The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts. I welcome everyone's attention and likes, and reject any market smoke screens!

Today is December 31, 2025, the time for year-end summaries; this year's Bitcoin lowest point is at 74457, the highest point is at 126208.5, with an overall fluctuation range of 52752.5 points. At first glance, it seems that this year's pullback depth is already sufficient. From the perspective of spot trading, compared to 2024, this year is undoubtedly a losing year. Unless there are users who just entered the market this year, generally, those who experienced last year's market are mostly bullish this year. Therefore, Lao Cui's spot trading is completely in a state of loss, barely surviving on contracts. This is not to recommend everyone to trade contracts, but more out of helplessness; watching the losses in spot trading is extremely torturous. Lao Cui has also shared the spot prices multiple times; currently, the heavy positions are all in SOL, with an average price in the 140-150 range, without a specific point due to the platform's calculation mechanism, based on historical positions. Additionally, Lao Cui still holds a certain amount of OKB, which has lost quite a bit, with an average price around 150.

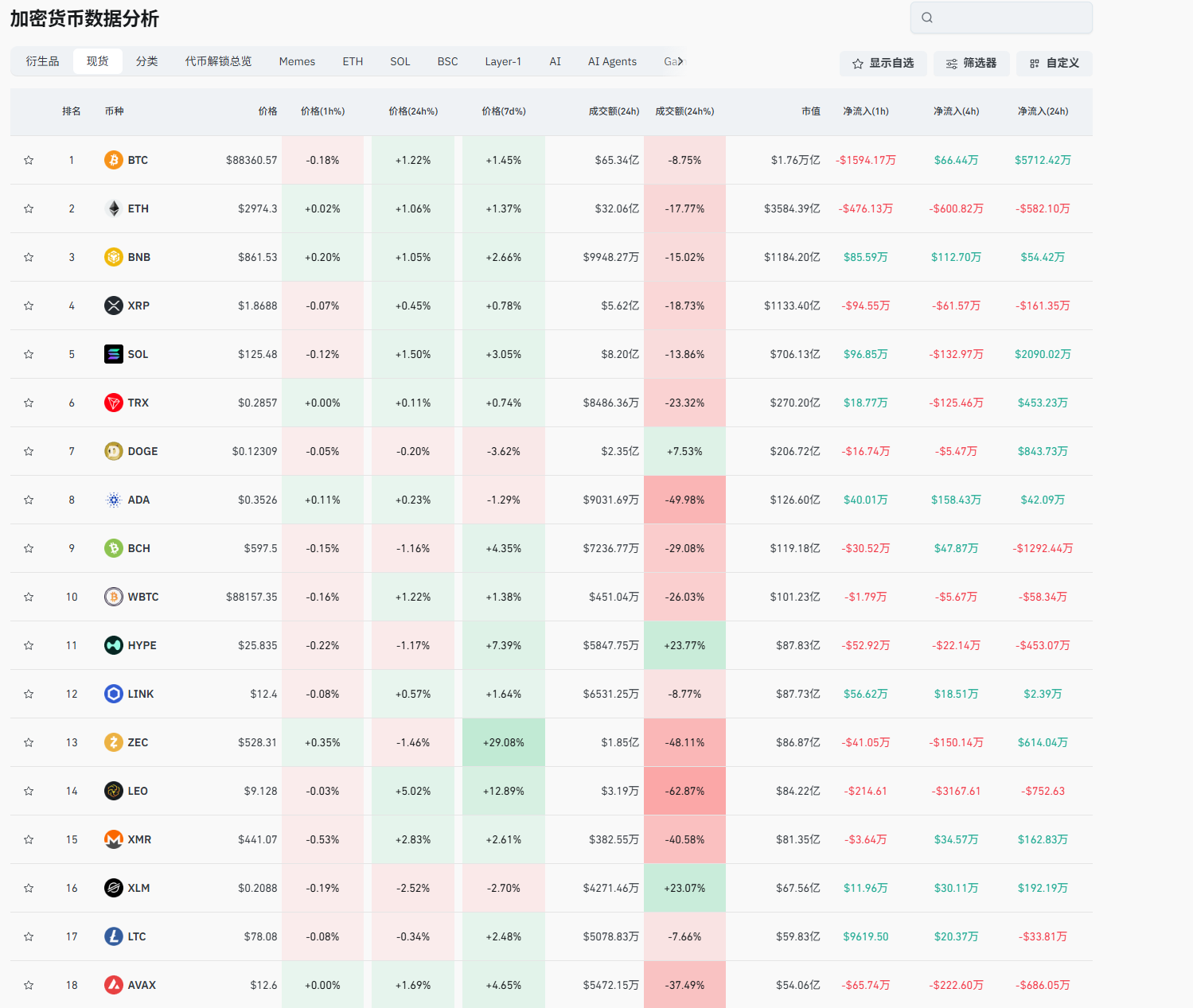

Other positions are relatively okay, adding up to less than 20%, with an overall loss of about 13WU. For the plans in 2026, Lao Cui will still consider holding Ethereum below 3000; ETH has already been included in the investment plan, of course, this is also waiting for the market to warm up a bit. In the downward trend, the contract positions also cannot be moved too recklessly. Another investment plan is XRP, which may be increased to about 10% of the position. The focus is on observing the strategy direction of cryptocurrencies in Europe; this point was mentioned yesterday, and afterward, the UK plans to implement a regulatory framework for crypto assets in 2027. The specifics of this regulatory framework still need to see the implementation of the regulations, including Russia's proposal to impose criminal penalties on illegal crypto miners. In Lao Cui's understanding, these two pieces of news are actually bearish, but the implementation of these two points still requires time to wait. This also indirectly indicates that the higher the risk, the stronger the value of the cryptocurrency channel, but the lack of interconnectivity in the financial sector and the strengthening of regulatory measures will definitely impact coin prices.

Especially after the new highs in the second half of 2025, the subsequent absolute positive news has not led to an increase in coin prices. Regarding this real result, it is not difficult to guess that there are only two conclusions; one is to lure more buyers, as the market makers prepare to close positions, and the other is to suppress and lure sellers, forcing retail investors to liquidate, and then raising prices again after a period. Currently, Lao Cui tends to lean towards the first guess because after the interest rate cuts and listings, major institutions maintain a positive outlook. However, if everyone keeps staring at the data, they will only find that more giants are offloading; otherwise, the outflow this year would not have reached a staggering 2.8 billion dollars. This is a significant contrast; one side is shouting about new highs while the other begins to reduce positions, showing signs of a market crash. Coupled with the scrutiny from other countries, whether in Europe or Japan and South Korea, all strategies through legal means are almost pushed towards the end of 2026 or even 2027, mostly waiting and observing, while substantial financial support is lacking.

So how to prove the second guess? The biggest giant, Trump, is a staunch supporter of the bulls; this support is not just a slogan but is backed by substantial funds. Whether it's buying through his own companies or improving strategies, he undoubtedly wants to push cryptocurrencies into the international market. Especially in yesterday's article, it was mentioned that in 2026, the U.S. will explore more ways to purchase Bitcoin; Lao Cui pays special attention to this statement, linking it to the previous tariff confrontation with the EU, which is merely an attempt to get them to compromise on the cryptocurrency market, that is, to relax regulations. These measures, Trump has been actively pursuing, and his actions do not express disappointment in the crypto space. If Lao Cui's memory is not confused, Trump bought 3000 Ethereum at the 4300 price, and currently, there are no signs of outflow from his wallet address, even showing signs of maintaining a dollar-cost averaging strategy. As you can see, in just a month, Coinbase has accepted a large influx of funds, with BlackRock and Grayscale also seeing net inflows.

Everyone, do not panic; their influx of funds is more about giving the platform appeal; this is also Trump's move. What he wants is the entire industry chain; regarding the sanctions against Europe, he wants to break through the platform's restrictions. The EU wants to use Coinbase but has to pay a large amount of taxes, which Trump cannot tolerate. Yesterday, the U.S. also released the minutes of the December meeting, which clearly stated that the interest rate cuts in 2026 may not be as aggressive as this year, with a maximum of only two cuts. The probability of a rate cut in January is only 13%, and in March, it is only 45%. This indicates that there may not be a rate cut in the first quarter of 2026. This is also a test for the crypto space, but more institutions lean towards achieving new highs in the first half of the year; of course, what these institutions say so far is just empty talk without any substantial facts to support it, so for us investors, we should not be easily misled.

As for the contract aspect, there will be no review; I can only say that if there are profits this year, most of them are from contract gains, and it is difficult to achieve in spot trading. To elaborate would imply a recommendation for contracts, so I will stop here. Overall, the gains for 2025, in the struggle with the giants of the crypto space, can be considered a mutual win and loss; breaking even is already not easy. The above text serves as a brief summary of Lao Cui's experiences in the crypto space in 2025, while also holding high expectations for 2026. Looking ahead, the remaining content will focus on the layout for 2026. If you are a contract user, the options will always be limited to mainstream coins; investing in Bitcoin and Ethereum is the most stable. Other coins are collectively referred to as small coins, and I do not recommend everyone to operate contracts with them. For spot trading, try to hold mainstream coins as much as possible. For users who cannot purchase Bitcoin and Ethereum, the alternative is SOL, followed by XRP, and finally ADA. If the appreciation rate of these types of coins is too low, you can consider their derivative small coins off-chain, such as UNI.

Lao Cui's summary: At the beginning of this year, Lao Cui held a pessimistic attitude towards the trend for 2026; with this recent decline, especially as many analysts uniformly believe that it will at least drop below 80,000 to around 75,000, it has instead filled Lao Cui with confidence about future trends. This year's Bitcoin lowest point has also reached 74457, although it was in the form of a spike, but in Lao Cui's eyes, it is already sufficient. Regarding the depth of the pullback, Lao Cui will not continue to look for new lows but rather leans towards the bulls. For the forecast of BTC in 2026, it has been mentioned before, with a minimum range of 130,000 to 150,000, there is a high probability of breaking new highs in 2026; Ethereum could reach at least 5000-6000, or even as high as 7000-8000. The turning point is Trump's layout, which can resolve these high positions in Europe. As for the small coins following the rise, Lao Cui does not see new highs; if SOL can touch the previous new high, Lao Cui may choose to clear positions, but for coins like XRP and ADA, if there are new highs, that would be at least 2-3 times, depending on how everyone chooses. As for contract users, starting from tomorrow, Lao Cui will no longer choose to short; there will be no operations in the range, only laying low for long positions, which were provided to everyone yesterday. Currently, Lao Cui is holding long positions in the market. If anyone has any questions, feel free to consult Lao Cui directly. At the end of the article, in 2026, Lao Cui will still not engage with platforms or group chats; those who have such ideas can look for other analysts.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation, strategizes for the big picture, and does not focus on individual pieces or territories, aiming for the ultimate victory. The novice, on the other hand, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。