The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts, rejecting any market smokescreens, and welcoming the attention and likes from all crypto friends!

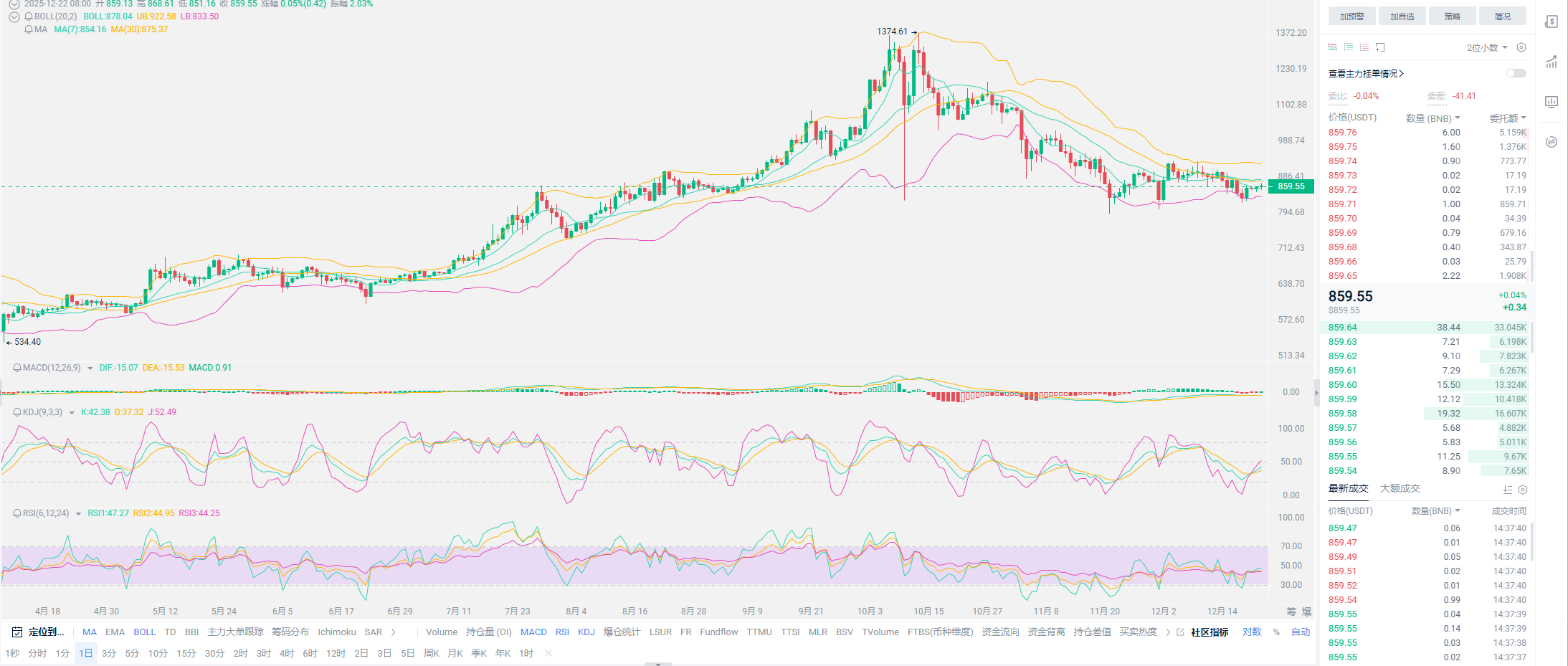

At this stage, the market is not moving much, and the impact of Japan's interest rate hike is not significant, so Lao Cui's updates may seem a bit fatigued. Whether for spot or contract users, the profits and losses are not too large. The original expectation was for a surge in growth by the end of the year, but it is indeed unexpected that a short-term fluctuation has come at the year's end. Before the interest rate hike, Lao Cui mentioned that everyone should wait for the negative news regarding the interest rate hike and then buy at the bottom; so far, this operation has not yielded much profit. The current fluctuations are only suitable for contract users, making small profits back and forth. This also gives us time to think calmly: is AI and blockchain really a bubble? Many friends may feel the difference; why does Lao Cui discuss these two together? Because in Lao Cui's perspective, they coexist. The development and challenges they face are almost the same, and the technology used in AI cannot be separated from the support of blockchain technology; what both need is almost aligned.

If we can confirm that AI is a bubble, then blockchain will also dissipate accordingly. Let's first focus on the AI field. In China, the application of AI is more about automation through artificial intelligence, which translates to personal use as AI browsers or photo editing tools. In fact, for individuals, the application of AI does not seem that important; Lao Cui mostly uses AI to verify information, but the data from AI has significant issues, especially regarding domestic data, which is mostly stagnant from two years ago, with almost no real-time data. When there are problems at the data level, the results will definitely have issues. Lao Cui's concerns about AI are indeed heavier than those about blockchain. So, if the AI sector encounters problems, which industries will be affected? Nvidia and data companies are the first to be impacted; you only need to focus on these two types of companies to basically understand whether AI's development is hindered.

Current data shows that Nvidia's performance has given many friends strong confidence in AI. The biggest advantage of AI is decentralization (algorithm logic), using its specific programs, which makes it relatively objective by eliminating human factors. This decentralization is the core of blockchain technology, and the problems faced by both are synchronous. The concepts are extremely advanced, but the implementation is extremely difficult, and this difficulty is mostly due to human factors. For example, the American restrictions on Apple's AI have led to a significant loss of functionality in Apple's AI assistant, making it appear more like a simple tool. Whether this resistance can be eliminated is a concern for Lao Cui, and he cannot confirm it. The development of both faces similar bottlenecks, and it is impossible to achieve absolute decentralization. AI faces data control issues, while blockchain faces even more severe problems; the right to issue currency has never been in the hands of others.

Both face such challenges, and the deepening of AI is currently most widely applied in the WEB3.0 era. Looking at the English term, you might feel it has some value. Translated, it is actually the Internet 3.0 era. The 1.0 era was like the Yellow Pages, such as browsers like Baidu and Google; the 2.0 era, which Lao Cui prefers to call the interactive era, includes short videos; the 3.0 era currently promotes interactive experiences, with live streaming meaning to help you directly find the source factory. All information will be directly aggregated and sent to your information terminal by data companies. Yes, the current application is information aggregation. So, centralized things are actually more in the hands of data companies, which resembles a transfer of power; this may challenge authority, so will it come in the future? This question may accompany us for a lifetime. Blockchain is similar; the Bitcoin controlled by Satoshi Nakamoto and the Americans is enough to destroy this market. What you call distributed computing and storage requires a lot of computing power and storage space.

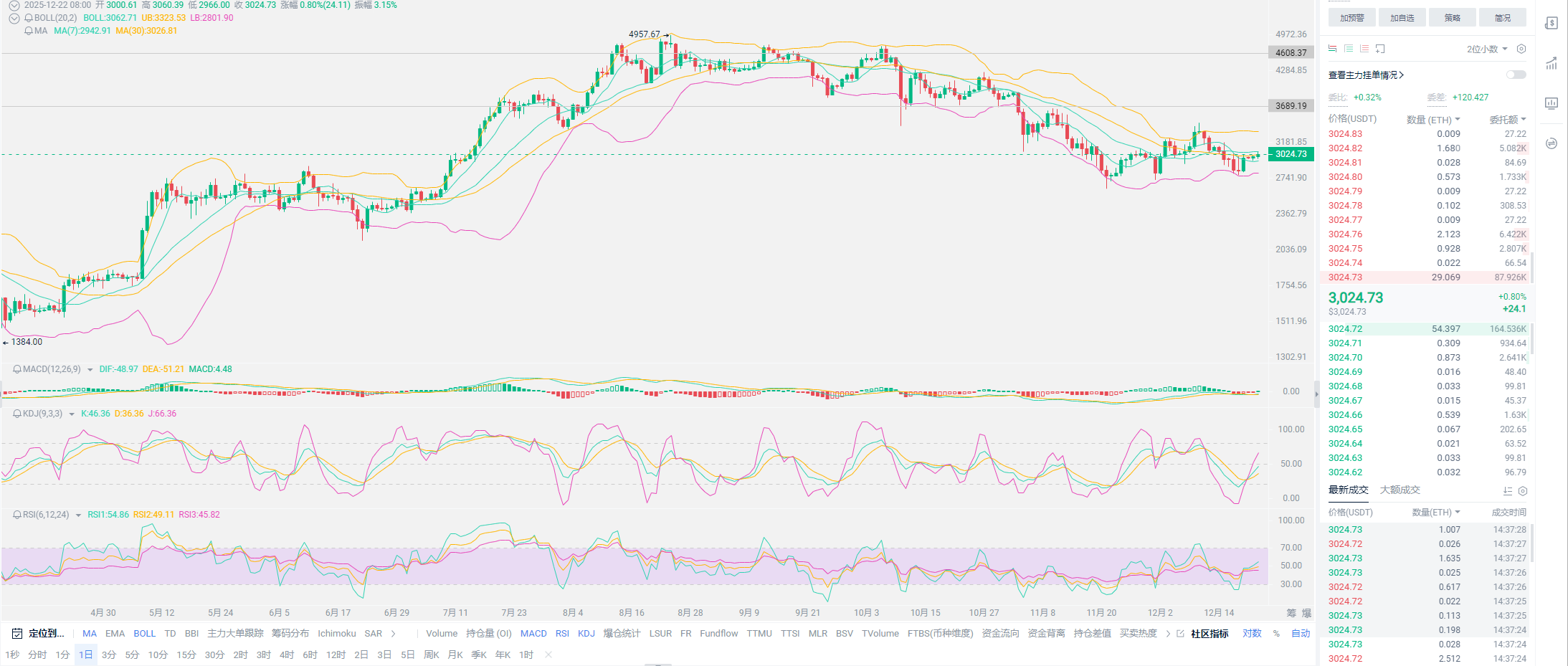

So, who holds the centralization? Whoever controls computing power, electricity, and storage will grasp the lifeblood of blockchain. How can we talk about decentralization? The upgrade of Ethereum seems dangerous in an era where many do not understand, but so far, it is a wise choice for Ethereum to abandon its original computing system. This upgrade is merely a transfer of power, discarding the computing power maintenance system, while the subsequent over-issuance is unrestrained; this mechanism of expanding personnel rewards is also the most dangerous mechanism. This is why Ethereum's market fluctuations are so huge. It can rise to 800 and also drop to 4957; many friends think it is a mechanism issue, and indeed, from the root definition, its fluctuations will not be small. Even a return below 1000 in the future is a normal phenomenon. The only difference at this stage is that it leans towards securitization, with more regulation and participation from giants, which indeed reduces the chances significantly; the Americans' endorsement ability is still very strong. Whether it is AI or blockchain, neither will allow for short-term extinction; at least in the next two years, they will not dissipate.

If you want to survive in the cryptocurrency market for the long term and gain certain profits, understanding the operational logic behind it is essential. Many friends are learning about the cryptocurrency market and realize that there is much to learn, such as the logic of the Federal Reserve's interest rate cuts, the Americans' balance sheet expansion, and Japan's interest rate hikes. Even on-chain data, the Americans' and various countries' pension purchases, as well as ETF inflows, and your regulations, even the platform's licenses. From the distribution of retail investors' chips to the funding volume of giants, and even considering Trump's psychological activities, it can be said that the struggle in the cryptocurrency market is extremely fierce, and the various connections can cause trend reversals. This uncertainty is what leads to high returns, but if we use accurate data to speak, Bitcoin has lived up to every user who believes in it since its inception. This path, though difficult, has seen people break through doubts all the way to the peak.

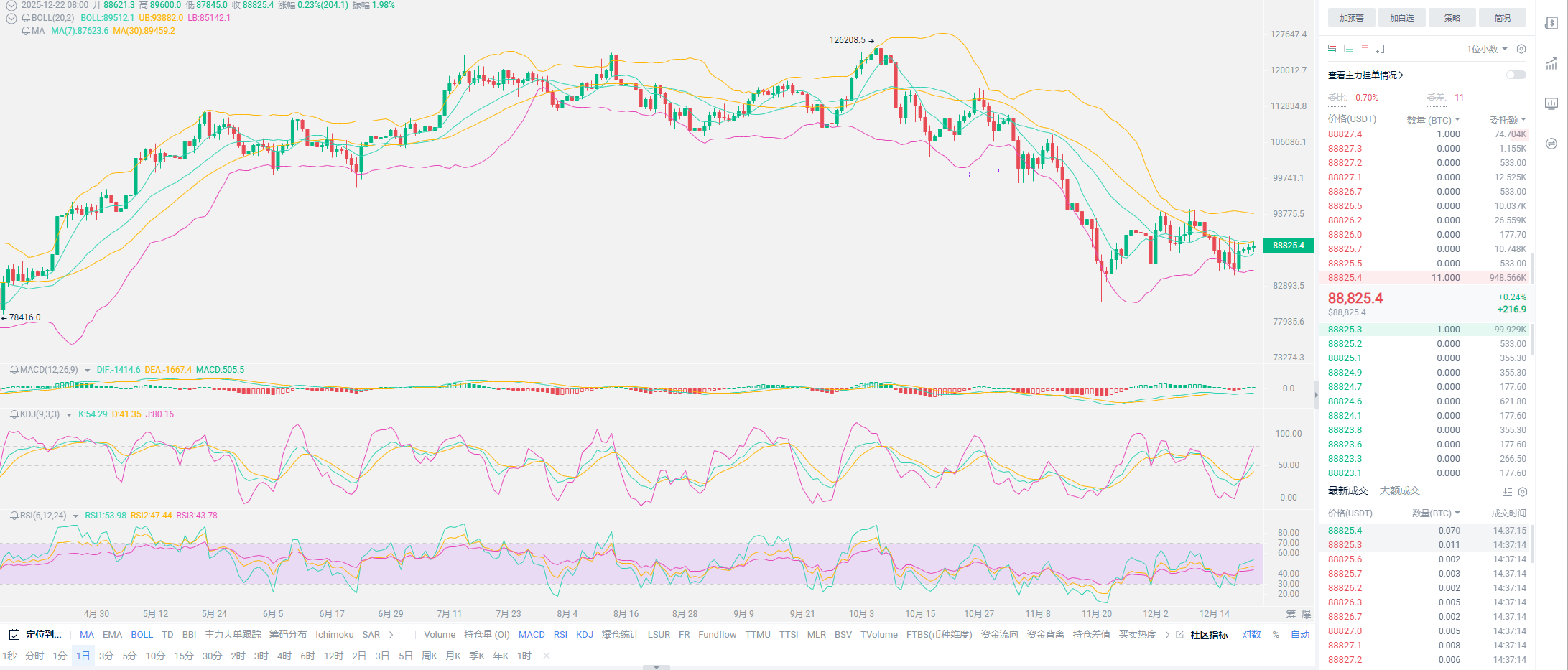

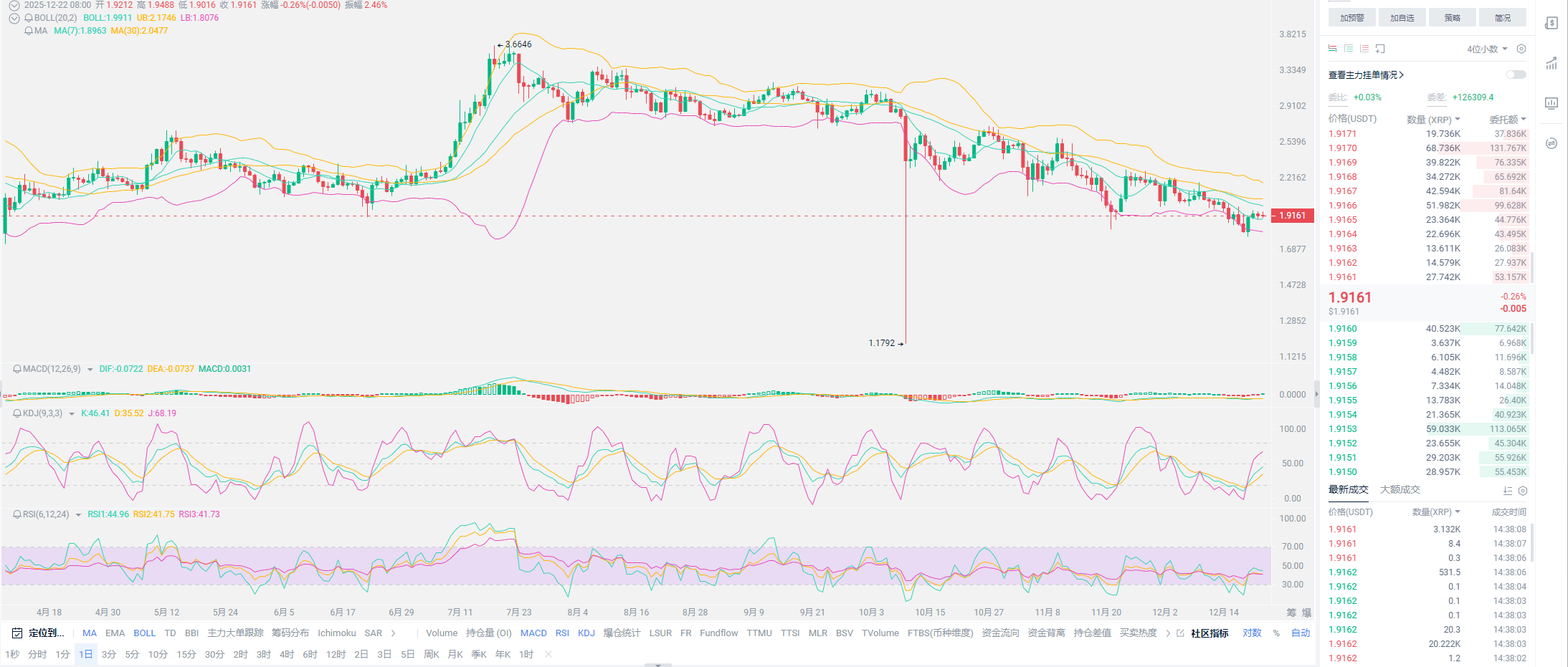

Lao Cui's summary: Many friends are extremely obsessed with short-term trends, and most of this part are contract users; although Lao Cui's words are light-hearted, they are indeed true. As long as there are no mistakes in the trend and proper control of one's position, there will not be too much loss. All doubts stem from a lack of self-confidence. The heavy positions of contract users make it impossible to sleep in the short term, leading to extreme internal consumption. The form of heavy positions is often not a choice for Lao Cui. The real contract form is for users to trade contracts in a spot manner, and the liquidation point must maintain sufficient depth. Currently, the pressure points in the cryptocurrency market are also very obvious: Bitcoin at 90,000 and Ethereum at 3100 have been tested multiple times. For the cryptocurrency market, a breakthrough is merely an opportunity, nothing more. The depth below will not be too deep; while shorting may yield profits, the risks are greater. Short positions can only be chased, not held long-term. This statement does not mean that a breakthrough will happen in the short term; the arrival of this opportunity requires a lot of capital to push it. Meanwhile, there are many smokescreens in the current market; you need to patiently discern, with a clear goal. Just remember, the Americans are injecting liquidity, interest rates are continuously dropping, and the trend is bullish; there is no need to pay too much attention to anything else. The only things to consider in terms of trends are political strategies and military confrontations.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation and the big trend, not focusing on one piece or one territory, aiming for the final victory. The novice, on the other hand, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。