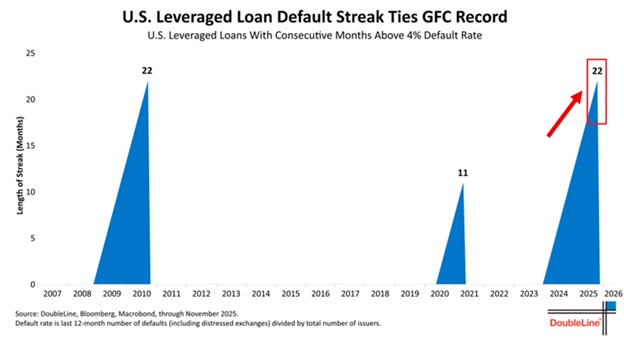

The default rate of leveraged loans in the United States has remained above 4% for 22 consecutive months, matching the record set during the 2008-2009 financial crisis, and it is still ongoing. Historically, this phenomenon has only occurred during three periods: once during the financial crisis, once during the pandemic shock in 2020, and now for the third time. Additionally, the first and second instances both triggered economic recessions.

The most noteworthy point here is not the absolute level of the monthly default rate, but rather the extended duration of high defaults. This indicates that the current issue does not stem from a one-time liquidity shock, but rather from the ongoing pressure on corporate cash flows and refinancing capabilities in a high-interest-rate environment.

Leveraged loans typically correspond to companies with lower credit quality and higher debt ratios, and they are the most sensitive part of the entire credit system to interest rate changes. When the default rate of such assets remains high for an extended period, it often means that companies can no longer self-repair through operational improvements or refinancing, and can only passively consume existing cash flows.

Unlike in 2008, this round of pressure is not primarily on the banking system, but is more concentrated in private equity, CLOs, and the non-bank credit system. The risks are not concentrated in a sudden explosion, but are being released in a slower, more dispersed manner, which is why macro data appears relatively stable on the surface, while credit pressures continue to accumulate.

From a cyclical perspective, credit is always a leading indicator. When the default rate of leveraged loans remains high for an extended period, it typically means that corporate investments, mergers and acquisitions, and capital expenditures will be suppressed, which will gradually transmit to employment and consumption levels. Therefore, this chart does not indicate that the market has entered a recession, but rather suggests that if the high-interest-rate environment continues, the probability of economic downturn is being continuously elevated.

In simpler terms, if the Federal Reserve does not control high interest rates, the probability of economic downturn or even recession is significantly increasing.

In this context, the market's pricing of risk assets will become more selective, and strategies that do not rely on direction but focus on cash flow and structural returns will be given greater weight. For example, the current interest in AI follows this logic; the hype around AI has led to higher sales, better financing, and a larger market.

In contrast, $BTC or cryptocurrencies are more reliant on liquidity, find it harder to generate cash flow, and are more affected by liquidity and policy. Of course, I still believe that BTC and tech stocks have a strong correlation; otherwise, BTC's price would have already halved.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。