1. Pawn Crossing the River: Pakistan's Cryptocurrency Ambitions Begin to Emerge

On December 12, 2025, the Pakistan Virtual Assets Regulatory Authority (PVARA) issued "No Objection Certificates" (NOCs) to two of the world's top cryptocurrency exchanges. This low-key administrative action is akin to a pawn crossing the river in chess; while it may not be earth-shattering, it is a crucial step toward a larger goal. This move not only marks Pakistan's formal embrace of blockchain and cryptocurrency technology but also conveys its ambition to the global digital economy market: to secure a place in the global digitalization game.

The strength of this "pawn" is far greater than it appears. According to data from the country's Ministry of Finance, Pakistan already has over 40 million digital asset users, with an estimated annual trading volume exceeding $300 billion. Such a massive market size gives Pakistan significant potential in the digital asset field. This data makes every move Pakistan makes particularly weighty.

This country, affectionately referred to as "Bati" by Chinese netizens for a long time, is attempting to tell a story of economic revival on the global economic chessboard using the language of blockchain and cryptocurrency. Its "pawn crossing the river" move may just be the exciting prologue to this story.

2. From Grassroots Craze to National Strategy: Pakistan's Crypto Story

Pakistan's cryptocurrency story can be said to have started from the "streets." The cryptocurrency craze in this country is not a result of government promotion but rather a spontaneous action by ordinary people. According to the 2025 Global Crypto Adoption Index by blockchain data analysis firm Chainalysis, Pakistan has firmly secured the third position globally, following India and Vietnam—jumping six places from ninth in 2024 to become the undisputed "dark horse."

_2025 Global Crypto Adoption Index. Source: _Chainalysis

Geopolitics and Economy: Pakistan's Crypto Advantages

The country covers an area of 880,000 square kilometers and has a population of 240 million, making it the fifth most populous country in the world. It borders Iran to the west, Afghanistan to the north, and has a long-standing standoff with India to the east, while the Arabian Sea lies to the south, giving it a highly sensitive strategic position. More importantly, it is located at the center of the "crypto-friendly neighbor circle":

- To the west is Iran, a "spiritual ally" of El Salvador that has adopted Bitcoin as legal tender (though Iran has not officially recognized Bitcoin, it legalized mining back in 2019 to circumvent sanctions);

- To the north is Afghanistan (where the Taliban has tacitly allowed Bitcoin trading for cross-border settlements);

- To the east is India, the world's largest country with a massive grassroots user base.

- This geopolitical environment makes Pakistan a natural intersection for three crypto corridors: Central Asia, South Asia, and the Persian Gulf.

Thus, Pakistan is almost inherently positioned as a node for the flow of on-chain funds throughout the region.

Why is this important? Because Pakistan receives over $30 billion in remittances from overseas Pakistani workers each year (the fifth highest globally), with traditional channel fees reaching 7-12%, while using USDT or Bitcoin costs less than 1%, reducing the time from days to minutes. Now, let's look at the economic structure:

- The traditional pillars are textiles and clothing (60% of exports), agriculture (rice, cotton), and remittances from overseas workers.

- However, these industries are highly susceptible to the impact of the rupee's depreciation—between 2022 and 2025, the Pakistani rupee depreciated by over 110% against the dollar.

- The banking account penetration rate is only 27% (even lower for women), but smartphone penetration has exceeded 70%, with young people (under 30 years old making up 70%) becoming natural "on-chain natives."

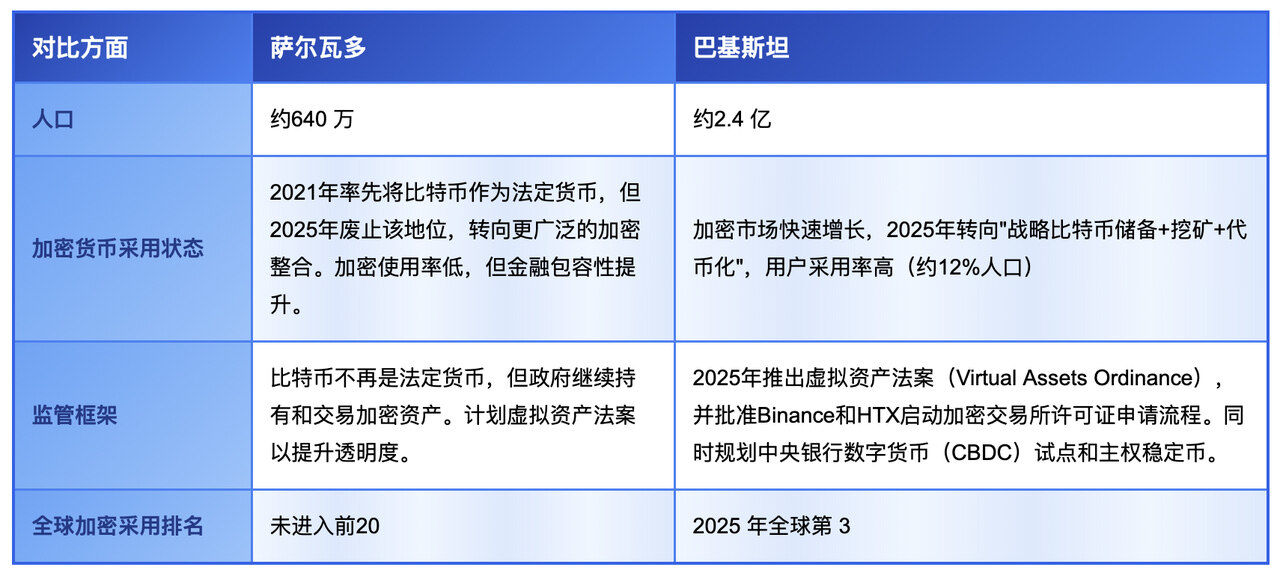

Pakistan vs. El Salvador: A Multidimensional Comparison

El Salvador conducted a "national experiment" with a population of over 6 million, while Pakistan, if successful, will directly impact 240 million people—the scale is not even comparable. PVARA Chairman Saqib's widely quoted remark at the 2025 Bitcoin MENA Conference was made in this context:

"What I mean is simple," he said. "If El Salvador can do it with a population of only 6 million, just imagine what achievements Pakistan, with 40 times the population and one of Asia's fastest-growing digital forces, could accomplish?"

However, behind the craze, there are also concerns. Due to a long-standing lack of regulation, illegal trading, money laundering, and fraud have occurred frequently. As the market continues to grow, the government can no longer sit idly by.

- In February 2025, Pakistan officially established the world's first virtual assets regulatory authority (PVARA) that employs AI-assisted regulation, while also launching the "2025 Virtual Assets Bill."

- In May 2025, Saqib announced that the country was preparing to establish a strategic reserve of Bitcoin (BTC) and was moving toward more crypto-friendly regulatory policies.

From this moment on, the "grassroots carnival" on the streets began to be incorporated into the national strategic vision—the goal is no longer to eliminate it but to transform this globally third-largest grassroots on-chain economy into a transparent, controllable, taxable, and super engine that can generate foreign exchange for the country.

Tokenization of National Assets: An Economic Revival Experiment of Putting Everything on the Chain

If Bitcoin is the "new engine" of Pakistan's economy, then blockchain technology is its "new runway." Pakistan is attempting a $2 billion economic experiment—asset tokenization.

The issuance of these "No Objection Certificates" (NOCs) is not merely a market access permit but a deep collaboration between Pakistan and the global blockchain industry. The MOU signed between the government and the approved exchanges highlights an asset tokenization plan: digitizing national assets such as sovereign bonds, treasury bonds, oil, and gas through blockchain technology. This $2 billion project aims to transform traditional financial assets into digital assets that can be traded on the blockchain.

In simple terms, asset tokenization involves converting Pakistan's traditional national assets, such as bonds, treasury bills, and commodity reserves, into digital assets that can be traded on the blockchain using blockchain technology. Through asset tokenization, Pakistan can not only enhance asset transparency but also attract international capital. This innovative model is expected to become a significant boost for Pakistan's economic recovery, especially for a country with limited foreign exchange reserves, as this attempt may be key to overcoming its economic difficulties.

* On the 12th of this month, Pakistani authorities signed an MOU with Binance to explore the tokenization of $2 billion in state-owned assets.

Pakistan's goal is clear: to combine its traditional resource advantages with blockchain technology and explore a path of economic revitalization that belongs to itself. While this is a bold experiment, its potential should not be underestimated. If successful, it could become a crucial driver for the country's economic recovery and even provide a reference experience for other developing countries.

3. Exploring Incremental Markets: Hot Opportunities and Cold Reflections

_PVARA Chairman Bilal bin Saqib, Binance co-founder Changpeng Zhao, Finance Minister Muhammad Aurangzeb, and HTX advisor Sun Yuchen (from left to right). Source: _ PVARA

As the regulatory infrastructure gradually improves, Pakistan is attempting to transform the grassroots-driven cryptocurrency craze into a new driving force for national economic transformation. Recently, Pakistani authorities have begun to regulate major global cryptocurrency exchanges and have issued preliminary licenses to several leading platforms, allowing them to establish branches in the country.

The platforms that have received regulatory approval are all significant players in the global cryptocurrency industry, holding advantages in market scale and technological capabilities. In recent years, these exchanges have actively advanced their compliance processes and have obtained operational licenses in multiple countries. Entering the Pakistani market is a key step in their expansion strategy in emerging markets.

Because the reality is that the global Web3 market urgently needs new incremental users.

Currently, the cryptocurrency penetration rate in developed markets in Europe and America is relatively high, and the users who should have entered the market have basically done so; the remaining users are either hesitant about cryptocurrency or staunch opponents. This means that in these mature markets, exchanges can only compete fiercely for existing users, with customer acquisition costs rising and growth potential becoming increasingly limited.

More critically, the vast user base accumulated during the Web2 era is waiting to be "converted." There are still billions of people globally who are accustomed to traditional internet services but are unfamiliar with blockchain and cryptocurrency. Pakistan is a typical case—boasting a population of over 240 million, with increasing acceptance of digital payments, the penetration rate of cryptocurrency still has significant room for growth.

Despite the enormous "Web2 to Web3 migration potential" in the Pakistani market, not all exchanges currently view this market positively. However, for those exchanges seeking long-term growth and new market expansion, such emerging markets are a crucial component of their global strategy. Rather than competing for existing users in already saturated developed markets, it is better to enter these emerging markets with significant conversion potential early on. Here, a Pakistani user who has never been exposed to cryptocurrency may, in the long run, be worth far more than an old user in Europe or America who frequently jumps between multiple platforms.

Conclusion: The Game Begins, Moves Made with Caution

On the grand chessboard of the global digital economy, Pakistan cautiously announces its entry with the posture of a "pawn crossing the river." This move, from issuing preliminary No Objection Certificates (NOCs) to exploring potential asset tokenization collaborations, from planning a Bitcoin strategic reserve to the gradual iteration of regulatory frameworks, has only activated the tip of the iceberg of local grassroots power but has opened up initial imaginative space for the Web3 incremental market.

For other emerging countries facing high remittance costs, currency depreciation, and a youth dividend, Pakistan provides a cautious and realistic example: blockchain is not an unattainable patent of wealthy countries, but a potential path to revival that needs to be gradually explored in a balance of compliance and risk, controllable, taxable, and capable of generating foreign exchange. The game between regulation and innovation has just begun, and Pakistan's blockchain experiment will become a sample worth continuous observation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。