原创|Odaily 星球日报(@OdailyChina)

作者|Wenser(@wenser 2010)

又是一年圣诞节,相较于以往火热的“圣诞行情”,今年的圣诞节对于加密货币市场而言,稍显冷清。

BTC 在 8.5 万美元至 9 万美元区间反复震荡;ETH 则没了之前新高的意气风发,略显颓唐;SOL、BNB 等主流币更是自“10·11 大暴跌”后一蹶不振,与新高价格的距离越来越远;至于山寨币?对于很多人来说或许只能说一句“不好意思,我们不熟”。

在此前的《4 大关键词,奏响 2025 Cryoto 四季歌》一文中,我们以 4 个季度关键词对行业过往一年的发展进行了简要回顾,受限于文章主题及篇幅,诸多行业参与者们的周遭经历只是一笔带过,原因无它,盖因对于大家普遍关心的“年度投资复盘”这一主题,我们进行了长达半个多月的问卷调查,收集了来自社区用户、加密 KOL、知名交易员以及媒体从业者、加密投资人等多个群体的“年度投资回忆录”。

在这里,我们能够看到,尽管市场在新高与低谷之间动荡,但仍有人留在牌桌并斩获颇丰,当然,成功背后的另一面,则是投资失意者的割肉离席、亏损出局。借助这份问卷结果及数据,我们得以一窥当下加密市场投资交易的真实样貌;借此机会,我们也将对本年度“那些让人拍断大腿的错失大机会”予以简要盘点,供读者吸取经验,来年再战。

2025 年度投资回忆录:总有人终将老去,但也有人正在年轻

以下为《Odaily 星球日报 2025 年度投资复盘》问卷调查相关信息,我们将从人群、投资战绩以及关注领域等方面进行详细分析。

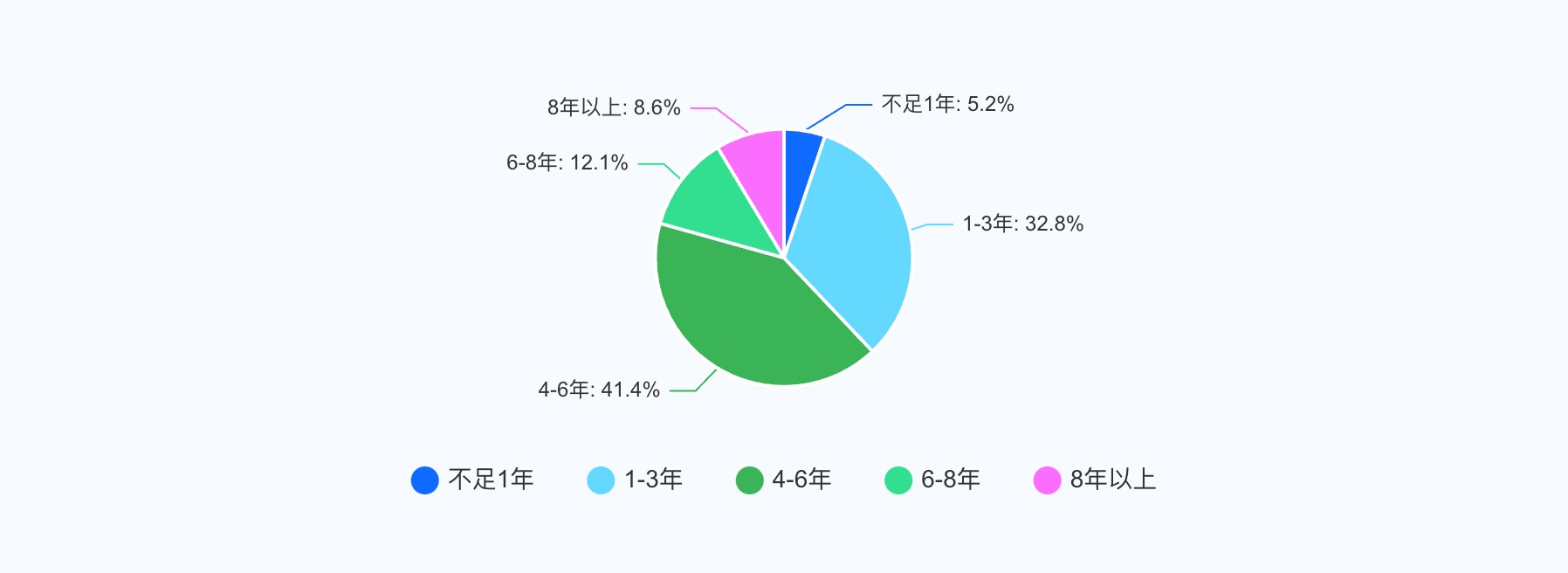

问卷对象:新韭菜 VS 老油条?入圈超 3 年人群占比超 6 成

先来说下本次问卷的人群画像。

根据问卷结果来看,超 60%的投资者入圈年限在 3 年以上,已经算是妥妥的“老油条”了,其中:

入圈 4-6 年的群体人数最多,占比约为 41%;

入圈 6-8 年的群体人数占比约为 12%;

8 年以上的群体人数则约为 9%。

相较于“3 年级以上人群”,“新韭菜”的人数占比则稍显单薄,入圈不足 1 年及入圈 1-3 年的人数总共为 21 人,在有效问卷中占比约为 38%。

看完问卷,笔者的第一个念头是——“难怪加密货币市场流动性不行了,原来是新韭菜越来越少了!”(Odaily 星球日报注:受限于问卷数量有限,以上结论仅为单份问卷调查结果,不代表行业整体人群结构)

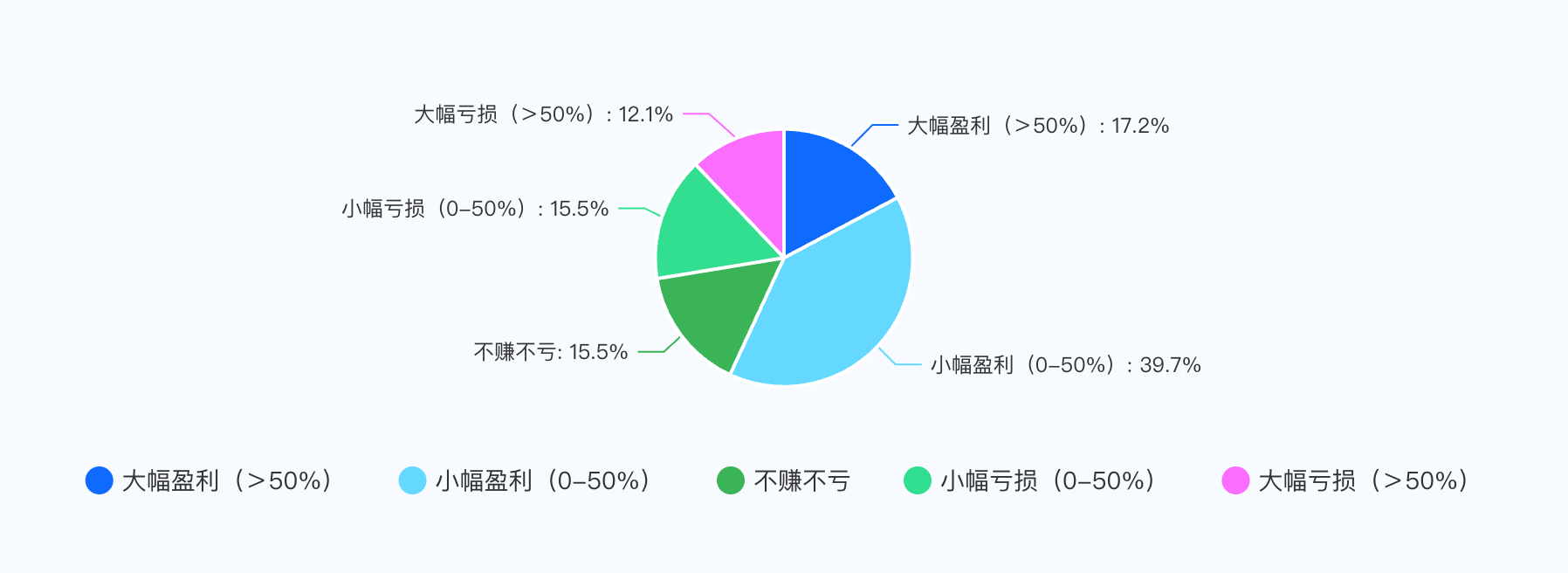

投资战绩:爆赚 VS 血亏?盈利群体占比超 57%

相信这也是多数人最为关注的问题,那就是——辛辛苦苦忙碌一年,到底是赚了还是亏了,是不是只有我一个人亏惨了?

看到问卷结果,我只能说还是低估了大家的赚钱能力——

大幅盈利(+50%以上)人数占比:17.2%;

小幅盈利(0-50%)人数占比:39.7%;

不赚不亏(相当于一年白玩)人数占比:15.5%;

小幅亏损(0-50%)人数占比:15.5%;

大幅亏损(-50%以上)人数占比:12.1%。

换言之,盈利群体占比接近 60%,不亏不赚的人占比约 15%,而超过 27%的人面临着或多或少的亏损,占比约三成,远低于市场观点及社区讨论时反映出来的情绪。如此反复横跳的猴市,还是赚钱的人更多,也侧面印证了,当下加密市场上确实是经验丰富的老韭菜多一点。至于新人,要么还在市场泥泞中摸爬滚打;要么已经被迎头痛击后割肉离场。

写到这里,笔者也只能无奈感叹一句:“平时群里说亏钱的人那么多,原来真亏钱的只有我一个?!”

盈利赛道:Meme 币 VS 主流币?土狗仍然是 YYDS

至于具体的盈利领域/赛道/项目/代币,问卷调查的结果稍显复杂。

不出意外,Meme 币(土狗项目)仍然是赚钱的不二法门,约 34%的问卷参与者提及主要靠这一领域的项目赚钱(少部分人甚至提及铭文,不知道是真的还是装的?);

约 26%的投资者则主要依靠 BTC、ETH、BNB、SOL 等主流币收获了盈利,考虑到今年 BTC、ETH、BNB、SOL 均阶段性地创下价格新高,有这样的表现并不奇怪,当然,这也取决于投资者是否及时止盈,否则,一味地当钻石手,只能自己躲起来悄悄哭了;

约 16%的人将票投给了 DeFi,考虑到今年是“稳定币大年”、“高端理财局”不少,这一结果也并不奇怪,加之链上 Perp DEX 的火热,DeFi 阶段性地迎来了“第二春”;

约 12%的投资者的主要盈利仍然来源于空投交互,说实话,这个结果多少有些出乎我的意料,毕竟,市场流动性紧缩的当下,不少加密项目方为了高控盘、好拉盘对社区空投分配份额越来越吝啬,多数项目反撸已成常态;但无论如何,市场如何变化,空投仍然是很多投资者低成本投入搏取高价值回报的不二法门,行情冷热不论,总归是有一些“撸毛圣手”坚守岗位,为市场和项目提供着各类活跃数据和交易量,值得所有人的敬意;

最后,没想到除去如 TRUMP、ASTER 这样的单个项目,居然还有人将 NFT 列为盈利领域,我只能说还是低估了交易员们的投资实力,在赛道接近沉寂甚至死亡的 NFT 领域还能赚到钱,除了一句“牛 X”,我也想不到其他的评价了。不过,考虑到 OpenSea CMO 近期仍然喊话招人,也足以说明,市场如何变化,还是有一些 NFT 收藏者或交易员仍然看好这个赛道,在用自己的真金白银为市场提供流动性,身为“NFT 遗老遗少”的一员,多少还是让人有些动容。

除此以外,单个项目中,也有人给出“WET、黄金、PING、币安 Alpha、DOGE”等答案,结果并无太大代表性和参考价值,因此这里不再单独分析,仅作说明提及。

亏损赛道:Meme 币 VS 合约?数据验证盈亏同源

有人得意,自然也有人失意。

在具体的亏损赛道及项目方面,问卷结果再次向我们展示了市场的残酷一面。

约 28%的投资者在 Meme 币及山寨币上损失惨重,其中既包括 Giggle、ASTER 等币安系资产,也包括 Base 生态山寨币(如 PING)以及 HYPE 这样的大热币种;

其次,亏损的另一大诱因则是“黑天鹅事件”——有人因质押服务商出事而在 FIL 上损失惨重;有人则在 Polymarket 上押注亏损;此外,DeFi 协议的无常损失、高位接盘 BTC、ETH、SOL 均为行业较为常见的亏损原因;

约 26%的投资者则在合约交易上跌了跟头,这一数据倒是略低于我个人预期,作为今年市场为数不多的“活跃交易场域”,主流币和山寨币合约开单仍是不少投资者的选择,而考虑到特朗普任职后的多变表态、朝令夕改的政令以及包括“10·11 大暴跌”在内的大规模清算黑天鹅,亏损结局亦是必然;

再次,作为“大败局赛道代表”的 NFT、GameFi、L2 相关项目也是不少投资者的亏损症结,大约有 22%的人因为没有及时转换投资思路、死拿某一类赛道资产,最终损失惨重;

最后,相较于以往投资领域仍然局限在加密货币圈内的投资标的,在今年加密主流化的主旋律影响下,DAT 财库公司股票也成了不少投资者的选择,而在市场下行震荡阶段,亏损自然而然地接踵而至:有人买入 MSTR、BMNR 等 DAT 龙头股,仍然无奈被套;也有人在“稳定币第一股”Circle(CRCL)上损失惨重。曾经的加密货币交易员摇身一变,成为了“尊贵的美股交易员”,但身份的转变并不意味着投资表现的必然顺利,也有可能代表着多了一种亏钱的渠道。

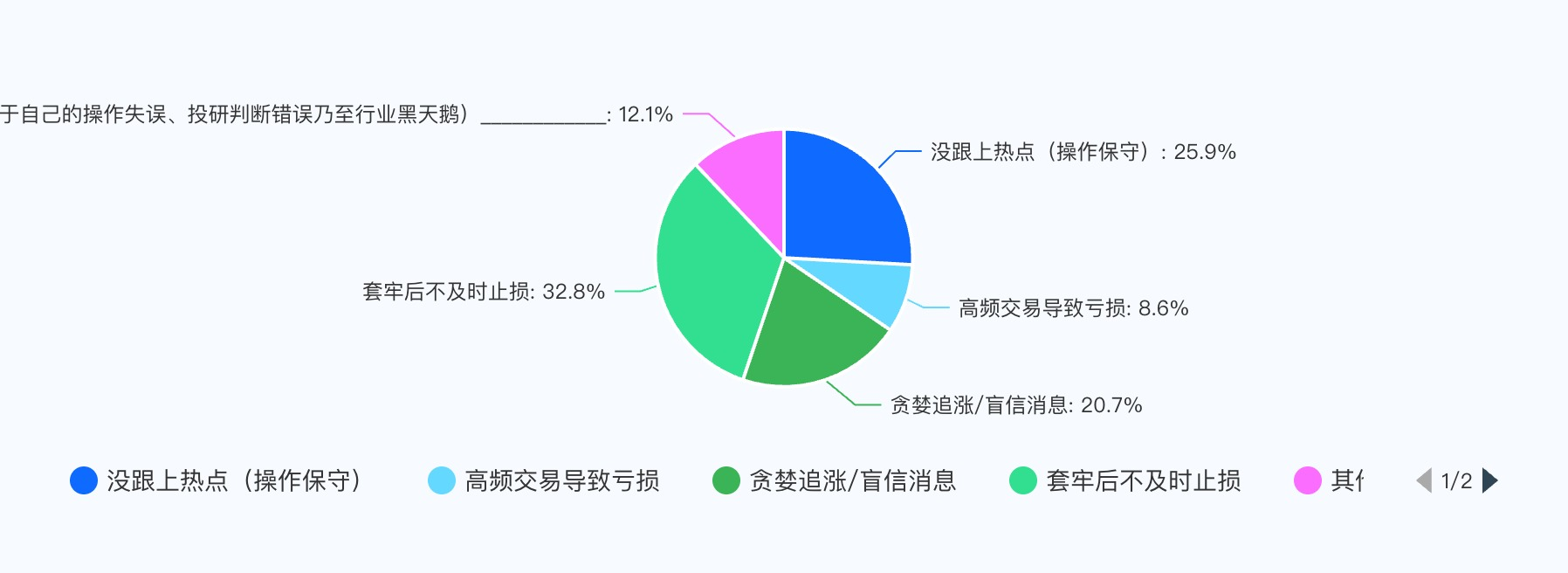

亏损反思:及时止盈 VS 果断止损?止盈是一堂人生必修课

聊完亏损,我们也在问卷中设置了具体的亏损原因问题,试图以此寻找大家存在的共性问题。

约三分之一的人将亏损归因于“套牢后未及时止损”,这也是包括我在内的加密货币投资者的通病之一,那就是没有想清楚,加密市场上 90%甚至 99%的山寨币都只有归零一途,只有极少数的代币能够经历低谷之后再次冲高,就算如此,大概率也只是野庄拉盘,为了更好地收割市场。这个故事告诉我们,及时止损、停止幻想,很有必要。

操作层面,反应慢半拍、操作保守或者盲信消息、追涨杀跌成为又一亏损主因,超过 45%的投资者在这些方面犯错导致投资亏损。根据笔者的个人观察,“成为先信资本”,等待其他人接盘,或许是市场上保持常胜不败的重要法门,而这,往往与信息敏锐度、信源渠道以及个人风险偏好、资金及设备准备等情况息息相关,很难一蹴而就。

最后,约 12%的人将亏损归因于操作失误、判断失误或行业黑天鹅,在这样一个上蹿下跳的“猴市”,很多时候确实也是“非战之罪”,投资者只能默默接受自己的亏损,调整状态,来年再战。

而最令我意外的是,高频交易导致亏损的人数占比远远低于个人预期,仅有 8.6%的人将个人亏损归因于此,一方面,可能大多数人确实较少高频交易;另外一方面,则可能大家对于高频交易的标准并不明确,有人可能一小时之内买入卖出十几次,但接下来一周时间都静观其变;也有人每天操作 3-5 次交易,每月交易时间占比可以多达二十天以上,很多人可能认为后者并不算高频交易,但其实相较于多数人,已然算得上“高频玩家”。

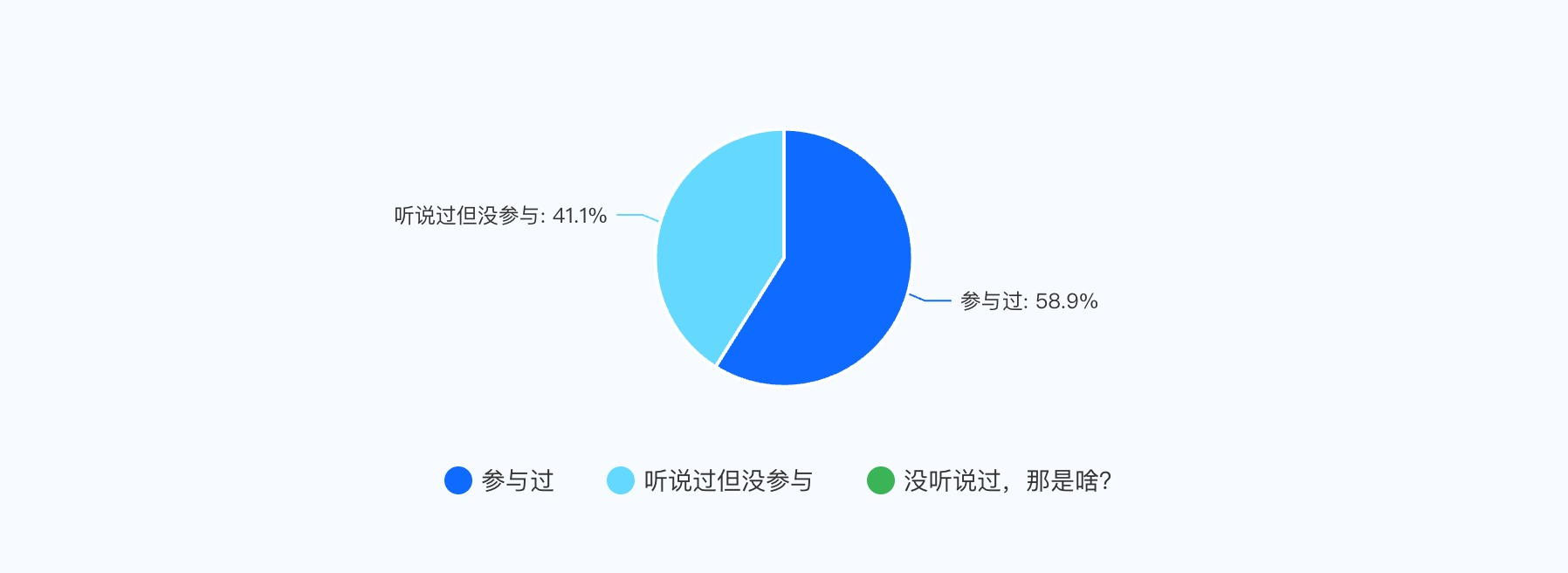

常用产品:Perp DEX VS 预测市场?仍有超 40%人群没用过预测市场

在被问及常用的热门产品时,相关数据颇为耐人寻味。

使用过 Perp DEX 的人群占比约为 40%,其中约 40%的人为 Hyperliquid 用户;约 22% 使用过 Lighter;约 12%的人使用过 Aster;使用其他平台的人数占比约为 15%,其中 DYDX、GMX 这样的老牌平台也有人使用,不得不说,DeFi 的长久魅力或许在这得到了又一次验证。

至于预测市场,参与使用的投资者占比接近 60%;超过 40%的投资者听说过但并未参与预测市场押注,从这一小样本数据来看,预测市场仍有较大的增长空间,2026 年 Polymarket、Kalshi、The Clearing Company 以及 BSC 生态、Base 生态的预测市场平台或将继续迎来用户增长爆发期。

展望未来:看好赛道 VS 投资建议?RWA、AI、Meme 分列前三,定投才是王道

问卷的最后,我们也设置了 2 道“开放式问题”,一个是“2026 年看好的赛道”;一个则是“可以分享的投资心得/建议”。

在看好赛道方面,RWA、AI 与 Meme 币分列前三名——

提及 RWA 的占比高达 31%,值得一提的是,这里的 RWA 结合了股票代币化、稳定币以及 PayFi 等元素;

提及 AI 的占比则约为 25%,在 AI 模型及应用渗透率逐渐提高、AI 相关科技公司迅猛发展的当下,AI 与加密货币的结合仍然是市场主流人群高度期待的方向之一;

Meme 币仍被不少人看好的原因或许在于其较低的进入门槛以及相较于主流币的高风险、高收益,但笔者个人对此持悲观态度,毕竟,山寨币被吸血已是必然,Meme 币这一极为依赖场内流动性的板块目前来看很难回到曾经的“百花齐放”阶段。

预测市场则是不少人的“共识”,Polymarket 和 Kalshi 两大估值超百亿美元的寡头以及交易量快速增长的行业规模让更多人看到了预测市场的发展潜力,而“万物皆可预测”的功能设置叠加 2026 年各类热门体育赛事及政治选举等热点事件或将为预测市场的火热再加一把火。

在具体的投资建议方面,多数人都认可“定投为王”的道理,并建议“只买 BTC”,但究竟能有多少人做到,只有自己知道了。

此外,有意思的点在于,加密 KOL @_FORAB 分享表示,建议每周五下午定投主流币,在时间把握方面颇有几分巧妙;也有不建议公开处刑的“某群友”表示,建议在下午 4 点之后再交易,因为“那时候老外醒了”,俨然将“老外”看做了“退出流动性”。

搞笑的是,有 6 位问卷参与者给出了自己的“投资建议”——“高买低卖”,堪称“韭菜成就指南”;也有人给出了自己的判断——“L1、L2 已死,远离合约或设置止损,寻找低市值 RWA 板块代币”;还有人更是直言提醒:“赚到钱了及时落袋为安;别上头;极端情绪要敢于出手”。

在此,我们对所有参与此次问卷调查的投资者表示感谢;同时,也感谢以下留下 ID 的问卷用户,感谢你们与 Odaily 星球日报读者们共同分享一份自己的年度投资回忆:@wanzwa6、@_FORAB、@airn_619、@muzz201o、@0xJerrrry、@bcxiongdi、@GaoNew3、@anchor9960、@cryptoshouyi、@Meiko5200、@a6825272、@qinxiaofeng888、@Asher_0210、@azuma_eth、@ethanzhang_web3、@0xmz2987、@gold7108。

无论如何,现在仍然活跃在加密市场上的每个人,都相当于彼此的“战壕战友”了。

2025 年我们错失的那些“大机会”:年度最扎心项目盘点

文章的最后,我想用简短的篇幅对今年无数人错失的“年度暴富大机会”进行简要盘点,一年走过,无数次暴富的机会曾摆在我们面前,但受限于本金、手速、认知乃至突发情况等不同状况的影响,我们还是与一次又一次的暴富机会擦肩而过。

在 2025 年的最后,回看过去,或许我们更能够看清,到底是“无法赚到认知以外的钱”,还是“机缘巧合下就是棋差一着”。无论是些许的遗憾还是更多的期盼,新的一年即将到来,总有新的机遇和挑战等待我们去征服、去探索、去成功或者去失败。

Q1 错失大机会:TRUMP、MELANIA、Swarms、PIPPIN、TST、MUBARAK、HYPE、VIRTUAL、IP、KAITO

第一季度,特朗普上台前的官方正版 Meme 币 TRUMP 称得上是“年度史诗级暴富机会”,不少中文区交易员借此实现了单币 100 万美元甚至超 1000 万美元的交易利润,堪称“一步 A8”的典范;随后,AI Agent 概念币经历了短暂余波之后,CZ 领衔的“币安系 Meme 币热潮”初现端倪,测试币概念、名人类 Meme 再度成为市场焦点;HYPE 的暴涨、IP 空投以及后续的 10 倍涨幅、KAITO 开创的“嘴撸赛道概念币”也是不错的造富机遇。

Q2 错失大机会:Circle(CRCL)上市、PUMP、LAUNCHCOIN、USELESS、MYX、HUMA、SAHARA

第二季度,DAT 逐渐加入加密战局,Circle 的“10 倍涨幅奇迹”在美股市场登台亮相,一举打破了加密原生人群对于这一合规稳定币之前的质疑和看衰,尽管后续受到市场影响仍然难掩颓势,但由此开启的“加密 IPO 热潮”为随后的 DAT 财库公司阵营扩大、股票代币化平台一定程度上奠定了基础;此外,Launchpad 平台的乱战、AI 领域的发展以及币安 Alpha 的神盘频出也为市场的流动性注入了新的活力,不少项目借此完成 TGE,把握到了难得的“市场最佳发币时间真空期”。

Q3 错失大机会::WLFI、Plasma(XPL)、ASTER、AVANT(Avantis)

第三季度,最为让人扼腕叹息的无外乎 2 大项目:一个是存 1 U 即可领取价值近 10000 U 代币的 Plasma(XPL);一个则是交易数万 U 额度即可领取不菲代币的 ASTER。尽管前者的理财活动需要满足手速或者 KYC 等条件,但回报颇丰的结果仍然让很多人拍断大腿;而后者,很多人痛惜叹气的原因,则在于“倒在了黎明前一夜”的卖飞,不乏有人卖飞价值数百万的 ASTER 代币。最后,也只能叹一句,时也命也。

Q4 错失大机会:币安人生、4、Giggle、ZEC

第四季度,则更偏向于回光返照的“人造牛市”,无论是在 CZ、何一等币安系代表人物一力主推的币安人生等 BSC 生态 Meme 币,还是“10·11 大暴跌”后焕发新生的隐私币板块代表 ZEC,都是经历了大盘新高后的“人造产物”,因此很难将其简单地判定为“大机会”,但无论如何,对于当时的市场而言,无疑是“加密市场本年度最后的造富余晖”。

最后的最后,借用群友的一句话来说,“你总以为机会无限,结果机会果真无限”。从后视镜视角来看,或许很多人也不会想到 2025 年拥有这么多的造富机会,而能够抓住一次,或许就足以翻身改命。

2025 年,加密主流化之年行将结束;2026 年,加密市场又有何等的波澜壮阔等待着我们呢?

See you next year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。