Our 2026 Markets Year Ahead Report is out now!

The liquidity regime that defined crypto's struggle over the past two years is reversing.

After removing $2.4 trillion from the system since mid 2022, the Federal Reserve has halted QT since December 1st. This marks the first major inflection in U.S. liquidity conditions since the tightening cycle began.

QT drained bank reserves from their peak toward the lower end of the Fed's comfort zone.

The Treasury General Account spiked to nearly $1 trillion as the government front-loaded T-bill issuance, acting as a liquidity vacuum throughout 2025. Meanwhile, the Reverse Repo Facility collapsed from over $2 trillion to practically zero, eliminating the shock absorber that cushioned prior Treasury refills.

With the RRP depleted and QT ending, any future Treasury issuance must come from bank reserves unless the Fed expands its balance sheet. Given how acutely the Fed remembers the 2019 repo spike, modest balance sheet expansion is the more likely path.

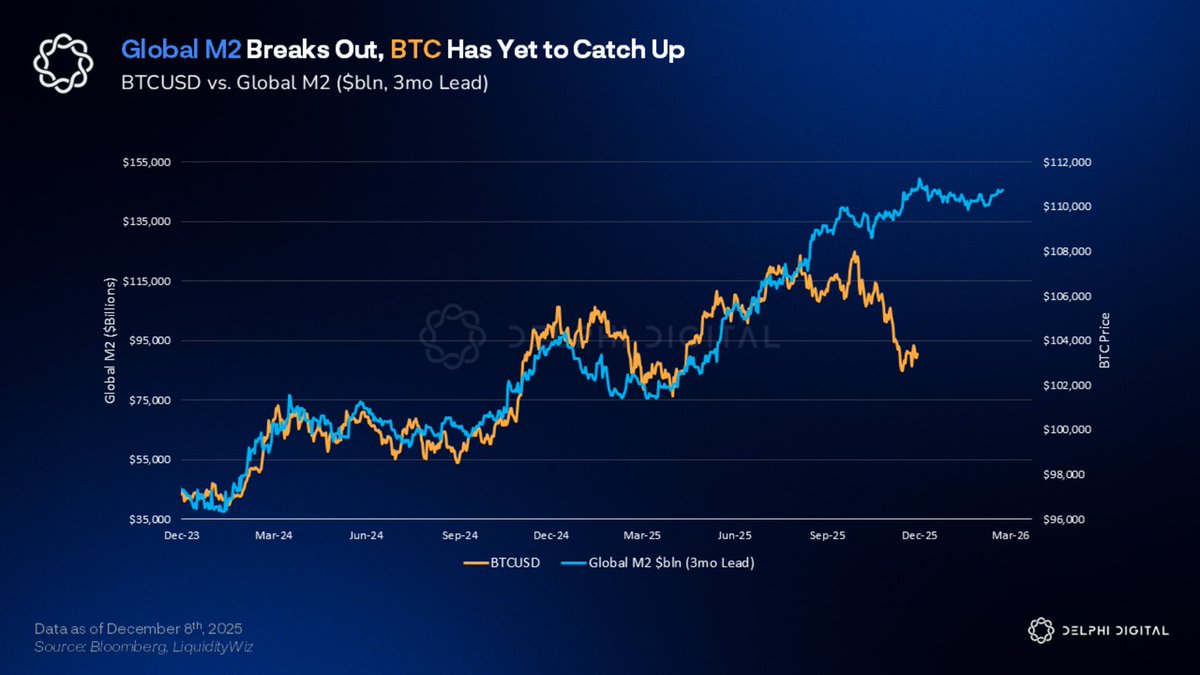

Combined with the TGA drawing down and rate cuts accelerating through 2026, the backdrop shifts from persistent tightening to normalization. This isn't the rapid liquidity expansion of 2020, but it's the first net positive flow environment crypto has seen since early 2022. Global M2 is already breaking to new highs. Could BTC follow?

Our full Markets Report breaks down the liquidity picture, gold's structural tailwinds, and what this regime shift means for crypto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。