The signal is not solely based on price, and XRP is currently in a position it has not held since 2022. The short-term bubble risk indicator has fallen to one of its lowest levels in years, a state that typically manifests during times of exhaustion, compression and transition rather than euphoric peaks. Most traders are unaware of how important that is.

XRP is not impressive

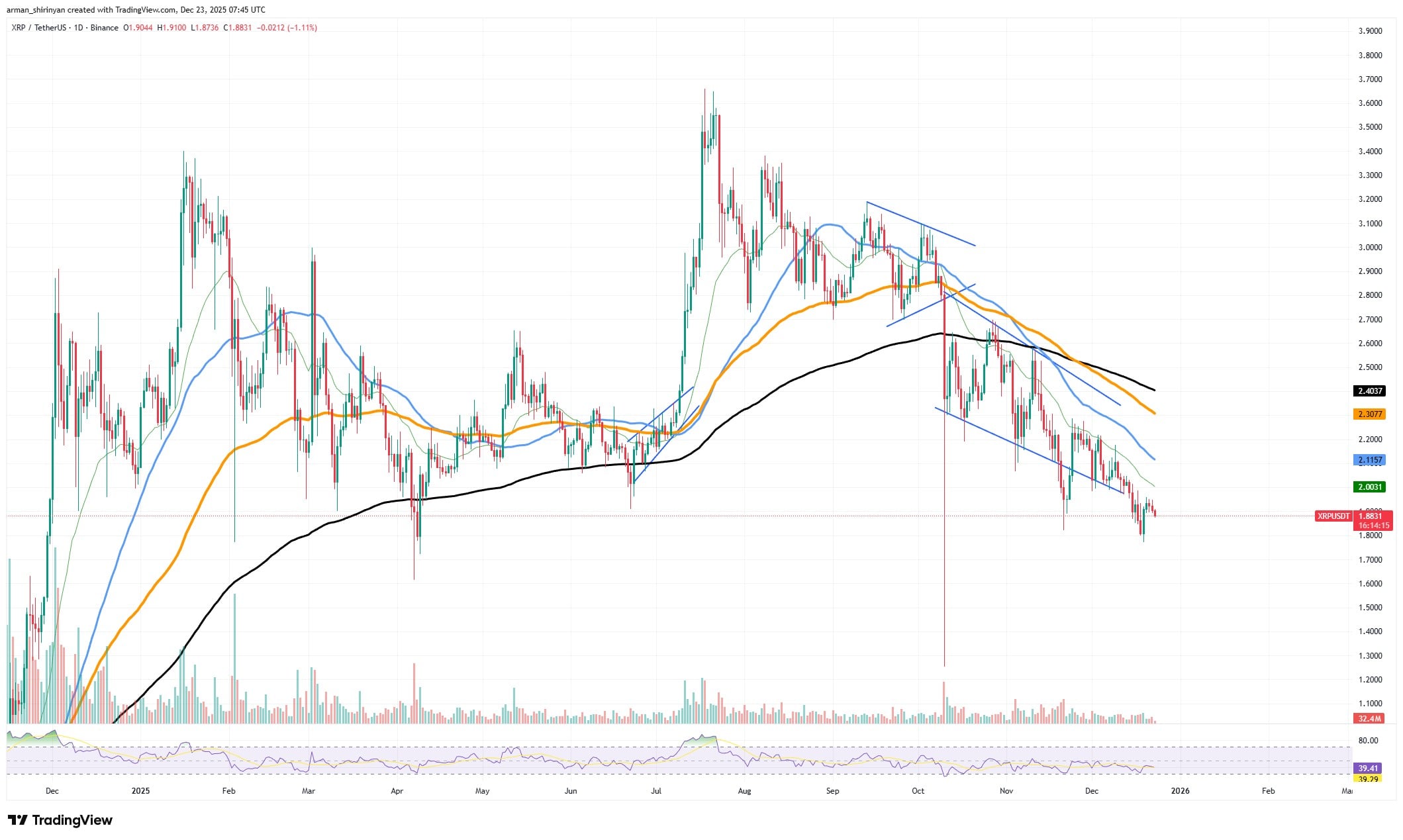

From a pricing standpoint, XRP appears unimpressive. With rallies frequently capped and sold into, the asset is still stuck in a declining structure, trading below significant moving averages. Volatility has plummeted, volume is thin and momentum is muted.

XRP/USDT Chart by TradingView

In reality, it shows that the market has eliminated excessive leverage and speculative positioning. This opinion is supported by the short-term bubble risk indicator. Previous cycles have demonstrated that local tops, aggressive retail participation and erratic price expansion are associated with increased bubble risk. XRP is currently at the other extreme of that range.

HOT Stories VanEck: Bitcoin Miner Capitulation May Signal BottomCrypto Market Prediction: Ethereum (ETH) Squeezed on Verge of Explosion, XRP's Attempt to End Bearish Dominance, Will Bitcoin Break Through $90,000 in Third Attempt?Leading ETH Treasury Firm Reaches Tremendous Milestone Shiba Inu Sell Wall Stalls Price Rally, Ripple’s Stablecoin Cuts Token Supply, Cardano Founder Takes Jab at XRP and SOL — Crypto News Digest

Bubble risks rapidly decreasing

The lack of short-term overheating is indicated by the subdued bubble risk. That significantly lowers the likelihood of a sharp decline brought on by forced unwinds, but it does not ensure an instant rally. Structural bottoms typically develop in this kind of setting. Buyers are more patient, sellers are less aggressive and price action is now range-bound rather than impulsive. That description is consistent with XRP’s recent actions.

You Might Also Like

Tue, 12/23/2025 - 06:24 'Time to Get Cooking': Cardano and Solana Founders Tease Cross-Chain BridgeByAlex Dovbnya

The downside follow-through has weakened, even though lower highs have been reached. Sharp liquidation cascades are not present, and each push lower requires less volume. That is stabilization rather than bullish momentum. In the past, XRP has typically performed best following protracted periods of boredom, as opposed to hype. These conditions are reflected in the current setup.

The market is more susceptible to increases in demand when bubble risk is low. Because positioning is light, any improvement in liquidity conditions, payment activity or overall market sentiment can have a disproportionate impact. It is important to note that this does not imply that XRP will surge tomorrow. Low bubble risk is a prerequisite, not a sufficient one, for long-term gains. It does indicate that the asset is no longer trading in a precarious position. The previous months’ downward asymmetry has subsided.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。