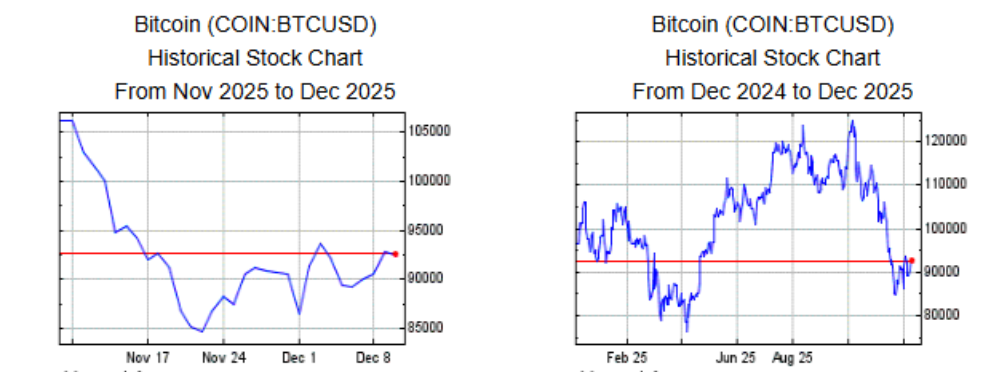

The price of Bitcoin has been fluctuating within a narrow range of $84,000 to $91,000, with market sentiment caught in a delicate balance between panic selling and short covering.

The Bitfinex Alpha report reveals a core contradiction: the market is close to a local bottom and has the conditions for stabilization, but is far from healthy. Over 7 million Bitcoins are in an unrealized loss state, reflecting the market's difficulty in reclaiming the true market mean.

The S&P 500 index is nearing historical highs, while Bitcoin struggles within a narrow range, exacerbating the structural weakness in the market.

1. Foundations for Market Stabilization Are Emerging

● From a temporal perspective, the crypto market is approaching a local bottom. While it remains to be seen whether the price has truly bottomed, signs of extreme deleveraging, panic selling by short-term holders, and exhaustion of selling pressure have emerged.

● Last week, Bitcoin saw a significant rebound, rising over 15% from recent lows to reach $93,116. However, selling pressure remains, as Bitcoin immediately dropped 4.1% after the market opened this week.

● The market has undergone large-scale deleveraging. The total open interest in Bitcoin futures has decreased from a peak of $94.12 billion to $59.17 billion, indicating that leverage has been orderly cleared.

● More importantly, as spot prices rise, open interest continues to contract, indicating that the market's rise is primarily driven by short covering rather than new speculative risk-taking.

2. Market Truth Revealed by Data

● On-chain data shows that over 7 million Bitcoins are in an unrealized loss state. This large number reflects the market's difficulty in reclaiming the true market mean and indicates that many holders are in a state of floating loss. If prices rebound near their cost lines, they may face significant selling pressure.

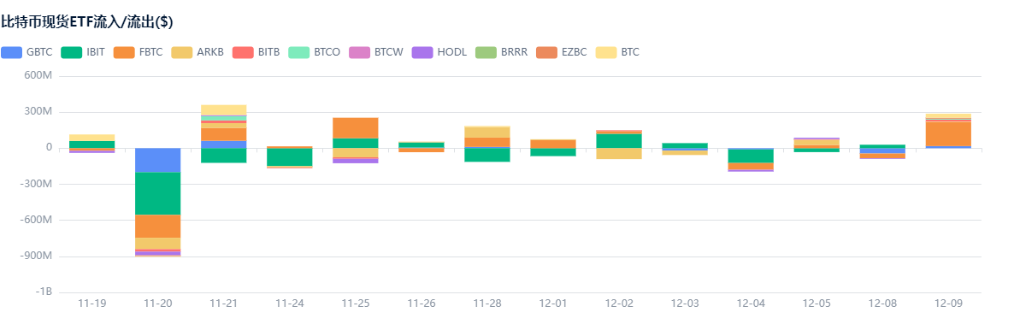

● Spot demand has significantly decreased, with continuous outflows from U.S. Bitcoin ETFs and a notable reduction in trading purchases. The cumulative trading volume changes on major exchanges have clearly turned negative, directly showing that traders are choosing to sell rather than increase their positions during the rebound. The market exhibits a typical characteristic of "sell on the rebound."

3. Institutional Behavior: Accumulation in the Shadows and Retail Selling at Highs

● The contradiction in the market lies in the fact that while retail investors and short-term traders choose to sell during the rebound, institutions are quietly accumulating assets. This phenomenon is particularly evident in the Ethereum market.

● According to reports, on the morning of December 8, Amber Group and Metalapha withdrew 9,000 ETH from Binance, worth over $28 million. These institutional transfers are typically associated with custody arrangements or long-term holdings rather than quick trades. In fact, institutions have accumulated nearly 4 million ETH over the past five months.

This institutional accumulation stands in stark contrast to retail selling. Institutions are quietly withdrawing assets from exchanges, reducing immediate supply in the market, while retail investors choose to sell during price rebounds.

This divergence may indicate that institutions hold an optimistic view of the market's long-term prospects, while retail investors are more focused on short-term fluctuations.

4. Three Root Causes of Structural Weakness in the Market

● The current structural weakness in the crypto market can be traced back to several fundamental reasons. The first is the increasing decoupling from traditional risk assets. While the S&P 500 index approaches historical highs, Bitcoin continues to struggle within a narrow range.

This decoupling phenomenon indicates that Bitcoin is forming its own independent demand logic, no longer simply following the fluctuations of traditional risk assets.

● The second reason is weak spot demand. Continuous outflows from U.S. Bitcoin ETFs and negative changes in cumulative trading volume indicate a lack of new capital inflows. Without the push of new funds, prices find it difficult to achieve effective breakthroughs.

● The third reason is psychological pressure. With over 7 million Bitcoins in an unrealized loss state, many holders are experiencing floating losses. These loss positions create significant psychological pressure, and the market needs time or major positive news to digest these floating losses before it can move forward more lightly.

5. Market Outlook: Stabilization and Risks Coexist

● The market is approaching a local bottom and has the foundations for entering a stabilization phase. If the market can establish a sustained recovery basis in the fourth quarter, it may lay a good foundation for performance in 2026.

● In terms of Ethereum, the price recently rose by 2.5%, trading close to $3,050, and has been fluctuating within a narrow range of $3,050 to $3,200. Analysts believe that if it can clearly break through the $3,300-$3,400 range, it may open the path to $3,700 to $3,800.

● Risks also exist. If the market cannot break through the current resistance, prices may fall back to $3,000, at which point buyers may re-enter. The large-scale margin long positions held by institutions also increase market volatility, and if prices drop, forced selling may amplify losses.

As of December 10, Ethereum is trading close to $3,050, while Bitcoin is around $91,549. A subtle change is occurring: the supply of Ethereum held by major exchanges has dropped to 8.7% of the total supply.

Over 28 million ETH are locked in staking, custody, and long-term storage, with an average of over 40,000 ETH being added to staking daily.

This change in supply dynamics reduces immediate selling pressure, making price fluctuations more dependent on new buy orders. The market may be quietly shifting to a new phase, and the direction of this phase will depend on the balance of power between institutional accumulation and retail selling.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。