Written by: Azuma (@azuma_eth)

This past weekend, the two major lending leaders on Solana, Jupiter Lend and Kamino, had a "falling out."

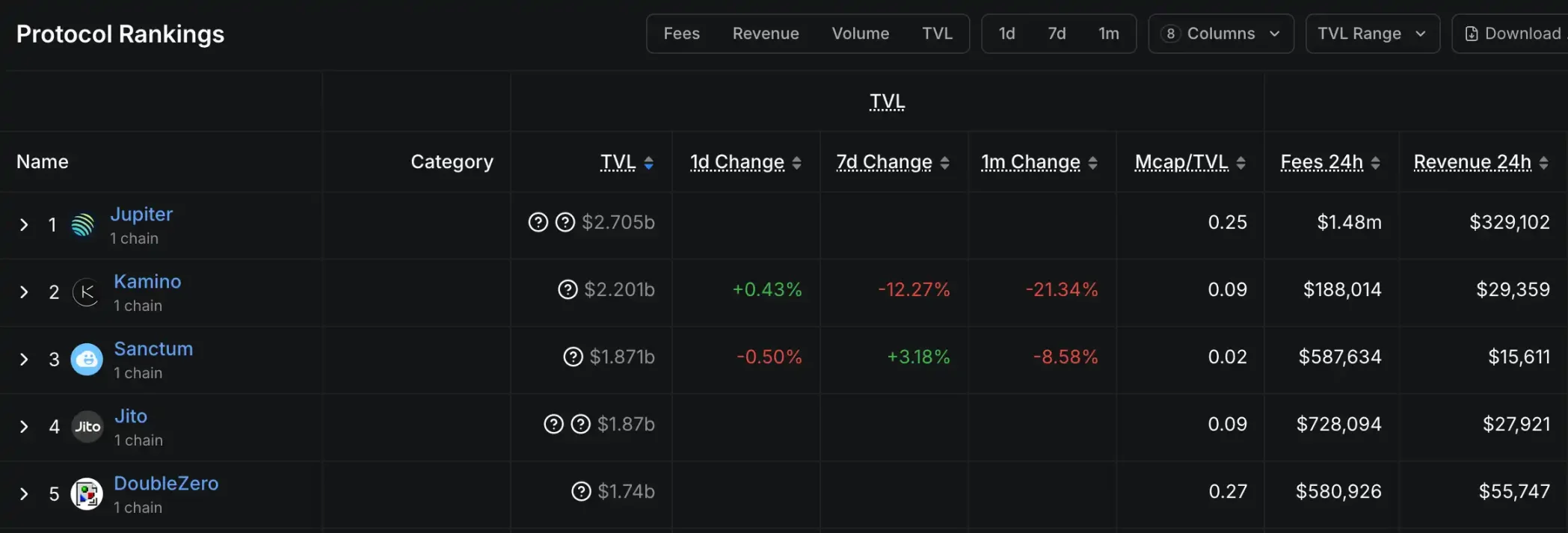

Comment from Odaily: Defillama data shows that Jupiter and Kamino are currently the two protocols with the highest TVL in the Solana ecosystem.

Cause of the Incident: The Tweet Deleted by Jupiter

The incident can be traced back to August of this year, when Jupiter's official team emphasized multiple times during the promotion of their lending product, Jupiter Lend, that it featured "risk isolation" (the related posts have been deleted), meaning that there would be no risk cross-contamination between different lending pools.

However, the design of Jupiter Lend after its launch did not align with the market's common understanding of a risk isolation model. In the general market perception, a DeFi lending pool that can be called risk-isolated is one that segments the risks of different assets or markets through design mechanisms, preventing a single asset default or a market collapse from affecting the entire lending pool structure. The main characteristics of this structure include:

· Pool Isolation: Different asset types (such as stablecoins, volatile assets, NFT collateral, etc.) are allocated to independent lending pools, each with its own liquidity, debt, and risk parameters.

· Collateral Isolation: Users can only use assets within the same pool as collateral to borrow other assets, cutting off cross-pool risk transmission.

In reality, however, Jupiter Lend's design supports re-collateralization (reusing collateral deposited in other parts of the protocol) to improve capital efficiency, which means that the collateral deposited in the vaults is not completely isolated from each other. Samyak Jain, co-founder of Jupiter, explained that the lending pools of Jupiter Lend are "isolated in a sense" because each pool has its own configuration, limits, liquidation thresholds, liquidation penalties, etc., and the re-collateralization mechanism is just to better optimize capital utilization.

Although Jupiter provided a more detailed explanation in their product documentation compared to their promotional content, objectively speaking, the mention of "risk isolation" in their early promotions indeed deviated from the general market understanding and could be seen as misleading.

Intense Battle Erupts: Kamino Launches an Attack

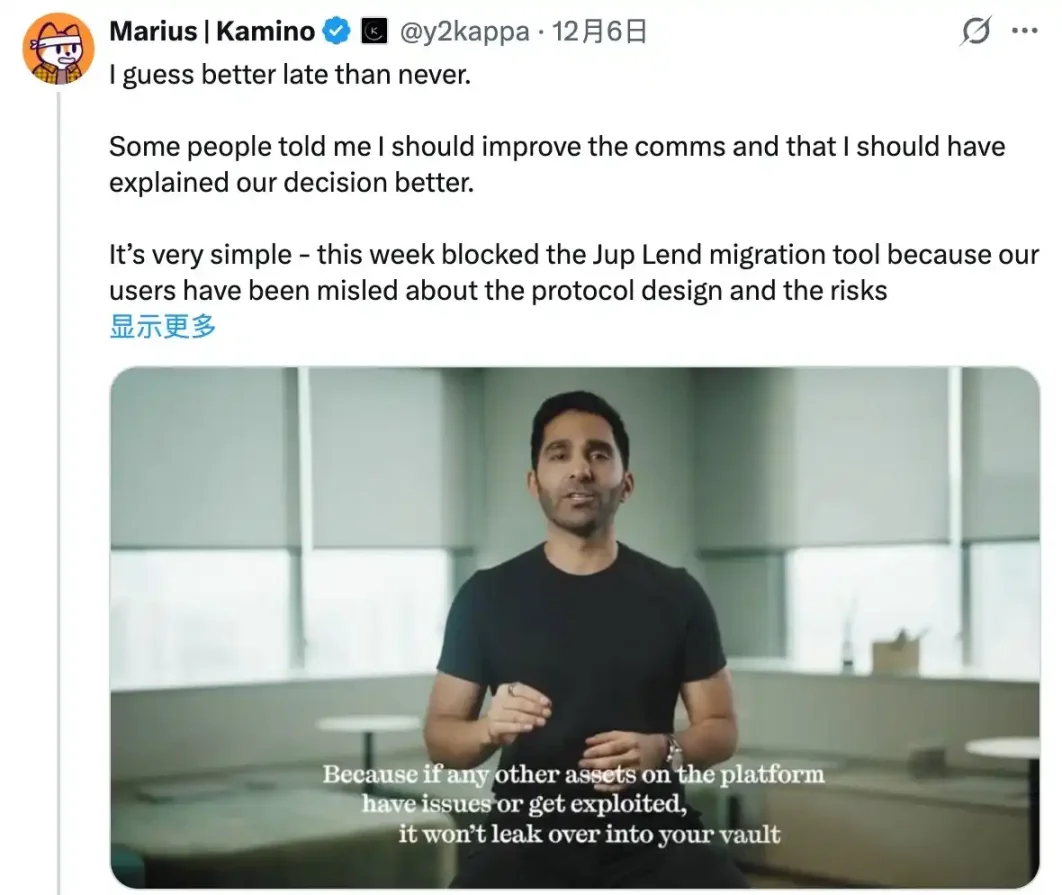

On December 6, Kamino co-founder Marius Ciubotariu took the opportunity to criticize Jupiter Lend and banned the migration tool from Kamino to Jupiter Lend.

Marius stated: "Jupiter Lend repeatedly claims that there is no cross-contamination between assets, which is completely absurd. In fact, in Jupiter Lend, if you deposit SOL and borrow USDC, your SOL will be lent to other users who are using JupSOL and INF for circular lending, and you will bear all the risks of these circular lending collapses or asset explosions. There are no isolation measures, and there is complete cross-contamination, which is contrary to the advertising and what people have been told… In both traditional finance (TradFi) and decentralized finance (DeFi), whether collateral is re-collateralized and whether there are contagion risks are important pieces of information that must be clearly disclosed, and no one should provide vague explanations about this."

After Kamino's attack, discussions surrounding the design of Jupiter Lend quickly ignited within the community. Some agreed that Jupiter was suspected of false advertising— for example, the CEO of Penis Ventures, 8bitpenis.sol, angrily accused Jupiter of openly lying and deceiving users from the start; others believed that the design model of Jupiter Lend balanced safety and efficiency, and that Kamino's attack was merely for market competition, with impure motives— for instance, overseas KOL letsgetonchain stated: "The design of Jupiter Lend achieves capital efficiency in a pool model while also possessing certain risk management capabilities of a modular lending protocol… Kamino cannot stop people from migrating to better technology."

Under pressure, Jupiter quietly deleted the early posts, but this led to a larger scale of FUD. Subsequently, Jupiter's Chief Operating Officer Kash Dhanda also came forward to admit that the team's previous claim on social media about Jupiter Lend having "zero contagion risk" was inaccurate and apologized, stating that they should have issued a correction statement at the same time as deleting the posts.

Core Conflict: The Definition of "Risk Isolation"

Considering the current opposing attitudes in the community, the fundamental disagreement seems to lie in the different definitions of the term "risk isolation" by different groups.

From the perspective of Jupiter and its supporters, "risk isolation" is not a completely static concept, and there can be some design space within it. Although Jupiter Lend does not conform to the commonly understood risk isolation model, it is also not a completely open capital pool model; while sharing a common liquidity layer that allows re-collateralization, each lending pool can be independently configured, with its own asset limits, liquidation thresholds, and liquidation penalties.

On the other hand, from Kamino and its supporters' perspective, any allowance for re-collateralization is a complete denial of "risk isolation," and as a project party, they should not deceive users with vague disclosures and false advertising.

Upper-Level Awareness: Some Fan the Flames, Others Mediate

Aside from the disputes between both parties and the community, another noteworthy point in this incident is the attitude of various upper-level stakeholders within the Solana ecosystem.

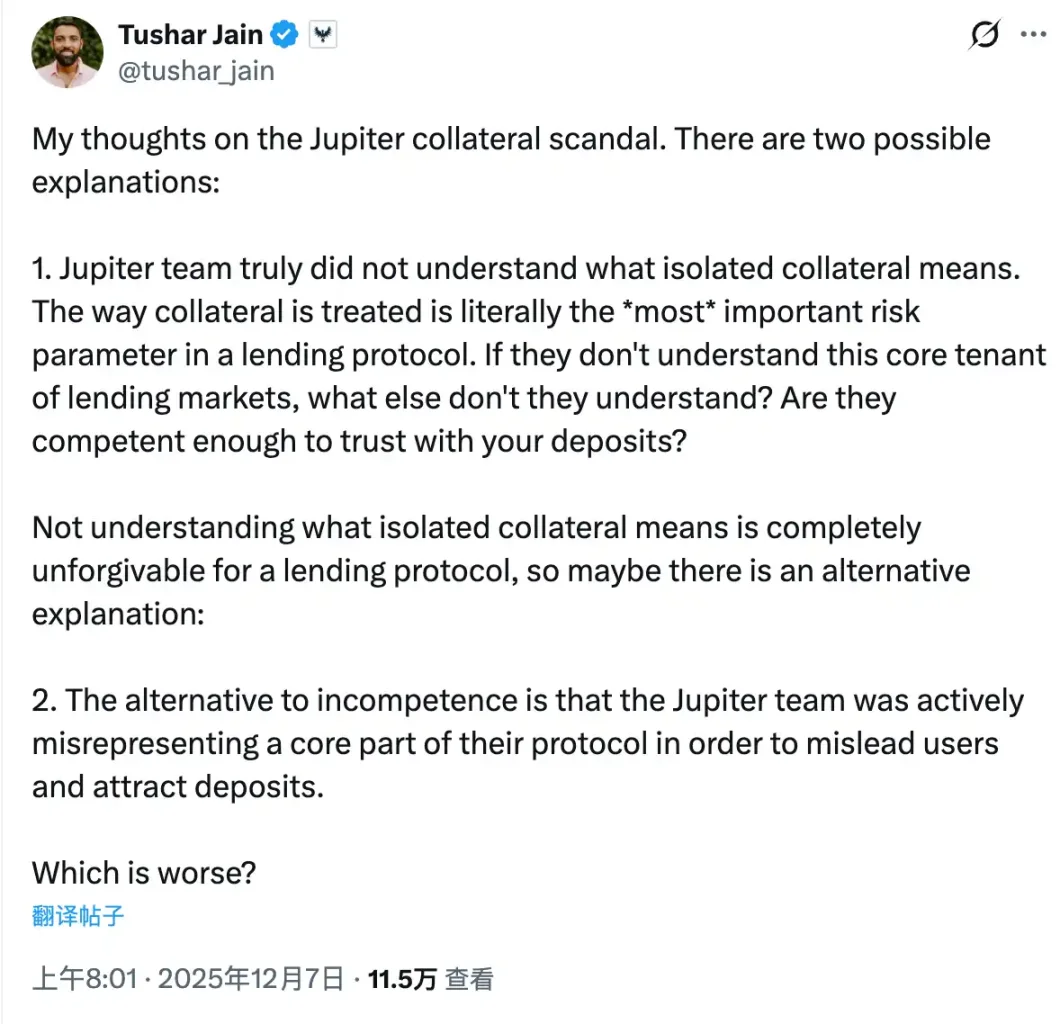

First is the venture capital fund Multicoin, which has the largest voice within the Solana ecosystem (seemingly without restraint). As an investor in Kamino, Multicoin partner Tushar Jain directly published a post questioning Jupiter, stating "either foolish or malicious, but either way, it cannot be forgiven"— objectively speaking, his comments significantly exacerbated the situation.

Tushar stated: "There are two possible explanations for the controversy surrounding Jupiter Lend. One is that the Jupiter team truly does not understand the meaning of isolated collateral. The handling of collateral is the most important risk parameter in a lending protocol. If they do not even understand this core principle of the lending market, what else do they not understand? Can their professional capabilities be trusted to safely deposit funds? For a lending protocol, not understanding the meaning of isolated collateral is completely unforgivable. The other possibility is that the Jupiter team is not incompetent but is actively misrepresenting the core parts of their protocol to mislead users and attract deposits."

Clearly, Tushar's motives are very clear, aiming to take this opportunity to help Kamino strike against its competitor.

Another important upper-level statement came from the Solana Foundation. As the parent ecosystem, Solana clearly does not want to see the two major seed players within its ecosystem overly opposed, leading to internal strife within the ecosystem.

Yesterday afternoon, Solana Foundation President Lily Liu posted on the X platform, calling on both projects to reconcile, stating: "Love you both. Overall, our lending market is currently about $5 billion, while the Ethereum ecosystem is about ten times that size. As for the traditional finance collateral market, it is countless times larger than this number. We can choose to attack each other, but we can also choose to look further— first work together to capture market share from the entire crypto market, and then jointly march into the vast world of traditional finance.

In summary— stop fighting, or Ethereum will benefit!

Underlying Logic: The Battle for Dominance in Solana Lending

Considering the data development and market environment of both Jupiter Lend and Kamino, this incident, while sudden, seems to be an inevitable collision that was only a matter of time.

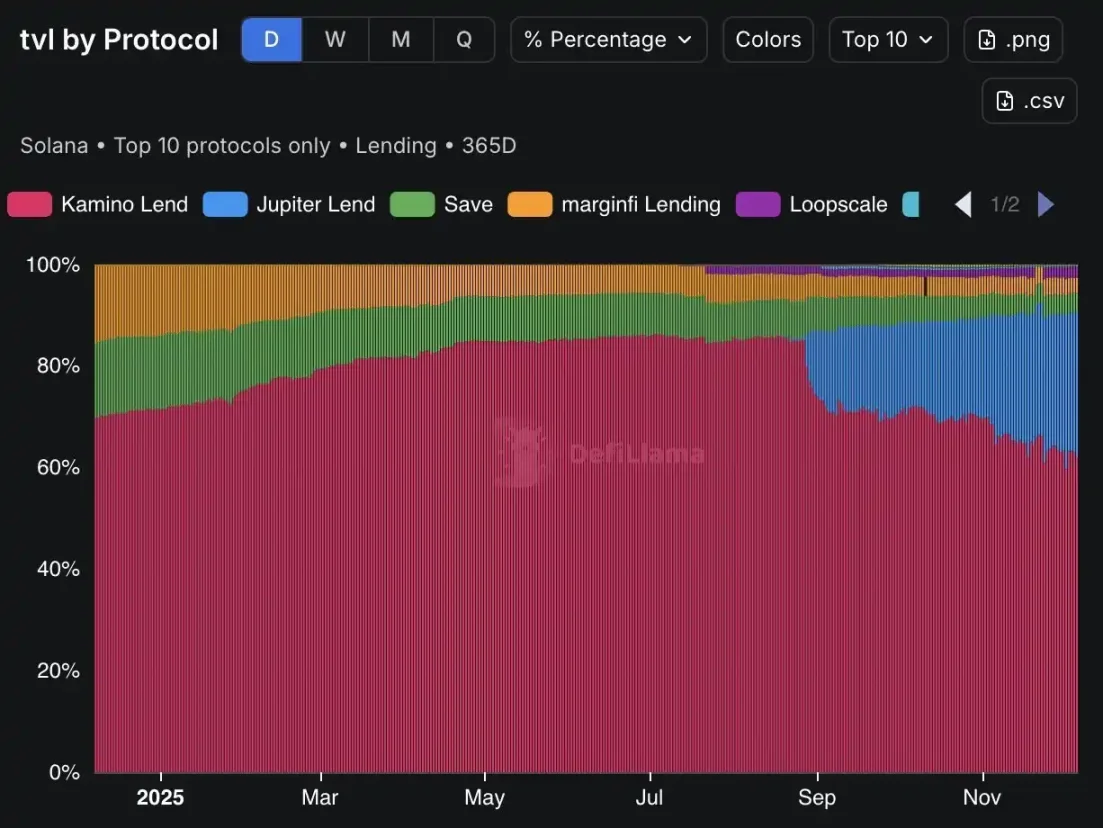

On one hand, Kamino (red in the chart below) had long held the position of the leading lending protocol in the Solana ecosystem, but since the launch of Jupiter Lend (blue in the chart below), it has captured a significant market share, becoming the only entity currently capable of challenging the former.

On the other hand, since the major market crash on October 11, market liquidity has tightened significantly, and the overall TVL of the Solana ecosystem has continued to decline; coupled with the collapse of several related projects, the DeFi market has become extremely sensitive to "safety."

When the market environment was good and incremental funds were abundant, Jupiter Lend and Kamino were relatively harmonious, as there was still profit to be made, and it seemed that they would only earn more… But as the market shifted to a competition for existing resources, the competitive relationship between the two became more tense, and safety issues became the most effective point of attack— even though Jupiter Lend has historically not had any security failures, the mere suspicion in its design was enough to raise user vigilance.

Perhaps from Kamino's perspective, now is the perfect opportunity to deal a heavy blow to its opponent.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。