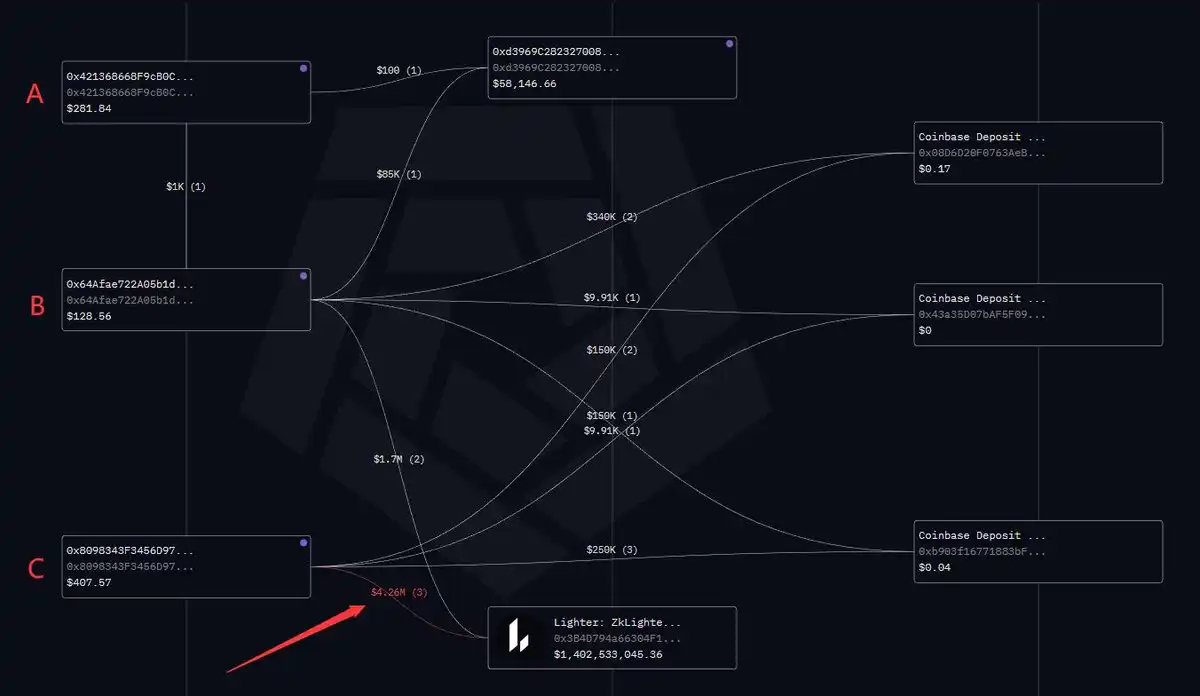

Recently, several addresses suspected to be associated with members of the Lighter team purchased $125,000 worth of "YES" shares in the Polymarket market "Will Lighter have its TGE before the end of the year." Coinbase also announced a few days ago that LIGHTER would be added to its listing roadmap. All evidence suggests that Lighter's TGE is indeed coming.

The market will ultimately punish every arrogant bystander, just as many initially viewed Hyperliquid as a performance-enhanced but more centralized GMX. Many have habitually regarded Lighter as just another imitator of Hyperliquid.

However, Lighter differs significantly from Hyperliquid in its business model, development strategy, and technical architecture. These differences indicate that Lighter will become the first real threat to Hyperliquid outside of CEX.

Retail-Friendly Fee Structure

Compared to Hyperliquid's tiered fee structure based on trading volume, Lighter adopts a zero-fee approach to attract retail traders.

According to community user @ilyessghz2's calculations, for ordinary traders with capital between $1,000 and $100,000, Lighter's total execution cost (slippage + fees) is significantly lower than that of Hyperliquid.

Hyperliquid's low fee advantage mainly applies to large accounts with over $500,000, while in the broader long-tail retail segment, Lighter actually offers more competitive trading costs. This "no fee" characteristic is particularly evident for high-frequency retail traders.

Undervalued Business Model

There is no such thing as a free lunch. Behind the zero-fee structure, Lighter essentially transplanted Robinhood's business model—Payment for Order Flow (PFOF)—onto the blockchain.

Lighter packages retail order flow and sells it to market makers, who profit from the bid-ask spread and pay rebates to Lighter. PFOF essentially cleverly transforms explicit trading costs into implicit execution costs (such as slightly wider spreads).

The fundamental reason for the PFOF model's existence is that market makers are willing to pay for retail order flow because these orders are often seen as "uninformed liquidity." Compared to institutional orders, retail trading directions often lack accurate predictions of future price movements, being more based on emotions or short-term fluctuations. Therefore, the risk for market makers in betting against them is very low, with significant profit potential.

As trading volume increases, Lighter can demand higher rebates from market makers. This model has been validated in traditional finance, with Robinhood earning hundreds of millions of dollars each quarter solely from PFOF.

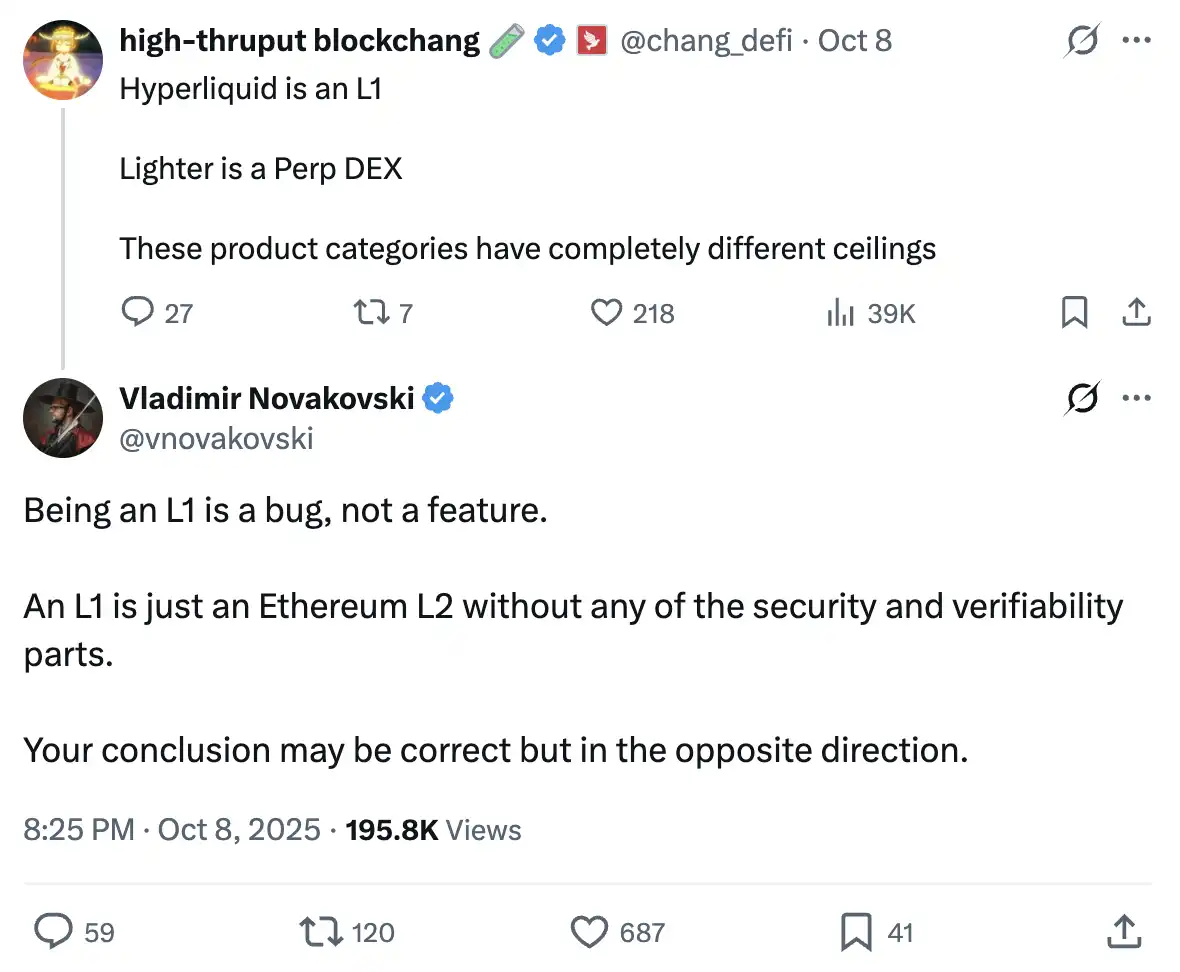

L1 is a "Bug"

Lighter's founder once stated, "L1 is a bug, not a feature," which placed him in the spotlight, but this statement indeed hints at Hyperliquid's pain points.

In the "JellyJelly attacks HLP" incident, the team protected HLP's funds by "pulling the plug." The "formalism" of validator voting cannot cover up the centralization issues of the platform itself.

Moreover, Hyperliquid's spot trading relies on HyperUnit, a multi-signature cross-chain bridge controlled by a few nodes. The dark history of multi-signature cross-chain bridges like Ronin and Multichain repeatedly proves that no matter how cleverly designed, as long as human trust is involved, there is a risk of being hacked through social engineering and facing a 51% attack.

As a standalone application chain, institutions must bear additional trust costs regarding the security of bridging nodes and the chain itself, which is nearly an insurmountable barrier on the compliance level.

Choosing to become an L2 on Ethereum allows Lighter to avoid relying on third-party trust assumptions. For risk-averse institutional funds, this is a fundamental difference. After entering Stage 1 of L2 in the future, even if Lighter's sequencer misbehaves or goes down, users can still force withdrawals through ETH mainnet contracts.

And this is just the appetizer; the crown jewel of Lighter's technical architecture is the "Universal Full-Collateral Margin" system, which is realized through zero-knowledge proofs based on the Ethereum mainnet mapping.

DeFi liquidity is fragmented. Users' deposits on Aave, LP tokens on Uniswap, and stETH staked on Lido cannot be directly used as trading collateral.

Using ZK technology, Lighter allows users to lock assets on the Ethereum mainnet (such as stETH, LP Tokens, and even future tokenized stocks) in L1 contracts while directly mapping them as collateral on L2, thus eliminating the need for a separate L1 -> L2 cross-chain bridge. This means users can hold stETH on the mainnet to earn staking rewards while using it as collateral to open contracts on Lighter, achieving real-time liquidation on the mainnet and maximizing "yield stacking" and capital efficiency.

This mapping capability brings Lighter a level of security that other L1 Perp DEXs cannot match, which is its biggest bargaining chip in attracting institutional-level funds.

The "Iron Triangle"

An "Iron Triangle" composed of "Robinhood-Lighter-Citadel" is emerging.

Lighter's founder, Vladimir Novakovski, previously worked at Citadel, the world's largest market maker, and served as an advisor to Robinhood. Robinhood is the most used stock brokerage for retail investors in the U.S., Citadel is Robinhood's largest market partner, and Robinhood is a direct investor in Lighter.

Ideally, this could become a perfect business closed loop. Robinhood is responsible for front-end customer acquisition, bringing tens of millions of retail investors into the crypto world; Lighter serves as the back-end execution engine, responsible for matching and clearing, providing a Nasdaq-level trading experience and security guarantees brought by ZK-rollup; while market makers like Citadel are responsible for digesting this order flow.

Once Citadel decides to use Lighter as its primary venue for hedging and trading tokenized stock spot, stock perpetual contracts, and RWAs, all securities relying on Citadel's liquidity will have no choice but to connect to Lighter. In this narrative, Lighter becomes the interface connecting traditional finance with the on-chain world.

Unification

Hyperliquid outsourced market deployment to external teams through the HIP-3 proposal, which brought ecological prosperity and strong buying pressure on HYPE, but inevitably led to severe liquidity fragmentation— for example, both HIP-3 exchanges Felix and Trade.xyz support trading TSLA, causing liquidity to be dispersed for the same asset.

At the same time, the compliance responsibilities of exchanges under the HIP-3 model are vague and difficult to unify, making it impossible to centrally address compliance issues.

Lighter has received investments from top-tier capital such as Peter Thiel's Founders Fund, a16z, and Coinbase Ventures, positioning itself favorably in the political capital game of compliance.

Lighter's insistence on a unified monolithic architecture also echoes Citadel's call to the SEC: "Tokenized assets must have the same rules, the same protections, and the same market structure."

Privacy

The fully transparent nature of Hyperliquid's trading is a clear disadvantage for large fund users. On-chain data publicly reveals the entry prices and liquidation points of all large positions, making it easy for large players to face the risk of being front-run or targeted for liquidation.

Lighter can hide users' trading and holding data. For large funds and institutional investors, anonymity is a basic requirement for conducting large transactions. After all, no one wants to expose their hand in front of their counterparties.

As the on-chain derivatives market matures, platforms that can effectively protect user trading privacy will have a better chance of attracting core liquidity.

The TGE Curse of Perp DEX

TGE is often a watershed moment in the fate of Perp DEXs. The key to Hyperliquid's success lies in its trading volume increasing rather than decreasing after the end of incentive programs, breaking the "mine, withdraw, sell" curse.

With a clear VC unlocking schedule, Lighter faces a more severe test. After the airdrop expectations are fulfilled, will users flow to the next Perp DEX? The loss of liquidity with TGE and the deterioration of slippage will directly harm the trading experience, triggering a "death spiral" of continuously shrinking trading volume.

Conclusion

Shifting the focus away from localized stock games, a grander narrative is unfolding.

A year ago, few could foresee that Hyperliquid could truly challenge centralized exchanges. Lighter and Hyperliquid are not mortal enemies but comrades in the same trench. They both point towards the long-standing old order.

The war of Perp DEXs against CEXs has just begun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。