日本央行宣布加息25个基点,将无担保隔夜拆借利率上调至0.75%,创下1995年以来最高水平。

该决定在为期两天的政策会议后公布,并以9:0的全票结果获得通过,完全符合市场预期。所有受访的50位经济学家均预测日本央行此次将采取加息行动,这是行长植田和男任内首次出现“全员押注加息”的一致预期。

决议公布后,日元兑美元短线拉升,目前报155.86。市场反应显示此次加息已被投资者充分消化,也印证了央行判断——当前的利率调整尚不足以改变宽松基调,更像是“渐进式正常化”的一环

一、历史规律:日本加息与比特币下跌的高度关联性

市场对日本央行加息的担忧并非空穴来风。历史数据清晰显示,日本货币政策转向与比特币价格下跌存在显著关联。

● 自2024年以来,日本央行的三次加息都伴随着比特币超过20%的价格下跌。具体而言,2024年3月加息后比特币下跌约27%,同年7月加息后下跌30%,2025年1月加息后再次下跌30%。

● 这种模式的形成与日本在全球金融体系中的独特地位有关。日本是美国国债最大的海外持有国,持仓超过1.1万亿美元。

● 其政策变动能够直接影响全球美元供应、国债收益率以及比特币等风险资产的价格表现。

● 分析师Hanzo指出,加密市场忽视日本央行动向是一个重大失误。日元是除了美元之外最大的外汇市场玩家,对资本市场的影响可能比欧元都大。

二、廉价日元套利交易如何影响加密市场

● 日本加息影响全球市场的核心机制在于“日元套利交易”的解除。这一金融操作多年来一直是全球市场流动性的重要来源。套利交易者以接近零的利率借入日元,然后兑换成美元或其他高收益货币,投资于美股、美债或加密货币等高收益资产。

● 当日本利率上升时,这些头寸的融资成本增加,可能迅速被平仓,导致所有市场出现强制清算和去杠杆化。当前的市场背景加剧了这种影响:多数主要央行在降息,日本央行却反向加息。

● 这种政策分化将引发套利交易平仓,导致加密货币市场再度动荡。更重要的是,本次加息本身或许并非关键风险所在,更关键的是日本央行对2026年政策指引所释放的信号。

● 日本央行已确认,自2026年1月起将出售价值约5500亿美元的ETF持仓。如果2026年日本央行将再次或多次加息,将进一步解除日元套利交易,引发风险资产抛售和日元回流。

三、全球流动性环境的分化与不确定性

● 日本央行加息并非孤立事件,它发生在全球货币政策高度分化的复杂环境中。美联储在完成首次降息后,市场关注点已转换到“2026年还能降几次、节奏会不会被迫放缓”。

● 尽管美联储在12月如预期降息25个基点,但前瞻指引明显转向谨慎。美联储最新预测显示,2026年全年仅预计降息一次。与此同时,市场仍然押注明年接近三次降息,这使得投资者的预期与央行释放的政策信号之间出现了明显分歧。

● 这种“名义宽松”与“实际流动性收紧”之间的微妙平衡,为风险资产带来了复杂影响。对比特币而言,这种“不统一的流动性环境”,往往比明确的紧缩更具杀伤力。

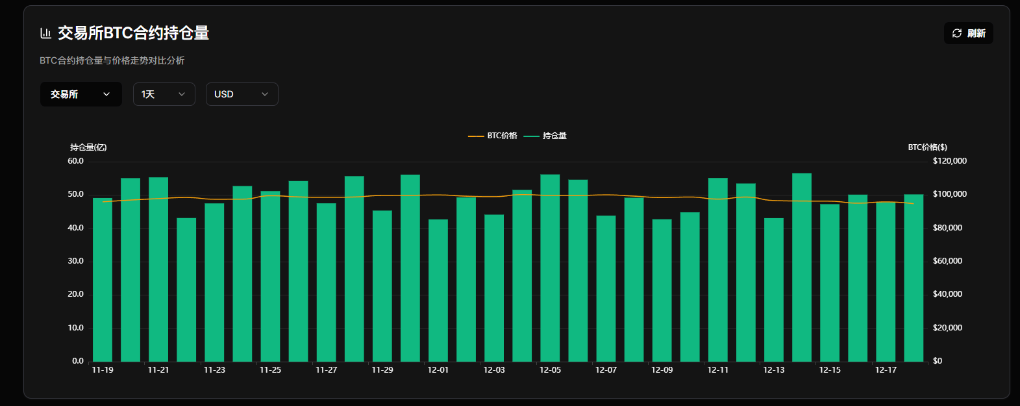

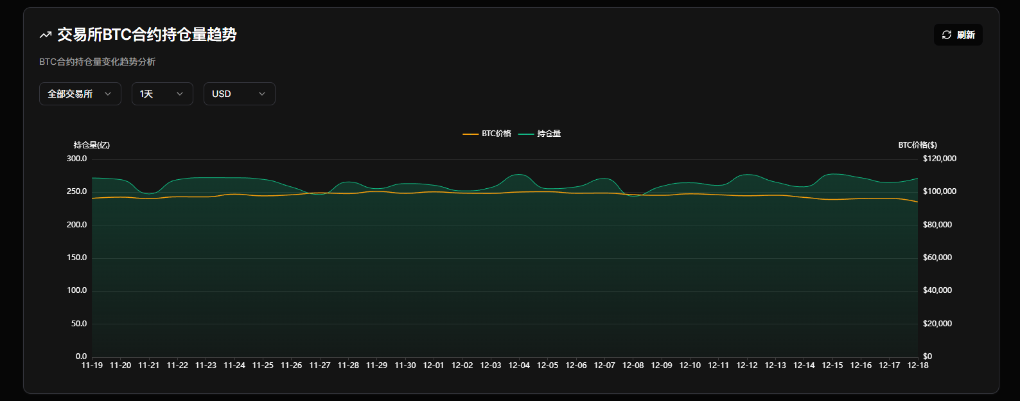

四、链上数据揭示的投资者行为转变

● 链上数据揭示了市场内部正在发生的深刻变化。比特币交易所净流入在12月18日达到3764 BTC(约3.4亿美元),创下阶段性高点。仅币安一家的净流入就达到2285 BTC,较前一阶段放大约8倍,明显指向大户集中充值、准备抛售的行为。

● 长期持有者的行为同样值得关注。过去6个月未动过的比特币持有者持续抛售的行为已经持续数月,且在11月下旬至2月中旬出现明显加。

● 矿工层面也出现了压力迹象。比特币全网算力暂报988.49EH/s,距离上周同一时刻下跌17.25%。据估计,按照每台机器平均250T算力计算,近期至少有40万台比特币矿机关机。

● 做市商的仓位变化构成了重要的背景因素。以Wintermute为例,其在11月下旬至12月初期间,累计向交易平台转移超过15亿美元的资产。市场对其大额转移的行为表现出恐慌,尽管在12月10日至18日期间,其BTC持仓出现271枚的净增持。

五、加密货币与传统金融市场的联动增强

随着加密货币市场日益成熟,其与传统金融市场的联动性显著增强。这种联动在压力时期表现得尤为明显。

● 加密货币概念股同步承压,Strategy与Circle日内跌幅均接近7%,Coinbase下跌逾5%,而矿企CLSK、HUT、WULF的跌幅甚至超过10%。

● 比特币现货ETF单日净流出约3.5亿美元(约4000枚BTC),以Fidelity的FBTC与Grayscale的GBTC/ETHE为主要流出来源。

● 以太坊ETF方面,累计净流出约6500万美元(约21000枚ETH)。

● 一个有趣的现象是,比特币在美国交易时段的表现相对更疲软。数据统计显示:“自贝莱德IBIT比特币ETF开始交易以来,若在收盘后时段持有,收益达222%,但若仅持有盘中时段,则亏损40.5%”。

这种跨市场、跨资产类别的风险传导,反映了加密货币已不再是孤立存在的资产类别,而是深度融入全球金融体系的一部分。

比特币价格走势图上,每一次日本央行加息的标记后都跟随着陡峭的下行曲线。全球廉价资本的水龙头正在缓慢关闭,加密世界高耸的流动性大厦地基开始松动。

交易员在社交媒体上热议:“每一次日本加息,比特币都会暴跌20-25%。”当12月19日的利率决议临近,超过17万账户已在这场预期的风暴中被冲垮。

加入我们的社区,一起来讨论,一起变得更强吧!

官方电报(Telegram)社群:https://t.me/aicoincn

AiCoin中文推特:https://x.com/AiCoinzh

OKX 福利群:https://aicoin.com/link/chat?cid=l61eM4owQ

币安福利群:https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。