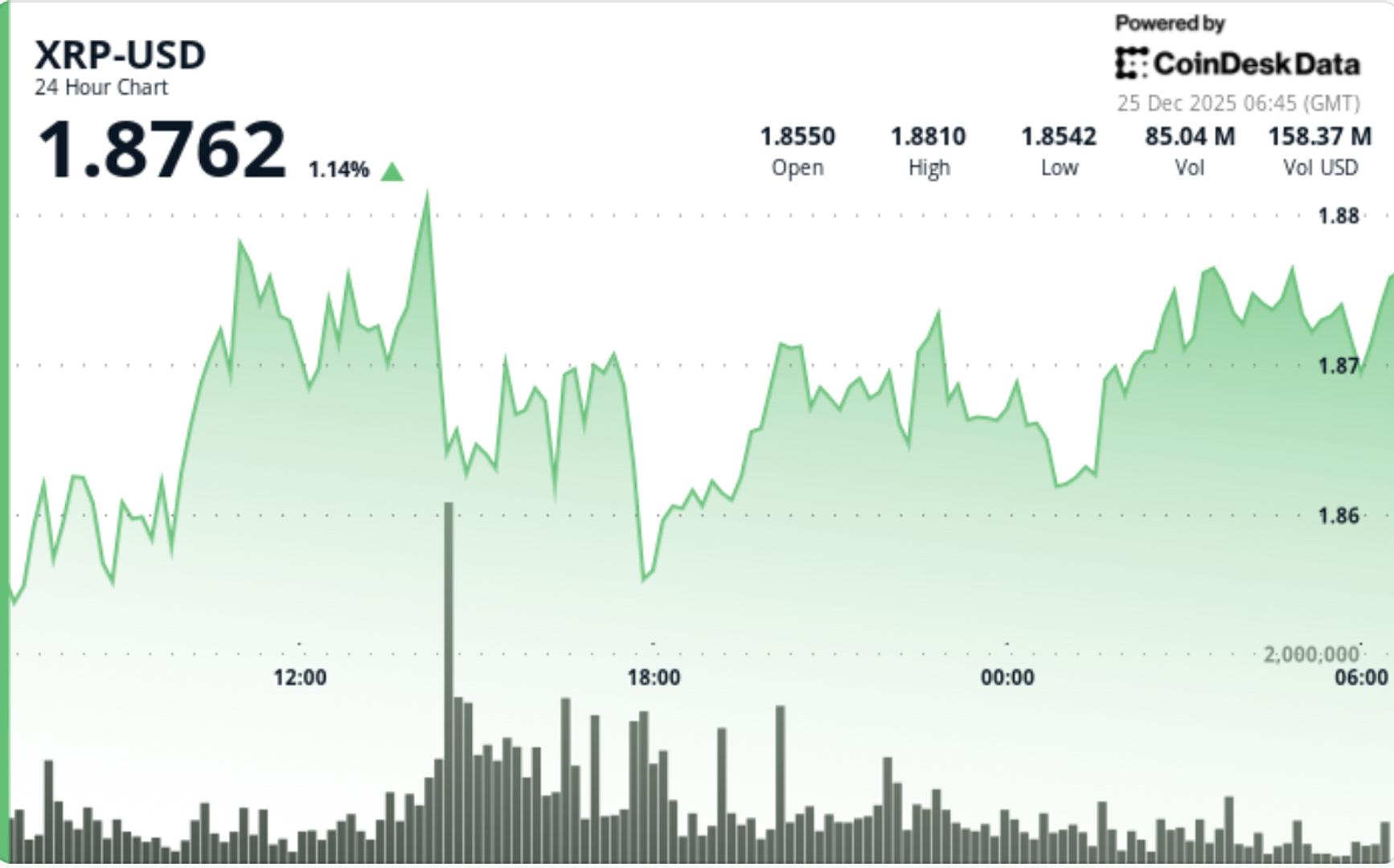

需要了解的事项:尽管现货ETF的需求保持稳定,ETF持有的总资产上升至12.5亿美元,XRP仍跌至1.86美元,交易者在反弹时卖出。机构投资者越来越多地通过交易所交易基金获得XRP的敞口,最近增加了819万美元,这表明他们更倾向于结构化产品。XRP仍在1.85–1.91美元的区间内,1.90美元附近有强烈的卖盘,而1.86美元附近有持续的买盘,暗示可能会出现决定性的突破。

尽管现货ETF的需求保持稳定,ETF持有的总资产上升至12.5亿美元,XRP仍跌至1.86美元,交易者继续在反弹时卖出——这一差距表明市场仍在消化关键技术水平的供应。

新闻背景

机构对XRP敞口的需求通过交易所交易基金持续增长,投资者在最近的交易中增加了819万美元。这使得ETF持有的净资产总额达到12.5亿美元,进一步强化了专业投资者通过受监管的工具建立头寸的想法,而不是追逐现货的动量。

这一流动趋势符合机构加密货币配置的更广泛模式:投资组合经理越来越倾向于减少保管和合规摩擦的结构化产品,尤其是在流动性充足和监管透明度提高的情况下。XRP在各个交易场所的深度以及稳定的ETF买盘保持了长期需求的完整性,即使短期价格波动仍然不稳定。

在更广泛的市场中,比特币的反弹尝试在美国交易时段缺乏持续性,使主要货币陷入风险规避的区间交易中,流动性重要,但技术水平仍主导日常交易。

技术分析

XRP从1.88美元跌至1.86美元,保持在1.85–1.91美元的区间内,卖方多次捍卫1.9060–1.9100的阻力区域。在交易最活跃的时段,成交量急剧上升,75.3百万的交易量——比平均水平高出约76%——在拒绝时出现,强调这并不是低流动性的漂移。这是一个市场在真实的卖盘压力下的表现。

价格短暂突破了1.854–1.858的整合区间,并在活动激增时测试了1.862,交易量大约是典型日内流动的8–9倍。但这一走势缺乏持续性,XRP在供应回归时又回落至1.86美元。

对1.90美元以上的反复防守表明卖方仍在利用该区域进行强势分发。同时,1.86–1.87美元附近的买盘持续出现,足以防止市场崩溃——形成一个收紧的螺圈,下一次突破可能是决定性的。

价格行动总结

- XRP从1.8783美元滑落至1.8604美元,保持在1.85–1.91美元的区间内

- 最强的卖盘反应出现在1.9061美元的阻力附近,成交量高于平均水平

- 多头在多次重测中保持了1.86美元的支撑,限制了下行的延续

- 短暂突破之前的整合区间未能转化为持续的走势

交易者应了解的事项

两种力量正在竞争,这就是故事:ETF流动在背景中持续支持,但短期交易者仍将1.90–1.91美元视为卖出区。

这些水平很清晰:

- 如果1.87美元保持,XRP能够重新夺回1.875–1.88美元,下一次测试是1.90–1.91美元的重供应集群。若收盘在此之上,将迫使空头回补,并将价格拉向1.95–2.00美元。

- 如果1.86美元失守,市场可能滑向1.77–1.80美元的下一个需求区间,历史上之前的买家在此处进行了防守,而“恐惧”情绪往往在此达到顶峰。

目前,市场表现得像是有分发压力的整合——但ETF流动作为稳定器,可能使下行走势变得更加缓慢,而不是自由下跌,除非比特币再次大幅下跌。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。