Thursday, Dec. 11, brought a shift in the week’s rhythm. After two sessions dominated by inflows, the crypto exchange-traded fund (ETF) market turned more cautious, with capital stepping out of both bitcoin and ether funds even as solana and XRP continued to attract fresh interest. The day didn’t lack activity; only conviction seemed to split sharply across asset classes.

Bitcoin ETFs posted $77.34 million in outflows, driven largely by heavy departures at Fidelity’s FBTC, which shed $103.55 million alone. Vaneck’s HODL followed with a $19.38 million exit, while Ark & 21Shares’ ARKB saw $16.38 million leave the fund.

Grayscale products added to the pressure, with $12.21 million exiting GBTC and another $10.97 million leaving its Bitcoin Mini Trust. Not everything was red: Blackrock’s IBIT absorbed $76.71 million, and Bitwise’s BITB picked up $8.44 million. Even so, the inflows weren’t strong enough to counterbalance the day’s selling. Trading activity totaled $3.80 billion, and net assets totaled $119.93 billion.

First day of outflows for ether ETFs this week after three days of inflows

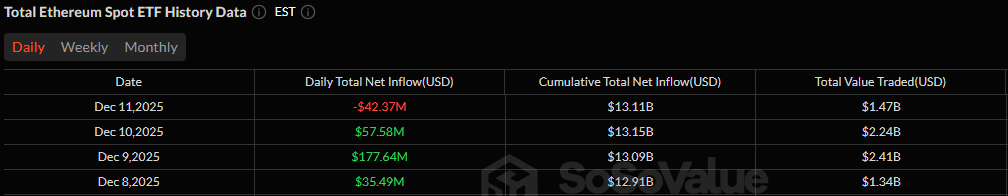

Ether ETFs also slipped into negative territory with $42.37 million in outflows. Grayscale once again led the retreat: ETHE saw $31.22 million depart, while its Ether Mini Trust recorded a further $10.03 million outflow. Fidelity’s FETH contributed another $3.21 million exit. The lone bright spot came from 21Shares’ TETH, which brought in $2.08 million, but it wasn’t enough to offset the broader pullback. Total value traded reached $1.47 billion, with net assets stable at $20.31 billion.

Solana ETFs, however, continued their strong weekly trend, bringing in $11.02 million. Bitwise’s BSOL led with $4.44 million, while Fidelity’s FSOL added $3.56 million. Grayscale’s GSOL contributed another $2.59 million, and Vaneck’s VSOL added $437.5K. Activity remained healthy at $32.42 million traded, with net assets unchanged at $928.73 million.

Read more: Bitcoin Sinks Again—Is It Because Fed Members Want Fewer Cuts in 2026?

XRP ETFs closed out another positive session with $16.42 million in inflows. Franklin’s XRPZ led with $9.87 million, followed by $4.98 million into Bitwise’s fund and $1.57 million into Grayscale’s GXRP. Trading volumes reached $25.26 million, keeping net assets steady at $929.82 million.

Across the board, Thursday’s flows reflected a divided market, as capital rotated out of bitcoin and ether while solana and XRP continued rising steadily. It was a day defined less by momentum and more by selective conviction, as investors shifted their weight across the crypto ETF market.

FAQ📊

- Why did bitcoin ETFs see outflows?

BTC funds saw $77M in exits mainly due to large redemptions from major issuers like Fidelity. - What caused ether ETFs to slip?

ETH products faced $42M in outflows driven by continued selling from Grayscale funds. - Which ETFs performed well today?

Solana and XRP ETFs posted steady inflows, showing stronger investor conviction. - What does this mixed flow pattern indicate?

It signals a split market where traders rotate capital between assets instead of buying broadly.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。