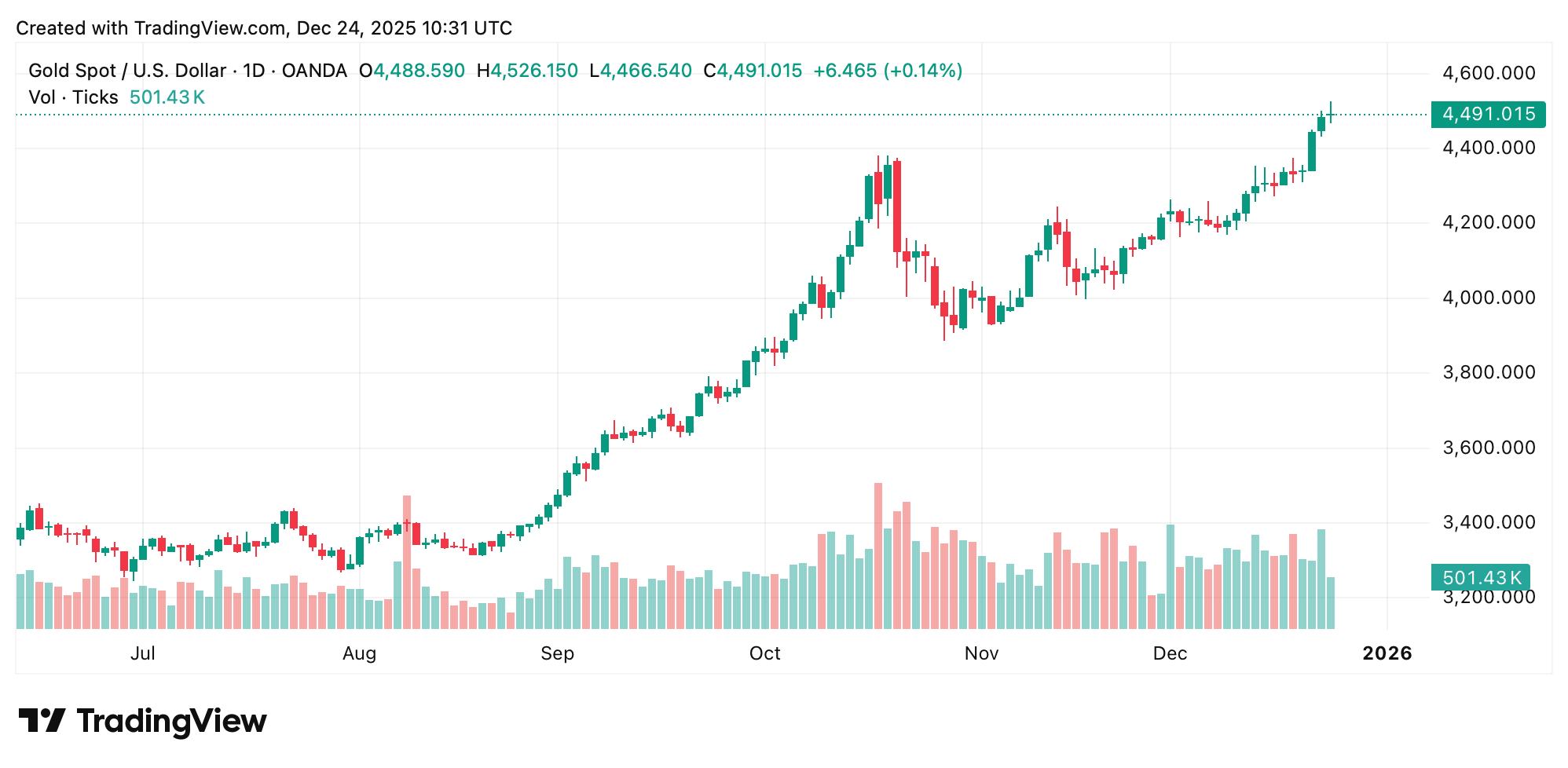

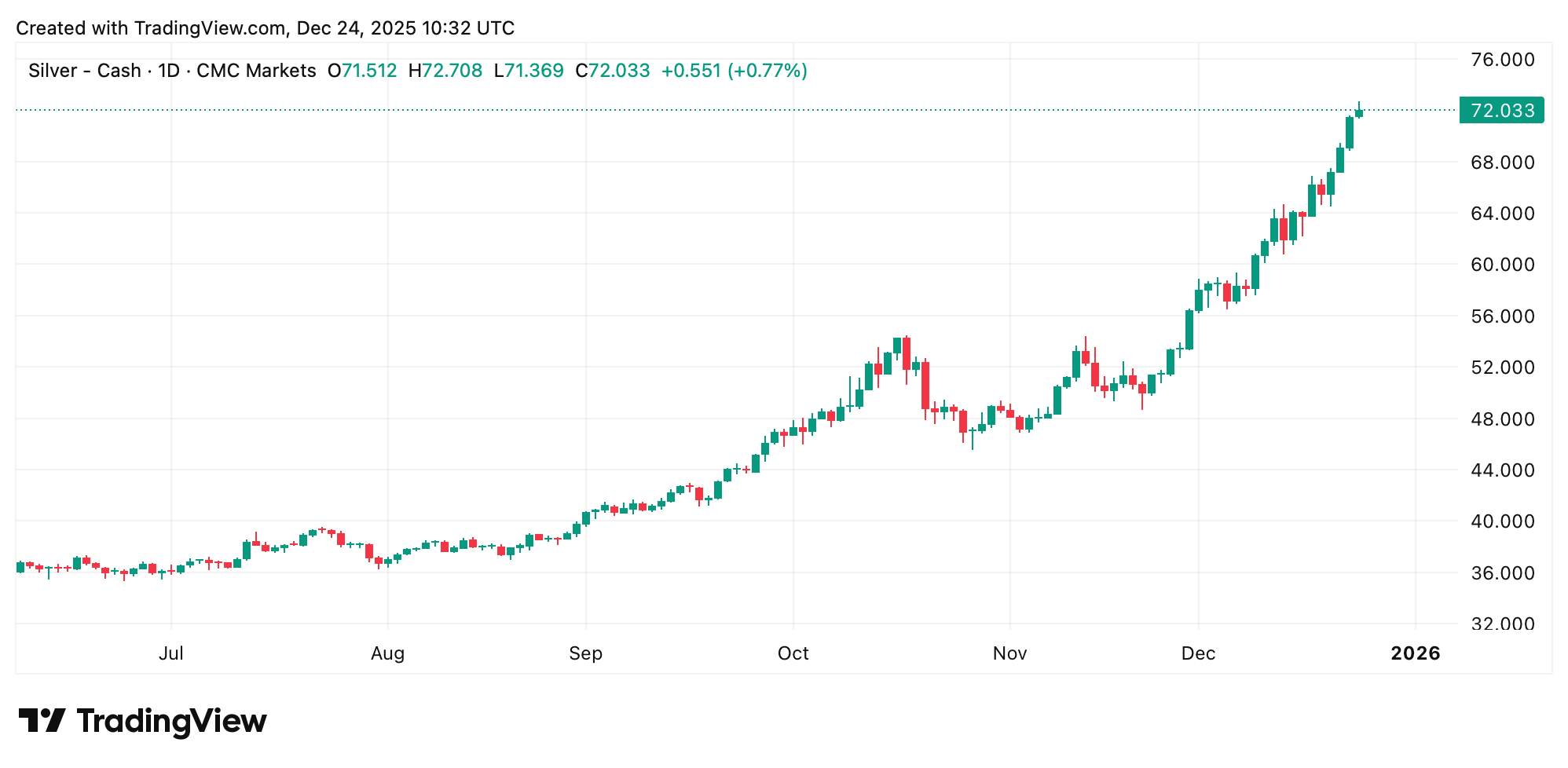

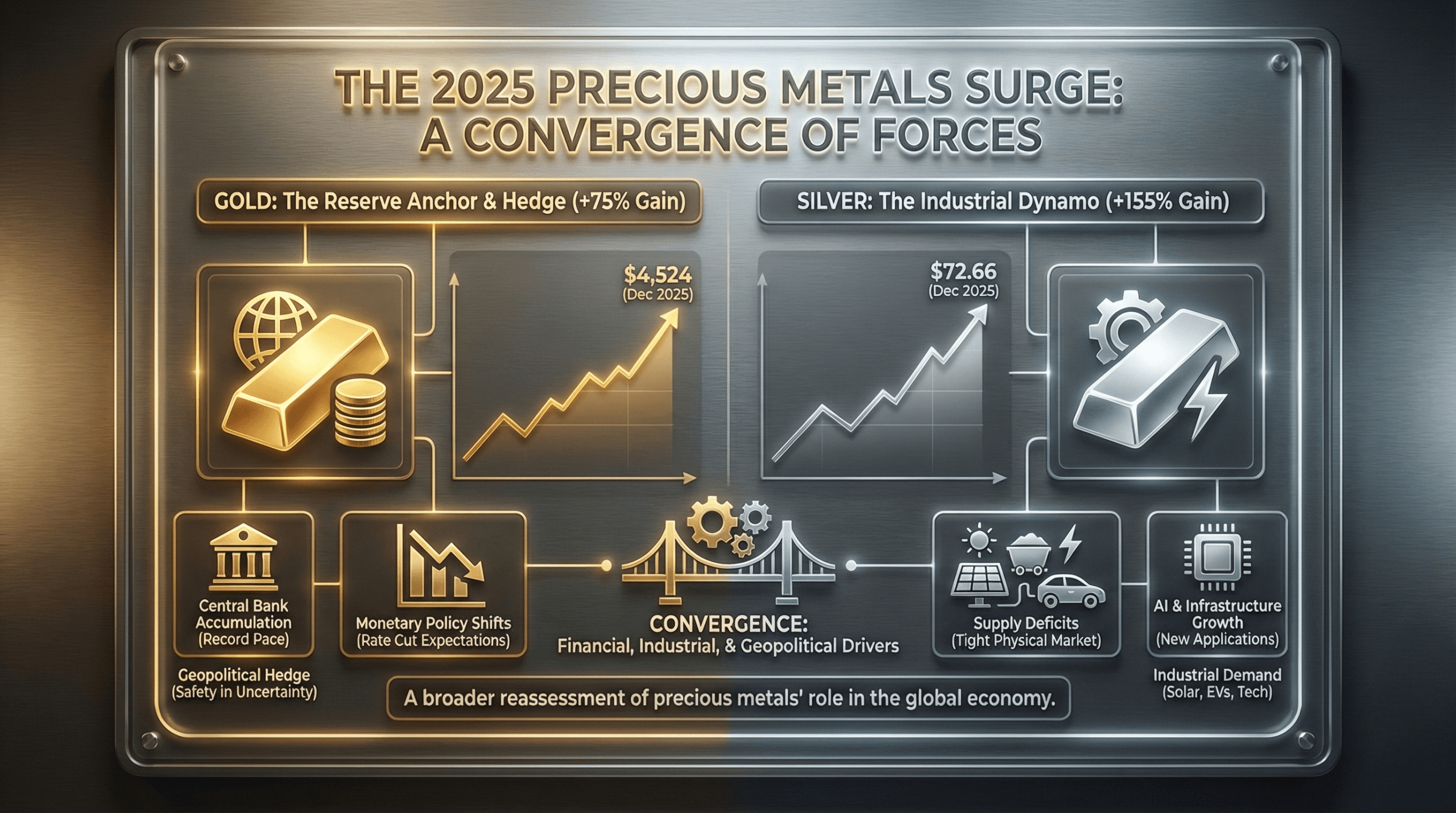

Gold prices climbed from $2,585 per ounce in January to $4,524 by Dec. 23, posting a 75% annual gain, while silver rose from $28.51 to $72.66 per ounce, marking a 155% increase over the same period.

The advance capped one of the strongest years for precious metals in decades, with both assets outperforming most major commodities and financial benchmarks. Analysts pointed to a combination of macroeconomic uncertainty, central bank diversification, and supply constraints as core drivers behind the sustained rally.

“The market divergence is hard to ignore. While indices show exhaustion, metals are soaring,” one X user wrote in mid-December. “With structural deficits & central banks buying, the flight to safety is on. The next leg higher is soon.”

Gold’s performance in 2025 reflected renewed demand for monetary hedges as real interest rates remained pressured for much of the year. Expectations for interest rate cuts early in the year set the tone, while persistent geopolitical tensions reinforced gold’s appeal as a reserve asset. Central banks continued to accumulate bullion at a historically elevated pace, adding steady demand independent of short-term market positioning.

Silver’s move proved even more pronounced, reflecting its dual role as both a monetary metal and a critical industrial input. Demand from solar manufacturing, electric vehicles, data centers, and electronics expanded throughout the year, tightening supply in a market already experiencing multi-year deficits. Unlike gold, silver’s price action showed sharper acceleration during periods of industrial demand growth.

Market data from 2025 showed that gold and silver followed a phased trajectory. Early gains were supported by monetary policy expectations and safe-haven flows. Midyear consolidation gave way to renewed upside momentum in the second half as physical supply constraints became more visible and investment demand reaccelerated.

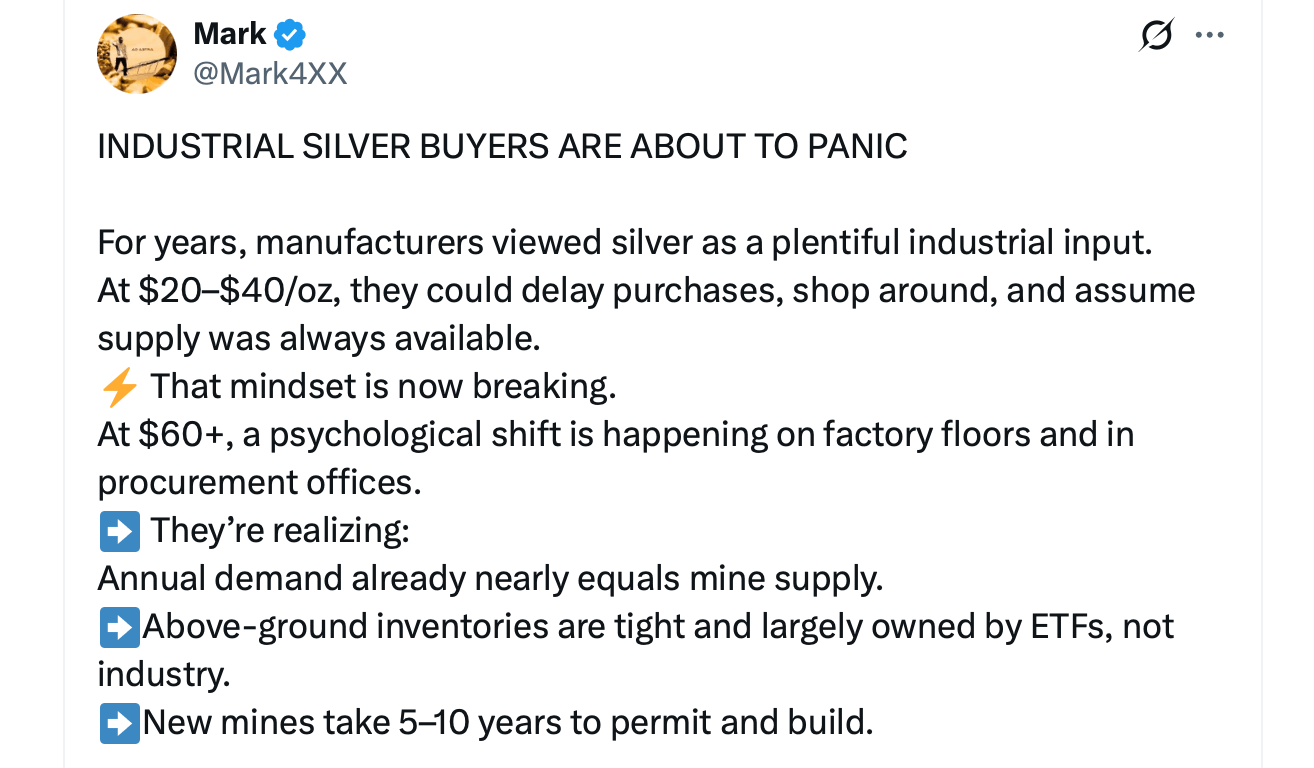

Silver inventories, particularly across major exchanges and vaulting systems, declined as industrial consumption absorbed available supply. Leasing rates rose sharply at several points during the year, signaling tightness in the physical market rather than speculative excess. These conditions amplified silver’s price response during periods of increased demand.

Gold’s rise was steadier but equally significant. Investment flows into bullion-backed products increased alongside physical bar and coin demand, particularly outside North America. Central banks in emerging and developed markets alike continued diversifying reserves amid concerns surrounding currency exposure and long-term fiscal sustainability.

The broader economic backdrop also played a role. Global debt levels remained elevated, while inflation metrics proved uneven across regions. These factors reinforced demand for hard assets viewed as stores of value (SoV), particularly during periods of currency volatility and geopolitical strain.

Industrial demand emerged as a defining feature of silver’s outperformance. Solar panel production alone accounted for a growing share of annual silver consumption, while electric vehicle manufacturing continued to increase silver loadings per unit. Expansion in artificial intelligence (AI) infrastructure and advanced electronics further tightened the supply-demand balance.

“Silver is no longer playing second fiddle — it’s gaining real market value, not just hype,” one X influencer explained. “Some analysts are calling this a once-in-a-decade reset. Silver may just be finding its real value, and if demand holds — this ride could go WAY higher.”

By year’s end, both metals reached new nominal highs, reflecting not only cyclical forces but longer-term structural shifts. Analysts noted that silver’s performance highlighted vulnerabilities in supply chains for energy transition technologies, while gold’s strength always points to ongoing demand for neutral reserve assets.

Also read: Blackrock’s 2025 Investment Themes Put Bitcoin and IBIT Front and Center

Market participants debated whether the gains represented a temporary overshoot or a repricing driven by durable fundamentals. While short-term volatility remained possible, the breadth of demand across investment, industrial, and official sectors differentiated 2025 from previous metals rallies.

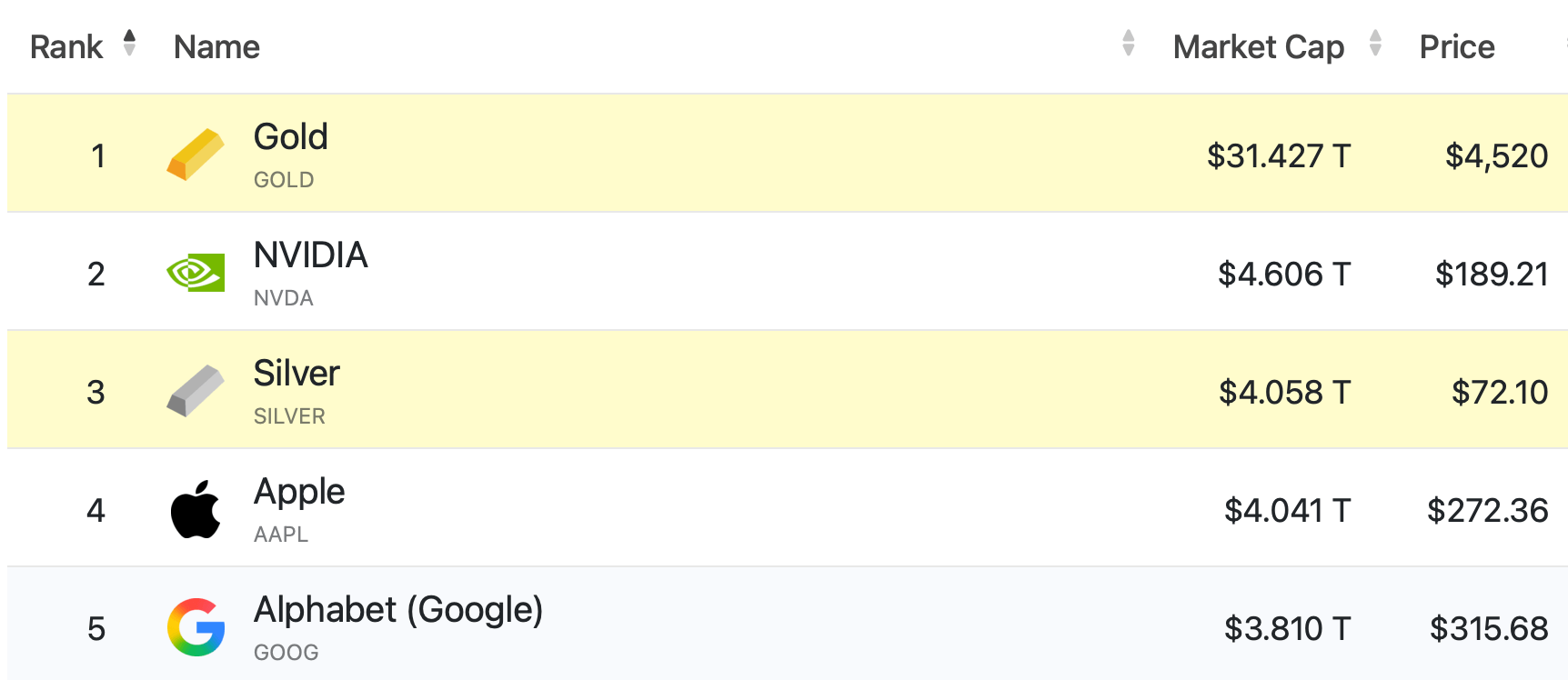

Silver flipped Apple this week, becoming the third most valuable asset by market cap.

Looking ahead, expectations for 2026 remain mixed but grounded in similar themes. Central bank demand is expected to persist, while industrial consumption of silver is projected to remain elevated. Potential economic slowdowns could affect industrial metals broadly, though structural demand drivers remain intact.

The 2025 performance of gold and silver ultimately reflected a convergence of financial, industrial, and geopolitical forces. Rather than a narrow speculative episode, the year’s gains signaled a broader reassessment of precious metals’ role within global markets as economic and technological transitions continue.

- Why did gold prices rise so sharply in 2025?

Gold gained on central bank buying, monetary policy expectations, and sustained demand for reserve assets. - What drove silver’s larger percentage gain compared to gold?

Silver benefited from rising industrial demand alongside tightening physical supply. - Did investment demand play a role in 2025’s metals rally?

Yes, both physical purchases and investment flows supported higher prices. - Are the precious metals gold and silver expected to remain strong going into 2026? Analysts see continued demand, though future performance will depend on economic and industrial conditions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。