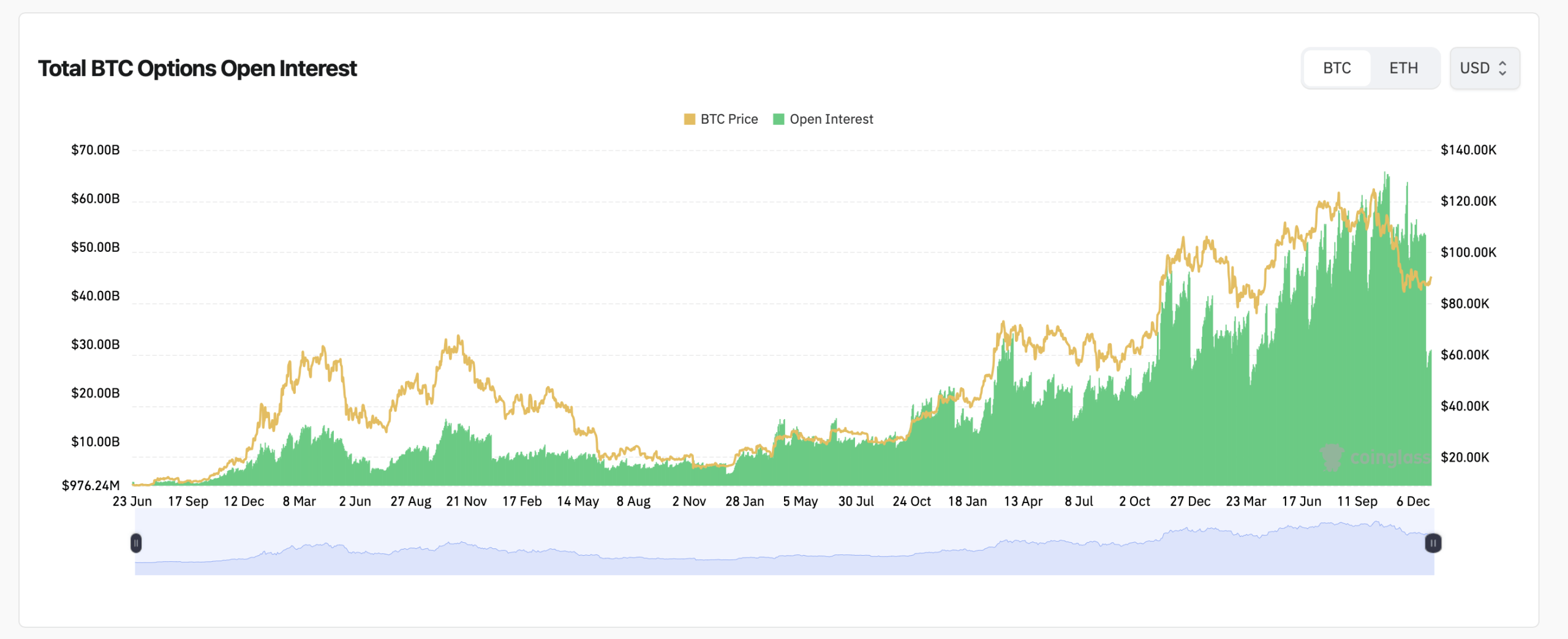

期权市场同样显示出拥挤的情况。比特币期权的总未平仓合约持续上升,买权占据主导地位。买权占未平仓合约的56.88%,为172,616 BTC,而卖权占43.12%,即130,848 BTC。过去24小时的交易量反映了这种偏向,买权合约再次超过卖权。

Deribit仍然是期权活动的重心。最大的未平仓合约位于BTC-30JAN26-100000-C合约,持有8,806 BTC,其次是1月和3月到期的重头寸,行权价在80,000美元到110,000美元之间。交易量数据显示,交易者积极轮换近期1月的行权价,包括买权和卖权,而不是放弃风险敞口。

另请阅读: Bitfarms在出售巴拉圭站点后退出拉美市场

主要期权场所的最大痛苦水平明显集中在当前现货价格下方。在Deribit上,多个即将到期的合约的最大痛苦点接近90,000美元,而币安和OKX也显示出类似的特征。在每种情况下,最大的名义集中点都位于当前价格下方,形成了一个期权卖方面临最低支付的引力区。

堆叠的到期轮廓强化了这一主题。1月和3月到期的合约承载着最重的名义权重,1月末和3月末的未平仓合约明显增加。这种结构表明,交易者在为波动性做准备,但并未承诺于单一的短期方向性押注。

综合来看,比特币的衍生品市场看似拥挤但保持冷静。期货交易者继续逐步增加风险敞口,而期权交易者则倾向于参与上涨,尽管在现货下方有明显的对冲。随着未平仓合约仍然高企,最大痛苦点徘徊在91,000美元下方,下一次决定性动作可能更多地取决于谁先退缩,而不是信念。

- 目前比特币期货的未平仓合约是多少?

- 比特币期货的未平仓合约约为 587.4亿美元,代表着超过 643,000 BTC 的未结合同。

- 哪个交易所主导比特币期货的头寸?

- 币安在名义价值上占据最大份额,其次是CME和Bybit。

- 比特币期权交易者是偏向看涨还是看跌?

- 期权数据显示出买权占主导的结构,买权占总未平仓合约的近 57%。

- 主要期权场所的最大痛苦水平在哪里?

- 币安、OKX和Deribit的最大痛苦水平集中在 90,000美元 的价格区间。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。