A rate decision passed with a vote of 9 to 3 depicts the intense tug-of-war within the Federal Reserve between stubborn inflation and employment risks, with the policy balance once again tilting towards preventive rate cuts amid subtle data changes.

The Federal Reserve decided to lower the target range for the federal funds rate by 25 basis points to 3.50%-3.75%, with a result of 9 votes in favor and 3 against. This marks the third consecutive rate cut since September of this year.

Alongside the rate decision, an important balance sheet operation was announced: the Federal Reserve stated it would purchase $40 billion in Treasury bills over a 30-day period starting December 12 to maintain sufficient reserves.

1. Core of the Decision: Preventive Rate Cuts and Subtle Wording Adjustments

● The Federal Reserve made subtle but crucial changes in its description of the current economic situation in the policy statement. The statement noted that "economic activity is expanding at a moderate pace," while acknowledging that "employment growth has slowed this year, and the unemployment rate has risen as of September."

Compared to previous statements, the description of the unemployment rate as "low" was removed, reflecting the actual changes in the labor market.

● Regarding inflation, the Federal Reserve admitted that "inflation has risen since the beginning of the year and remains at elevated levels." This wording maintains previous vigilance regarding inflation pressures, echoing the core inflation rate of 2.8% in September.

● On the future policy path, the statement added new guidance, indicating that when assessing the "magnitude and timing" of further adjustments, it would carefully evaluate the latest data, changes in the economic outlook, and risk balance. This change in wording suggests that the Federal Reserve has enhanced its flexibility regarding subsequent policies.

2. Internal Game: Policy Differences Behind the 9-3 Vote

● The voting results of this meeting showed clear divisions of opinion. Nine members supported a 25 basis point rate cut, while three members voted against it.

● Among the opposition, Governor Stephen Moore advocated for a larger rate cut, favoring a one-time reduction of 50 basis points. Chicago Fed President Austan Goolsbee and Kansas City Fed President Jeffrey Schmid opposed any rate cuts, wishing to maintain rates unchanged.

● This is the first time since 2019 that three officials have cast dissenting votes in the same policy meeting. This division highlights differing assessments of economic risks within the Federal Reserve: one side is more concerned about a weakening labor market, while the other is more focused on stubborn inflation pressures.

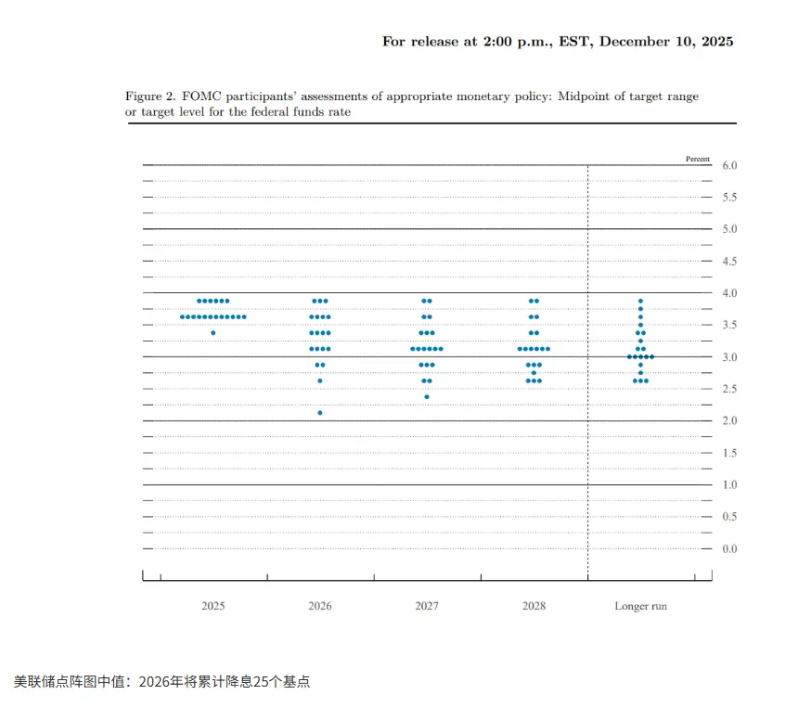

3. Dot Plot Analysis: Rate Path Forecast for 2026-2027

According to the latest released dot plot, there is a clear divergence in the Federal Reserve officials' expectations for the rate path in 2026.

● The dot plot shows that among the 19 FOMC members, 4 believe rates should remain unchanged in the 3.50%-3.75% range, 4 support a 25 basis point cut, and 4 support a 50 basis point cut. Additionally, 3 believe rates should drop below 3%, while another 3 even think rates should be raised by 25 basis points.

● Despite the differences, the median forecast indicates that officials expect a 25 basis point cut in both 2026 and 2027. This suggests that, based on current levels, rates could fall to the 3.00%-3.25% range by the end of 2027.

4. Technical Balance Sheet Expansion: Substance of the $40 Billion Bond Purchase Plan

● In addition to the rate cut decision, the Federal Reserve announced an important balance sheet operation. The committee judged that "the reserve balances have fallen to adequate levels" and decided to initiate purchases of short-term U.S. Treasury securities.

● The initial purchase scale is set at $40 billion, and it may be maintained at a high level in the coming months to alleviate pressure in the money market. Powell emphasized at the press conference that such operations are "purely to maintain sufficient reserve supply" and are unrelated to the stance of monetary policy.

● This operation marks a significant adjustment in the Federal Reserve's monetary policy implementation framework. Just two weeks ago, the Federal Reserve concluded a three-year quantitative tightening (QT) policy by allowing bonds to mature without reinvestment to reduce the balance sheet.

5. Economic Outlook: Upward Revision of Growth Expectations and Downward Adjustment of Inflation Forecasts

● In terms of economic forecasts, Federal Reserve officials have become more optimistic about growth expectations for 2026, while slightly lowering their inflation forecasts.

● According to the latest predictions, officials have raised the median GDP growth expectation for 2026 from 1.8% in September to 2.3%, reflecting increased confidence in economic resilience.

● Regarding inflation expectations, the median forecast for the personal consumption expenditures (PCE) inflation rate at the end of 2026 has been revised down from 2.6% in September to 2.4%, but it remains above the long-term target of 2%. This adjustment reflects the Federal Reserve's expectation of a gradual decline in inflation, while acknowledging that the process may be relatively slow.

6. Policy Background: Complex Data Environment and External Pressures

● This policy decision comes amid a complex economic data environment and external pressures. The unemployment rate has risen from 4.1% in June to 4.4% in September, while the inflation rate remains high at 2.8%.

● The government shutdown has further complicated the policy outlook, leading to delays in the release of some key economic data. This incompleteness of data increases the difficulty of decision-making for the Federal Reserve.

● External political pressures are also increasing. President Trump has indicated that he has decided who will succeed Powell as Federal Reserve Chair when his term ends in May 2026 and hinted that he will formally announce the candidate early next year. The White House has previously criticized the Federal Reserve for not cutting rates quickly enough, raising concerns about whether the independence of the central bank is under threat.

7. Market Impact: From Expectation Management to Actual Operations

● The Federal Reserve's policy combination—preventive rate cuts and technical balance sheet expansion—will have multiple impacts on the market. The rate cut decision itself was widely anticipated by the market, but the degree of internal disagreement exceeded some investors' expectations.

● Regarding balance sheet operations, the Federal Reserve plans to maintain a high purchase scale initially, then adjust based on seasonal demand changes. Powell estimates that after the peak tax filing season in April 2026, the monthly bond purchase amount may drop to between $20 billion and $25 billion.

● This arrangement reflects the lessons learned by the Federal Reserve from the turmoil in the repurchase market in 2019. At that time, prolonged quantitative tightening led to severe fluctuations in the short-term interest rate market, forcing the Federal Reserve to intervene urgently.

After the decision was announced, the three major U.S. stock indices experienced significant volatility. The market is digesting the uncertainty of the rate path and the dual signals of balance sheet expansion.

The deep divisions revealed by the dot plot suggest that every future action by the Federal Reserve may be accompanied by intense internal debate. As the April 2026 tax filing season approaches, the monthly bond purchase scale may decrease from $40 billion to $20-25 billion, but this "technical balance sheet expansion" has effectively injected liquidity into the market.

New York Fed President Williams has candidly stated that determining whether the market has "sufficient reserves" is "an imprecise science." At this crossroads, every step the Federal Reserve takes feels like cautious navigation in uncharted waters.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。