美国银行系统正站在流动性紧张的边缘,一个被市场普遍忽视的信号,可能比降息本身更能揭示美联储未来的政策走向。

12月1日,美联储正式结束了为期数年的资产负债表缩减进程。此时,美国银行系统的准备金已降至历史上与融资紧张相关的水平,隔夜融资利率也开始周期性测试政策利率走廊的上限。

市场关注的焦点几乎都集中在联邦基金利率的下调幅度上,普遍预期将降息25个基点。但此次会议的核心信号,可能藏在一个被广泛低估的领域——美联储即将披露的资产负债表新战略。

一、政策转折点

持续三年的量化紧缩政策已在12月1日画上句号。这一决定标志着自新冠疫情后激进的紧缩周期正式告一段落。

● 如果将量化宽松比作为市场“输血”,量化紧缩就是“抽血”。而停止量化紧缩意味着美联储停止了“抽血”,试图将资产负债表维持在相对稳定的水平。

● 截至上月,美联储的资产负债表规模已从2022年近9万亿美元的峰值缩减至6.6万亿美元。虽然规模较疫情前仍高出约2.5万亿美元,但持续数年的紧缩已经导致银行体系准备金显著下降。

● 这一政策转变的背后是美国经济面临的复杂局面。通胀率虽然从高位回落,但仍在2%的目标之上徘徊。与此同时,就业市场开始显现出降温迹象,最新数据显示失业率已攀升至4.3%。

二、流动性红灯

美联储为何选择在此刻停止“抽血”?多种迹象表明,美国金融体系已经亮起了流动性红灯。

● 一方面,银行准备金水平持续下降,目前已达到历史上与融资紧张相关的水平。另一方面,反映短期融资状况的担保隔夜融资利率已经开始周期性测试政策利率走廊的上限。这些发展显示,美国银行系统正逐渐进入流动性紧张的境地。

● 美国银行业甚至出现临时借入15亿美元资金以应对季度性资金需求的情况。数据显示,当时财政部需收取约780亿美元的税款与新发债务结算,导致美国财政部现金余额突破8700亿美元。

三、扩表计划浮出水面

● 在此背景下,市场关注的焦点已开始从利率调整转向资产负债表战略。预计美联储将明确或通过实施说明稿,概述如何过渡到储备管理购买计划。

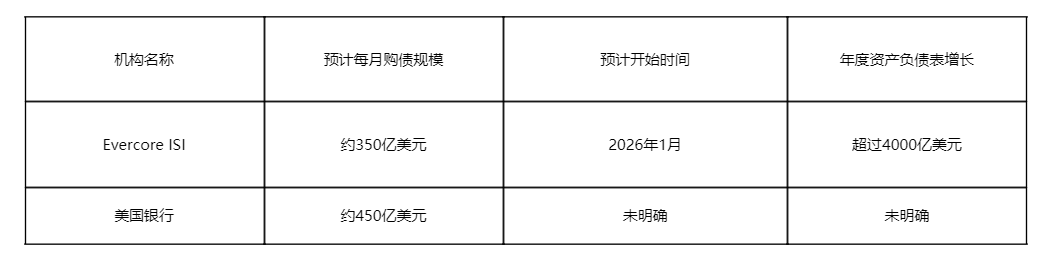

● 该计划最早可能在2026年1月开始实施,每月将投入约350亿美元购买国库券,使得资产负债表年度增长超过4000亿美元。

● 更激进的预测来自美国银行,该机构预计美联储将在本周会议结束时宣布每月约450亿美元的“储备管理购债”计划。这一规模甚至超过了华尔街的普遍预期。美联储理事沃勒近期表示,这一举措对于维持回购市场秩序及美联储货币政策的顺畅传导至关重要。

四、内部分歧与外部压力

美联储内部对于货币政策走向存在明显分歧。部分委员担忧通胀可能加剧,而另一些委员则更关注防范可能出现的经济衰退。

● 德意志银行首席经济学家卢泽蒂预测,此次会议可能成为1988年以来首次有三名理事提出反对意见的会议。更值得关注的是,这也可能是2019年9月以来首次出现“双向反对”的会议。

● 分析人士指出,外部政治压力可能促使美联储成员更加团结。鲍威尔前高级顾问邦芬认为:“外部压力会促使人们围绕机构凝聚起来。”

● 这种内部分歧反映了美联储面临的双重困境:既要应对通胀压力,又要防范经济下行风险。

五、市场已提前反应

● 尽管美联储会议尚未召开,但市场已经对潜在的政策转向做出反应。加密货币市场全面反弹,比特币一度突破94,500美元,24小时涨幅达2.48%。

● 传统金融市场同样表现活跃。美股加密概念股全线飘红,其中BitMine Immersion涨幅达到9.32%,Circle涨幅为5.93%。

● 不同机构对美联储资产负债表扩张计划的预测有所不同,下表展示了主要机构的观点:

● 市场预期分化明显,但对于美联储即将转向更为宽松的资产负债表政策已形成基本共识。这一预期部分源于美联储官员近期的表态,其中鲍威尔曾在10月14日的讲话中表示,量化紧缩“可能在未来几个月内”终止。

六、风险与机遇并存

● 美联储政策转向的长期影响仍然复杂。短期来看,停止“缩表”有利于改善美国银行系统的流动性,稳定隔夜回购利率等短期利率,支持美股和债市,并降低市场融资成本。

● 对于全球市场和新兴经济体,流动性的改善意味着资本外流压力可能减轻,资本甚至可能回流股市和债市,推动资产价格上升。

● 然而,风险同样不容忽视。有分析指出,美联储后续可能转向技术性“扩表”,即小规模、定期、可预测地购买资产,包括短期美国国债等。但在财政赤字高企、资产价格过热之际“扩表”,形同将债务货币化,可能助长资产泡沫。

对新兴经济体而言,跨境资金的“潮汐效应”可能引发局部泡沫或债务风险,加剧市场波动。

随着美联储正式结束量化紧缩,市场目光开始投向即将公布的资产负债表新战略。在全球金融格局中,每一次美债购买的增加都意味着全球流动性的重新分配。

当资产负债表年度增长可能超过4000亿美元的计划浮出水面,不只是华尔街的交易员,从法兰克福到新加坡的央行官员,都在重新计算本国货币政策的空间。

加入我们的社区,一起来讨论,一起变得更强吧!

官方电报(Telegram)社群:https://t.me/aicoincn

AiCoin中文推特:https://x.com/AiCoinzh

OKX 福利群:https://aicoin.com/link/chat?cid=l61eM4owQ

币安福利群:https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。