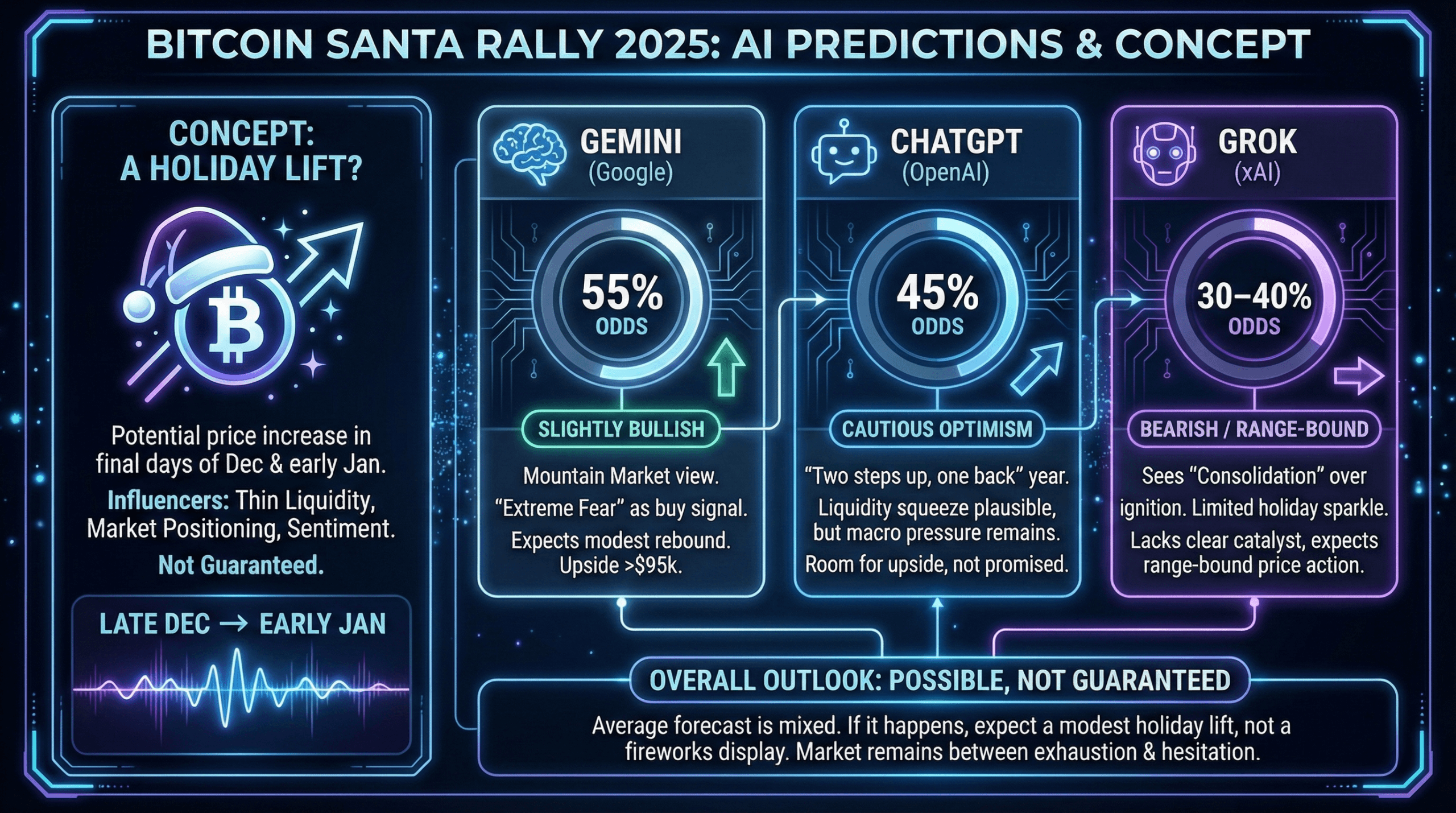

Bitcoin has bobbed between $87,836 and $90,353 per coin on Monday, flashing a few bullish tailwinds even as recent weeks have leaned bearish. With the calendar racing toward year-end, one familiar question is back on traders’ screens: Is a Santa Rally still in the cards for bitcoin in 2025? To find out, three of today’s top artificial intelligence (AI) models—ChatGPT, Grok, and Gemini—were asked to analyze bitcoin’s past and present price action and assign odds to a late-December rebound.

A Santa Rally, borrowed from equity markets, typically refers to strength during the final days of December and the first trading sessions of January. In stocks, the pattern has shown up often enough to earn folklore status. For bitcoin, which trades 24/7, the concept usually maps to the period from late December through early January, when thin liquidity and positioning can exaggerate moves in either direction.

When queried, all three AI models agreed on one thing: 2025 has been a roller coaster. Bitcoin spent much of the year swinging between optimism and digestion, printing fresh price highs before surrendering ground in the fourth quarter. Where they diverge is how much holiday cheer they expect from here.

Gemini: Slightly Better Than a Coin Flip

Gemini’s assessment frames 2025 as a “mountain” market—early pressure, a midyear climb to record highs, and a sharp cooldown into Q4. After peaking above $126,000 in early October, bitcoin slid into the low $80,000s before stabilizing near $85,000 to $90,000 heading into late December. From Gemini’s vantage point, sentiment has been wrung out enough to allow a modest rebound.

The model assigns 55% odds to a Santa Rally scenario, defined as a breakout above $95,000 with upside targets stretching into the low six figures.

Google Gemini (thinking-mode) odds.

Google‘s Gemini points to renewed spot bitcoin exchange-traded fund inflows, extreme-fear sentiment readings, and improving macro expectations as reasons the market could catch a holiday bid. A dramatic return to all-time highs, however, is viewed as highly unlikely this year.

Grok: Range-Bound With Limited Holiday Sparkle

Grok takes a more cautious stance. Its review of 2025 highlights compressed volatility, exchange-traded fund outflows late in the year, and a market still nursing a double-digit drawdown from October’s peak. While bitcoin has shown short-term stabilization and modest recovery over the past month, Grok argues that conditions resemble consolidation rather than ignition.

Xai Grok’s (Deepsearch) chances.

For Grok, the odds of a meaningful Santa Rally sit around 30% to 40%, depending on how one defines “rally.” The model notes that historical December gains for bitcoin have been mixed, especially outside strong bull phases. Without a clear catalyst—such as a decisive policy shift or sustained institutional buying—Grok expects price action to remain largely range-bound through year-end.

ChatGPT: Cautious Optimism, But No Free Gifts

ChatGPT’s analysis lands between the other two. It frames 2025 as a “two steps up, one step back” year, marked by multiple record attempts followed by a prolonged digestion phase. With bitcoin roughly 29% below its October high and derivatives markets still defensive, the model sees room for upside—but not certainty.

OpenAI’s ChatGPT 5.2 (thinking-mode) answer.

ChatGPT assigns 45% odds to a Santa Rally, defined simply as bitcoin finishing the late-December-to-early-January window higher than it starts. Thin holiday liquidity, options expirations, and cautious positioning could fuel a squeeze, but lingering macro pressure and put-heavy derivatives skew temper enthusiasm. In short, a bounce is plausible, not promised.

Taken together, the three AI models sketch a market caught between exhaustion and hesitation. Bulls can point to washed-out sentiment, exchange-traded fund (ETF) demand flickers, and seasonal tendencies. Bears counter with unresolved technical resistance, tax-related selling, and a market still digesting its autumn excesses.

The average of the three forecasts lands near the middle: a Santa Rally is possible, but far from guaranteed. If it comes, the models agree it’s more likely to look like a modest holiday lift than a fireworks display.

- What is a bitcoin Santa Rally?

It refers to a potential price increase during the final days of December and early January. - Do AI models agree on a Santa Rally for bitcoin in 2025?

No, estimates range from about 30% to 55%, depending on the model and assumptions. - What factors could support a bitcoin Santa Rally?

Thin holiday liquidity, improved sentiment, and renewed institutional inflows. - What could prevent a Santa Rally this year?

Technical resistance, cautious derivatives positioning, and lingering macro pressure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。