Bitcoin investors are scratching their heads over why stocks and PMs are on a roll while the leading digital asset — along with a long list of altcoins — is stumbling. The debate is everywhere, bubbling up across Reddit threads and splashed all over social media hubs like X and Facebook.

On X, plenty of voices pin the crypto split on market manipulation, liquidity shifts, or a short-lived decoupling, with many framing the lull as a classic window to accumulate. “Looks like the perfect setup for a classic rotation,” the X account Paplianos wrote. “ Gold, Silver, NASDAQ, S&P 500, and Dow are all at or near ATHs—overbought territory with RSI screaming exhaustion and plenty of holders itching to liquidate profits before any macro hiccup.”

The X account added:

“What’s more logical than hyping a beaten-down market like crypto at its relative lows? No bad news, just ‘manipulation’ keeping BTC -28% off peaks and alts suppressed.”

Another X account argued that rising prices for gold, silver, and bitcoin simply “chugging along” reflect the loss of purchasing power caused by excessive money printing and government deficits, which pushed up interest rates and living costs—meaning everyday expenses feel higher because the currency itself is worth less.

Others flatly insisted that “there is no explanation” for bitcoin to post its weakest fourth quarter in seven years, especially in the absence of any bad headlines or lingering FUD.

One person insisted:

“There is no explanation for this except pure market manipulation.”

The chatter stretches well beyond X, with plenty of people digging into the topic over on Reddit’s r/ bitcoin forum. One specific Reddit post zeroes in on whether bitcoin’s lagging performance signals fading confidence in it as a serious hedge, or if it’s merely slow off the blocks compared with gold and copper — and still has time to play catch-up.

“Interesting signal, but I see it more as rotation than rejection. Gold = fear / debt hedge, copper = real-world growth & electrification,” one Redditor replied to the forum post. “ BTC usually lags in these phases, then reacts later when liquidity expectations shift. Not adopted by sovereigns yet, but also not priced as infra — that ‘identity gap’ is exactly why timing matters. Feels early-cycle boring… until it suddenly isn’t.”

Also read: Libra Saga: Hayden Davis Signed NDA to Become Argentina’s Blockchain Advisor

Others pointed to possible underlying issues, including the increasingly heated debate over whether quantum computing could one day threaten Bitcoin’s core infrastructure. One Redditor said the topic raised several serious worries.

“I’m concerned about quantum computing,” the person wrote. “I’m concerned about quantum computing. Also concerned about what happens as MSTR cools their buying in jeopardy of having their stock price drop and being excluded from different indices. Indeed, a lot is happening,” the Redditor added.

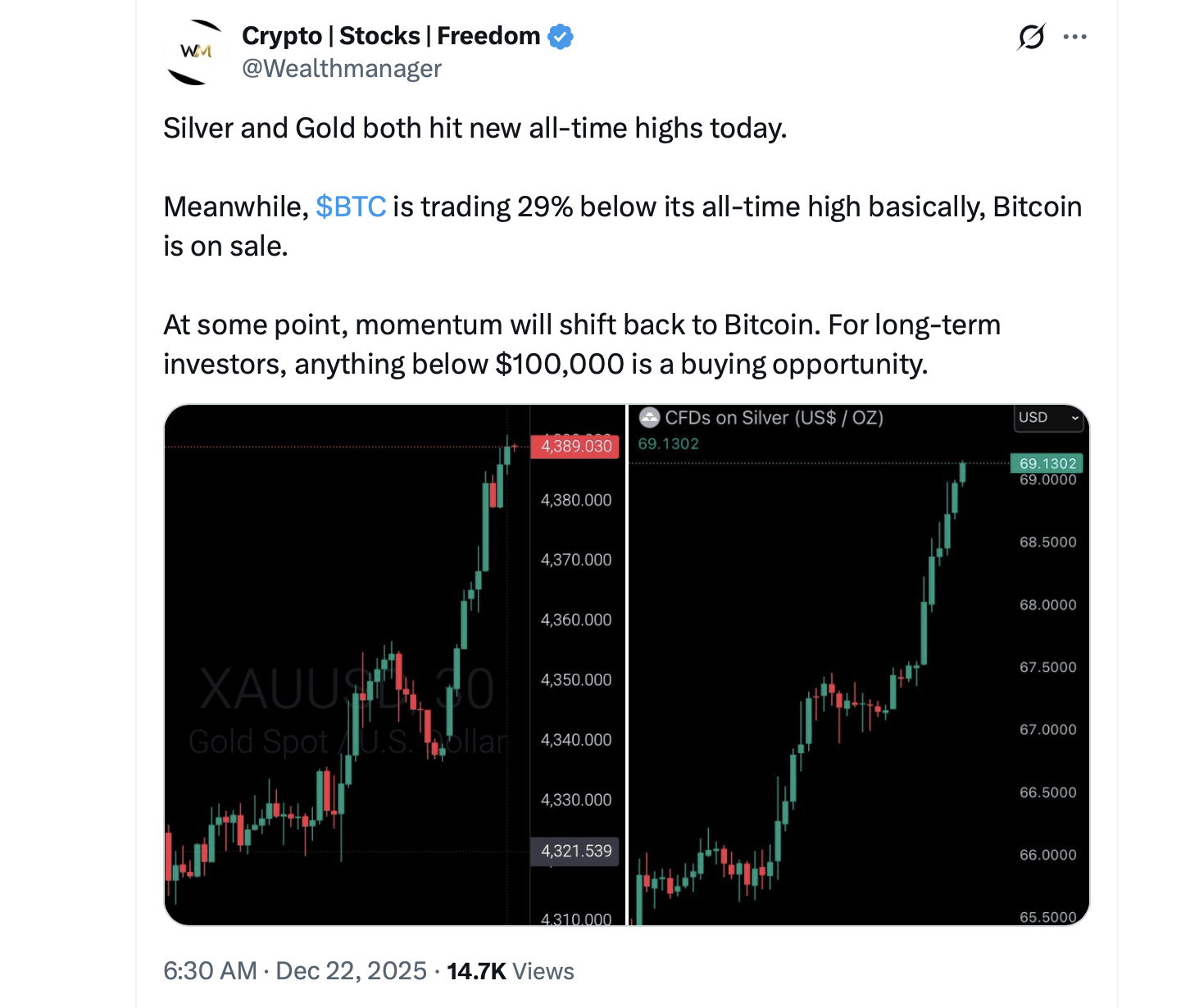

Some believe bitcoin is “on sale” and will see a rebound after capital shifts.

Plenty of people weighed in with their own takes. “ BTC is the last on the list that will get pumped. In a bear market, BTC drops aggressively,” one Redditor stressed, prompting another to nod in agreement: “Not to mention PMs having been priced into people’s psyche for millennia. BTC has less than 3% market penetration but has only been a thing for a decade.”

Whether the split is a fleeting pause or something more structural, the conversation itself signals a market still searching for its next catalyst. For some, bitcoin’s stall feels like a confidence test; for others, it looks like a familiar waiting game where attention and capital drift elsewhere before circling back. The lack of a clear trigger has only amplified the noise, leaving narratives like manipulation to fill the gap where price action has not.

Some have blamed the October 10 deleveraging event, where roughly $20 billion in derivatives positions were wiped off the map in liquidations.

As the calendar flips toward 2026, the debate shows no signs of cooling. Gold and silver may enjoy their moment in the spotlight, equities may keep flexing, and crypto may continue to test patience — but history suggests these phases rarely last forever. For now, bitcoin sits in that awkward middle ground: doubted by skeptics, defended by believers, and watched closely by everyone else, all waiting to see which story the market decides to tell next.

- Why is bitcoin underperforming gold and stocks in late 2025? Many traders point to liquidity rotation, market structure dynamics, or temporary decoupling rather than negative news.

- Are investors claiming bitcoin price manipulation? Yes, a growing number of market participants on X and Reddit argue that price action reflects manipulation rather than fundamentals.

- Does bitcoin’s weak Q4 signal a loss of confidence? Some see it as a patience test, while others view it as a lagging phase that has historically preceded renewed momentum.

- What risks are investors discussing around bitcoin right now? Topics include quantum computing fears, reduced corporate buying, and bitcoin’s role as a long-term hedge.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。