比特币的价格在过去一小时内高达89,995美元至90,094美元,结束了一个区间震荡的24小时交易,市值约为1.79万亿美元。交易量达到强劲的329.8亿美元,价格在87,655美元和90,353美元之间波动。这一数字巨头虽然没有突破新的历史高点,但显然在当前的战场上展现出实力。

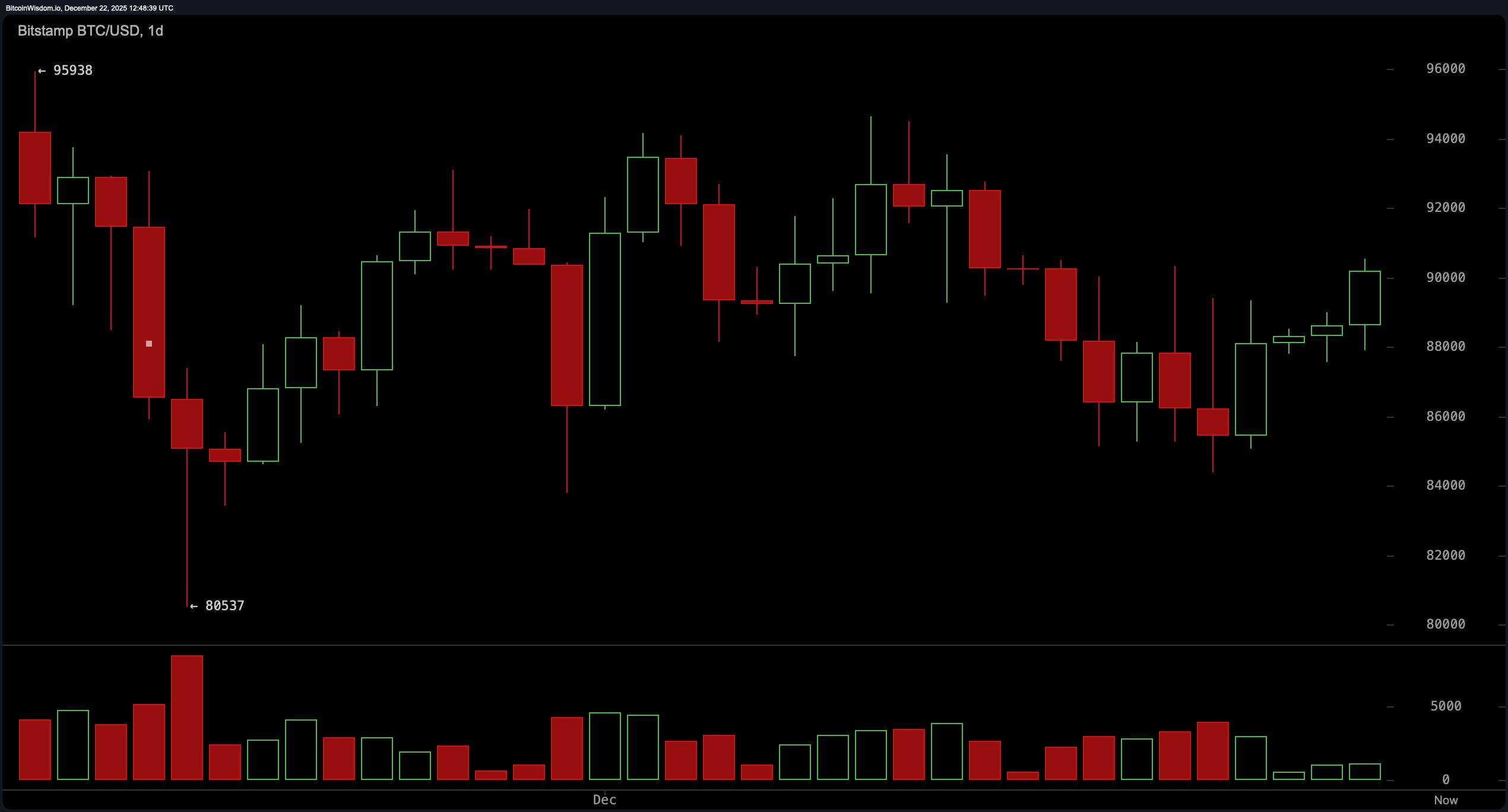

日线图描绘出一种经过深思熟虑的乐观情绪。在摆脱了80,537美元的急剧下跌后,比特币现在正在巩固其反弹轨迹。一系列带上影线的绿色蜡烛反映出买家正在出现——但又有足够的犹豫,使91,000美元的阻力保持不变。

动能正在积聚,尽管速度谨慎,交易量的上升表明机构投资者正在悄然为他们的火箭加油。如果比特币能够在91,000美元以上稳固收盘,通往95,000美元至96,000美元区间的大门将微微开启。

BTC/USD 1日图,来源于Bitstamp,日期为2025年12月22日。

放大到4小时图,中期走势倾向看涨,经典的高点和低点定义了结构。价格从约84,398美元剧烈反弹,攀升至90,536美元,伴随交易量激增——这表明鲸鱼们不仅在观望,他们正在行动。当前在86,500美元和89,000美元之间的整合带充当了发射台。若价格回访89,000美元至89,500美元区间,只要价格保持在87,000美元以上,可能会提供重新入场的机会。

BTC/USD 4小时图,来源于Bitstamp,日期为2025年12月22日。

在1小时图上,所有信号都是绿灯,全速前进。突破是决定性的,90,536美元成为最近的高点。上涨过程中的交易量增加巩固了这一短期看涨趋势。88,500美元至89,000美元区域,曾经是阻力,现在已转变为舒适的支撑区。如果出现小幅回调至89,500美元至90,000美元,且卖压较弱,这可能只是下一轮上涨前的短暂停留。

BTC/USD 1小时图,来源于Bitstamp,日期为2025年12月22日。

现在让我们谈谈指标。振荡器在各个方面都表现得很冷静,相对强弱指数(RSI)稳定在50,随机振荡器在45,商品通道指数(CCI)几乎没有变化,保持在-8——所有这些都表明中立。平均方向指数(ADX)读数为24,表明趋势仍在伸展。但如果你在寻找一些看涨的拉拉队员,动量为-216,移动平均收敛发散(MACD)为-1,325——这两者都暗示着背后有一些向前的推动力。

然而,移动平均线(MAs)则呈现出混合的信号。短期线如10日指数移动平均线(EMA)在88,605美元和10日简单移动平均线(SMA)在87,947美元都在向上微调。中期30日EMA,位于90,574美元,略显反向情绪。然而,重型长期平均线如200日EMA和200日SMA——分别远高于当前价格,分别为102,001美元和107,885美元——表明比特币在完全恢复之前仍有许多山要攀登。翻译:我们正处于短期强势与长期犹豫之间的拉锯战。

看涨判决:

随着动能上升、机构级别的交易量激增,以及在关键支撑区上方的强劲持稳,比特币似乎已准备好突破。若确认突破91,000美元的阻力,可能会引发向95,000美元至96,000美元的反弹,重新点燃自80,000美元下跌以来摇曳不定的牛市火焰。目前,牛市掌握主动权——安全带可选。

熊市判决:

尽管强劲反弹,比特币仍被困在91,000美元的阻力下,并面临长期移动平均线的阻力。中立的振荡器和收窄的价格区间暗示信心减弱。如果没有决定性的突破,这一切可能都是下一次下滑前的烟雾——尤其是在交易量减弱或89,000美元支撑崩溃的情况下。

- 今天比特币的价格是多少?截至2025年12月22日,比特币交易价格为90,094美元。

- 比特币当前的关键阻力位在哪里?91,000美元区域是所有时间框架内的关键阻力。

- 交易者应该关注哪些支撑位?短期内,关键支撑位在88,500美元至89,000美元之间,长期支撑位在85,000美元。

- 比特币显示出看涨还是看跌信号?技术指标和价格结构倾向于看涨,但阻力仍未突破。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。