Original Author: Nishil Jain

Original Translation: Luffy, Foresight News

Last week, Coinbase launched a brand new product touted as the "Future of Finance." One application can achieve five major functions: 5×24 hour stock trading, centralized exchange and on-chain cryptocurrency trading, futures and perpetual contract trading, prediction markets, and it even features an AI financial analyst. All functions can be operated via mobile, and users can instantly switch their single account balance across different asset classes.

Not long ago, Robinhood had already made its move: launching tokenized stock trading in Europe, 5×24 hour futures trading, cryptocurrency interest services, and planning to launch social trading features, Robinhood Social, in 2026.

The mainstream discourse on platform X interprets this trend as the evolution of a "super app," but people overlook a key point: this is not merely a simple addition of functions, but a breaking down of the artificially divided boundaries of financial asset classes due to regulatory and technological constraints.

Why, after a decade of fragmented development, are financial applications now experiencing a wave of integration? What does this mean for users and platforms involved? Next, we will officially delve into the topic.

The Pain Points of Fragmentation

Over the past decade, financial technology applications have emerged, but most only cover a single aspect of financial services, with functions like stock trading, cryptocurrency, payments, and savings scattered across different applications.

While this model provides users with more choices and allows companies to focus on refining single solutions, it presents numerous issues in practical use.

Want to sell stocks and then buy cryptocurrency? Stock trading needs to be executed on Monday, and T+1 settlement can only be completed on Tuesday; after that, initiating a withdrawal takes 2-3 days for the funds to arrive in the bank account; then transferring the funds to Coinbase takes another 1-2 days. From "deciding to adjust the asset allocation" to "the funds actually landing," the entire process takes about 5 days. During these 5 days, the investment opportunity you were eyeing may have already disappeared, while your funds remain stagnant in a cumbersome process.

For example, if you want to buy Bitcoin at $86,000 on December 18, you might end up completing the transaction at $90,000 due to process delays. For more volatile investment opportunities like meme coins, initial coin offerings (ICOs), or initial public offerings (IPOs), the losses caused by such delays can be even more severe.

The problem of fragmentation is not limited to a single region. An Indian investor wanting to purchase Nvidia stock must repeatedly complete multiple KYC verifications, open an account with a broker that supports Indian users investing in U.S. stocks, and deposit additional funds just to buy that one stock.

We have all felt this operational friction, but it is only recently that the infrastructure capable of solving this problem has gradually taken shape.

The Cornerstone of Change: Improvement of Infrastructure

Three structural changes have made the birth of integrated financial platforms possible.

Tokenization Breaks Time Barriers

Traditional stocks can only be traded during the trading hours of the New York Stock Exchange (NYSE) (9:30 AM to 4 PM Eastern Time, 5 days a week), while cryptocurrencies enable 7×24 hour continuous trading. By implementing stock tokenization on layer two networks, it has been proven that with reasonable technological mechanisms, stocks can theoretically be traded around the clock.

Now, the tokenized stocks launched by Robinhood in Europe support 5×24 hour trading, and Coinbase will follow this model.

Regulatory Frameworks Becoming Clearer

In recent years, the successful listing of Bitcoin spot ETFs, the advancement of stablecoin legalization, the review of tokenization regulatory frameworks, and the approval of prediction markets by the U.S. Commodity Futures Trading Commission (CFTC) have all contributed to a clearer regulatory environment. Although the regulatory landscape is not perfect, it is sufficiently clear for platforms to confidently develop multi-asset products without fear of being completely shut down.

Maturity of Mobile Wallet Infrastructure

Embedded wallets can now seamlessly handle complex cross-chain operations. The Privy platform, acquired by Stripe, allows users to create wallets using existing email addresses without needing to interact with seed phrases; the recently launched cryptocurrency trading app Fomo enables non-cryptocurrency users to trade on-chain tokens like Ethereum, Solana, Base, and Arbitrum without manually selecting networks, and it supports Apple Pay deposits, automatically handling all complex processes in the background. Users only need to click "Buy Token" to complete the operation.

The Core Logic of Liquidity Integration

The core driving force behind this transformation is that the funds scattered across different applications are essentially idle funds.

In an integrated model, users only need to hold a single account balance: after selling stocks, the funds can be instantly used to purchase cryptocurrencies without waiting for settlement windows, withdrawal review periods, or going through intermediaries like banks. The original 5-day opportunity cost completely disappears.

Platforms that integrate liquidity are more efficient. With deeper liquidity pools, they can provide better execution speeds; since all trading pairs share the same underlying liquidity, they can support more trading pairs; they can offer returns on idle capital like banks; additionally, with reduced friction, user trading volume increases, allowing them to earn more fee income.

Coinbase's Integration Blueprint

Coinbase is the most typical case in this wave of financial integration. Founded in 2012, it started as a simple cryptocurrency exchange, supporting only the buying and selling of Bitcoin and Ethereum. Over the next few years, Coinbase gradually added institutional custody, staking services, and cryptocurrency lending products, evolving into a full-service cryptocurrency platform by 2021.

Its expansion has not stopped: it launched the Coinbase Card for cryptocurrency spending, the merchant payment solution Coinbase Commerce, and built its own layer two blockchain, Base.

The new product launch on December 17 marked the full realization of Coinbase's "super app" vision. Now, Coinbase supports 24-hour stock trading and plans to launch real-world asset tokenization services for institutions, Coinbase Tokenize, in early next year. By integrating prediction markets through collaboration with Kalshi, it will launch futures and perpetual contract trading, and has integrated decentralized exchange trading functions from the Solana ecosystem within the app. Additionally, the Base app has expanded to 140 countries and enhanced the social trading experience.

Coinbase is gradually becoming the operating system for on-chain finance. Through a single interface and a single account balance, it covers all asset class trading needs, aiming to allow users to complete all financial operations without leaving the platform.

Robinhood is also following a similar development path: starting with commission-free stock trading, gradually adding cryptocurrency trading, offering a gold subscription service with 3% cash back and 3.5% deposit interest, futures trading, and then launching tokenized stocks in Europe.

Both platforms are betting on the same core logic: users do not want to download different applications for stocks, cryptocurrencies, and derivatives; they need a single account balance, a unified operating interface, and the ability to instantly adjust their fund allocations.

Social Trading: An Emerging Differentiation Competitiveness

Asset integration solves liquidity issues but does not address the challenge of asset discovery for users.

When there are millions of assets available in the market, how should users filter trading targets? How should they build their investment portfolios?

This is where the value of social features comes in. Coinbase's Base app has a built-in dynamic information feed that allows users to see others' buying actions; Robinhood plans to launch Robinhood Social in 2026; eToro has offered social trading features since 2007, paying 1.5% of the assets held by copy traders as commission.

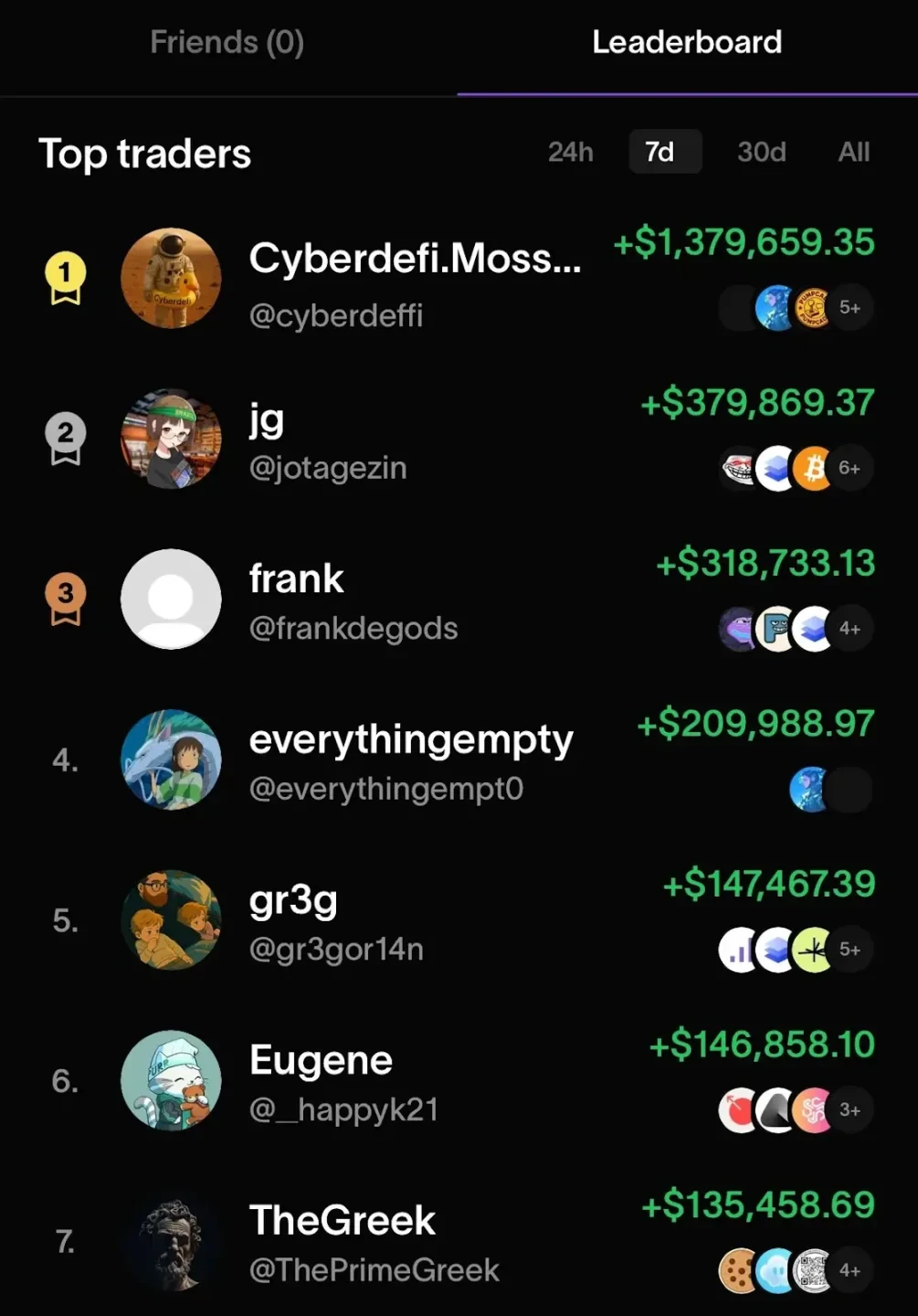

In the on-chain space, several applications exploring social trading features have emerged, such as Fomo, 0xPPL, and Farcaster. These applications allow users to view their friends' investment targets, follow them, and copy their trading actions.

Leaderboard page of Fomo

Social trading enables users to view others' trading behaviors in real-time and copy them with one click. This significantly reduces decision friction: no need for independent research, just follow trusted trading strategies. Once a platform forms a stable community ecosystem—where users follow trading experts and build personal reputations—users find it hard to migrate to other platforms, creating strong competitive barriers and user stickiness for trading applications.

Centralized exchanges have offered copy trading features since 2022, but usage rates have remained below 2%. Mobile application platforms are betting on enhancing user experience to increase the popularity of this feature. Whether their judgment is correct will determine whether social trading can become a true differentiating competitive advantage or merely another ordinary feature.

Pessimistic Perspective: Potential Risks and Controversies

Let’s face the reality: the original intention of cryptocurrency was to achieve financial decentralization, removing intermediaries and allowing users to control their own assets.

Yet now, we are rebuilding centralized platforms: Coinbase controls asset custody, trade execution, and social relationship chains; Robinhood holds the private keys of embedded wallets; users need to trust the platform's solvency, security, and operational continuity. All of this conceals counterparty risks.

The issues brought by gamification are also becoming increasingly severe: 7×24 hour trading means you might make impulsive trades at 3 AM; social information feeds can trigger FOMO when you see others making profits; push notifications alert you to every market fluctuation in real-time. This is essentially a scaled-up casino psychology, meticulously optimized by designers who understand how to trigger dopamine responses.

Is this a step forward in financial democratization, or merely a rehashed exploitative system? This is a philosophical question worth pondering.

The Essence Behind the Phenomenon

We spent a decade dismantling financial services, with the assumption that fragmentation could foster competition and bring more choices.

But it has proven that fragmentation also leads to inefficiency: idle funds, dispersed liquidity, and users, due to cumbersome fund transfer processes, are forced to hold more idle capital. The new era is changing this situation.

Coinbase and Robinhood are gradually becoming new banks: they control your salary, savings, investment, and consumption patterns, manage trade execution, asset custody, and access permissions, and intervene in every transaction. The only difference from traditional banks is that their operating interfaces are more aesthetically pleasing, trading markets are open around the clock, and deposit rates are 50 basis points higher.

Whether we are achieving financial democratization by lowering barriers and improving efficiency, or merely replacing gatekeepers while retaining the barriers themselves, the era of fragmentation has ended. In the coming years, we will witness whether financial integration based on open underlying technologies can yield better results than the traditional banks we once fled from, or if it merely changes the logo that locks in users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。