Today's homework is not too bad. After the interest rate meeting ended in the early morning, the market fell into a temporary situation of positive sentiment settling down. Not to mention that Powell's speech and the dot plot were not as dovish as investors had imagined. Overall, the risk market has seen some emotional pullback, especially since we are about to face a large amount of data and the uncertainty of Japan's interest rate hike. This should be a standard "Sell the news" phase.

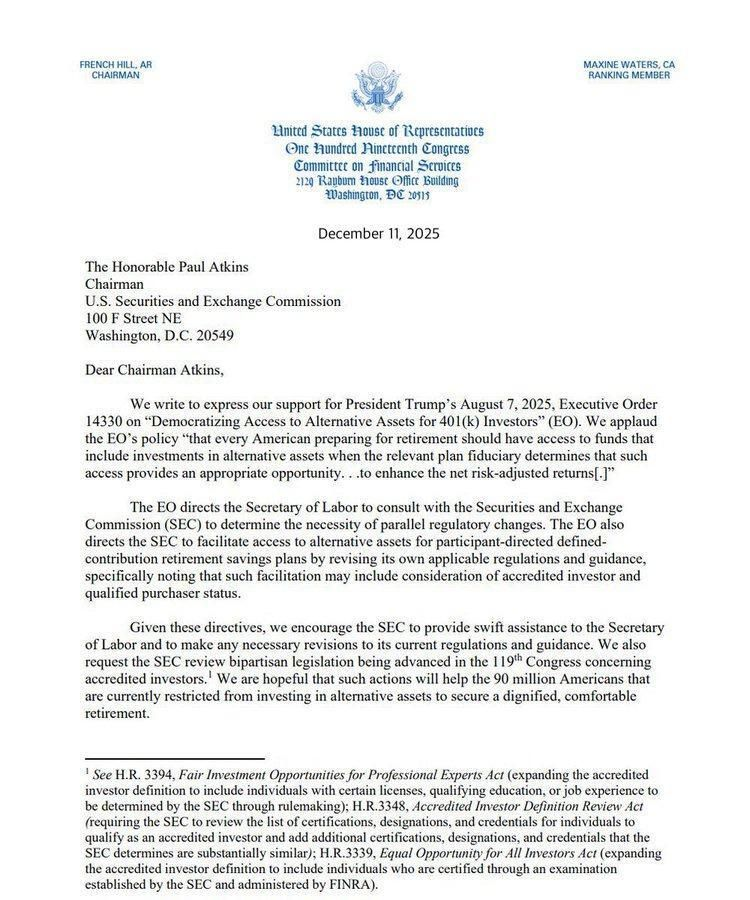

However, the Fed's RMP will inject some liquidity into the market, and there is also some good news stimulating the market today. A formal letter jointly sent by the bipartisan leadership of the U.S. House Financial Services Committee to SEC Chairman Paul Atkins urges him to expedite the process of allowing ordinary American retirement investors to purchase alternative assets (including cryptocurrencies) in their 401(k) plans.

In simpler terms, both parties agree on formally incorporating crypto assets into the U.S. retirement system. Once the SEC and the Department of Labor amend the rules as requested in the letter, $BTC and $ETH spot ETFs will naturally become compliant assets for 401(k) plans, creating a "slow but never-ending" accumulation force from long-term, stable, and continuous retirement fund buying.

Looking back at Bitcoin's data, although the turnover has decreased, it remains at a relatively high level. In the last 24 hours, short-term investors have been speculating on the Fed's stance. Therefore, when the speech ended without more dovish content, the market believed that the short-term positive sentiment had already settled, and the remaining concern was the negative impact of Japan's interest rate hike. This is why we can see that investors who have been bottom-fishing below $90,000 in the past two days are the main force behind the turnover.

From the perspective of chip structure, the current stability is still very good. Even though the price has experienced several declines and fluctuations, investors who are stuck at high levels and those who invested earlier are still in a wait-and-see attitude.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。