Written by: Uweb

In the current global financial system, which is rapidly moving towards deep digitalization, a new book focusing on the cutting-edge trend of "convergence of securities and crypto" has officially hit the market.

Recently, the Chinese version of "Convergence of Securities and Crypto: RWA and Digital Asset Treasury Reshaping the Next-Generation Capital Markets" was officially published by CITIC Press, alongside the English version aimed at international readers.

This book, co-authored by Dr. Jia Ning, Dr. Liang Xinjun, Zhang Huachen, Dr. Bai Haifeng, and Wang Hongbin, revolves around two key themes: Real World Assets (RWA) and Digital Asset Treasury (DAT), providing a systematic cognitive framework and action guide for the next generation of capital markets. With the Chinese and English versions launched, the book also plans to gradually release more language versions in the future to serve a broader global readership.

The new book launch event was held on November 23 at the New York East Bookstore, located in the heart of Manhattan's Chinatown. This landmark Chinese bookstore, with nearly half a century of history, hosted a seminar for the new book "Convergence of Securities and Crypto" amidst the mingling of literary fragrance and light.

The launch event focused on the century intersection of traditional capital markets and digital asset markets. On the day of the event, the East Bookstore was packed with over 50 elites from top investment banks, asset management institutions, and technology companies on Wall Street, engaging in deep discussions about the cutting-edge trends of the convergence of securities and crypto. The relationship between securities and digital currencies is rapidly moving towards deep integration, with guests at the event exploring the possibilities and opportunities of the next generation of capital markets through enthusiastic and rational exchanges.

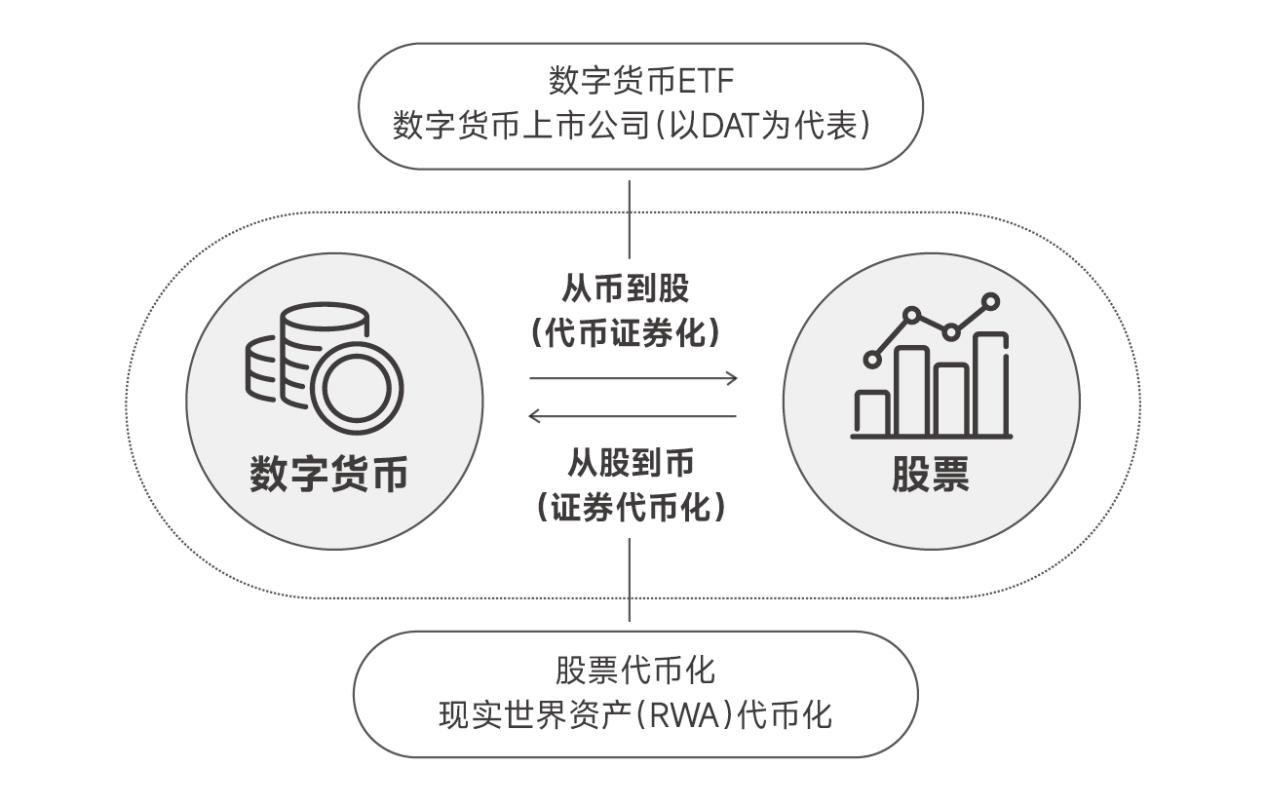

Dr. Jia Ning, President of Uweb Business School, Director of the Hong Kong Registered Digital Asset Analyst Association, and Honorary Chairman of the Hong Kong Blockchain Association, pointed out that the tokenization of securities and the securitization of tokens are becoming industry consensus, forming two main lines of capital markets. These two directions together constitute the backbone of future capital market development and are facilitating the innovative effect of 1+1>2 between traditional capital markets and digital asset markets.

The Century Intersection of Capital Markets: From Parallel Systems to Bidirectional Convergence

Over the past century, traditional securities such as stocks and bonds have established a mature regulatory, institutional, and pricing system; meanwhile, digital currencies represented by Bitcoin and Ethereum have rapidly grown in the soil of blockchain technology, forming another parallel market structure. "Convergence of Securities and Crypto" points out that with the accelerated implementation of new models such as RWA tokenization, stablecoins, digital currency ETFs, and DAT companies, the two are moving from parallel worlds towards deep integration, entering a bidirectional convergence phase where stocks come from the blockchain and currencies go to Wall Street.

Using the two main lines of securities tokenization and token securitization, this transformative picture is clearly depicted: on one hand, traditional securities such as stocks and bonds are beginning to go on-chain, registered, settled, and traded in the form of tokens; on the other hand, digital currencies like Bitcoin and Ethereum are being incorporated into mainstream capital markets through compliant vehicles such as ETFs and DAT companies, becoming an important part of institutional asset allocation and corporate balance sheet restructuring.

This trend signifies not only an innovation in asset allocation methods but also a reconstruction of financial infrastructure. Public chains will evolve into underlying facilities for human co-governance and sharing, achieving instant settlement and real-time exchange across assets. Consequently, the operational logic, liquidity mechanisms, and risk management methods of financial markets will be redefined, collectively shaping a new landscape for the next generation of international capital markets.

ETF, DAT, and Stablecoins: The Three Pillars of Token Securitization

In the chapter on token securitization, "Convergence of Securities and Crypto" traces the historical and logical starting points of how tokens have gradually crossed the institutional barriers of Wall Street, moving towards compliance and mainstream acceptance. The book emphasizes the birth logic of digital currency spot ETFs, viewing it as the IPO moment for Bitcoin. ETFs add a layer of familiar financial packaging to digital assets, allowing them to enter the asset allocation baskets of institutional investors such as pension funds, sovereign funds, and family offices in a standardized and regulated manner.

At the same time, DAT companies are seen as important representatives of convergence-type listed companies. These companies actively allocate digital assets like Bitcoin on their balance sheets, combining their main business cash flow to form a composite value source of business income + digital asset appreciation. The book introduces concepts such as mNAV and stock token quantity to describe the contribution path of digital currency assets to a company's long-term valuation and competitiveness.

Stablecoins represent another fast track for accelerating the convergence of securities and crypto. "Convergence of Securities and Crypto" analyzes stablecoins like USDC and USDT and the companies behind them, pointing out that stablecoins are evolving into the liquid blood of the global digital economy: they are not only important tools for cross-border settlement and fund allocation but also the most fundamental value carriers in RWAFi and DeFi ecosystems. As stablecoin regulatory frameworks are gradually implemented in the U.S., EU, and Asia, their position in the global financial system will shift from technological innovation to infrastructure.

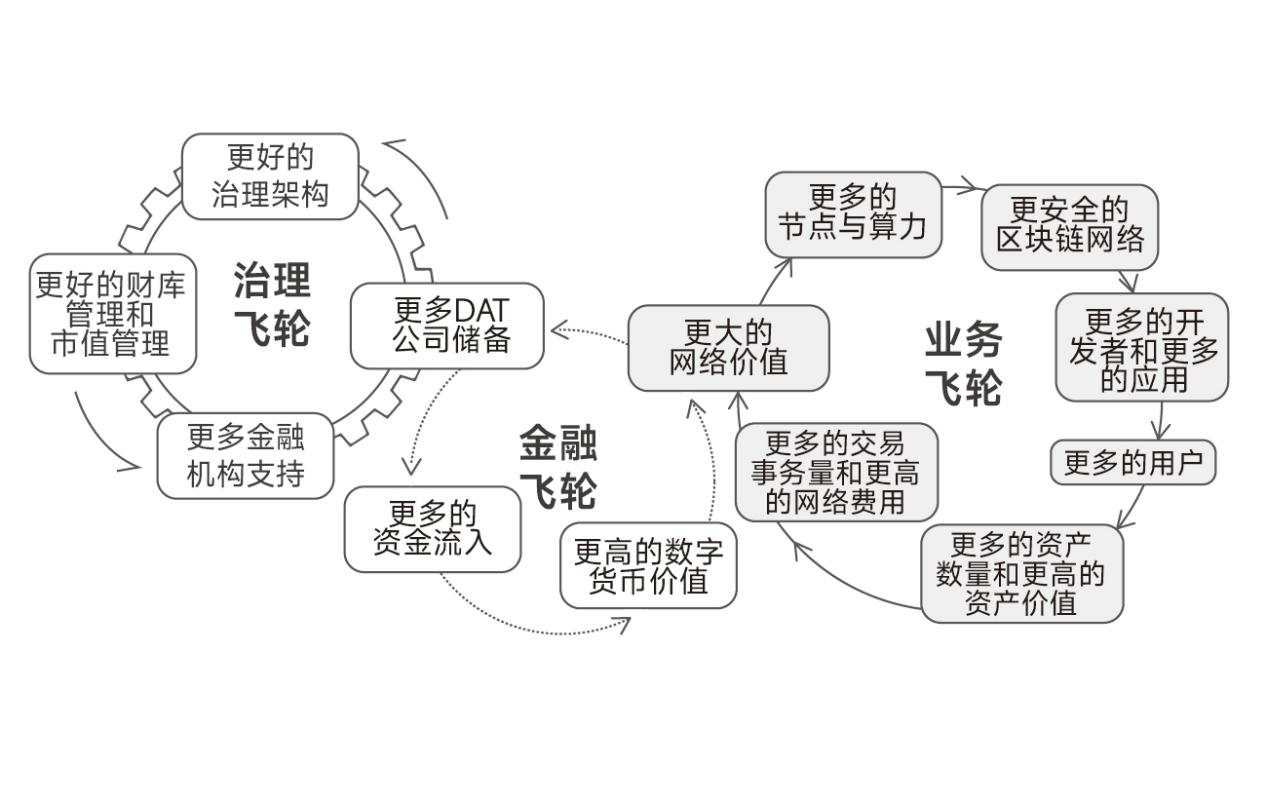

The Flywheel of Convergence: Synergistic Evolution of Business Models and Financial Structures

In addition to technical and product-level analysis, "Convergence of Securities and Crypto" also builds a comprehensive thinking framework regarding business model and ecosystem evolution. The book introduces concepts such as the threefold composite flywheel of convergence, where the financial flywheel and business flywheel together form the engine of growth, while the governance flywheel serves as a balancing weight. The governance flywheel provides an inherent steady-state mechanism for the capital and business of the convergence era, allowing the two growth flywheels to maintain a relatively continuous positive cycle in a complex macro environment.

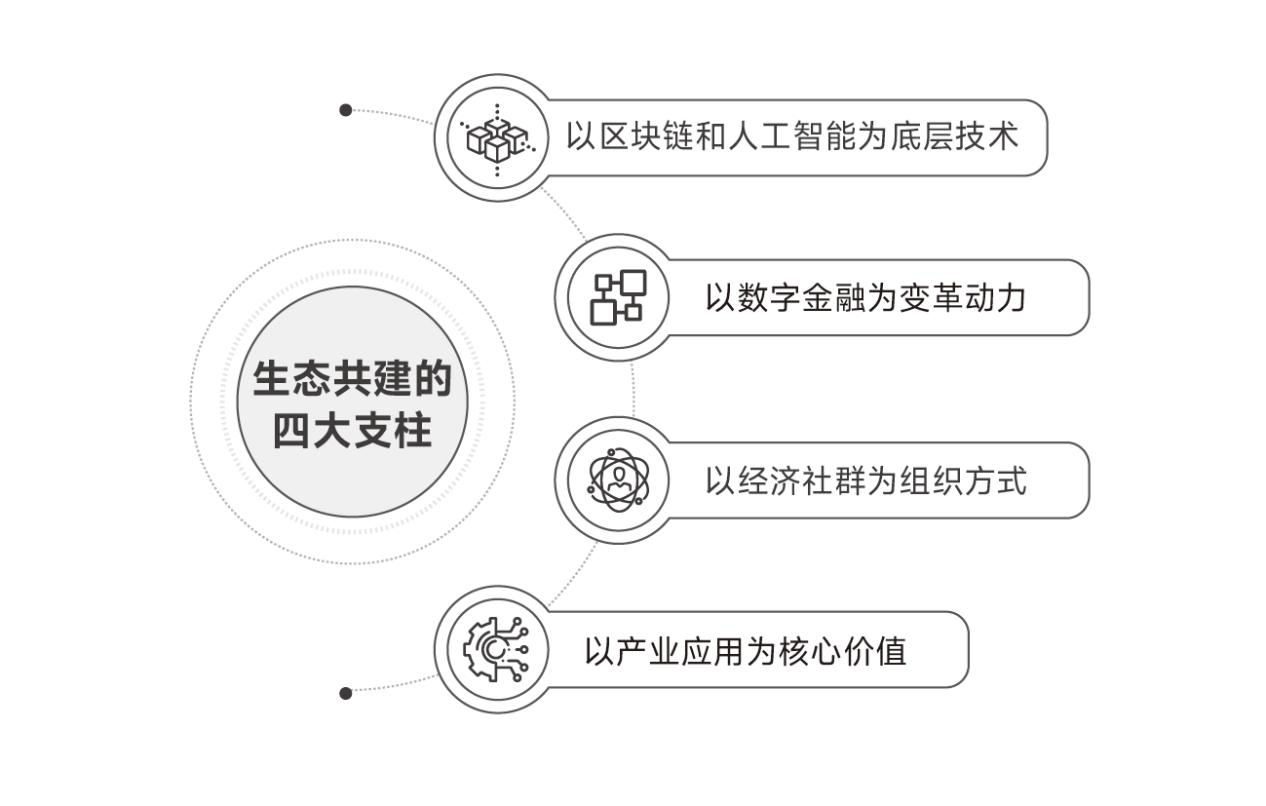

Moreover, the ecological co-construction of convergence will feature four pillars: blockchain and AI as underlying technologies, digital finance as the driving force for transformation, economic communities as organizational forms, and industrial applications as core values. These pillars interact continuously to form a synergy, gradually shaping new market logic.

An important characteristic of "Convergence of Securities and Crypto" is the combination of theoretical depth and practical experience. One of the authors, Dr. Jia Ning, has long been engaged in the fields of digital currency and RWA, possessing rich theoretical knowledge and practical experience. He is a director of the Hong Kong Registered Digital Asset Analyst Association, which was initiated by industry veterans to actively serve Hong Kong's national strategy of building an international digital asset center. His founded high-end education institution, Uweb (University of Web3), aims to cultivate top global talents in the digital economy and has launched RWA and digital asset-related courses in Singapore, the U.S., Hong Kong, Shenzhen, Hainan, and other locations, providing long-term training services for government departments, financial institutions, and international organizations, including UNESCO, Ant Group, Hong Kong Cyberport, Industrial Bank, Nanyang Commercial Bank, Lingnan University of Hong Kong, and The Chinese University of Hong Kong. Uweb continuously promotes cutting-edge explorations in RWA tokenization, AI research methodologies, and on-chain data analysis systems with its profound academic foundation and industry resources.

Several authors come from the front lines of traditional finance, investment, and technology industries, making this book not only possess a cross-market and cross-disciplinary perspective but also a comprehensive ability in policy understanding, business implementation, and product design. This multidimensional perspective + systematic framework writing style gives "Convergence of Securities and Crypto" a distinct identity among numerous Web3 and financial innovation readings.

At the book launch event, the author team shared insights on core topics such as the dual main lines of securities tokenization and token securitization, how to reshape financial infrastructure, and the value reassessment of DAT companies and convergence-type listed companies, engaging in deep dialogues with guests from regulatory research, traditional financial institutions, and leading Web3 enterprises. Discussions on practical issues surrounding stablecoins, ETFs, RWA product design, and cross-border compliance will also provide actionable perspectives and inspiration for financial practitioners and technology entrepreneurs present.

As capital markets enter the fast lane of convergence, understanding the operational logic behind RWA and DAT is no longer an elective course for a few pioneering institutions but will become a required course for participating in the new round of global financial competition. The book "Convergence of Securities and Crypto" attempts to provide a clear roadmap for this profound transformation, helping regulators better build rule frameworks, assisting institutions and entrepreneurs in finding upgrade paths, and enabling every reader concerned about the future of wealth forms to see the outline of the next generation of capital markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。