Twenty One Capital arrived on the New York Stock Exchange (NYSE) with the kind of swagger only a bitcoin-native company can muster, but investors offered a far less celebratory welcome. Trading under the ticker XXI, shares sank about 19.97% against the greenback on Dec. 9, a reminder that public markets enjoy reality checks almost as much as they enjoy volatility.

Born through a SPAC merger with Cantor Equity Partners, Twenty One enters the arena calling itself the first bitcoin-native public company — not simply a corporate treasury holding BTC like Strategy or Japan’s Metaplanet, but an outfit stitching bitcoin into every thread of its business model. Its central thesis rests on the idea that bitcoin is not just a treasury item but the backbone of a new financial operating system. Whether Wall Street agrees is very much a work in progress, but the company’s ambition is anything but subtle.

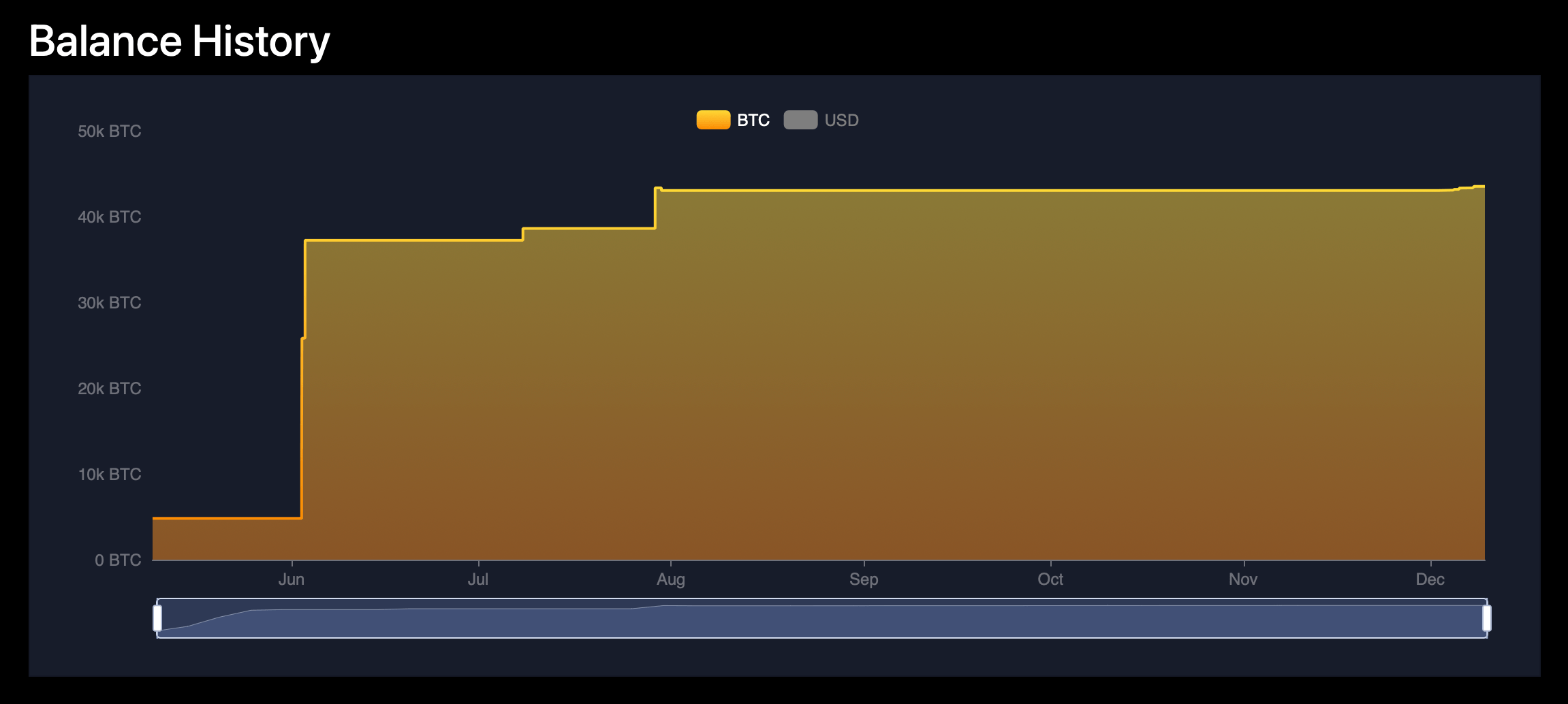

Twenty One positions its digital asset treasury (DAT) mandate as more than passive accumulation. The firm holds 43,514 BTC, placing it squarely as the third-largest corporate holder of bitcoin worldwide. Rather than lock the stash away and hope for the best, the company aims to promote a full suite of bitcoin-oriented services: capital-efficient accumulation strategies, bitcoin-native financial products, lending, capital markets advisory, and a catalog of educational media.

It also plans to introduce a “ bitcoin per share” metric aimed at giving investors direct visibility into how its treasury affects shareholder value. In an industry obsessed with transparency, the promise of routine onchain proof of reserves doesn’t hurt either. At the helm is Jack Mallers, the 30-year-old Strike founder whose résumé includes helping El Salvador turn bitcoin into national currency.

Mallers describes bitcoin as “honest money,” and his rhetoric has shaped Twenty One’s ethos — heavy on transparency, heavy on conviction, and heavy on the belief that DAT firms should operate more like high-bandwidth financial platforms than static vaults. Mallers’ background, however, doesn’t guarantee immunity from public-market scrutiny, and XXI’s first-day price action made that clear.

Image source: Twenty One Capital via X.

XXI opened the session under pressure as DATs broadly pulled back over the past couple of weeks, offering no buoyancy for newly listed firms. The stock dropped toward $10.50, brushing against its PIPE pricing and signaling that investors were more interested in testing the business model than celebrating Mallers’ NYSE cameo. Bitcoin hovered between $90,900 to above $94,000 per coin during XXI’s first trading session — a level that provided little assistance to a company whose equity value is tightly tethered to BTC’s mood.

Getting to the public stage required one final act of housekeeping: consolidating more than 43,000 BTC out of escrow and into Twenty One’s direct custody. Blockchain observers watched the transfer in real time as Whale Alert and others flagged over 43,000 BTC moving across the chain. With that move, Twenty One’s ranking among corporate bitcoin holders became clear, trailing only Strategy, Marathon Digital, and with Metaplanet behind it.

What separates Twenty One from its DAT peers is its attempt to diversify revenue streams without diluting its bitcoin-first thesis. Instead of treating BTC purely as a speculative reservoir, the firm aims to engineer lending products and capital markets tools built directly on top of its holdings. In theory, this creates a feedback loop: a strong treasury supports services, services reinforce demand, and everything lives onchain for investors to verify.

Read more: ‘Bitcoin After Dark’ ETF Lands at SEC as Nicholas Wealth Unveils Night-Only Strategy

In practice, the DAT sector has seen its share of wipeouts, with some competitors down 60–99% from their highs or market opens. Market-to-Net Asset Value ratios (mNAVs) are down across the board, and one specific DAT, Sequans, sold a fraction of bitcoin last November. Twenty One is hoping a wider product set means it won’t join them.

Twenty One’s BTC balance sheet.

The company’s large backers — including Tether, Softbank Group, Bitfinex, and Cantor Fitzgerald — showcase the institutional interest circling bitcoin-native firms. But backing alone won’t guarantee success in a field where sentiment can flip quicker than a block confirmation. As XXI’s debut showed, public markets are still figuring out how to value DAT firms, and a steep day-one drop is hardly an outlier for a sector built on high-octane expectations.

Even so, the listing marks another step in bitcoin’s long march into traditional finance (TradFi). XXI gives U.S. investors a new route for bitcoin exposure without holding the asset directly, and its onchain transparency promises a level of verification that most public companies could never replicate. But the real test will come in the quarters ahead — whether Twenty One can deliver revenue from the ecosystem it’s building, and whether the market eventually prices it as an innovator rather than a proxy for bitcoin’s mood swings.

- What is XXI? It is the New York–listed ticker for Twenty One Capital, a bitcoin-native digital asset treasury (DAT) firm.

- How much bitcoin does Twenty One hold? The company controls 43,514 BTC, placing it among the largest corporate holders globally.

- Why did XXI shares fall on listing day? The stock dropped nearly 20% amid a cautious sentiment toward DAT firms.

- What makes Twenty One different from other DAT companies? It blends a large bitcoin treasury with lending, advisory, and claims onchain transparency services aimed at building a broader financial ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。