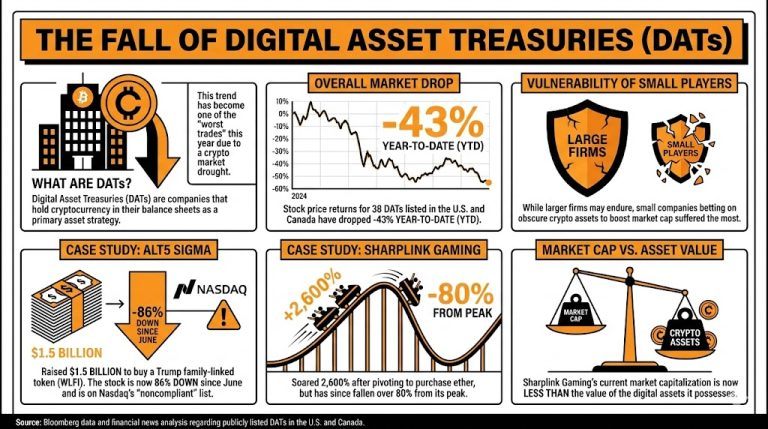

Digital Asset Treasuries (DATs), which are companies that hold cryptocurrency in their balance sheets, have become one of the worst trades this year, trending down after the recent cryptocurrency market drought.

According to numbers compiled by Bloomberg, which accounted for 138 DATs listed in the U.S. and Canada, the stock price returns for these companies dropped -43% year-to-date (YTD), figures that evidence the disastrous results of following this market trend.

Nonetheless, while companies like Strategy and Bitmine might have the backing to endure, small companies that bet on the trend using more obscure crypto assets to increase their market capitalization have suffered the most.

For example, Alt5 Sigma, which raised $1.5 billion back in August to purchase 7.5% of a Trump family-linked token, WLFI, is now 86% down since June. The company was also recently put on Nasdaq’s list of “noncompliant companies.”

Other cases are even more extreme. Sharplink Gaming, another company that entered the DAT bandwagon by purchasing ether, soared 2,600% after announcing its crypto pivot. Now, it has fallen over 80% from its peak, leaving its market cap at less than the value of the digital assets it possesses.

Analysts assess that the negative results of the DAT sector, which reached a market cap of over $100 billion in its heyday, can impact the cryptocurrency market as companies shed their crypto holdings to try to stay afloat.

Even Strategy, the crown jewel of the sector, has acknowledged that it could have to sell bitcoin. Phong Le, Strategy’s CEO, recently stated in a podcast that the company “would sell Bitcoin” for funding its dividend payments if needed.

In fact, industry insiders believe that this is already happening behind closed doors. Rob Hadick, General Partner at Dragonfly, stated that interest in these companies had dried up and that DATs have been basically providing selling pressure to crypto markets since November.

Read more: Are DATs Over? Experts Weigh in on the Trend’s Future

Analysts expect smaller DATs to be less effective in enduring the pressure of holding these volatile assets, while behemoths like Strategy and Bitmine will maintain their position and enlarge it for the foreseeable future.

What are Digital Asset Treasuries (DATs)?

DATs are companies that hold cryptocurrency on their balance sheets, but they have experienced significant declines in stock value this year.How much have DATs lost in value recently?

According to Bloomberg, DATs in the U.S. and Canada have seen stock price returns drop by -43% year-to-date.Which companies have struggled the most in this downturn?

Smaller DATs that invested in obscure cryptocurrencies, like Alt5 Sigma, have faced severe losses, with some companies down over 80% from their peaks.What implications does this decline have for the broader cryptocurrency market?

As DATs sell off crypto holdings to stay afloat, analysts warn this could create selling pressure in the market, impacting overall prices.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。