Last night, the U.S. Bureau of Labor Statistics (BLS) released the non-farm employment reports for October and November, which had been delayed due to the government shutdown, presenting the market with a complex puzzle.

The report painted a contradictory picture: on one hand, there was the "fire" of job growth, and on the other, the "ice" of rising unemployment and stagnant wages. This intertwining of ice and fire not only left ordinary investors confused but also plunged the market into a new round of speculation regarding the Federal Reserve's interest rate cuts.

1. Data Analysis: Which is Heavier, the "Good News" or the "Bad News"?

This is a typical report that requires "careful dissection," as every number has a story behind it.

1. Surface "Fire": Job Growth Exceeds Expectations

● The seasonally adjusted non-farm payrolls increased by 64,000 in November, surpassing the market's general expectation of 50,000. After an unexpected decline in October, this rebound appears particularly positive.

● However, the official stance is much cooler than the numbers suggest. The report states that non-farm employment has "barely changed" since April. This bland official wording douses a bucket of cold water on the apparent heat.

2. Underlying "Ice": Unemployment Rate Hits Four-Year High, Wage Growth Weakens

● The unemployment rate rose to 4.6%, the highest level since September 2021, exceeding the market expectation of 4.5%. More precise data shows that the unrounded unemployment rate has risen to 4.573%, significantly up by 13 basis points from September.

● Wage growth continues to cool. The average hourly wage increased by 3.5% year-on-year in November, with a monthly increase of only 0.1%, both below expectations. The slowdown in wage growth is a clear signal of easing inflation pressures but may also indicate future pressure on consumer purchasing power.

3. "Ghost Data": Powell Discounts Non-Farm Figures

The complexity of the report is also reflected in its statistics. Federal Reserve Chairman Powell publicly questioned the accuracy of non-farm data during the December meeting, suggesting that official data overestimates job growth by about 60,000 positions on average each month. If adjusted accordingly, the true situation of non-farm growth over the past few months is nearly zero, or even negative growth.

2. Market Immediate Reaction: Traders "Race Ahead" on Rate Cut Expectations

Faced with mixed data, the financial market showed a clear selectivity: more willing to believe the signals of economic cooling and quickly bet on looser monetary policy.

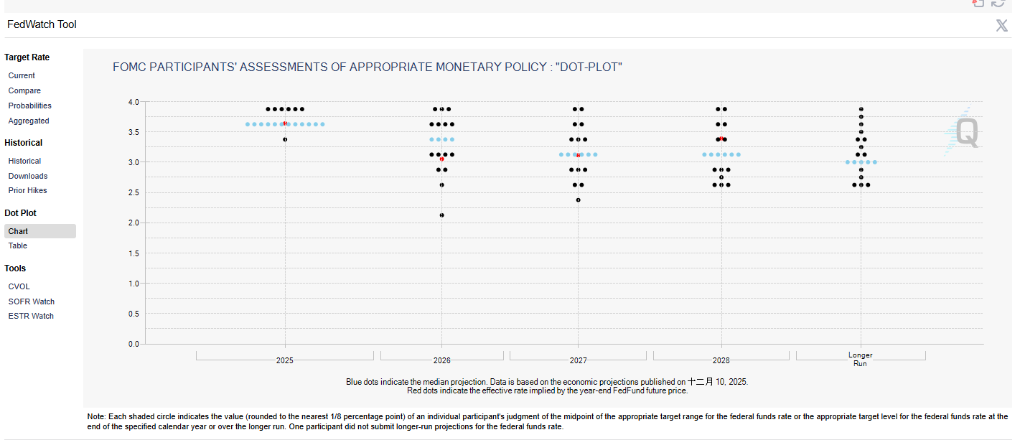

● Rate cut expectations heat up: Following the report's release, the federal funds futures market indicated that traders raised the probability of a rate cut at the Federal Reserve's January 2026 meeting from about 22% to over 31%. The market has fully priced in at least two rate cuts (a total of 50 basis points) within 2026.

● Dollar "drops and jumps," gold rises briefly: The dollar index quickly fell to a new low upon hearing the news but later regained some ground, reflecting market indecision. As a non-yielding asset, spot gold surged briefly, supported by expectations of rate cuts and safe-haven demand.

● Risk assets respond positively: U.S. stock index futures strengthened, indicating that the market tends to interpret this report as "bad news is good news"—that is, the economic slowdown is just enough to prompt the Federal Reserve to cut rates, but not to the extent of triggering recession fears.

3. In-Depth Analysis: What Will the Federal Reserve Focus On?

In the fog of conflicting data, which side will the Federal Reserve's decision-making scale tip towards? Professional institutions' analyses point to several key judgments.

● The Federal Reserve has shifted to "employment first": When the current rate cut cycle began in September 2025, Chairman Powell clearly stated that the downside risks facing the labor market are a key focus of rate cut decisions, and policy is adjusting from a focus on inflation to a more neutral stance. Therefore, the continued rise in the unemployment rate will undoubtedly catch the Federal Reserve's attention.

● This report "will not significantly change the Federal Reserve's judgment": Nick Timiraos, a well-known journalist often referred to as the "new Federal Reserve correspondent," quickly commented after the report's release, stating that the data itself is unlikely to significantly alter the Federal Reserve's judgment on whether to continue cutting rates. This sets the tone that the market should not overinterpret monthly fluctuations.

● The core issue is whether the balance in the labor market has been disrupted: CITIC Securities analysis pointed out that the Federal Reserve's previous summary of the labor market was "low hiring + low layoffs," but in the past two months, the "low layoffs" characteristic has begun to show marginal changes. The key is whether this change will expand. If the unemployment rate does not continue to rise significantly in December, the Federal Reserve may still consider the current policy rate to be "well-positioned."

4. Major Asset Outlook: Not Just a Stage for Gold

How will the warming expectations of easing affect various asset classes? The market's capital flows in 2025 provide some clues.

- Gold: Short-term sentiment support, long-term logic solid:

a. Rate cut expectations directly lower the opportunity cost of holding gold, providing support for gold prices. The price reaction of gold following the report's release has validated this.

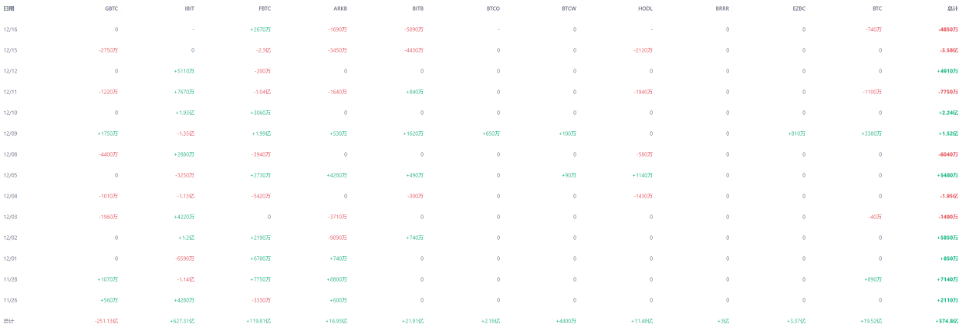

b. From a longer investment cycle perspective, gold is gaining structural buying interest. Central banks worldwide continue to purchase gold, and ETF inflows reached historic levels in 2025. However, it is worth noting that the dominance of gold ETFs is being challenged—by the end of 2025, the assets under management of Bitcoin ETFs reached $150 billion, closely trailing the $180 billion of gold ETFs, highlighting a generational shift in asset allocation.

- Bitcoin: A new darling under liquidity expectations:

a. As a "digital asset" highly sensitive to global liquidity, Bitcoin also benefits under easing expectations. In 2025, Bitcoin ETFs attracted record inflows, indicating that institutions are viewing it as an alternative tool to hedge against dollar depreciation and inflation.

b. Historical data shows that when the market chases risk or seeks new value storage tools, funds tend to rotate between gold and Bitcoin. When the rate cut cycle is confirmed, this rotation may occur again.

- U.S. Stocks: A Fragile "Goldilocks" Balance:

a. The market's optimistic response is based on the beautiful assumption of "economic soft landing + monetary shift to easing." However, if future data shows that the economic slowdown is faster than expected, corporate profits will face pressure, potentially shaking the foundations of the stock market.

b. Currently, investor sentiment is quite optimistic. Data shows that after weekly declines in U.S. stocks in 2025, funds tend to accelerate inflows into stock ETFs, exhibiting a "buy the dip" characteristic. Whether this inertia can continue in the face of real economic tests is the biggest suspense.

5. Outlook and Conclusion: Divergence and Consensus

Overall, this non-farm report reinforces the market's consensus on economic slowdown but also solidifies professional institutions' judgment that "the Federal Reserve will not hastily cut rates aggressively."

● Short-term divergence: Market traders are trying to "mine gold" from the data, betting first on a more aggressive easing path; while mainstream institutions (such as CITIC Securities) remain relatively cautious, maintaining the baseline forecast that "the Federal Reserve may pause in January next year, followed by only one small rate cut."

● Long-term consensus: Regardless of the path, the door to the rate cut cycle has already opened. The Federal Reserve's policy focus has shifted from combating inflation to preventing risks in the labor market. For investors, rather than getting caught up in the fluctuations of single-month non-farm data, it is better to pay attention to the inflation (CPI/PCE) data and retail sales data to be released in the next week or two, as they will provide a clearer picture for rate decisions in December and beyond.

● Final judgment: This is a report that reinforces trends rather than reverses them. It reveals the fact of slowing economic momentum but does not provide an urgent reason for immediate significant rate cuts. The interplay between market restlessness and the Federal Reserve's caution will become the main theme in the coming months. What investors need to do is to seek opportunities in this expectation gap and be wary of any potential market volatility triggered by misjudgments from either side.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。