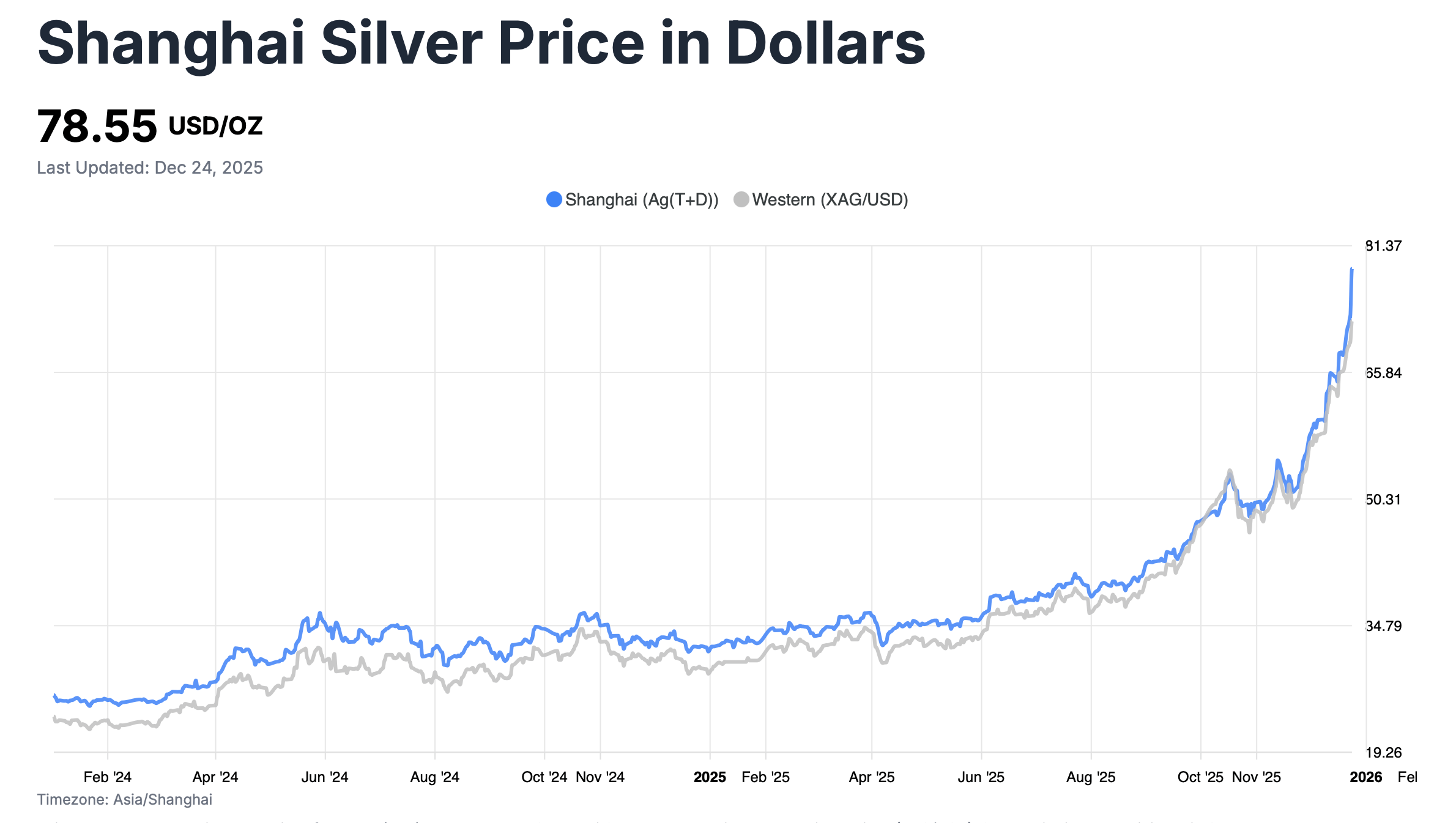

Silver prices on the Shanghai Gold Exchange climbed to lofty territory on Dec. 24, 2025, with the Ag(T+D) spot contract settling near 19,400 Chinese yuan per kilogram, or roughly $78.55 per ounce using the day’s USD/CNY rate of about 7.015.

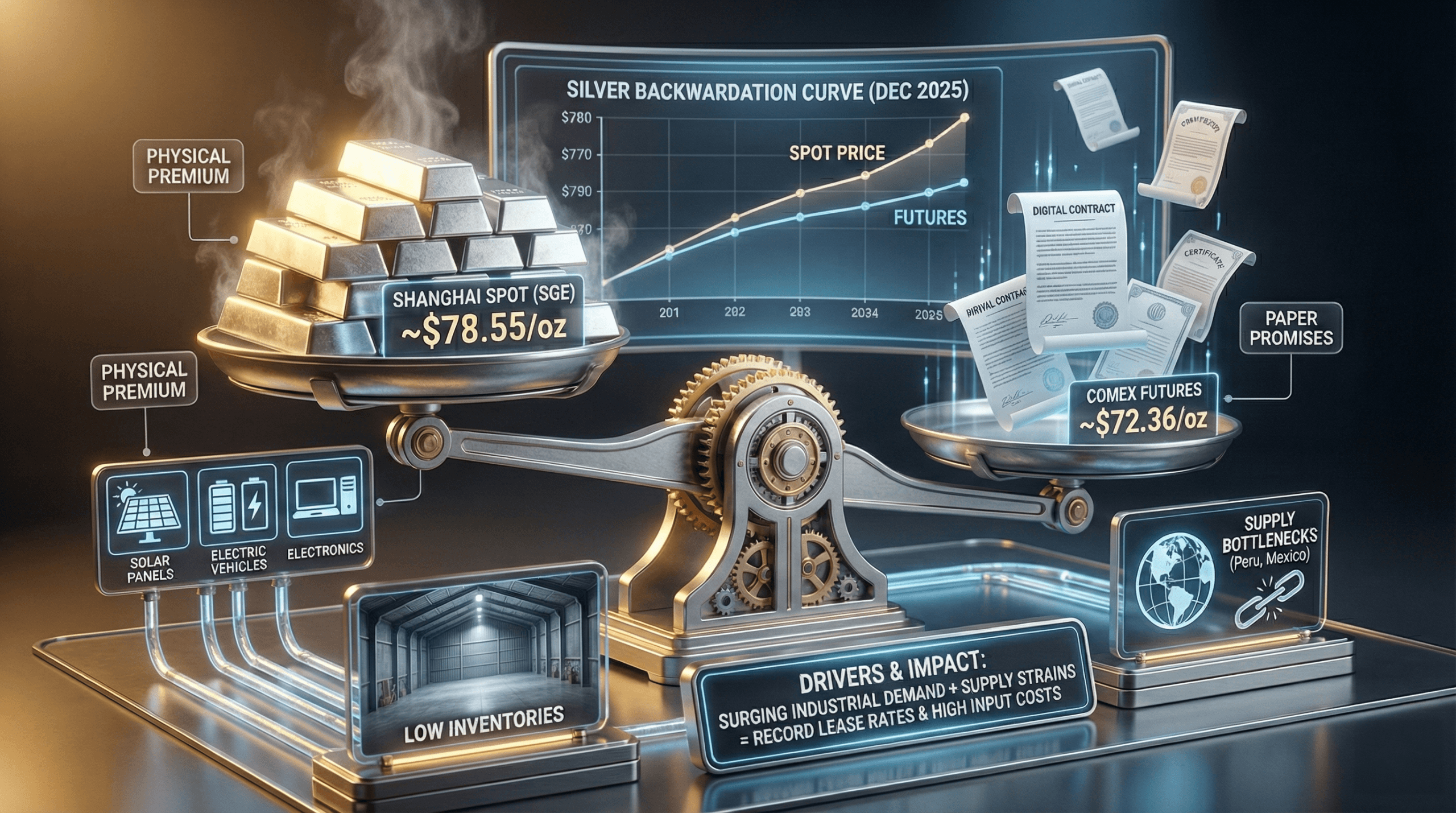

That price tag placed Shanghai silver comfortably above the global yardstick on Comex, where futures wrapped up at $72.36 per troy ounce. The gap pointed to local strains in China’s market, where near-term physical demand looked heavier than available supply.

Silver backwardation—when spot prices top futures—made itself known in China’s silver contracts toward the end of 2025. On the Shanghai Futures Exchange, near-dated silver futures sat below the spot equivalent, with the main contract around 17,609 yuan per kilogram, or about $78.02 per ounce, confirming the inverted curve. Such a setup, far from business as usual, suggested traders preferred metal in hand now rather than promises later, often an early warning of supply stress.

The main force behind this backwardation traced back to thinning silver stockpiles in China, the world’s largest consumer of the metal. Inventories on Shanghai exchanges slid to multi-year lows by November 2025, pressured by strong industrial appetite that ran ahead of imports and local output. China’s solar panel industry, a heavy silver user for photovoltaic cells, grew sharply in 2025, helping fuel expectations of a global silver deficit for a fifth straight year.

Other contributors included supply hiccups from major mining regions beyond China, notably Peru and Mexico, where labor disputes and environmental rules trimmed production. These global bottlenecks restricted bullion flows into China, intensifying the local mismatch. Trade policy shifts and currency moves added to the mix, as a firmer yuan against the U.S. dollar raised import costs and nudged holders toward keeping metal close.

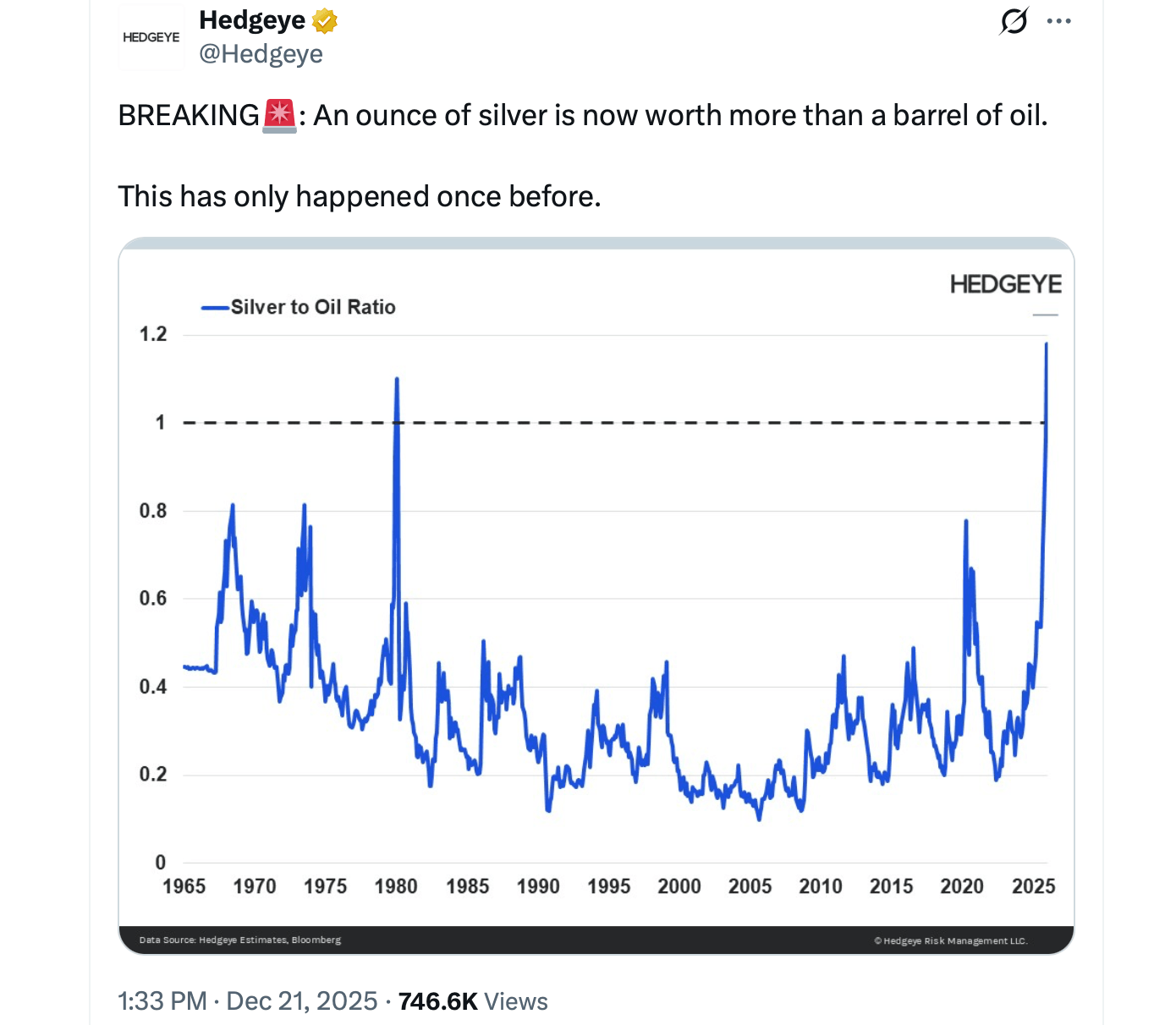

The first big blast higher in silver on the chart—circa 1979–1980—came courtesy of the Hunt brothers’ audacious bid to corner the global silver market. The brothers—chiefly Nelson Bunker Hunt and William Herbert Hunt—went on a buying spree in the 1970s, hoovering up physical silver and loading up on silver futures. The strategy was part inflation shield, part currency-hedge panic after the Bretton Woods system fell apart, with a side quest of gaining oversized influence over supply. That party ended abruptly when COMEX and the Chicago Board of Trade rewrote the margin rules, sending prices tumbling.

On the demand front, China’s electronics and electric vehicle industries added further pressure, since silver’s conductivity makes it indispensable for batteries and wiring. Investment demand heated up too in recent times, with retail buyers and institutions eyeing silver as a hedge against inflation and geopolitical strains, including U.S.-Venezuela tensions that indirectly influenced commodity routes. Together, these forces fed a loop in which higher spot prices encouraged hoarding physical metal instead of rolling into futures.

Also read: Crypto Traders Cry Foul as Bitcoin Lags Behind a Red-Hot Gold, Silver and Stock Market

The backwardation has sent ripples across China’s silver market, bringing sharper day-to-day price swings. Trading volumes on Shanghai exchanges jumped, with reports of brisk activity as speculators lined up for possible short squeezes. Silver lease rates—essentially the cost to borrow physical metal—rose to record territory, signaling tight conditions in the lending pool.

Chinese producers reacted by speeding up sales to take advantage of elevated spot prices, a move that could ease immediate pressure but risk future supply gaps if investment in mining falls behind. Industrial users, meanwhile, faced steeper input costs, which could filter through to higher prices for exports such as solar panels and electronics. This dynamic highlighted silver’s split personality as both a factory input and a financial plaything.

Beyond China, the backwardation echoed through global pricing, with Comex futures showing sympathetic moves even as inversion remained milder in Western markets. Analysts have warned that ongoing deficits could propel silver toward triple-digit prices if supply fails to recover in 2026. Still, Federal Reserve rate decisions and economic momentum in regions like the U.S. and Europe could temper the pace.

Traders kept a close watch on inventory data, treating Shanghai warehouse levels as a pulse check on market tightness. By late December 2025, withdrawals from these stocks continued, reinforcing the backwardated curve and sparking calls for more recycling and alternative sourcing. Comparisons to past squeezes surfaced, though specialists cautioned that any resolution hinges on supply chain adjustments.

In sum, China’s silver backwardation in 2025 points to deeper structural strains in the global market, where demand from green technologies has been outpacing mine supply growth. As the year wraps up, Shanghai’s premium over Comex has held firm, a sign that physical imbalances could spill into the new year unless policy shifts or production gains step in.

- Why did silver trade at a premium in Shanghai on Dec. 24, 2025?

Silver on the Shanghai Gold Exchange priced above futures as tight physical supply in China pushed spot demand ahead of paper contracts. - What does silver backwardation mean for China’s market?

Backwardation in China signals that buyers are willing to pay more for immediate delivery than future supply, pointing to near-term scarcity. - How did Shanghai prices compare with Comex silver?

Shanghai silver traded well above prices on the Comex, reflecting localized pressures not fully seen in Western markets. - What sectors are driving silver demand in China?

China’s solar, electronics, and electric vehicle industries are absorbing large volumes of silver, tightening availability across the domestic market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。