Original Title: Prediction Markets at Scale: 2026 Outlook

Original Author: INSIGHTS4.VC

Translated by: Peggy, BlockBeats

Editor's Note: In 2025, prediction markets are accelerating towards the mainstream: brokers, sports platforms, and crypto products are entering simultaneously, and demand has been validated. The real watershed is no longer product innovation, but whether scalability can be achieved within a regulatory framework.

This article highlights the global regulatory comparisons, the divergence of on-chain and compliant paths, and the 2026 World Cup as a "system-level stress test," indicating that prediction markets are entering a knockout stage centered on compliance, settlement, and distribution. The winners will be the platforms that can operate stably under peak loads and stringent regulations.

The following is the original text:

The U.S. event contract market significantly accelerated in 2025, resonating with the approach of a "generational-level" catalyst.

Kalshi's valuation doubled to $11 billion, and Polymarket is reportedly seeking a higher valuation level; meanwhile, platforms targeting the mass market—including DraftKings, FanDuel, and Robinhood—are launching compliant prediction products ahead of the 2026 FIFA World Cup (to be held in North America). Robinhood expects that the event market has generated about $300 million in annualized revenue, becoming its fastest-growing business line, showing that "opinion-based trading" is entering the financial mainstream at scale.

However, this growth is colliding head-on with regulatory realities. As platforms prepare for the participation peak driven by the World Cup, prediction markets are no longer just a product issue but increasingly a "regulatory design" issue. In reality, the focus of team building is shifting from merely meeting user needs to designing legal qualifications, jurisdictional boundaries, and settlement standards. The importance of compliance capabilities and distribution partnerships is gradually becoming as critical as liquidity; the competitive landscape is increasingly shaped by "who can scale operations within the allowed framework," rather than who can launch the most markets.

The Intertwined Forces of Regulation

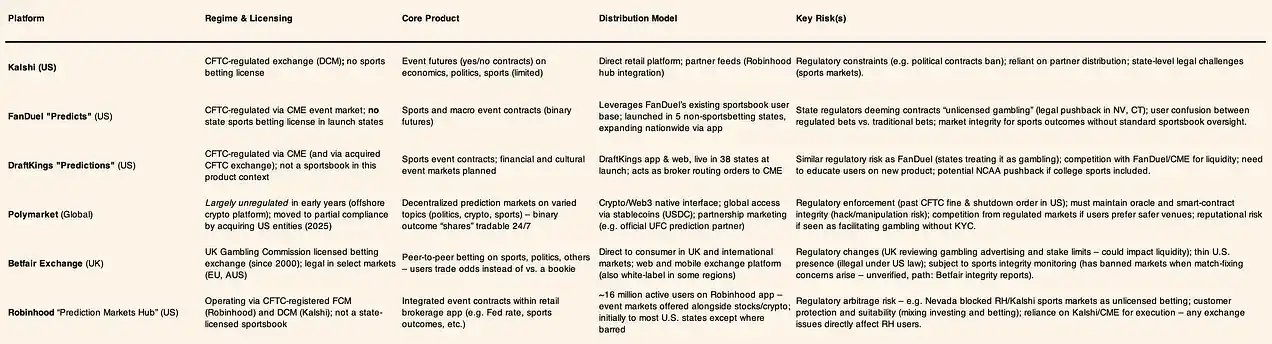

The U.S. Commodity Futures Trading Commission (CFTC) only allows a small class of event contracts linked to economic indicators, while deeming other types unacceptable gambling. In September 2023, the CFTC blocked Kalshi's attempt to launch political futures; however, a subsequent court challenge granted limited approval for contracts related to presidential elections.

At the state level, regulatory attitudes are more stringent towards "sports-like" markets. In December 2025, the Connecticut gaming regulator issued a cease-and-desist order to Kalshi, Robinhood, and Crypto.com, determining that the sports event contracts they offered constituted unlicensed gambling; Nevada also sought judicial action to halt similar products, forcing relevant platforms to delist in that state.

In response, established giants like FanDuel and DraftKings are limiting prediction products to jurisdictions where "legal sports betting is not yet available," highlighting that distribution strategies are now driven by regulatory boundaries rather than user demand. The core implication is clear: what determines scale is not product innovation, but regulatory tolerance. Contract design, settlement terms, marketing language, and geographical expansion paths are being systematically engineered to pass legal qualification reviews; platforms that can operate within accepted regulatory frameworks will gain more lasting advantages. In this market, regulatory clarity itself constitutes a moat, while uncertainty directly limits growth.

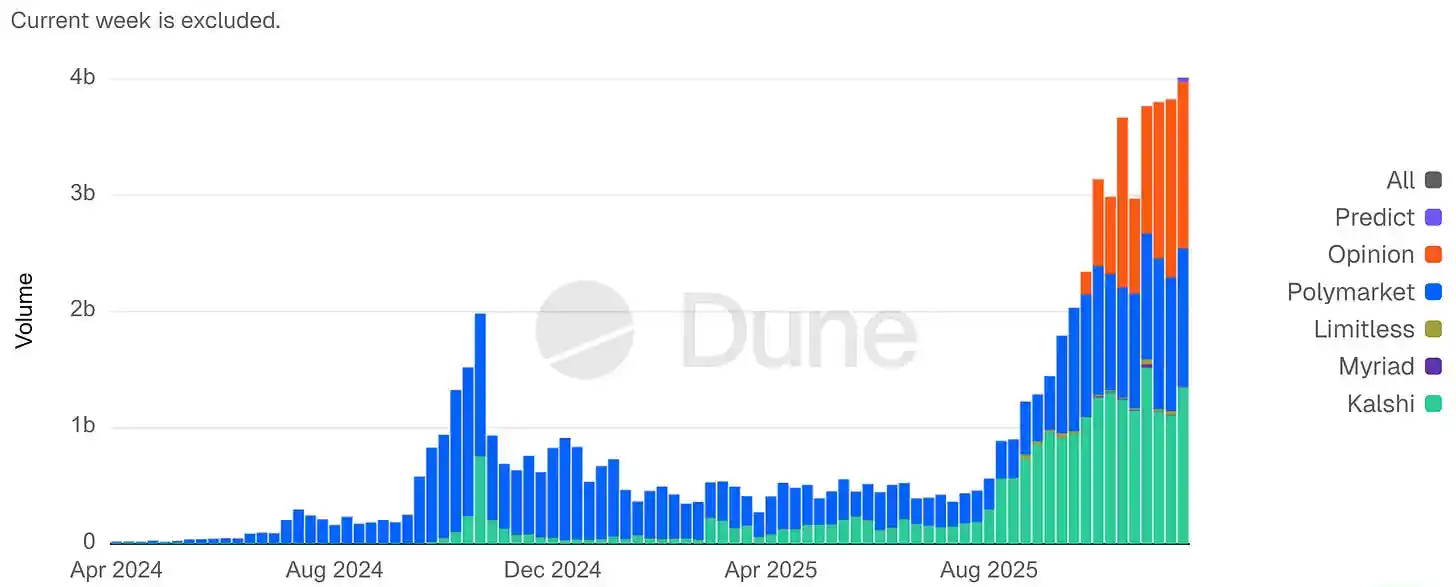

Weekly Prediction Market Notional Volume

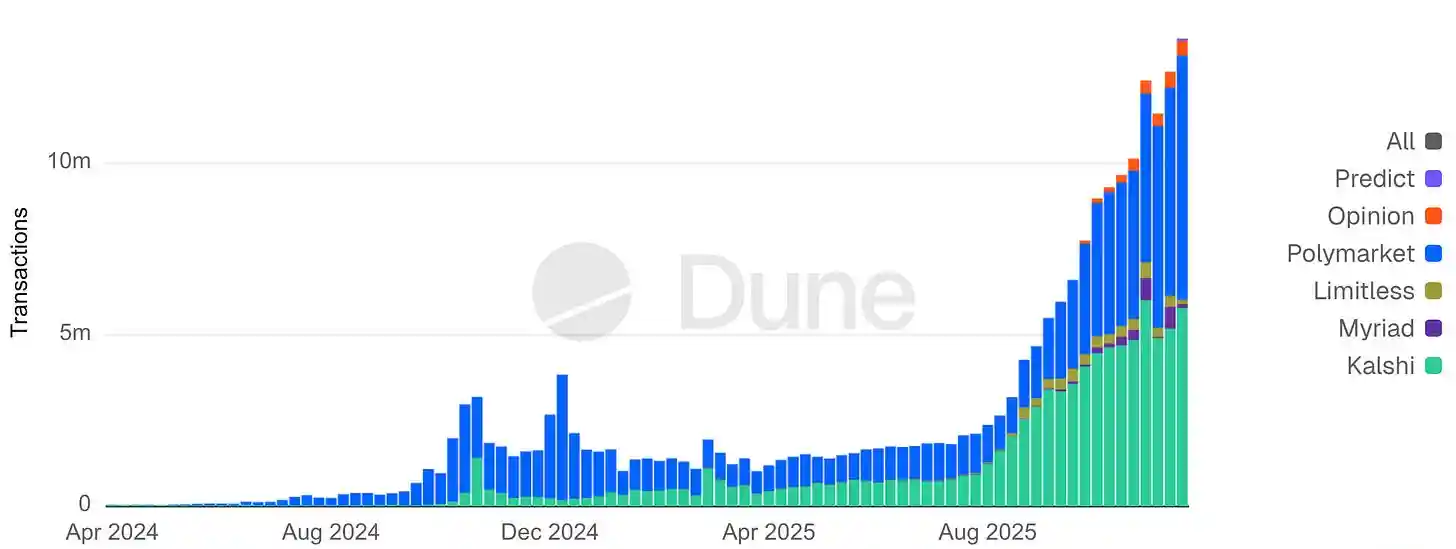

Weekly Prediction Market Transactions

Global Comparable Cases

Outside the U.S., mature betting platforms and newer licensing systems indicate that under gambling regulation, event markets can achieve liquidity, but their economics and product boundaries are significantly constrained. The UK's Betfair Exchange has proven that market depth can be formed within a gambling license framework, although strict consumer protection rules limit profitability. In Asian markets, betting is often monopolized by state-run or offshore platforms, reflecting strong potential demand but also long-standing enforcement and fairness challenges. Latin America is moving towards formalization: Brazil opened its regulated gambling market in January 2025, attempting to transform a long-existing gray area into a taxed and regulated activity.

The overall trend across regions is consistent: regulation is closing loopholes. Lottery (Sweepstakes) and social casino models relying on "free tokens + prize mechanisms" have been restricted or banned in multiple jurisdictions, significantly raising the compliance threshold for any products that skirt the gambling boundary. The global direction is towards stricter regulation, rather than indulgence of gray areas.

On-Chain Platforms vs. Compliance

Decentralized prediction markets have traded compliance for faster, more global access. Take the crypto platform Polymarket as an example: it was fined $1.4 million by the Commodity Futures Trading Commission (CFTC) in January 2022 for unregistered event swaps and was forced to implement geographic restrictions on U.S. users. Subsequently, Polymarket shifted its approach: strengthening internal controls (bringing in former CFTC advisors) and acquiring a licensed entity in 2025, allowing it to return to the U.S. in a testing format in November 2025. Its trading volume subsequently soared—reportedly reaching $3.6 billion for a single election issue in 2024, with monthly transaction volumes hitting $2.6 billion by the end of 2024; and in 2025, it attracted blue-chip investors at an estimated valuation of around $12 billion.

On-chain platforms rely on oracle technology for rapid market establishment and settlement but face a trade-off between speed and fairness: governance and oracle disputes can delay results, and anonymity raises concerns about manipulation or insider trading. Regulators are also remaining vigilant: even if the code is decentralized, organizers and liquidity providers may still become targets for enforcement (as seen in the Polymarket case). The challenge in 2026 will be to combine the innovations of a 24/7 global market and crypto instant settlement with sufficient compliance without sacrificing openness.

User Behavior and Transaction Trends

In 2025, prediction markets surged simultaneously in sports and non-sports events. Industry estimates show that total nominal transaction volume expanded more than tenfold compared to 2024, reaching about $13 billion/month by the end of 2025. The sports market became the main "transaction engine," with high-frequency events generating continuous small trades; political and macro markets acted as "capital magnets," with fewer transactions but larger individual amounts.

Structural differences are evident: at Kalshi, sports contracts contributed the majority of cumulative transaction volume, reflecting repeated participation from entertainment-driven users; however, open positions are more concentrated in political and economic contracts, indicating heavier single-position funding. At Polymarket, the political market similarly dominates open positions, despite lower trading frequency. Conclusion: sports maximize turnover, while non-sports concentrate risk.

This results in two types of participants:

Sports users: more like "traffic traders," engaging in multiple small transactions driven by entertainment and habit;

Political/macroeconomic users: more like "capital allocators," making fewer but larger transactions, seeking informational advantages, hedging, or narrative influence.

Platforms thus face dual optimization: maintaining traffic participation while providing credibility and fairness for capital-driven markets.

This also explains the concentration of risk: controversies in 2025 mainly arose in non-sports areas, including opposition from U.S. collegiate sports regulators regarding contracts related to student athletes. Platforms quickly delisted related contracts, indicating that governance risk rises with funding concentration and information sensitivity, rather than merely with pure transaction volume growth. Long-term growth depends on whether high-impact non-sports markets can operate without crossing regulatory or reputational red lines.

2026 World Cup: System-Level Stress Test

The FIFA World Cup will be jointly hosted by the United States, Canada, and Mexico and should be viewed as a full-stack stress test for event trading and compliant gambling infrastructure. Historical analogies show:

The 1994 U.S. World Cup primarily tested physical venues; the 1996 Atlanta Olympics shifted the critical path towards communication, information distribution, and emergency response. IBM's "Info '96" centralized timing and scoring, telecom companies expanded cellular networks, and Motorola deployed large-scale intercom systems; the bombing at Centennial Olympic Park on July 27 that year highlighted the importance of integrity and resilience under high pressure.

The pressure points in 2026 will clearly enter the digital + financial coupling layer: the tournament will expand to 48 teams, 104 matches, and 16 cities, with multiple concentrated bursts of attention and trading flow over approximately five weeks. The global betting scale for the 2022 World Cup was widely estimated to be in the hundreds of billions of dollars, with peak windows bringing extreme short-term liquidity and settlement loads.

The North American compliance track will bear a larger proportion of activities—38 U.S. states, Washington D.C., and Puerto Rico have legalized sports betting to varying degrees, with more funds flowing through KYC, payment, and monitoring systems rather than offshore channels. App-based distribution further tightens the coupling: live broadcasts, real-time contracts, deposits, and withdrawals are often completed within a single mobile session.

Observable operational pressure points for event contracts/prediction markets include: liquidity concentration and volatility during match windows; settlement integrity (data delays, dispute resolution); cross-federal/state product and jurisdictional design; scalability of KYC/AML/responsible gambling/withdrawals under peak demand.

The same regulatory and technical stack will also be tested again at the 2028 Los Angeles Olympics, making the 2026 World Cup more like a filtering event: it may trigger regulatory intervention, platform consolidation, or market exits, distinguishing infrastructure built for peak phases from platforms that can sustain compliant scaling.

Payment and Settlement Innovations

Stablecoins are transitioning from speculative assets to operational infrastructure. Most crypto-native prediction markets complete deposits and settlements using dollar-pegged stablecoins, and regulated platforms are also testing similar channels. In December 2025, Visa launched a pilot in the U.S. allowing banks to use Circle's USDC for on-chain settlements 24/7, building on cross-border stablecoin experiments that began in 2023. In event-driven markets, stablecoins (where permitted) provide advantages in instant access, global coverage, and matching settlement with continuous trading periods.

In practice, stablecoins function more like settlement middleware: users see them as faster deposit and withdrawal tools; operators benefit from lower failure rates, improved liquidity management, and near-instant settlements. Therefore, stablecoin policies have a second-order impact on prediction markets: restricting stablecoin channels increases friction and slows withdrawals; regulatory clarity benefits the deep integration of mainstream gambling and brokerage platforms.

But there are also resistances. Christine Lagarde warned in 2025 about the monetary stability risks of private stablecoins and reiterated support for a central bank digital euro; the European Central Bank also pointed out in its November 2025 "Financial Stability Assessment" that the expansion of stablecoins could weaken banks' funding sources and disrupt policy transmission. In 2026, a more gradual integration is likely to occur: more gambling platforms will accept stablecoin deposits, payment institutions will bridge cards to crypto, while strengthening licensing, reserve audits, and disclosures, rather than fully endorsing native crypto payment tracks.

Macroeconomic Liquidity Background

Assessing the prosperity of 2025 requires skepticism: loose funds can amplify speculation. The Federal Reserve's shift to end quantitative tightening at the end of 2025 may slightly improve liquidity in 2026, affecting risk appetite more than adoption direction. For prediction markets, liquidity impacts participation intensity: ample funds → increased transactions; tightening → reduced marginal speculation.

However, the growth in 2025 occurred in a high-interest-rate environment, indicating that prediction markets are not primarily driven by liquidity. A more reasonable framework is to view macro liquidity as an accelerator rather than an engine. Long-term factors—mainstream distribution of brokerage/gambling, product simplification, and increased cultural acceptance—better explain baseline adoption. Monetary conditions affect amplitude but do not determine whether adoption occurs.

"The Missing Element": Super App Distribution and Moat

The key question is: who controls the user interface for integrated trading/gambling?

Consensus is forming: distribution is king, and the real moat lies in super app-style user relationships.

This drives intensive collaboration: exchanges want retail users (e.g., CME Group's collaboration with FanDuel/DraftKings), and consumer platforms want differentiated content (e.g., Robinhood's partnership with Kalshi, DraftKings acquiring a small CFTC exchange).

The model resembles comprehensive brokerage: stocks, options, crypto, and event contracts are presented side by side, allowing users to stay on the platform.

Prediction markets are exceptionally sensitive to liquidity and trust: thin markets can fail quickly, while depth compounds returns. Platforms with existing users, low customer acquisition costs, ready KYC, and funding channels naturally outperform independent venues that need to build depth from scratch. Therefore, it resembles options trading more than social networking: depth and reliability outweigh novelty. This is also why the "function vs. product" debate is increasingly decided by distribution rather than technology.

Robinhood's early success supports this judgment: it launched event trading to some active traders in 2025, rapidly scaling up; ARK Invest estimates its recurring revenue reached $300 million by year-end. The moat comparison is clear: independent prediction markets (even with innovation) struggle against existing user bases. For example, FanDuel has over 12 million users and quickly established liquidity and trust in five states by integrating CME event contracts; DraftKings replicated a similar path in 38 states. In contrast, Kalshi and Polymarket spent years building depth from scratch and are now more actively seeking distribution partnerships (with Robinhood, Underdog Fantasy, and even UFC).

Possible outcomes: a few large aggregation platforms gain network effects and regulatory endorsements; small platforms either specialize (e.g., only doing crypto events) or get acquired. Meanwhile, the fusion of fintech and media super apps is approaching: PayPal and Cash App may soon position prediction markets alongside payments and stocks; Apple, Amazon, and ESPN have explored sports betting collaborations from 2023 to 2025, potentially evolving into broader event trading. The true "missing element" may be the moment when tech giants fully embed prediction markets into super apps—integrating news, gambling, and investment into a moat that few competitors can match.

Before that, the user lock-in competition among exchanges, gambling companies, and brokers will continue. The key question for 2026 is: will prediction markets become a feature of large financial apps, or continue to exist as independent verticals? Early evidence points towards integration.

However, regulators may also remain vigilant about super apps that seamlessly switch between investment and gambling. The ultimate winners will be platforms that can persuade both users and regulators—whose moats come not only from technology and liquidity but also from compliance, trust, and experience.

Opinion Trade (Opinion Labs): A Macro-Focused On-Chain Challenger

Opinion Trade (launched by Opinion Labs) positions itself as a "macro-priority" on-chain prediction trading platform, with a market form closer to dashboards for interest rates and commodities rather than betting products dominated by entertainment events. The platform went live on the BNB Chain on October 24, 2025, and by November 17, 2025, its cumulative nominal transaction volume had exceeded $3.1 billion, with an average daily nominal transaction volume of about $132.5 million in the early stages.

During the period from November 11 to 17, the platform's weekly nominal transaction volume was about $1.5 billion, ranking among the leading prediction market platforms; as of November 17, its open contract size reached $60.9 million, still trailing behind Kalshi and Polymarket at that time.

On the infrastructure level, Opinion Labs announced a partnership with Brevis in December 2025 to introduce a zero-knowledge proof-based verification mechanism into the settlement process, aiming to reduce the trust gap in market outcome determinations. The company also disclosed the completion of a $5 million seed round of financing, led by YZi Labs (formerly Binance Labs), with other investors participating, which not only provided financial support but also strategically connected closely with the BNB ecosystem.

Additionally, the platform's clear geographic restrictions on the U.S. and other restricted jurisdictions highlight a core trade-off faced by on-chain prediction markets in 2025-2026: how to achieve rapid global liquidity aggregation under regulatory boundaries.

Consumer-Level Prediction Markets as "ICO 2.0" Distribution Channels

Sport.Fun (formerly Football.Fun) provides a concrete case of how consumer-level prediction markets can evolve into a new generation of token distribution infrastructure. This emerging "ICO 2.0" model is directly embedded into consumer applications with real revenue. Sport.Fun launched on Base in August 2025, initially focusing on event trading similar to fantasy football, and later expanded to NFL-related markets.

By the end of 2025, Sport.Fun disclosed that its cumulative transaction volume had exceeded $90 million, with platform revenue surpassing $10 million, demonstrating that the product had validated a clear product-market fit before any public token issuance.

The company completed a $2 million seed financing round, led by 6th Man Ventures, with participation from Zee Prime Capital, Sfermion, and Devmons. This investor structure reflects the rising market interest in consumer-facing crypto applications—these projects combine financial primitives with entertaining participation methods, rather than merely betting on underlying infrastructure. More importantly, this round of funding was invested only after user activity and monetization capabilities had been validated, overturning the traditional sequence of "selling tokens first, then finding users" seen in early ICO cycles.

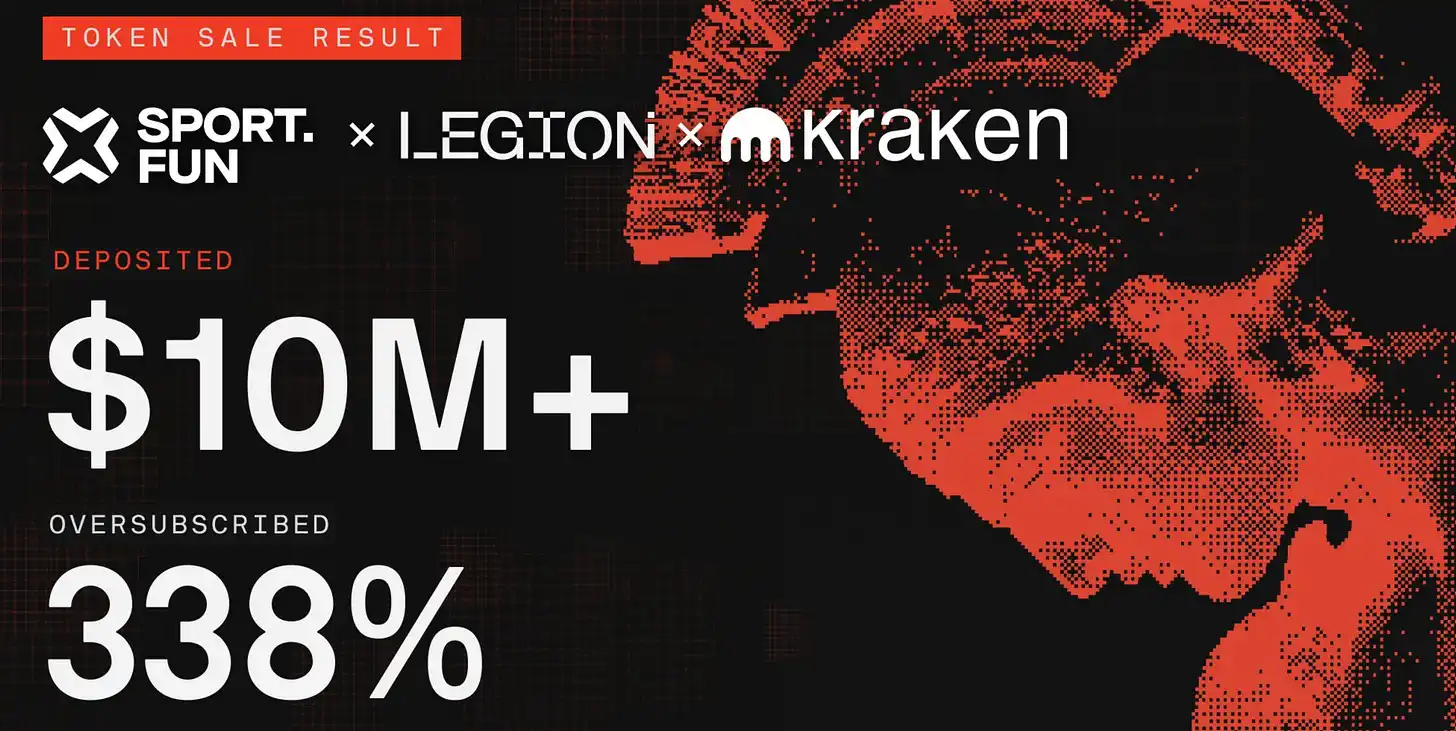

The public token issuance of Sport.Fun further confirms this shift.

The public sale of $FUN took place from December 16 to 18, 2025, via the Kraken Launch platform, and was completed through a contribution and qualification-oriented Legion distribution path. This sale attracted over 4,600 participants, with a total subscription amount exceeding $10 million; the average participation size per wallet was about $2,200. Demand exceeded the $3 million soft cap by approximately 330%.

Ultimately, $4.5 million was raised, with the token priced at $0.06, corresponding to a fully diluted valuation (FDV) of $60 million; after exercising the green shoe mechanism for expansion, a total of 75 million tokens were sold.

The design of the token economic model aims to strike a balance between liquidity and post-launch stability.

According to the arrangement, 50% of the tokens will be unlocked during the token generation event (TGE) in January 2026, with the remaining portion released linearly over six months. This structure is markedly different from the "immediate full unlock" commonly seen in early ICO cycles, reflecting lessons learned and corrections made from past experiences driven by volatility that ultimately led to price collapses. Functionally, this token issuance resembles a natural extension of existing consumer markets—allowing users who are already actively trading on the platform to "invest" back into the products they are using.

Conclusion

By the end of 2025, prediction markets have transitioned from marginalized experiments to a credible, mass-market category. Their growth drivers stem from mainstream channel distribution, product simplification, and clearly visible user demand. The current core constraint is no longer "whether adoption will occur," but rather how to design within regulatory frameworks: legal qualifications, settlement integrity, and cross-jurisdictional compliance will determine who can achieve scalability.

The FIFA World Cup should not be simply understood as a growth narrative but rather as a system-level stress test under peak loads—a comprehensive examination of liquidity, operational capacity, and regulatory resilience. Platforms that can pass this test without triggering enforcement risks or suffering reputational damage will define the next phase of industry consolidation; those that fail will accelerate the industry's move towards higher standards, stronger regulation, and fewer but larger winners.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。