Net inflow to Bitcoin exchanges reaches a peak, as the upcoming interest rate hike by the Bank of Japan and the Federal Reserve's indecisive policies are triggering a comprehensive sentiment reversal in the cryptocurrency market.

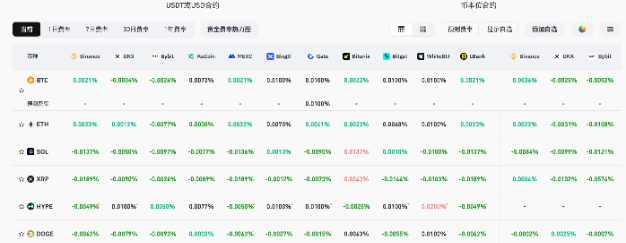

On December 18, the funding rates of current mainstream centralized and decentralized exchanges indicate that the market remains broadly bearish.

Behind this phenomenon is the Bitcoin price, which has fallen back to around $85,600, and Ethereum has lost the $3,000 mark. The driving factors have shifted from mere market sentiment to deeper macro and structural pressures.

1. Market Sentiment Indicators

● According to AiCoin data, the funding rates of current mainstream centralized and decentralized exchanges consistently show that market sentiment is leaning towards a broad bearish outlook.

● This indicator serves as a core sentiment barometer for the crypto market, especially the perpetual contract market. The funding rate essentially acts as a funding exchange mechanism between long and short traders, with its core function being to anchor the price of perpetual contracts to the spot price of the underlying asset.

● When this rate is significantly below the 0.01% baseline, or generally below 0.005%, it indicates that short positions dominate the market, and traders holding long contracts need to pay fees to shorts, clearly reflecting the prevailing pessimism and cautious expectations in the market.

2. Macro Pressures

● The shift in market sentiment primarily stems from profound changes in the global macroeconomic landscape. The Bank of Japan's shift in monetary policy is seen as a key "domino." The expectation of the Bank of Japan's first interest rate hike since January 2025 reached a 97% probability by mid-December, with the market generally believing this is almost a foregone conclusion.

● Historical data shows a clear pattern: In the 4 to 6 weeks following the last three interest rate hikes by the Bank of Japan (March 2024, July 2024, January 2025), Bitcoin experienced significant declines of 20% to 30%.

● The transmission mechanism lies in the reversal of yen carry trades. Due to Japan's long-standing zero or negative interest rates, global investors have become accustomed to borrowing low-cost yen to invest in high-yield assets such as U.S. stocks, U.S. bonds, or cryptocurrencies. Once the yen enters a rate hike cycle, this leveraged capital will quickly unwind, leading to forced liquidations and deleveraging pressures on global risk assets, including the crypto market.

● Meanwhile, across the ocean, while the U.S. has completed its long-anticipated first rate cut, the future policy path has become more uncertain. The market's focus has quickly shifted from "when will rates be cut" to "how many more times can rates be cut in 2026, and will the pace slow down."

● Analysts warn that if employment data shows a "cliff-like cooling" or inflation remains stickier than expected, the Federal Reserve may even accelerate the reduction of its balance sheet to hedge against potential easing effects, leading to a complex situation where nominal policy easing coexists with actual liquidity tightening.

3. On-chain Selling Signals

Macro pressures are quickly transmitted to the specific behaviors of market participants, with on-chain data clearly revealing the sources and intensity of selling pressure.

● For institutional investors, Bitcoin spot ETFs have recently seen a significant outflow of approximately $350 million in a single day, primarily from products issued by major players like Fidelity and Grayscale. Bitcoin's performance during U.S. trading hours has been relatively weaker, highlighting the attitude of domestic institutional funds.

● A more direct on-chain signal appeared on December 15, when the net inflow of Bitcoin to exchanges reached 3,764 BTC, marking a peak. Among them, Binance alone accounted for a net inflow of 2,285 BTC, amplifying about 8 times compared to the previous phase. This concentrated deposit behavior towards exchange addresses is typically interpreted as large holders or institutions preparing to sell.

● Additionally, some well-known market makers, such as Wintermute, have also been observed transferring assets worth over $1.5 billion to trading platforms recently, exacerbating market concerns about liquidity supply.

4. Miners and Long-term Holders

● Another significant source of on-chain selling pressure comes from the core pillars of the cryptocurrency ecosystem—long-term holders and Bitcoin miners. Addresses holding Bitcoin for over six months, referred to as "old money," have been selling for several months, with recent signs of acceleration.

● The miner community is also under pressure. On-chain monitoring platforms have noted a significant rotation in Bitcoin's overall network hash rate, a phenomenon that often coincides with periods when miners face financial pressure and liquidity tightening. According to F2pool data, as of December 15, Bitcoin's overall network hash rate has dropped to approximately 988.49 EH/s, down 17.25% from a week ago.

The significant drop in hash rate corroborates rumors about "Xinjiang Bitcoin mines shutting down."

● Industry veterans estimate that based on an average hash rate of 250T per mining machine, at least 400,000 Bitcoin mining machines are currently shut down. This typically means that miners are selling their mined Bitcoin to pay for electricity, maintain operations, or obtain fiat income during periods of low coin prices, thereby creating sustained selling pressure in the market.

5. Potential Paths and Risk Warnings

In the face of multiple pressures converging in the market, potential paths and risks have become the focus of investor attention.

● Analysts point out that if the Bank of Japan can pause its rate hikes in future meetings after this hike, the current sharp decline in the market may come to a halt, or even usher in a corrective rebound.

● However, the greater risk lies in the possibility that the Bank of Japan's policy may mark the beginning of a long-term tightening cycle. The Bank of Japan has confirmed that it will begin selling approximately $550 billion worth of ETF holdings starting in January 2026.

● If rate hikes continue in 2026 alongside accelerated bond sales, the ongoing unwinding of yen carry trades could evolve into a prolonged sell-off of risk assets, causing longer-term and more profound impacts on the crypto market.

The overall Bitcoin network hash rate has dropped over 17% in a week, corresponding to about 400,000 mining machines being shut down. Meanwhile, the upcoming interest rate hike by the Bank of Japan is described by analysts as the last major event in the financial industry this year, with historical data ruthlessly showing that Bitcoin has struggled to escape significant declines after each rate hike.

The future of the market hangs in the balance between the policy divergence of major global central banks—especially Japan and the U.S. As the tide of liquidity begins to recede globally at different paces and intensities, the crypto market, which is extremely sensitive to liquidity, is increasingly sounding the alarm.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。