美国时间 2025 年 12 月 15 日,纳斯达克正式向 SEC 提交 Form19b-4,申请将美股和交易所产品的交易时间延长至 23/5(每天交易 23 小时,每周交易 5 天)。

但纳斯达克申请的交易时间并非单纯延长,而是将交易时间改为两个正式交易时段:

日间交易时段(美东时间 4:00-20:00)和夜间交易时段(美东时间 21:00-次日 4:00)。其中 20:00-21:00 暂停交易,所有未成交订单在暂停时间统一取消。

很多读者看到消息就兴奋了起来,觉得这是不是美国在为 24/7 的美股代币化交易做准备?但加密沙律仔细研究了文件,想和大家说,先别急着下定论,因为纳斯达克在文件中表示,很多传统证券交易规则和复杂订单不适用夜间交易时段,部分功能也会受限。

我们对美股代币化一直非常关注,认为它是现实世界资产代币化最为重要的标的之一,尤其是美国 SEC(证券交易委员会)的各种官方动作,近期也是层出不穷。

这份申请文件让大家对美股代币化又有了期待,是因为美国想将证券交易时段向数字资产市场的 24/7 靠近一大步。不过,细细看来:

纳斯达克这份文件可压根没提到任何代币化的事儿,只是针对于传统证券的制度改革。

如果大家希望对纳斯达克的动作有更深的了解,加密沙律可以再专门写一篇文章详细解读。但今天,我们还是想聊聊美股代币化实打实相关的消息——

SEC 正式“允许”美国证券托管中枢巨头对提供代币化服务的尝试。

美国时间 2025 年 12 月 11 日,SEC 交易与市场部工作人员向 DTCC 出具了一份《不采取行动函(No-Action Letter,NAL)》,并随后在 SEC 官网公开。该函件明确表示,在满足特定条件的前提下,SEC 不会就 DTC 开展与其托管证券相关的代币化服务采取执法行动。

乍一看,很多读者觉得 SEC 是官宣“豁免”了在美股上采用代币化技术这件事儿。但细细看来,实际情况相差甚远。

那么,这份函件究竟写了什么?美股代币化的最新发展到底走到哪一步了呢?我们先从函件的主角说起:

一、DTCC、DTC 是谁?

DTCC,全称 Depository Trust & Clearing Corporation,是一家美国集团公司,旗下包括负责托管、股票清算、债券清算的不同机构。

DTC,全称 Depository Trust Company,是 DTCC 的子公司,也是美国最大的证券集中托管机构,负责统一保管股票、债券等证券,并负责交收与过户,目前对证券资产的托管和记账规模超过 100 万亿美元,可以把 DTC 理解为整个美股市场的账本管理员。

二、DTC 和美股代币化有什么关系?

2025 年 9 月初,纳斯达克向 SEC 申请以代币化形式发行股票的新闻?在那份申请中,就已经出现了 DTC 的身影。

纳斯达克声明代币化股票和传统股票唯一的区别,是在 DTC 对订单的清算和结算中。

(上图截自纳斯达克申请提案)

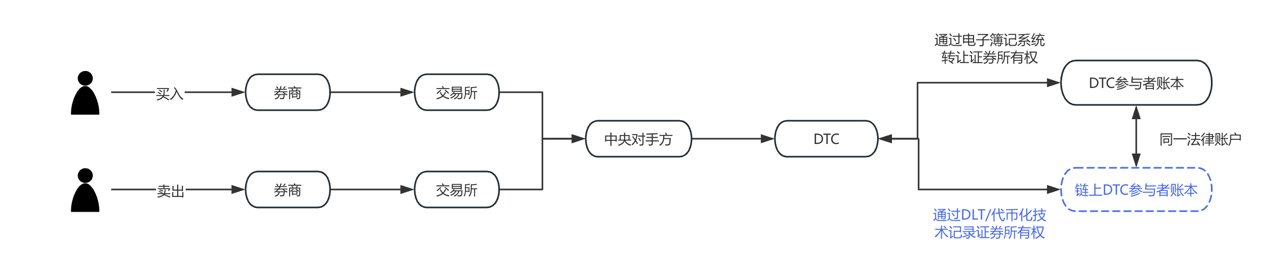

为了让这件事更加通俗易懂,我们画了一张流程图,蓝色部分就是纳斯达克在今年 9 月的提案中申请改变的部分。可以明显看出,DTC 是美股代币化的关键实现和实操机构。

三、新公布的《不采取行动函》讲了什么?

很多人直接将这份文件等同于 SEC 同意 DTC 使用区块链进行美股记账,这是不够准确的。要正确理解这件事,必须认识美国《证券交易法》中的一个条款:

《证券交易法(Securities Exchange Act of 1934)》第 19(b)条规定,任何自律组织(包括清算机构)在变更规则或重大业务安排时,必须向 SEC 提交规则变更申请,并获得批准。

纳斯达克的两份提案都是基于这条规定提交的。

然而,规则申报流程通常很长,可能拖延数月,最长可达 240 天。那如果每一步改变都需要申请再通过,耗费的时间成本就太长了。因此,为确保自己的证券代币化试点活动能够顺利进行,DTC 申请豁免自己在试点期间完全遵守 19b 申报流程的义务,SEC 就此给予了同意。

也就是说,SEC 只是暂时免除了 DTC 的部分程序性申报义务,并不是实质性地许可代币化技术在证券市场的应用。

那接下来,美股代币化会如何发展呢?我们需要搞清楚以下两个问题:

(1)DTC 能够无需申报地进行什么试点活动?

目前,美股的托管记账采用这样的运行模式:假设券商在 DTC 有账户,DTC 会用一套中心化系统记录买入、卖出的每一笔股票和份额。而这次 DTC 提出,我们能不能给券商提供一个选择,把这些股票持仓记录用区块链代币的方式再记录一遍?

实际操作起来,先让参与方去登记一个合格的,受 DTC 认可的登记钱包(Registered Wallet)。当参与方向 DTC 发出代币化指令后,DTC 会做三件事:

a)把这部分股票从原账户挪到一个总账池;

b)在区块链上铸造代币;

c)把代币打到这个参与方的钱包里,代表该参与方对这些证券的权益。

在此之后,这些代币可以在这些券商之间直接转移,而不需要每一次转移都通过 DTC 的集中式账本。不过,所有代币转移都会被 DTC 通过一个名为 LedgerScan 的链下系统实时监控和记录,而 LedgerScan 的记录将构成 DTC 的官方账簿。如果参与方希望退出代币化状态,可以随时向 DTC 发出“去代币化”指令,DTC 会销毁代币,并将证券权益重新记回传统账户。

NAL 中还详细说明了技术和风控限制,包括:代币只能在 DTC 批准的钱包之间转移,所以 DTC 甚至拥有在特定情况下强制转移或销毁钱包中代币的权限,代币系统和 DTC 核心清算系统严格隔离等等。

(2)这份函件的意义在哪里?

从法律层面来看,加密沙律需要强调的是,NAL 并不等同于法律授权或规则修改,它不具有普遍适用的法律效力,而仅代表 SEC 工作人员在既定事实和假设条件下的执法态度。

美国证券法体系并不存在一条单独的“禁止使用区块链记账”规定。监管更关注的是在采用新技术后,既有的市场结构、托管责任、风控与申报义务是否仍被满足。

此外,在美国证券监管体系中,NAL 这类函件长期被视为监管立场的重要风向标,尤其当对象是 DTC 这样的系统重要性金融机构时,其象征意义实际上大于具体业务本身。

从披露内容来看,SEC 此次豁免的前提非常清晰:DTC 并非在链上直接发行或交易证券,而是对其托管体系中的既有证券权益进行代币化表示。

这种代币实际上是一种“权益映射”或“账本表达”,用于提升后台处理效率,而非改变证券的法律属性或所有权结构。相关服务运行在受控环境和许可型区块链之上,参与方、使用范围和技术架构均受到严格限制。

加密沙律认为,这个监管态度是非常合理的。链上资产最容易出现的就是洗钱、非法集资这种金融犯罪,代币化技术是新技术,但不能成为犯罪的帮凶。监管需要在肯定区块链在证券基础设施中的应用潜力的同时,坚守现有证券法与托管体系的边界。

四、美股代币化的最新发展进度

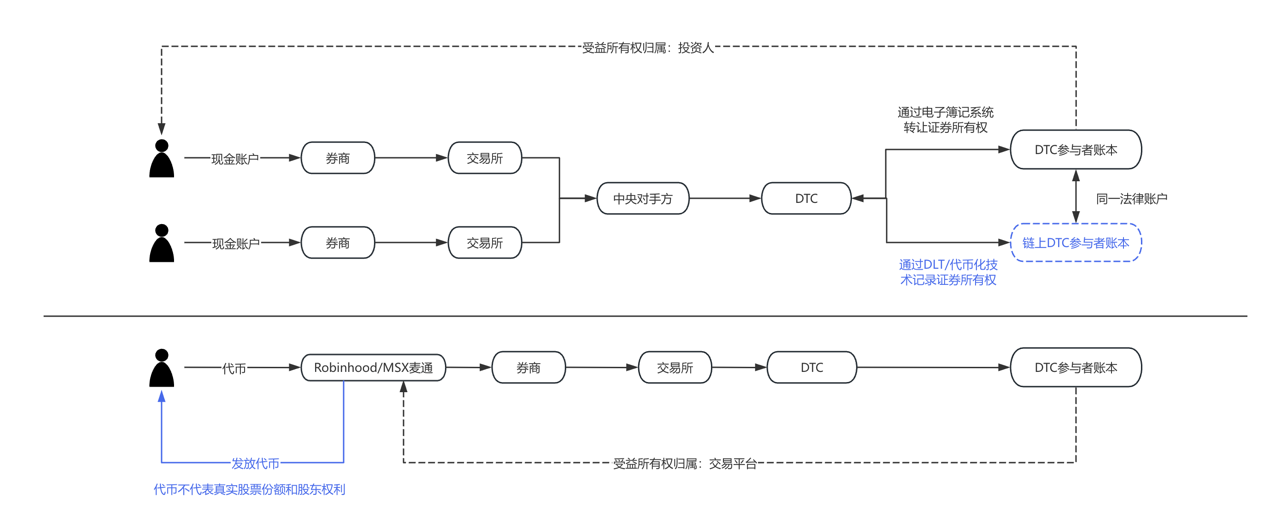

美股代币化的讨论已经开始从“是否合规”逐步转向“如何实现”。如果将当前市场上的实践进行拆解,可以看到至少两种并行但逻辑不同的路径正在形成:

- 以 DTCC 和 DTC 为代表的,是由官方意见主导的代币化路径,其核心目标是提高结算、对账和资产流转效率,服务对象主要是机构和批发市场参与者。在这一模式下,代币化几乎是“隐形的”,对终端投资者而言,股票仍然是股票,只是后台系统发生了技术升级。

- 与之相对的是券商和交易平台可能扮演的前端角色。以 Robinhood、MSX 麦通为例,其近年来在加密资产、股票碎片化交易以及延长交易时间等方面持续进行产品探索。如果美股代币化在合规层面逐步成熟,这类平台天然具备成为用户入口的优势。对它们而言,代币化并不意味着重塑商业模式,而更可能是对现有投资体验的技术延展,例如更接近实时的结算、更灵活的资产拆分以及跨市场产品形态的融合。当然,这一切的前提仍然是监管框架的逐步明朗。这类探索通常走在监管边界附近,风险与创新并存,其价值不在于短期规模,而在于对下一代证券市场形态的验证。从现实角度看,它们更像是为制度演进提供样本,而非直接替代现有美股市场。

为了使大家理解得更加直观,可以看如下的对比图:

五、加密沙律观点

从更宏观的角度看,美股代币化真正试图解决的问题,并不是把股票“变成币”,而是如何在保持法律确定性和系统安全性的前提下,提升资产流转效率、降低运营成本,并为未来的跨市场协同预留接口。在这一过程中,合规、技术与市场结构将长期并行博弈,演进路径也必然是渐进而非激进的。

可以预期的是,美股代币化不会在短期内对华尔街的运行方式有根本性的改变,但它已经是美国金融基础设施议程中的重要项目了。SEC 与 DTCC 的这次互动,更像是一次制度层面的“试水”,为后续更广泛的探索划定了初步边界。对于市场参与者而言,这或许不是终点,而是一个真正值得持续观察的起点。

特别声明:本文为加密沙律团队原创作品,仅代表本文作者个人观点,不构成对特定事项的法律咨询和法律意见。文章如需转载,请私信沟通授权事宜:shajunlvshi。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。