Crypto is facing a token identity crisis.

The lines are blurring on both sides. Equity is moving onchain with companies like Securitize filing for IPOs. Tokens are becoming more equity like through MetaDAO's ownership coins and Uniswap's fee switch.

Customer Acquisition Cost tokens (CAC) are one model that has gone relatively overlooked. Rather than functioning as equity or a governance mechanism, these tokens operate as pure customer acquisition tools.

PayPal famously burned over $60M in VC cash on incentives to increase initial distribution. CAC tokens achieve the same goal but use token emissions to fund user acquisition at scale. The declining reward curves mirror growth marketing where early users receive larger incentives that taper off as network effects compound.

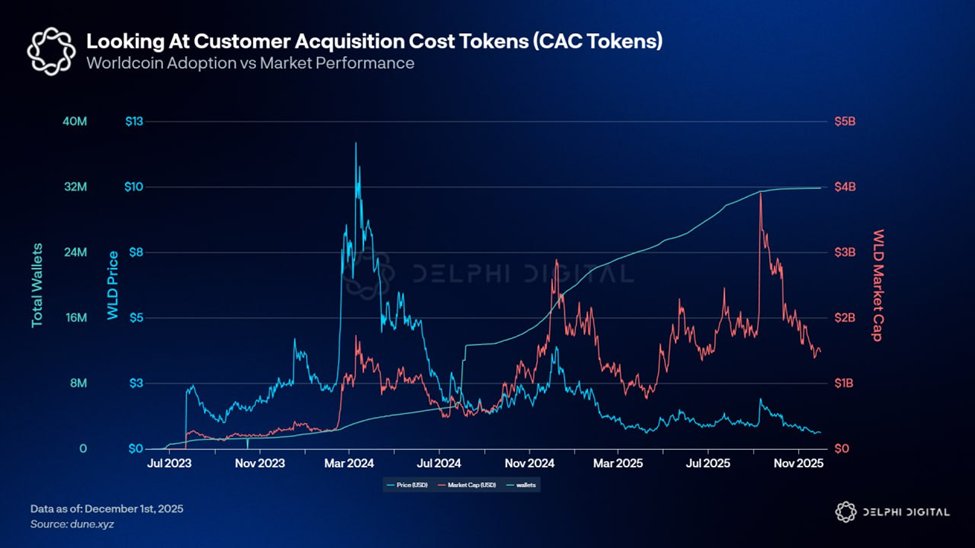

Worldcoin has been a clear example of this approach, distributing over 500M WLD tokens for onboarding while the World App's growth metrics continue to climb.

As regulatory clarity improves and more companies with existing equity explore tokens for their crypto products, the CAC model could become a dominant framework as they focus on funding distribution at scale.

The token identity crisis is only growing, but that's not necessarily a bad thing. It means the design space is maturing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。