新的阿根廷国会将在新的一年里处理几个与加密货币和稳定币相关的关键问题。

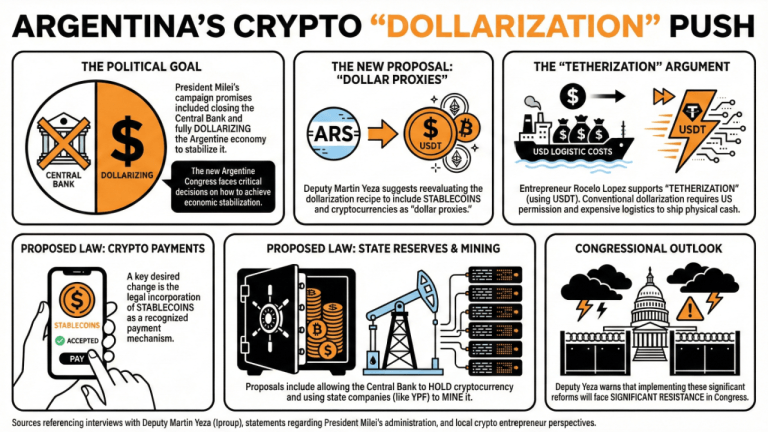

根据副代表马丁·耶萨的说法,政府将在今年重新评估美元化的方案,以稳定经济,并将稳定币和加密货币纳入作为美元的替代品。

在与Iproup的交谈中,他表示:

如果实施一系列改革,我们将面临重大阻力,这种类型的会议在国会中肯定不会受到欢迎。

然而,他希望看到的变化之一是将稳定币纳入支付机制。他还认为,允许中央银行通过国有企业(如YPF)持有和挖掘加密货币,即使政府并不立即利用这些可能性。

米莱总统的一个关键竞选承诺是关闭中央银行并美元化经济,以降低通货膨胀数字。

当地加密企业家罗塞洛·洛佩斯支持阿根廷经济的“稳定化”,指的是Tether,即市值最大的稳定币USDT的发行方。

对于阿根廷经济的常规美元化,美国必须批准,并且需要考虑将美国现金运送到阿根廷的相关运输和物流成本。

“稳定化”相比于常规的美元化过程将提供好处,而不涉及美国政府。洛佩斯强调,操作将是可追踪的,且交易成本低。

最近的报告显示,阿根廷银行已准备好向客户提供加密服务,中央银行正在起草特别措施,以向私营银行开放加密货币市场。

阅读更多: 阿根廷中央银行考虑允许银行提供加密服务

新阿根廷国会将解决哪些与加密货币相关的关键问题?

国会将重新评估将稳定币和加密货币作为美元替代品的使用,以帮助在2026年稳定经济。副代表马丁·耶萨倡导哪些改革以促进加密货币的采用?

耶萨支持将稳定币纳入支付机制,并允许中央银行通过国有企业持有和挖掘加密货币。罗塞洛·洛佩斯如何看待阿根廷的“稳定化”理念?

洛佩斯倡导“稳定化”,作为传统美元化的灵活替代方案,提供可追踪性和低成本交易等好处,而无需美国的许可。阿根廷银行在加密货币方面有哪些进展?

报告显示,阿根廷银行正在准备提供加密服务,中央银行正在制定措施以向私营银行开放加密市场。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。