一些交易日就像拔河比赛,资金在一个方向上流动数小时后突然反弹回去。12月4日星期四完美地捕捉到了这种感觉。比特币和以太坊ETF投资者急剧撤回,而资金则悄然转向索拉纳和新兴的XRP ETF市场。

比特币ETF以1.9464亿美元的资金流出领跌,终止了该类别短暂的稳定期。当天的压力主要来自黑石的IBIT,流出1.1296亿美元,提醒人们该基金已成为机构需求的风向标。

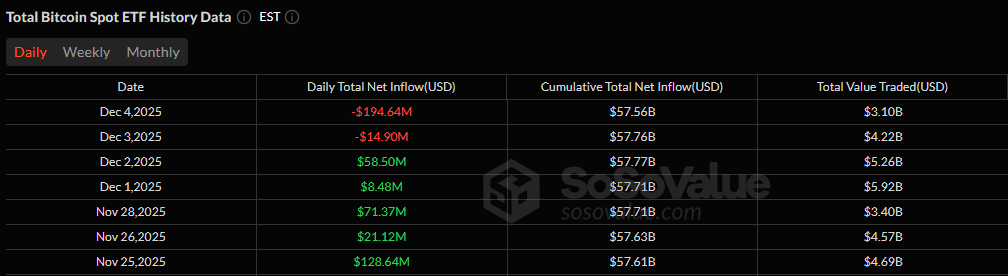

富达的FBTC紧随其后,流出5420万美元,而Vaneck的HODL损失了1434万美元。灰度的传统GBTC又记录了1013万美元的流出,Bitwise的BITB以301万美元的流出结束了这一红色潮流。尽管动荡,总交易活动达到了31亿美元,净资产仍保持在1206.8亿美元的坚实水平。

在连续五天流入后,比特币ETF经历了两天的连续流出。

以太坊ETF的表现也不佳,结束时净流出4157万美元。灰度的产品承受了大部分压力:ETHE流出3096万美元,而以太迷你信托流出2104万美元。富达的FETH又为该类别的下降增加了1792万美元。

唯一的亮点是黑石的ETHA,流入2835万美元,但这不足以抵消更广泛的回撤。尽管如此,以太坊ETF在交易额达到17.5亿美元、净资产为196.4亿美元的情况下,仍然显示出结构性韧性,即使在卖压之下。

阅读更多:以太坊ETF以1.4亿美元的流入领先,比特币和索拉纳下滑

与此同时,索拉纳ETF保持了稳定的上升节奏,流入459万美元。富达的FSOL以205万美元领跑,灰度的GSOL增加了154万美元,Bitwise的BSOL和Canary的SOLC分别贡献了73.466万美元和26.969万美元。总交易价值达到4239万美元,净资产保持在910.07万美元的坚实水平。

在市场的新领域,XRP ETF持续显著上涨,四个发行商共流入1284万美元。富兰克林的XRPZ以570万美元位居榜首,随后是Bitwise的XRP(376万美元)、灰度的GXRP(204万美元)和Canary的XRPC(134万美元)。

常见问题📉

- 为什么比特币和以太坊ETF出现大规模流出?

来自IBIT、FBTC、ETHE和FETH等旗舰基金的重磅赎回使这两个类别急剧下滑。 - 为什么索拉纳ETF在整体市场疲软的情况下仍然保持正增长?

FSOL、GSOL、BSOL和SOLC的较小但稳定的流入使该类别保持在绿色区域。 - 是什么推动了XRP ETF的新流入?

投资者向新兴山寨币ETF的轮换激发了对所有四个XRP产品的新兴趣。 - 这是否意味着加密ETF情绪的转变?

是的,资金正在从BTC和ETH转向替代领域,交易者正在多样化风险敞口。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。