Due to the government shutdown, the key economic data for the U.S. for October and November, which was scheduled for release, will be intensively rescheduled this week, becoming the last and largest source of uncertainty for the financial markets at the end of the year.

The core economic data, including non-farm employment and CPI, originally set to be released in early November, has been postponed to this week due to the previous U.S. government shutdown. This means that the typically calm mid to late December will unusually welcome a "data bomb" that could reshape market logic.

Market analysis generally views this week as a core window period that will determine asset trends in early 2026. The postponed "terrifying data" on retail sales will also be released, further increasing market volatility.

1. Unconventional Data Release Week

The core logic of global market trading this week revolves entirely around a special event: the combined release of U.S. core economic data for October and November.

● Due to the previous U.S. government shutdown, several key data releases, including non-farm employment, CPI, and retail sales, were forced to be postponed. According to the schedule, the U.S. Department of Labor will release the combined non-farm employment report for October and November on Tuesday (December 16).

● Similarly, the postponed CPI data for October and November is scheduled to be released on Thursday (December 18). This unconventional, high-density data release disrupts the market's original seasonal calm rhythm, making mid-December a decisive moment for determining asset price trends at the end of the year and even into next year.

● The importance of the data lies in the "employment-inflation" picture it paints, which is the cornerstone of the Federal Reserve's interest rate decisions.

2. Market Expectations: A Contradictory Answer Sheet

Before the data is released, the market has formed a contradictory "expected answer sheet" through surveys conducted by institutions such as The Wall Street Journal.

| Data Category | Release Time | Data Period | Market Forecast Value | |-----------------------|----------------------|-------------|-----------------------| | Non-Farm Employment| December 16 (Tuesday)| November | +50,000 | | Unemployment Rate | December 16 (Tuesday)| November | 4.50% | | CPI Year-on-Year | December 18 (Thursday)| November | 3.10% | | Core CPI Year-on-Year| December 18 (Thursday)| November | 3.00% |

● The market expectations themselves reveal the core contradictions of the current economy: on one hand, the market expects employment growth to significantly slow down (with a non-farm forecast of only +50,000 for November), suggesting that the economy may be cooling.

● On the other hand, inflation expectations remain stubbornly high (with CPI expected at 3.1% and core CPI at 3.0%), far exceeding the Federal Reserve's 2% target, indicating a stalemate in the anti-inflation process. This contradictory answer sheet is a microcosm of the Federal Reserve's decision-making dilemma and the source of market volatility.

3. The Federal Reserve's Dilemma: Seeking Balance Amid Contradictory Data

Regardless of the data combination, the Federal Reserve, which follows a "data-dependent" model, will find itself in a deeper dilemma.

● If the data combination is "weak employment + high inflation", indicating a potential "stagflation" scenario, this would be the worst-case scenario. The Federal Reserve would have to make a painful choice between supporting economic growth and curbing inflation, leading to peak policy uncertainty.

● If the data combination is "strong employment + high inflation", this would confirm the concerns of some Federal Reserve officials that the risk of economic overheating remains, and inflation is deeply entrenched. Market expectations for the Federal Reserve to maintain high interest rates "higher for longer" would be reinforced, and the possibility of restarting discussions on interest rate hikes cannot be ruled out.

● The only combination that could provide some relief to the market is "weak employment + low inflation". This scenario would clearly point to an economic cooling and controlled inflation, paving the way for the Federal Reserve to initiate a clear rate-cutting cycle in 2026. However, given the current inflation stickiness, the probability of this scenario occurring is relatively low.

4. Asset Prices Facing "Stress Tests"

This delayed data "makeup exam" will conduct a comprehensive "stress test" on major global asset classes.

● Foreign Exchange Market: The U.S. dollar index will be directly tested. Any data indicating relative resilience in the U.S. economy or stubborn inflation could strengthen the dollar. Conversely, if the data is broadly weak, the dollar will come under pressure.

● Stock Market: The U.S. stock market, especially interest rate-sensitive tech growth stocks, will face significant volatility. Stronger-than-expected data could dampen hopes for rate cuts, leading to a market pullback; weaker-than-expected data could trigger concerns about an economic recession, which would also be detrimental to the stock market.

● Bond Market: U.S. Treasury yields, particularly short-term yields, will be most sensitive to inflation data. Higher-than-expected CPI data could trigger a sell-off in Treasuries, pushing yields higher.

● Gold: Gold prices will be caught in a dilemma. High inflation data theoretically benefits gold as an inflation hedge, but it will also push up the dollar and interest rates, putting pressure on gold. The movement of gold will depend on whether the market leans more towards trading the "inflation" logic or the "interest rate" logic.

5. Cryptocurrency Market: Standing at the Crossroads of Liquidity

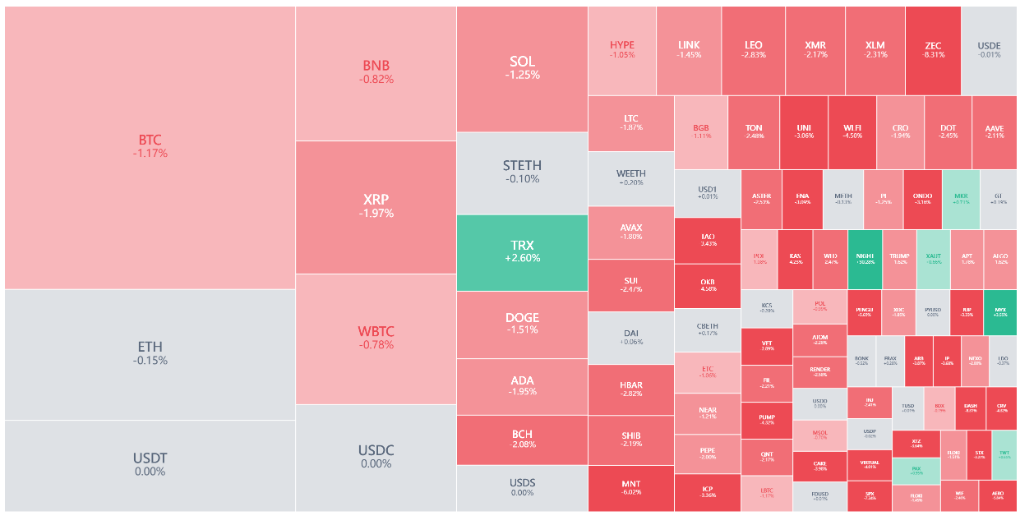

As a "high-sensitivity detector" for global liquidity and risk appetite, the cryptocurrency market is at a critical crossroads.

● Traditional macro logic still dominates the short-term trends in the cryptocurrency market: loose liquidity expectations act as a booster, while tightening expectations serve as a fire extinguisher. Therefore, this week's data, by influencing Federal Reserve policy expectations, will directly affect the prices of mainstream cryptocurrencies like Bitcoin.

Scenario One: Data Strengthens Tightening Expectations (High Probability)

If any of the non-farm or CPI data significantly exceeds expectations, market bets on rate cuts in 2026 will sharply retreat. This will lead to:

- An increase in expectations for marginal tightening of dollar liquidity.

- A suppression of market risk appetite.

In this scenario, cryptocurrencies, as leading risk assets, are likely to face sell-offs alongside traditional U.S. stocks, with volatility sharply increasing.

Scenario Two: Data Strengthens Rate Cut Expectations (Low Probability)

If the data shows a clear cooling in the labor market and a significant drop in inflation, the market will rekindle hopes for an early shift by the Federal Reserve. This would provide an ideal macro environment for the cryptocurrency market: a weaker dollar, declining real interest rate expectations, and a return of risk appetite. Bitcoin is expected to lead a rebound in risk assets.

Considering the stickiness of inflation, the likelihood of the first scenario occurring is higher. Participants in the cryptocurrency market must prepare for potential "tightening shocks" and closely monitor the immediate reactions of the dollar index (DXY) and U.S. 2-year Treasury yields, which are typically more accurate leading indicators of capital flows.

"All eyes are on the upcoming U.S. employment and inflation data." Traders are holding their breath, as this delayed data storm will directly set the tone for closing 2025 and for investments in 2026.

Whether in the foreign exchange market, stock market, or cryptocurrency world, a clearer macro trading picture for 2026 will emerge after this week.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。