On December 5, 2025, the China Internet Finance Association and six other major financial industry associations jointly issued a rare "Risk Warning on Preventing Illegal Activities Related to Virtual Currencies." This document, with unprecedented clarity and comprehensive prohibitions, sets an insurmountable red line for all business activities involving virtual currencies and emerging "real-world asset tokens" within the country.

This is not an isolated industry warning. Just a week earlier, the People's Bank of China had convened a "Coordination Mechanism Meeting for Combating Virtual Currency Trading Speculation," involving 13 departments, which for the first time officially clarified that "stablecoins are a form of virtual currency."

Industry insiders generally believe that the mechanized deployment from central ministries to the synchronized execution by the seven industry associations marks a shift in China's regulation of virtual currencies from special governance to a new stage of normalized and synthesized operations, with the regulatory network tightening with unprecedented density and intensity.

This regulatory "heavy-handed" approach targets three core objectives:

First, to thoroughly clarify the illegal financial nature of virtual currencies and their variants;

Second, to order all licensed financial institutions and internet platforms to completely sever any service connections with the virtual currency industry;

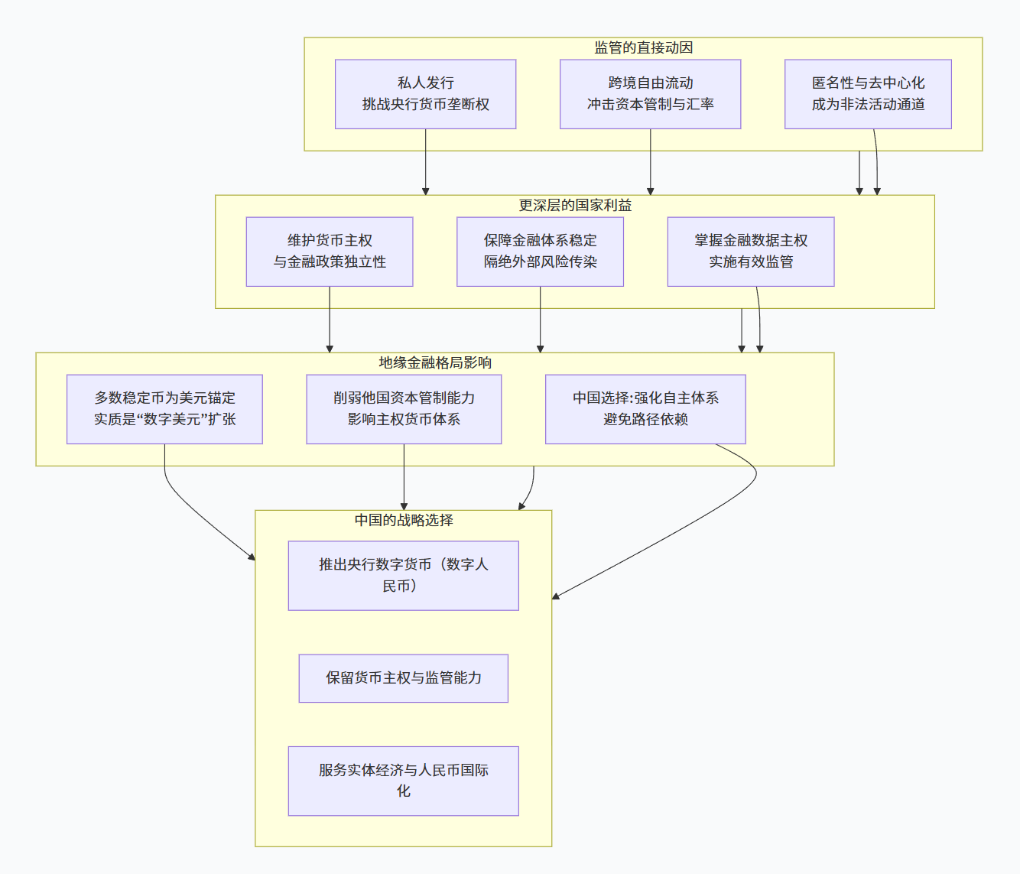

Third, to issue the most severe risk warnings to the public amid the global digital asset concept craze. Behind this is a deep national financial security logic aimed at maintaining monetary sovereignty, ensuring financial system stability, and defending the capital project management system.

1. Regulatory Upgrade: From "Prohibiting Activities" to "Cutting Off Services"

The core of this joint warning from the seven associations lies in extending regulatory firepower from focusing on virtual currency trading itself to the entire financial and technological service ecosystem that supports its operation. The document imposes highly targeted prohibitions on various market participants.

● First, various financial institutions are required to act as a "firewall." Banks and payment institutions are strictly prohibited from providing any accounts, clearing, settlement, or credit services for the issuance or trading of virtual currencies or real-world asset tokens, and it is explicitly stated that no financial support should be provided for "mining" activities. Securities, funds, futures, and other investment institutions are required not to engage in financial products and services related to these activities. This means that the channels through which virtual currencies attempt to exchange fiat currency and transfer funds via the traditional financial system have been effectively sealed.

● Second, marketing and technical services of internet platform companies are strictly prohibited. The document clearly requires that platforms must not provide marketing promotion, information release, or technical support for related illegal activities. This will greatly compress the online dissemination space for virtual currency projects within the country, striking at their development model of using social platforms for traffic generation and community operation.

● Crucially, regulatory responsibility is firmly placed on the institutions themselves. The document requires banks and payment institutions to strictly conduct customer due diligence, proactively assess and report suspicious clues. This establishes the proactive monitoring and reporting obligations of financial institutions, placing the defenses against money laundering and fraud upfront. Any institution that "knows or should know" but still provides services will be held legally accountable for their domestic staff and the institution itself.

2. Focus Extension: RWA Explicitly Prohibited for the First Time

Unlike previous risk warnings, a prominent new highlight of this joint statement is the explicit prohibition of "real-world asset tokenization" for the first time.

● Real-world asset tokenization typically refers to the act of converting rights to physical assets such as real estate, artworks, bonds, and private equity into digital tokens for financing and trading through blockchain technology. In recent years, with places like Hong Kong exploring asset tokenization "sandbox" projects, this concept has also attracted attention domestically, with some companies attempting to explore the "domestic assets + overseas issuance" model.

● This time, the seven associations pointed directly to its inherent risks, including false asset risks, operational failure risks, and speculative risks, and firmly announced: "No real-world asset tokenization activities have been approved by our financial regulatory authorities." The document further clarifies that regardless of whether the issuance and financing activities occur domestically or abroad, as long as services are provided to domestic residents, it constitutes illegal financial activity.

● This move completely closes the loophole for criminals to engage in illegal fundraising and unauthorized securities issuance under the guise of "financial technology innovation." Analysis indicates that this reflects the regulatory authority's penetrating management concept of "substance over form" in financial activities; any attempt to segment, tokenize, and publicly finance traditional financial assets without permission is prohibited.

3. Clear Definition: Reaffirming the Non-Monetary Nature of Virtual Currencies and Analyzing the Real Risks of "Stablecoins"

While expanding the regulatory boundaries, the document also clearly defines the essence of various virtual currencies, especially providing an in-depth risk analysis of the recently much-discussed "stablecoins."

● The document reaffirms that all virtual currencies, including Bitcoin, are not issued by monetary authorities, are not legal tender, do not possess legal repayment characteristics, and cannot be circulated as currency in the market. For "air coins" (such as π coins) that tout technological gimmicks, the document directly exposes their lack of substantial innovation, absence of application scenarios, and serious issues of fraud and manipulation.

● For some market participants who harbor "compliance fantasies" about stablecoins, the document cites the spirit of the central bank meeting, clearly stating that they "are a form of virtual currency." The risk warning details three major risks of stablecoins: the inability to effectively meet customer identity verification and anti-money laundering requirements, and the significant risk of being used for money laundering, fundraising fraud, and illegal cross-border fund transfers.

● This definition completely shatters the speculation that stablecoins could become "exceptions." Legal experts point out that this reflects the state's resolute defense of monetary sovereignty, capital project management, and anti-money laundering as three major security lines.

The anonymity, cross-border, and free-flowing characteristics of stablecoins (especially mainstream US dollar stablecoins) could essentially form a "parallel currency system" and fund transfer channel that operates outside of regulation, posing a direct challenge to the country's monetary sovereignty and foreign exchange management.

4. Defending Monetary Sovereignty and Responding to Global Digital Financial Competition

This comprehensive upgrade in regulation is not only driven by the urgent need for domestic risk prevention but also takes place within the larger context of global digital financial competition and the evolution of the international monetary system.

● From an international perspective, dollar-dominated stablecoins are expanding at an unprecedented pace. Research indicates that the US support for cryptocurrencies is opening up a "new dollar cycle," making it a "digital dollar liquidity" supplement to traditional financial markets, which is essentially an extension and consolidation of dollar hegemony in the digital age.

The US is attempting to strengthen its international monetary position through dollar stablecoins. In this context, allowing stablecoins backed by the dollar to circulate freely within the country would be tantamount to opening the door to the infiltration of "digital dollars."

● China's response strategy is clear and firm: on one hand, it adopts a "zero tolerance" prohibition attitude towards any private digital tokens that may erode monetary sovereignty, interfere with capital controls, or become illegal cross-border fund transfer channels; on the other hand, it accelerates the research and application of the state-backed legal digital currency—digital renminbi.

Recent measures, such as establishing an international operation center for digital renminbi in Shanghai, aim to optimize cross-border payments through a secure and controllable official digital currency system, actively participating in and shaping the future global digital payment landscape.

This "combination of blocking and unblocking" strategy reflects the foresight of top-level design. Blocking is to prevent financial risks and the disorderly impact of international capital; unblocking is to seize the initiative in the future forms of currency and open new paths for the internationalization of the renminbi in the digital age.

5. Data Security, Protecting the "Purse"

In the face of continuously evolving concepts and rhetoric, the seven associations issued a strong call to the public in their warning: to effectively enhance risk awareness and protect their "purse."

● The document reminds the public that virtual currency prices are highly volatile and are often used for speculative trading and pyramid schemes. The public should be wary of any "historical returns" displays, trading suggestions, or speculative prospect promotions related to virtual currencies or RWA tokens, and refuse to click on links and QR codes from overseas trading platforms. If any related clues are discovered, they should be promptly reported to regulatory authorities or the police.

● For ordinary investors, this means they must completely abandon any luck-based mentality. Within the country, any organization or individual engaging in the issuance, trading, exchange of virtual currencies, or providing information intermediary services for trading is considered illegal financial activity, and any resulting losses will be borne by themselves. Even if trading is conducted through overseas platforms, domestic facilitators and service providers will also face legal accountability.

6. The Era of Normalized Regulation Begins, Reconstructing Compliance Survival Logic

● The joint "show of strength" by the seven major financial industry associations, in response to the work coordination mechanism meeting led by the central bank, jointly announces the arrival of a new era of virtual currency regulation in China. This is no longer a movement-style rectification but a tightly woven protective network based on normalized mechanisms, multi-departmental synthesized operations, and covering the entire chain of capital flow and information flow.

● The signal conveyed is extremely clear: in mainland China, any commercial or financial path for virtual currencies and their various variants (including stablecoins, RWA tokens, etc.) has been completely sealed off. Any market participant, whether an institution or an individual, must completely abandon the fantasy of seeking arbitrage in the "gray area."

In the future, related regulations will only become more refined and in-depth.

For financial institutions and technology companies, the logic of survival and development must be based on an absolute separation from virtual currency businesses and a proactive fulfillment of risk monitoring responsibilities.

For the state, while strengthening the financial security defense line, how to leverage underlying technologies like blockchain to empower the real economy, and how to actively participate in and lead the digital transformation of the global financial system through innovative tools like digital renminbi, will be more important long-term issues.

This regulatory storm is not only a powerful purification of domestic financial order but also a firm declaration of China's financial sovereignty and development path in the turbulent international financial competition.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。