Author: Jacob Zhao @IOSG

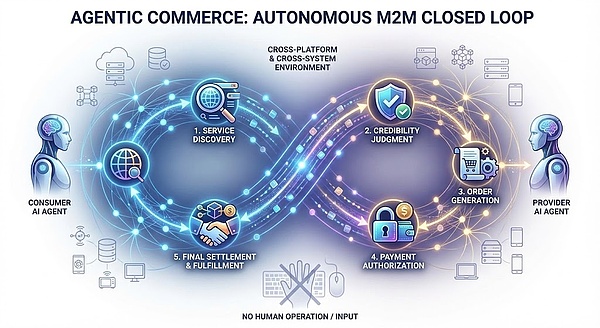

Agentic Commerce refers to a complete commercial system where AI agents autonomously complete the entire process of service discovery, credibility assessment, order generation, payment authorization, and final settlement. It no longer relies on human step-by-step operations or information input, but instead allows agents to automatically collaborate, place orders, make payments, and fulfill contracts in a cross-platform, cross-system environment, thus forming a self-executing commercial loop between machines (M2M Commerce).

In the cryptocurrency field, the most practically valuable scenarios are currently concentrated in stablecoin payments and DeFi. Therefore, in the process of integrating Crypto and AI, the two most valuable paths are: AgentFi, which relies on existing mature DeFi protocols in the short term, and Agent Payment, which gradually improves around stablecoin settlement and relies on protocols such as ACP/AP2/x402/ERC-8004 in the medium to long term.

Agentic Commerce is currently limited in the short term by factors such as protocol maturity, regulatory differences, and merchant user acceptance, making it difficult to scale quickly; however, in the long term, payment is the underlying anchor point of all commercial loops, and Agentic Commerce holds the most long-term value.

Agentic Commerce Payment System and Application Scenarios

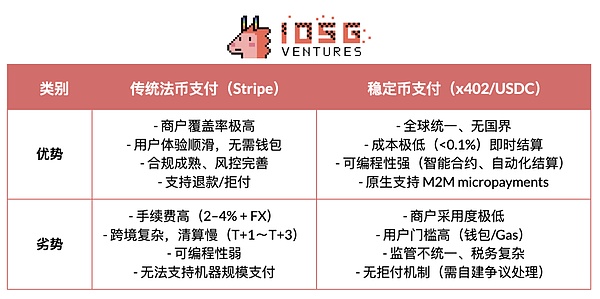

In the Agentic Commerce system, the real-world merchant network is the most valuable scenario. Regardless of how AI Agents evolve, the traditional fiat payment system (Stripe, Visa, Mastercard, bank transfers) and the rapidly growing stablecoin system (USDC, x402) will coexist in the long term, together forming the foundation of Agentic Commerce.

Comparison of Traditional Fiat Payments vs. Stablecoin Payments

Real-world merchants—from e-commerce, subscriptions, SaaS to travel, content payment, and enterprise procurement—carry trillion-dollar-level demand and are also the core value source for AI Agents' automatic price comparison, renewals, and procurement. In the short term, mainstream consumer and enterprise procurement will still be dominated by the traditional fiat payment system.

The core obstacle to the scalability of stablecoins in real-world commerce is not technology, but regulation (KYC/AML, taxation, consumer protection), merchant accounting (illegal repayment of stablecoins), and the lack of dispute resolution mechanisms due to irreversible payments. Due to these structural limitations, stablecoins will find it difficult to enter highly regulated industries such as healthcare, aviation, e-commerce, government, and utilities in the short term. Their implementation will mainly focus on low-regulation or on-chain native scenarios such as digital content, cross-border payments, Web3 native services, and machine economy (M2M/IoT/Agent), which is also the first opportunity window for Web3 native Agentic Commerce to achieve scale breakthroughs.

However, by 2025, regulatory institutionalization is rapidly advancing: the U.S. stablecoin bill has gained bipartisan consensus, Hong Kong and Singapore have implemented stablecoin licensing frameworks, the EU's MiCA has officially come into effect, Stripe supports USDC, and PayPal has launched PYUSD. The clarification of regulatory structures means that stablecoins are being accepted by the mainstream financial system, opening up policy space for future cross-border settlements, B2B procurement, and the machine economy.

Best Application Scenario Matching for Agentic Commerce

The core of Agentic Commerce is not to replace one payment track with another, but to hand over the execution subjects of "ordering—authorization—payment" to AI Agents, allowing the traditional fiat payment system (AP2, authorization credentials, identity compliance) and the stablecoin system (x402, CCTP, smart contract settlement) to leverage their respective advantages. It is neither a zero-sum competition between fiat and stablecoins nor a narrative of a single track replacement, but a structural opportunity that expands the capabilities of both sides simultaneously: fiat payments continue to support human commerce, while stablecoin payments accelerate machine-native and on-chain native scenarios, with both complementing and coexisting, becoming the dual engines of the agent economy.

Overview of the Underlying Protocol Standards for Agentic Commerce

The protocol stack of Agentic Commerce consists of six layers, forming a complete machine commercial link from "capability discovery" to "payment delivery." The A2A Catalog and MCP Registry are responsible for capability discovery, while ERC-8004 provides on-chain verifiable identity and reputation; ACP and AP2 handle structured ordering and authorization instructions, respectively; the payment layer consists of parallel traditional fiat tracks (AP2) and stablecoin tracks (x402); the delivery layer currently lacks a unified standard.

Discovery Layer: Addresses "How do Agents discover and understand callable services?" The AI side builds a standardized capability catalog through A2A Catalog and MCP Registry; Web3 relies on ERC-8004 to provide addressable identity guidance. This layer is the entry point of the entire protocol stack.

Trust Layer: Answers "Is the other party trustworthy?" There is currently no universal standard on the AI side, while Web3 constructs a unified framework for verifiable identity, reputation, and execution records through ERC-8004, which is a key advantage of Web3.

Ordering Layer: Responsible for "How are orders expressed and verified?" ACP (OpenAI × Stripe) provides a structured description of products, prices, and settlement terms, ensuring that merchants can fulfill contracts. Since it is difficult to express real-world commercial contracts on-chain, this layer is primarily dominated by Web2.

Authorization Layer: Handles "Does the Agent have legitimate authorization from the user?" AP2 binds intent, confirmation, and payment authorization to the real identity system through verifiable credentials. Web3 signatures currently lack legal effect, thus cannot bear the contractual and compliance responsibilities of this layer.

Payment Layer: Determines "Through which track is the payment completed?" AP2 covers traditional payment networks such as cards and banks; x402 provides a native API payment interface for stablecoins, allowing assets like USDC to be embedded in automated calls. These two tracks form functional complementarity here.

Fulfillment Layer: Answers "How is content securely delivered after payment is completed?" Currently, there is no unified protocol: the real world relies on merchant systems to complete delivery, while Web3's cryptographic access control has yet to form cross-ecosystem standards. This layer remains the largest blank in the protocol stack and is most likely to give birth to the next generation of foundational protocols.

Detailed Explanation of Key Core Protocols for Agentic Commerce

Focusing on the five key links of service discovery, trust assessment, structured ordering, payment authorization, and final settlement in Agentic Commerce, institutions such as Google, Anthropic, OpenAI, Stripe, Ethereum, and Coinbase have proposed underlying protocols for the corresponding links, thus jointly constructing the next generation of the core protocol stack for Agentic Commerce.

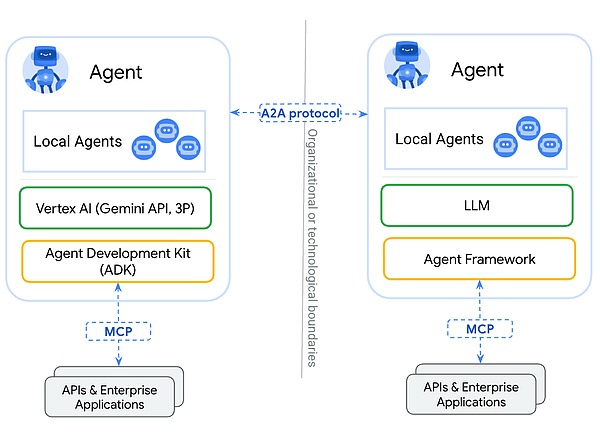

Agent‑to‑Agent (A2A) – Interoperability Protocol for Agents (Google)

A2A is an open-source protocol initiated by Google and donated to the Linux Foundation, aimed at providing a unified communication and collaboration standard for AI Agents built by different vendors and frameworks. A2A is based on HTTP + JSON-RPC, enabling secure, structured message and task exchanges, allowing Agents to engage in multi-turn dialogues, collaborative decision-making, task decomposition, and state management in a native manner. Its core goal is to build "the internet of agents," enabling any A2A-compatible Agent to be automatically discovered, invoked, and combined, thus forming a distributed Agent network across platforms and organizations.

Model Context Protocol (MCP) – Unified Tool Data Access Protocol (Anthropic)

MCP, launched by Anthropic, is an open protocol that connects LLM/Agents with external systems, focusing on unified tool and data access interfaces. It abstracts databases, file systems, remote APIs, and proprietary tools into standardized resources, allowing Agents to access external capabilities securely, controllably, and auditable. The design of MCP emphasizes low integration costs and high scalability: developers only need to integrate once to enable Agents to use the entire tool ecosystem. MCP has been adopted by several leading AI vendors, becoming the de facto standard for agent-tool interaction.

MCP focuses on "How do Agents use tools"—providing models with unified and secure access to external resources (such as databases, APIs, file systems, etc.), thereby standardizing the interaction between agent-tool / agent-data.

A2A addresses "How do Agents collaborate with other Agents"—establishing native communication standards for cross-vendor and cross-framework agents, supporting multi-turn dialogues, task decomposition, state management, and long lifecycle execution, serving as the foundational interoperability layer between agents.

Agentic Commerce Protocol (ACP) – Ordering and Checkout Protocol (OpenAI × Stripe)

ACP (Agentic Commerce Protocol) is an open ordering standard (Apache 2.0) proposed by OpenAI and Stripe, establishing a structured ordering process that can be directly understood by machines for buyers—AI Agents—merchants. The protocol covers product information, price and terms verification, settlement logic, and payment credential transmission, allowing AI to securely initiate purchases on behalf of users without becoming a merchant.

Its core design is that AI calls the merchant's checkout interface in a standardized manner while the merchant retains all commercial and legal control. ACP enables structured orders (JSON Schema / OpenAPI), secure payment tokens (Stripe Shared Payment Token), is compatible with existing e-commerce backends, and supports REST and MCP publishing capabilities, allowing merchants to enter the AI shopping ecosystem without system modifications. Currently, ACP has been used in ChatGPT Instant Checkout, becoming an early deployable payment infrastructure.

Agent Payments Protocol (AP2) – Digital Authorization and Payment Instruction Protocol (Google)

AP2 is an open standard jointly launched by Google and several payment networks and technology companies, aimed at establishing a unified, compliant, and auditable process for AI Agent-led payments. It binds the user's payment intent, authorization scope, and compliant identity through digitally signed authorization credentials, providing verifiable evidence of "who is spending money on whom" for merchants, payment institutions, and regulators.

AP2 is designed with a "Payment-Agnostic" principle, supporting credit cards, bank transfers, real-time payments, and extending access to stablecoin payment tracks such as x402. In the entire Agentic Commerce protocol stack, AP2 does not handle specific product and ordering details but provides a general Agent payment authorization framework for various payment channels.

ERC‑8004 – On-Chain Agent Identity / Reputation / Verification Standard (Ethereum)

ERC-8004 is an Ethereum standard proposed by MetaMask, the Ethereum Foundation, Google, and Coinbase, aimed at building a cross-platform, verifiable, and trustless identity and reputation system for AI Agents. The protocol consists of three on-chain components:

Identity Registry: Mints on-chain identities for each Agent similar to NFTs, which can connect to MCP / A2A endpoints, ENS/DID, wallets, and other cross-platform information.

Reputation Registry: Standardizes the recording of scores, feedback, and behavioral signals, making the historical performance of Agents auditable, aggregable, and combinable.

Validation Registry: Supports validation mechanisms such as stake re-execution, zkML, and TEE, providing verifiable execution records for high-value tasks.

Through ERC-8004, the identity, reputation, and behavior of Agents are recorded on-chain, forming a discoverable, tamper-proof, and verifiable trust foundation across platforms, which is an important infrastructure for building an open and trustworthy AI economy in Web3. ERC-8004 is currently in the review stage, meaning the standard is basically stable and feasible, but it is still widely soliciting community feedback and has not yet been finalized.

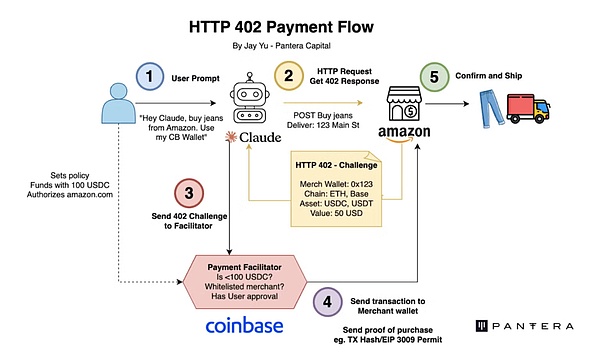

x402 – Stablecoin Native API Payment Track (Coinbase)

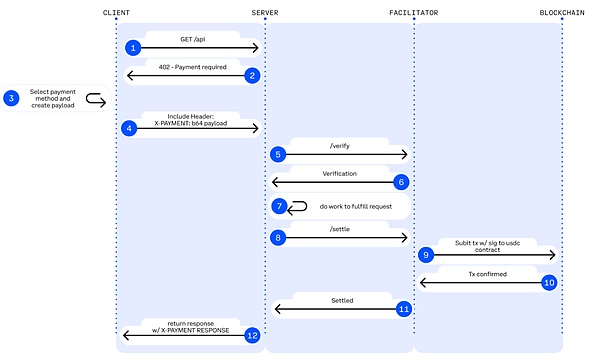

x402 is an open payment standard (Apache-2.0) proposed by Coinbase, transforming the long-idle HTTP 402 Payment Required into a programmable on-chain payment handshake mechanism, allowing APIs and AI Agents to achieve accountless, frictionless, on-demand payment settlements without the need for accounts, credit cards, or API keys.

▲ Illustration: HTTP 402 Payment Workflow

Source: Jay Yu@Pantera Capital

Core mechanism: The x402 protocol revives the HTTP 402 status code left over from the early internet. Its workflow is as follows:

Request and Negotiation: The client (Agent) initiates a request -> The server returns a 402 status code and payment parameters (such as amount, receiving address).

Autonomous Payment: The Agent locally signs the transaction and broadcasts it (usually using stablecoins like USDC), without human intervention.

Verification and Delivery: The server or a third-party "Facilitator" verifies the on-chain transaction and releases resources immediately.

x402 introduces the role of the Facilitator, acting as middleware connecting Web2 APIs and the Web3 settlement layer. The Facilitator is responsible for handling complex on-chain verification and settlement logic, allowing traditional developers to monetize APIs with minimal code, while the server does not need to run nodes, manage signatures, or broadcast transactions, relying solely on the interfaces provided by the Facilitator to complete on-chain payment processing. The most mature implementation of the Facilitator is provided by the Coinbase Developer Platform.

The technical advantages of x402 include: supporting on-chain micropayments as low as 1 cent, breaking through the limitations of traditional payment gateways that cannot handle high-frequency small calls in AI scenarios; completely removing accounts, KYC, and API keys, allowing AI to autonomously complete M2M payment loops; and achieving gasless USDC authorization payments through EIP-3009, natively compatible with Base and Solana, with multi-chain scalability.

Based on the introduction to the core protocol stack of Agentic Commerce, the following table summarizes the positioning, core capabilities, main limitations, and maturity assessment of the protocols at each level, providing a clear structured perspective for building a cross-platform, executable, and payable agent economy.

Representative Projects in the Web3 Agentic Commerce Ecosystem

The current Web3 ecosystem of Agentic Commerce can be divided into three layers:

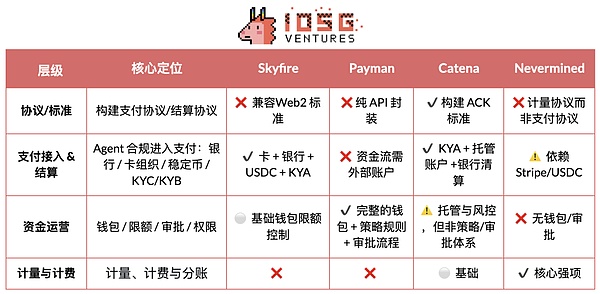

Business Payment System Layer (L3), including projects like Skyfire, Payman, Catena Labs, Nevermined, etc., providing payment encapsulation, SDK integration, quota and permission governance, human approval, and compliance access, and connecting to traditional financial tracks (banks, card organizations, PSP, KYC/KYB) to build a bridge between payment business and machine economy.

Native Payment Protocol Layer (L2), composed of protocols like x402, Virtual ACP, and their ecosystem projects, responsible for charging requests, payment verification, and on-chain settlement, which is the core that truly achieves automation and end-to-end clearing in the current agent economy. x402 does not rely on banks, card organizations, or payment service providers, providing on-chain native M2M/A2A payment capabilities.

Infrastructure Layer (L1), including Ethereum, Base, Solana, and Kite AI, providing a trusted foundation of technology stack for on-chain execution environments, key systems, MPC/AA, and permission runtime for payment and identity systems.

L3 Business Payment System Layer - Skyfire: Identity and Payment Credentials for AI Agents

Skyfire centers on KYA + Pay, abstracting "identity verification + payment authorization" into JWT credentials usable by AI, providing verifiable automated access and charging capabilities for websites, APIs, and MCP services. The system automatically generates Buyer/Seller Agents and custodial wallets for users, supporting card, bank, and USDC top-ups.

At the system level, Skyfire generates Buyer/Seller Agents and custodial wallets for each user, supporting balance top-ups via cards, banks, and USDC. Its greatest advantage is complete compatibility with Web2 (JWT/JWKS, WAF, API Gateway can be used directly), providing "identity-enabled automated payment access" for content websites, data APIs, and tool-based SaaS.

Skyfire is a practically usable intermediary layer for Agent Payment, but both identity and asset custody are centralized solutions.

L3 Business Payment System Layer - Payman: AI Native Fund Permission Risk Control

Payman provides four capabilities: Wallet, Payee, Policy, and Approval, building a governable and auditable "fund permission layer" for AI. AI can execute real payments, but all fund actions must meet the quotas, policies, and approval rules set by users. Core interactions are completed through the natural language interface payman.ask(), with the system responsible for intent parsing, policy verification, and payment execution.

The key value of Payman lies in: "AI can move money, but never overstep its authority." It shifts enterprise-level fund governance to the AI environment: automatic payroll, reimbursements, vendor payments, bulk transfers, etc., can all be completed within clearly defined permission boundaries. Payman is suitable for financial automation within enterprises and teams (salaries, reimbursements, vendor payments, etc.), positioning itself as a controlled fund governance layer, and does not attempt to build an open Agent-to-Agent payment protocol.

L3 Business Payment System Layer - Catena Labs: Agent Identity/Payment Standards

Catena builds a unified identity protocol for Agents (ACK-ID) and an Agent-native payment protocol (ACK-Pay) with AI-native financial institutions (custody, clearing, risk control, KYA) as the commercial layer and ACK (Agent Commerce Kit) as the standard layer. The goal is to fill the gaps in verifiable identity, authorization chains, and automated payment standards missing in the machine economy.

ACK-ID establishes the ownership chain and authorization chain of Agents based on DID/VC; ACK-Pay defines payment requests and verifiable receipt formats decoupled from the underlying settlement networks (USDC, banks, Arc). Catena emphasizes long-term cross-ecosystem interoperability, positioning itself closer to the "TLS/EMV layer of the Agent economy," with a strong degree of standardization and a clear vision.

L3 Business Payment System Layer - Nevermined: Metering, Billing, and Micropayment Settlement

Nevermined focuses on the usage-based economic model for AI, providing Access Control, Metering, Credits System, and Usage Logs for automated metering, pay-per-use billing, revenue sharing, and auditing. Users can recharge credits via Stripe or USDC, and the system automatically verifies usage, deducts fees, and generates auditable logs with each API call.

Its core value lies in supporting real-time micropayments below a cent and Agent-to-Agent automated settlements, allowing data purchases, API calls, workflow scheduling, etc., to operate on a "pay-per-call" basis. Nevermined does not build new payment tracks but constructs a metering/billing layer on top of payments: driving AI SaaS commercialization in the short term, supporting A2A marketplaces in the medium term, and potentially becoming the micropayment fabric of the machine economy in the long term.

Skyfire, Payman, Catena Labs, and Nevermined belong to the business payment layer, all needing to connect to banks, card organizations, PSPs, and KYC/KYB to varying degrees. However, their true value lies not in "accessing fiat currency" but in addressing machine-native needs that traditional finance cannot cover—identity mapping, permission governance, programmatic risk control, and pay-per-use billing.

Skyfire (Payment Gateway): Provides "identity + automatic deduction" for websites/APIs (on-chain identity mapping to Web2 identity).

Payman (Financial Governance): Focuses on internal enterprise policies, quotas, permissions, and approvals (AI can spend money but not overstep authority).

Catena Labs (Financial Infrastructure): Combines with the banking system to build (AI-compliant banks) through KYA, custody, and clearing services.

Nevermined (Cash Register): Only focuses on metering and billing on top of payments; payment relies on Stripe/USDC.

In contrast, x402 operates at a lower level, being the only native on-chain payment protocol that does not rely on banks, card organizations, or PSPs, allowing direct on-chain deductions and settlements through the 402 workflow. When upper-layer systems like Skyfire, Payman, and Nevermined can call x402 as a settlement track, it provides Agents with a truly automated native payment loop for M2M / A2A.

L2 Native Payment Protocol Layer - x402 Ecosystem: From Client to On-Chain Settlement

The x402 native payment ecosystem can be divided into four levels: Client, Server, Payment Execution Layer (Facilitators), and Blockchain Settlement Layer. The client is responsible for initiating payment requests from Agents or applications; the server provides data, inference, or storage API services to Agents on a per-call basis; the payment execution layer completes on-chain deductions, verification, and settlement, serving as the core execution engine of the entire process; the blockchain settlement layer handles the final token deductions and on-chain confirmations, achieving immutable payment execution.

▲ Illustration: X402 Payment Flow

Source: x402 White Paper

Client Integration Layer (Client-Side Integrations / The Payers)

Enabling Agents or applications to initiate x402 payment requests is the "starting point" of the entire payment process. Representative projects include:

thirdweb Client SDK— The most commonly used x402 client standard in the ecosystem, actively maintained and supporting multiple chains, serving as the default tool for developers to integrate x402.

Nuwa AI— Allows AI to access x402 services directly without coding, representing the "Agent payment entry."

The official website also lists early clients like Axios/Fetch, Mogami Java SDK, Tweazy, etc.

Currently, existing clients remain in the "SDK era," essentially serving as developer tools. More advanced forms of clients, such as browser/OS clients, robot/IoT clients, or enterprise systems capable of managing multiple wallets/multiple Facilitators, have yet to emerge.

Server / API Product Providers (Services / Endpoints / The Sellers)

Selling data, storage, or inference services to Agents on a per-call basis, some representative projects include:

AIsa— Provides API calls and settlement infrastructure for paid resources for real-running AI Agents, allowing access to data, content, computing power, and third-party services on a per-call, per-token, or per-usage basis; currently the top x402 caller.

Firecrawl— The most commonly consumed web parsing and structured crawling entry for AI Agents.

Pinata— A mainstream Web3 storage infrastructure, x402 can cover real underlying storage costs, not lightweight APIs.

Gloria AI— Provides high-frequency real-time news and structured market signals, serving as an intelligence source for trading and analytical Agents.

AEON— Extends x402 + USDC to offline merchant acquisition in Southeast Asia / Latin America / Africa.

Neynar— Farcaster social graph infrastructure, opening social data to Agents via x402.

Current servers focus on crawling/storage/news APIs, while more advanced key layers such as financial transaction execution APIs, advertising APIs, Web2 SaaS gateways, and even APIs capable of executing real-world tasks remain largely undeveloped, representing the most potential growth curve for the future.

Payment Execution Layer (Facilitators / The Processors)

Completing on-chain deductions, verification, and settlement, this is the core execution engine of x402, with representative projects including:

Coinbase Facilitator (CDP)— An enterprise-level trusted executor, with zero fees on the Base mainnet + built-in OFAC/KYT, making it the strongest choice for production environments.

PayAI Facilitator— The fastest-growing execution layer project with the broadest multi-chain coverage (Solana, Polygon, Base, Avalanche, etc.), being the most used multi-chain Facilitator in the ecosystem.

Daydreams— A strong scenario project combining payment execution with LLM inference routing, currently the fastest-growing "AI inference payment executor," becoming the third major force in the x402 ecosystem.

According to x402scan data from the past 30 days, there are also a number of mid-tail Facilitators/Routers, including Dexter, Virtuals Protocol, OpenX402, CodeNut, Heurist, Thirdweb, x402.rs, Mogami, Questflow, etc., with overall transaction volume, seller count, and buyer count significantly lower than the top three.

Blockchain Settlement Layer

The final point of the x402 payment workflow, responsible for completing the actual token deductions and on-chain confirmations. Although the x402 protocol itself is Chain-Agnostic, current ecosystem data shows that settlements are mainly concentrated on two networks:

Base— Promoted by the official CDP Facilitator, USDC native, with stable fees, currently the largest settlement network in terms of transaction volume and seller count.

Solana— Supported by multi-chain Facilitators like PayAI, growing the fastest in high-frequency inference and real-time API scenarios due to high throughput and low latency.

The chain itself does not participate in payment logic, and as more Facilitators expand, the x402 settlement layer will show a stronger trend towards multi-chain.

In the x402 payment system, Facilitators are the only true executors of on-chain payments, closest to "protocol-level revenue": responsible for verifying payment authorizations, submitting and tracking on-chain transactions, and generating auditable settlement proofs, while also handling replay, timeout, multi-chain compatibility, and basic compliance checks. Unlike Client SDKs (Payers) and API servers (Sellers) that only handle HTTP requests, they are the final clearing outlet for all M2M/A2A transactions, controlling traffic entry and settlement fee rights, thus being at the core of value capture in the Agent economy and receiving the most market attention.

However, the reality is that most projects remain in the testnet or small-scale demo stage, essentially functioning as lightweight "payment executors," lacking moats in key capabilities such as identity, billing, risk control, and multi-chain steady-state processing, exhibiting obvious low barriers to entry and high homogeneity. As the ecosystem matures, Facilitators will present a winner-takes-all pattern: leading institutions with stability and compliance advantages (like Coinbase) will have a significant lead. In the long term, x402 remains an interface layer and cannot carry core value; the truly sustainable competitive advantage lies in comprehensive platforms that can build identity, billing, risk control, and compliance systems on top of settlement capabilities.

L2 Native Payment Protocol Layer - Virtual Agent Commerce Protocol

The Virtual Agent Commerce Protocol (ACP) provides a universal standard for commercial interactions for autonomous AI, enabling independent agents to request services, negotiate terms, complete transactions, and accept quality evaluations in a secure and verifiable manner through a four-stage process: Request → Negotiation → Transaction → Evaluation. ACP uses blockchain as a trusted execution layer, ensuring that the interaction process is auditable and immutable, and establishes an incentive-driven reputation system by introducing Evaluator Agents, allowing heterogeneous and independent professional Agents to form "autonomous business entities" and engage in sustainable economic activities without centralized coordination. Currently, ACP is still in its early stages, with a limited ecosystem scale, resembling an exploration of "multi-agent commercial interaction standards."

L1 Infrastructure Layer - Kite AI: Emerging/Vertical Agent Native Payment Chain

Mainstream general-purpose public chains like Ethereum, Base (EVM), and Solana provide Agents with the core execution environment, account system, state machine, security, and settlement foundation, featuring mature account models, stablecoin ecosystems, and a broad developer base.

Kite AI is a representative "Agent Native L1" infrastructure designed specifically for agents, providing a foundational execution environment for payments, identity, and permissions. Its core is based on the SPACE framework (stablecoin native, programmable constraints, agent-first authentication, compliance auditing, economically viable micropayments), and it achieves fine-grained risk isolation through a three-layer key system of Root→Agent→Session; combined with optimized state channels, it constructs an "Agent Native Payment Railway," reducing costs to $0.000001 and controlling latency to the millisecond level, making API-level high-frequency micropayments feasible. As a general execution layer, Kite is upward compatible with x402, Google A2A, and Anthropic MCP, and downward compatible with OAuth 2.1, aiming to become the unified Agent payment and identity foundation connecting Web2 and Web3.

AIsaNet integrates x402 and L402 (the 402 payment protocol standard based on the Lightning Network developed by Lightning Labs) as a micropayment and settlement layer for AI Agents, supporting high-frequency trading, cross-protocol call coordination, settlement path selection, and transaction routing, allowing Agents to complete cross-service, cross-chain automatic payments without needing to understand the underlying complexities.

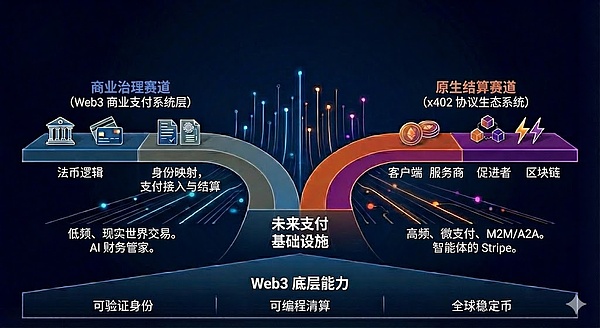

Summary and Outlook: From Payment Protocol to Reconstruction of Machine Economic Order

Agentic Commerce is the establishment of a new economic order dominated by machines. It is not as simple as "AI automatically placing orders," but rather a complete reconstruction of cross-entity links: how services are discovered, how trust is established, how orders are expressed, how permissions are granted, how value is settled, and who bears disputes. The emergence of A2A, MCP, ACP, AP2, ERC-8004, and x402 standardizes the "commercial closed loop between machines."

Along this evolutionary path, future payment infrastructure will diverge into two parallel tracks: one based on traditional fiat logic for business governance, and the other based on the x402 protocol for native settlement. The value capture logic between the two differs.

Business Governance Track: Web3 Business Payment System Layer

Applicable Scenarios: Real-world transactions with low frequency and non-micropayments (e.g., procurement, SaaS subscriptions, physical e-commerce).

Core Logic: Traditional fiat will dominate in the long term, with Agents serving as smarter front-ends and process coordinators, rather than replacing Stripe/card organizations/bank transfers. The hard barriers to the large-scale entry of stablecoins into the real business world lie in regulation and taxation.

Projects like Skyfire, Payman, and Catena Labs derive their value not from the underlying payment routing (usually handled by Stripe/Circle) but from "machine governance services" (Governance-as-a-Service). This addresses machine-native needs that traditional finance cannot cover—identity mapping, permission governance, programmatic risk control, accountability, and M2M/A2A micropayments (settled by token/second). The key is who can become a trusted "AI financial steward" for enterprises.

Native Settlement Track: The Endgame of the x402 Protocol Ecosystem and Facilitators

Applicable Scenarios: High-frequency, micropayments, M2M/A2A digital native transactions (API billing, resource flow payments).

Core Logic: x402 (L402) serves as an open standard, achieving atomic binding of payments and resources through the HTTP 402 status code. In programmable micropayments and M2M/A2A scenarios, x402 is currently the most complete and advanced protocol in the ecosystem (HTTP native + on-chain settlement), with its position in the Agent economy expected to be comparable to "Stripe for agents."

Simply integrating x402 on the Client or Service side does not bring track premiums; the real growth potential lies in accumulating long-term repurchase and high-frequency calling upper-layer assets, such as OS-level Agent clients, robot/IoT wallets, and high-value API services (market data, GPU inference, real-world task execution, etc.).

Facilitators assist Clients and Servers in completing payment handshakes, invoice generation, and fund settlement as protocol gateways, controlling both traffic and settlement fees, making them the closest link to "revenue" in the current x402 Stack. Most Facilitators are essentially "payment executors," exhibiting obvious low barriers to entry and homogeneity. Giants with usability and compliance advantages (like Coinbase) form a dominant pattern. The core value to avoid marginalization will shift to the "Facilitator + X" service layer: by building verifiable service directories and reputation systems, providing arbitration, risk control, treasury management, and other high-margin capabilities.

We believe that the future will form a "dual-track parallel" of the "fiat system" and the "stablecoin system": the former supports mainstream human commerce, while the latter carries high-frequency, cross-border, micropayment scenarios that are machine-native and on-chain native. The role of Web3 is not to replace traditional payments but to provide the underlying capabilities of verifiable identity, programmable settlement, and global stablecoins for the Agent era. Ultimately, Agentic Commerce is not limited to payment optimization but is a reconstruction of the machine economic order. When billions of micropayments are automatically completed by Agents in the background, those protocols and companies that first provide trust, coordination, and optimization capabilities will become the core force of the next generation of global commercial infrastructure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。