比特币最近的反弹并非偶然,Cryptoquant及其研究人员的新数据显示,交易所流入量急剧下降,表明卖方终于喘了一口气。

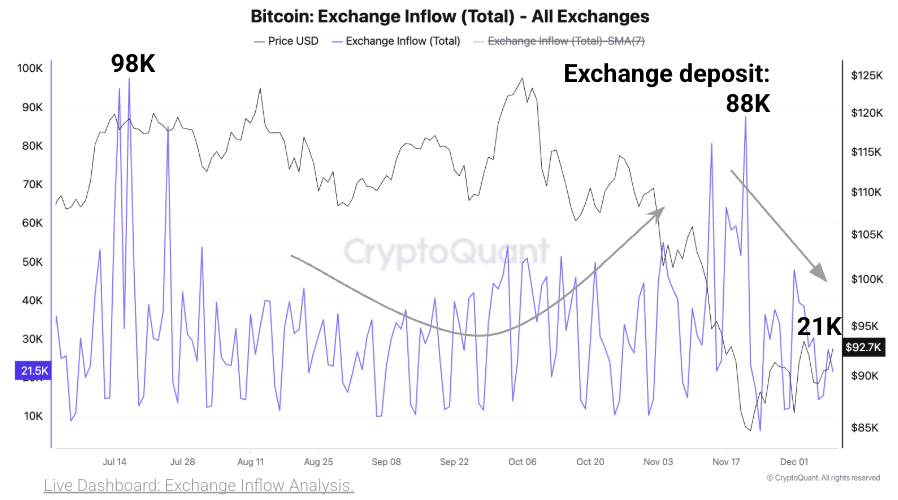

在11月21日跌至80,000美元后,比特币已回升至94,000美元,因为关键链上指标的卖压减弱。研究团队指出,比特币流入交易所的数量从11月21日的88,000下降至今天的21,000,这一变化在历史上有助于短期内稳定价格。

Cryptoquant的分析师将这种温和的变化与大户减少主动分配联系在一起。该公司的最新报告显示,鲸鱼曾占所有存款的近一半——在11月中旬为47%——但现在仅占21%。

平均存款规模也呈下降趋势,从11月22日的1.1 BTC下降至今天的0.7 BTC,下降幅度为36%。报告的作者认为,这一退缩消除了现货市场的主要摩擦来源。该公司的研究人员还强调了投降的作用。

在11月13日,比特币跌破100,000美元时,新老鲸鱼实现了6.46亿美元的损失——这是自7月以来的最大损失。根据Cryptoquant对投资者群体的建模,这些损失并没有止步于此:自11月中旬以来,鲸鱼已吸收了约32亿美元的实现净损失。

短期持有者的情况也不太好。该分析公司报告称,他们的支出产出利润比率(SOPR)已经低于1周,最低达到-7%,这表明快速市场参与者中普遍存在投降现象。Cryptoquant的研究人员表示,历史上,这种痛苦往往会耗尽卖方的力量,并减缓下行动能。

随着美联储会议的临近,该公司将当前结构描述为“波动前的平静”。如果卖压保持温和,分析师们认为有空间进行一次反弹,可能将比特币推升至99,000美元——这是Cryptoquant的交易者链上实现价格模型的下限,通常在熊市阶段充当阻力位。

阅读更多: 欧洲人利用加密货币购买杂货、咖啡和账单,WhiteBIT报告发现

在这个水平之上,市场策略师标出了两个额外的战场:102,000美元,代表一年移动平均线,以及112,000美元,交易者实现价格。这两个阈值在历史上都充当了情绪的转折点,可能决定动能是延续还是停滞。

图表强化了这些动态。交易所流入图表显示,从历史最高点后的激增到11月底的降温,呈现出明显的下行趋势,而实现价格区间则勾勒出Cryptoquant研究人员追踪的三个主要阻力区。数据支持该公司的观点,即如果卖方保持观望,反弹可能还有更大的空间。

尽管如此,Cryptoquant保持谨慎的语气。研究人员强调,尽管当前的设置看起来有利于反弹,但宏观条件、鲸鱼行为和交易所层面的流动性可能会迅速变化。就目前而言,比特币似乎较为平静——但在这个市场中,平静往往会突然结束。

- Cryptoquant认为比特币稳定的主要原因是什么?Cryptoquant将稳定归因于鲸鱼和短期持有者的交易所存款急剧下降。

- 鲸鱼在Cryptoquant的分析中为何重要?鲸鱼的存款行为是一个关键信号,因为根据Cryptoquant的说法,它直接影响短期的卖方压力。

- Cryptoquant接下来关注哪些价格水平?报告强调99,000美元、102,000美元和112,000美元作为下一个主要阻力区。

- 大户实现了多少损失?分析计算出自11月中旬以来,鲸鱼实现的损失约为32亿美元。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。