撰文:区块链骑士

近期,曾被寄予 Web3 社交厚望的 Farcaster 创始人 Dan Romero,在公开信中明确表示,历经 4.5 年探索后,「社交优先」路线已被证实行不通,未来将全面聚焦钱包产品开发,因为「每一个新增且留存的钱包用户,都是协议的新用户」。

这个累计融资 1.8 亿美元,估值近 10 亿美元的明星项目,用近乎 "认错" 的姿态,为 Web3 行业的入口之争提供了重要注解。

这一转变折射出 Web3 与 Web2 的核心差异,在互联网时代,社交无疑是流量聚合的超级入口。

Facebook 凭借社交关系链连接了全球 29 亿用户,微信以社交为基石衍生出支付、办公等全场景服务,社交属性成为互联网产品的「流量基石」。

但 Web3 的核心是价值交互而非信息传递,用户进入生态的首要需求是管理数字资产和完成链上活动。

这使得承载私钥管理、资产交互功能的钱包,天然成为 Web3 的入口级产品,而如今 Farcaster 的转型,本质上是对这一逻辑的认同,但这真的就是 Web3 入口的终局吗?

钱包为何越来越重要?

钱包的核心价值源于其作为链上交互入口的不可替代性。

与互联网产品的账号密码体系不同,Web3 世界中,钱包地址是用户的唯一身份标识,私钥则是资产所有权的凭证。

无论是配置加密资产,参与 DeFi,还是使用链上应用,所有操作都必须通过钱包发起签名验证,这使得钱包成为用户进入 Web3 生态的「第一道门」。

尤其是近两年链上用户的爆发式增长,进一步放大了钱包的战略价值。

随着以太坊 L2 技术的成熟和 Solana 生态的复苏,以及传统金融机构的入场,链上活跃用户规模持续扩大。

Dune 数据显示,2025 年第三季度全球活跃加密钱包地址达 8.3 亿个,其中 82% 的地址在 30 天内发起过链上交易,而连接钱包的 DApp 数量较去年增长 117%。

同时,DEX 的崛起与 CEX 的份额被蚕食,更凸显了钱包的不可替代性。

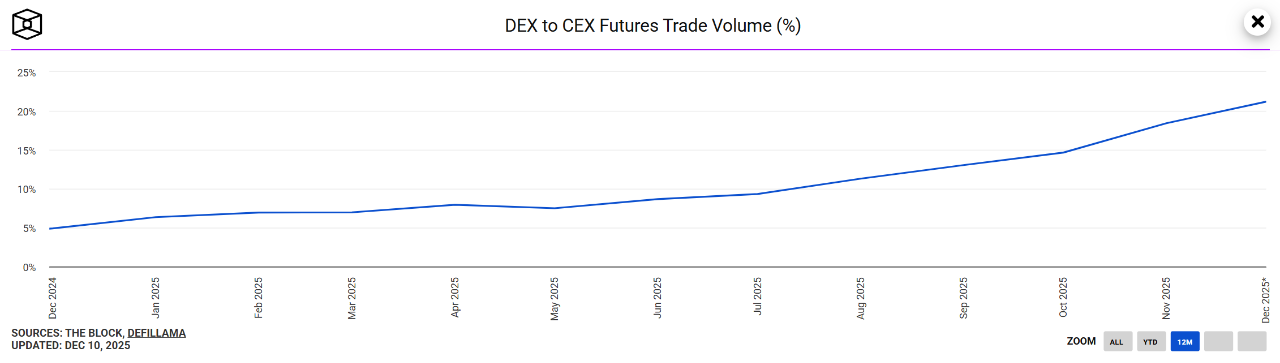

2025 年以来,DEX 市场份额从年初的 10.5% 升至三季度末的 19%,期货市场占比也从 4.9% 增至 13%。

第三季度全球 DEX 现货交易量达 1.43 万亿美元,较上一季度增长 43.6%,创历史新高。

这种转变的核心逻辑是用户对资产自主权的追求,通过钱包连接 DEX,用户无需将资产托管给交易所,实现了「我的资产我做主」,而这一趋势正推动钱包从工具向生态入口升级。

另外,传统金融机构的布局更印证了钱包的行业地位。例如纽约梅隆银行已采用 MPC(多方计算)推出托管钱包,为机构客户提供安全的资产存储服务。

贝莱德更是直言,公司目标是将当今传统金融中的所有东西复制到数字钱包中。

这些传统机构的入场,不仅为钱包赛道带来了增量用户,更推动钱包成为连接传统金融与 Web3 的核心桥梁。

巨头竞逐:钱包赛道的布局与博弈

面对钱包赛道的战略价值以及 CEX 面临的挑战,加密行业的巨头们已展开全面布局,其中 Coinbase、Binance 与 OKX 的发展路径构成了行业新的图景。

Coinbase 作为美国合规标杆,其钱包产品深度对接自身交易所生态,用户可无缝实现「法币购买 - 链上交互 - 资产转回」的闭环操作。

随着今年对 Base 链的改革,Coinbase 钱包已成为该链上最主要的交互入口,通过手续费补贴等方式吸引开发者与用户,形成了一个集金融、消息传递、内容创作及去中心化应用于一体的全方位平台。

而 Binance 则凭借规模优势打造 「全场景钱包生态」,其钱包产品已整合公链交互、质押、Launchpad 等全链路服务。

受 OKX 开放生态启发,Binance 于 2025 年 8 月推出 CEX-DEX 无缝交易功能,用户可直接通过钱包调用相关 DEX 的流动性,无需进行资产跨平台转移。

在三大巨头的钱包布局中,OKX 的超前战略最具引领性。早在 2023 年,OKX 便跳出单一公链局限,确立 「多链优先」 的发展战略。

其钱包已稳定支持 130 条公链的资产存储与交互,是行业内支持公链数量最多的钱包产品之一。

同时,随着 OKX 钱包核心代码完整托管于 GitHub,开源透明赢得了全球开发者信任,通过开放标准化 API 接口。

目前已接入上千个去中心化应用,形成覆盖几乎全部链上活动的生态矩阵,开源也成为了行业新的趋势。

OKX 也是率先支持交易所直联钱包的机构,听说当年搭建了一个数百人的技术团队、每月开销数百万才打造出了这个颇受用户喜爱的钱包。

也用一骑绝尘的姿态闯入了原本拥挤的钱包赛道,并成为 Web3 头部产品,不得不说这样的前瞻性和敢于砸钱的魄力实属罕见。

正是得益于 OKX 的提前布局,Coinbase 和 Binance 也陆续看到了其中的机会,纷纷选择战略跟进,这也是今年各大交易所的重头戏。

目前几乎都形成了自家钱包生态,以满足日益增长的链上经济活动需求,这也助推了钱包在生态地位的扩大。

Web3 入口大局已定?答案未必

尽管钱包目前已确立 Web3 入口的核心地位,但断言 「大局已定」 为时尚早,当前 Web3 入口格局依然存在些许变数。

回顾行业发展,入口重心已完成两次关键迁移:早期用户需求集中于交易所,CEX 凭借出入金优势成为绝对入口,一度垄断行业流量。

而随着以太坊智能合约兴起,DeFi 与 NFT 生态爆发,用户对资产自主权的需求推动入口重心向钱包转移,钱包逐渐承担起 DApp 交互、资产管理等核心功能。

如今,这一格局仍在动态演变中。

未来,随着技术迭代,入口格局还可能进一步演化。AI 与钱包的结合已现雏形,一些产品通过 AI Agent 可实现自然语言交互、智能风险预警,让钱包更贴近普通用户需求。

同时,账户抽象的普及则可能降低钱包使用门槛,推动入口进一步下沉。

正如移动互联网初期的浏览器入口最终被社交、电商分流,Web3 行业仍处于早期阶段,技术迭代与需求进化仍可能催生新的入口形态。

但可以确定的是,在金融上链成为明确趋势的背景下,钱包的核心价值将持续强化。

正如 OKX CEO Star 在最近出席阿布扎比金融周时表示,互联网世代正在创造全新的链上经济,在未来几十年里,全球约 50% 的经济活动将运行在区块链之上。

相对应的,传统金融机构的加密资产托管规模在年内增长了 120%。

这些数据背后,是链上经济活动的持续繁荣,而钱包作为资产管理与交互的核心工具,将直接受益于这一趋势。

当然,回看 Farcaster 的转型并非终点,而是 Web3 行业回归价值本质的起点。

互联网的入口是连接人与人,而 Web3 的入口是连接人与价值(未来还可能是连接机器与机器),这一核心差异决定了钱包的不可替代性。

对于行业参与者而言,无论是继续深耕钱包技术创新,还是探索钱包与其他场景的融合,都需以用户资产安全与体验优化为核心。

Web3 的入口之争或许尚未落幕,但钱包已凭借其独特价值,成为当前阶段最确定的赛道赢家。

那么,下一个赛道赢家又会是谁?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。