The stock price has halved from its historical high, with a market value evaporating by over 60%. The once-glorious "Bitcoin whale" MicroStrategy is now standing on the fault line of a confrontation between the old and new financial systems.

MicroStrategy's stock price has plummeted from a high of about $300 in October 2025 to approximately $181 currently. This company, referred to by the market as the "Bitcoin central bank," has seen a decline of over 40% year-to-date, with a more than 60% drop in the past month.

This decline is not only remarkable in magnitude but also accompanied by a massive evaporation of market value. MicroStrategy's market capitalization has shrunk from nearly $100 billion at its peak to about $49.26 billion. Notably, the company's stock price decline far exceeds the correction in Bitcoin itself, raising questions in the market about the sustainability of its business model.

1. Liquidity Crisis Triggered by Index Exclusion

● The most direct threat facing MicroStrategy comes from the potential exclusion from the MSCI index. In an advisory document released in October, MSCI explicitly stated that it is assessing the possibility of removing "digital asset treasury companies" from its global investable market index. Such companies are defined as those holding digital assets that exceed 50% of their total assets.

● A report from JPMorgan warns that if MicroStrategy is excluded, it could trigger about $2.8 billion in passive fund outflows. If other index providers follow suit, the total sell-off could reach up to $8.8 billion.

● Analysts at TD Cowen predict more directly: "Bitcoin treasury companies like MicroStrategy will be removed from all MSCI indices in February this year." A formal decision is expected around mid-January.

2. Vulnerability of Leverage Structure

● MicroStrategy's core business model is a "debt issuance - buy Bitcoin - stock price increase - reissue debt" leverage cycle. Since 2020, the company has raised over $20 billion through the issuance of common stock, preferred stock, and convertible bonds to purchase Bitcoin.

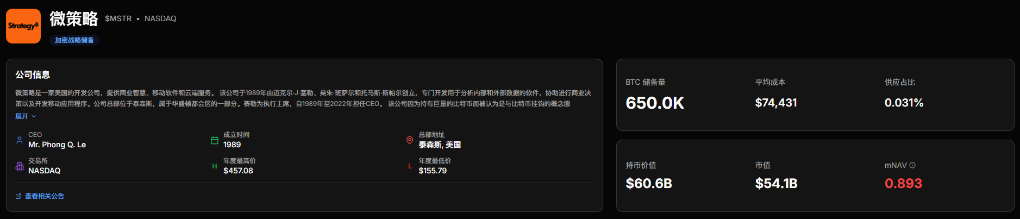

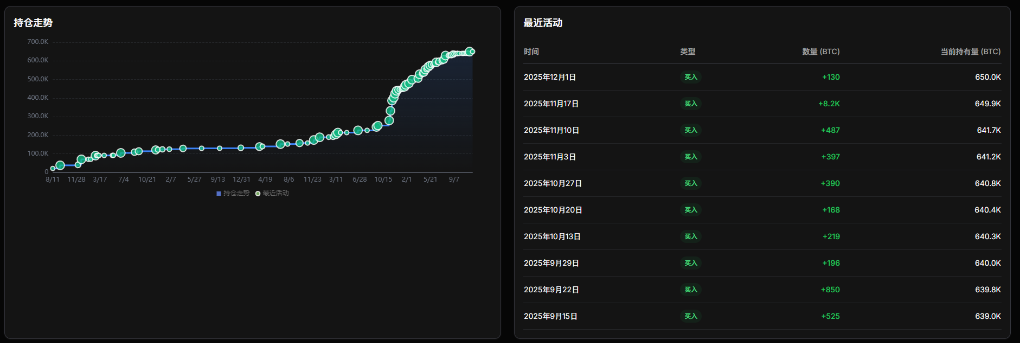

● This strategy has generated enormous profits during market upswings but has also exposed structural weaknesses during market corrections. MicroStrategy currently holds over 640,000 Bitcoins, accounting for about 3% of the total circulating supply. The average purchase cost of these Bitcoins is approximately $74,400 each.

● Although the current price of Bitcoin (around $86,000) is still above the company's average cost, the significant drop in stock price has raised concerns among investors about its financing capabilities. The company has raised $20 billion this year through tools like preferred stock STRK/STRF, achieving a S&P B- rating, but the sustainability of this high-leverage strategy in a market reversal is in question.

● More worryingly, most of MicroStrategy's financing occurred when the stock price and net asset value (NAV) were at peak levels, leading to significant unrealized losses for investors who entered at high prices.

3. Short Selling Forces on the Hunt

● Market data shows that MicroStrategy's short interest has exceeded 27.49 million shares, an increase of nearly 9% from a month ago. This short-selling pressure comes not only from investors with a pessimistic view of Bitcoin but also from a specific market hedging behavior.

● Tom Lee, chairman of BitMine, explained in a recent CNBC interview that MicroStrategy has become the most convenient way to hedge against Bitcoin: "Some can use MicroStrategy's options chain, which has extremely high liquidity, to hedge all their crypto assets."

● This dynamic makes MicroStrategy an unexpected pressure valve in the crypto market, absorbing hedging, short-selling, volatility, and market anxiety that are not closely related to its underlying Bitcoin strategy and long-term arguments.

4. Narrative Premium Erosion

● MicroStrategy's stock price has long contained a significant "faith premium." The price investors pay often corresponds to only half of the Bitcoin net value, while the other half reflects expectations of the company's founder, Michael Saylor, to continue low-interest financing and outperform the market.

● However, this premium is rapidly dissipating. Data shows that MicroStrategy's mNAV (market value to Bitcoin holdings ratio) has dropped to just above 1.1, the lowest level since the pandemic. Meanwhile, a fundamental question has emerged in the market: Why don't investors just buy Bitcoin ETFs directly?

● Bitcoin spot ETFs have surpassed $100 billion in assets under management in less than a year since their launch. These ETFs offer a purer, lower-leverage risk exposure to Bitcoin, avoiding the complex balance sheet issues faced by companies like MicroStrategy.

● When the market suddenly realizes, "Why don't I just buy Bitcoin ETFs directly?" the narrative premium of MicroStrategy could quickly evaporate, potentially leading to a "Davis Double Whammy": Bitcoin prices remain unchanged, but MicroStrategy's stock price halves due to the premium going to zero.

5. The Battleground of Old and New Currency Systems

● The crisis facing MicroStrategy is not just a dilemma for a single company but a microcosm of the conflict between old and new currency systems. On one side is the traditional system: the Federal Reserve + Wall Street + commercial banks, represented by JPMorgan; on the other side is the emerging new system: the Treasury + stablecoin system + a financial structure collateralized by Bitcoin in the long term.

● Michael Saylor transformed a mediocre software company into a Bitcoin ark, holding Bitcoin assets far exceeding the company's capacity. His bet is essentially a rebellion against the long-term devaluation of fiat currency and a proactive layout for the emerging currency system.

● In this struggle, MicroStrategy has become a key bridge—it converts the dollar and debt structure of traditional finance into a large-scale exposure to Bitcoin. If the new system rises, MicroStrategy is the core converter; if the old system strikes back, MicroStrategy is the critical node that must be suppressed.

● The cryptocurrency community has reacted strongly to MSCI's proposal and JPMorgan's analysis, with some cryptocurrency supporters publicly calling for a boycott of JPMorgan and shorting its stock. They accuse the bank of potentially "front-running," meaning they position themselves before releasing negative reports to profit from the sell-off.

This turmoil is not just about the fate of a single company but could accelerate the rotation of institutional investors' channels to gain exposure to Bitcoin, shifting from proxy stocks to more clearly regulated spot ETFs.

6. Survival Possibilities: Reversal Factors and Long-Term Prospects

● Despite facing multiple crises, MicroStrategy still has some potential reversal factors. TD Cowen analysis points out that if the company can continue executing its Bitcoin accumulation strategy, by 2027, it could hold 815,000 BTC. At that level, the embedded Bitcoin value per share could support a target price of $585, indicating about a 170% upside from current levels.

● The company is also actively taking measures to address liquidity pressures. MicroStrategy recently announced the establishment of a $1.44 billion dollar reserve specifically to support preferred stock dividend distributions and debt costs. This move should reassure cautious investors that the company can maintain dividends at current levels for up to two years.

● Additionally, the prospect of potentially being included in the S&P 500 index could expand institutional holdings and stabilize the inflow of funds into the stock. Further regulatory clarity surrounding Bitcoin could further enhance investor confidence.

● Michael Saylor himself has remained relatively calm about the current crisis, emphasizing that the company is an operating business with a $500 million software business, using Bitcoin as "productive capital." In a recent statement, he repeatedly highlighted its innovative financial products, including structured Bitcoin credit tools like STRK and STRC.

The plunge of MicroStrategy is not an isolated event but a local skirmish in a grand currency war. Michael Saylor's Bitcoin ark is navigating dangerous waters between traditional finance and the crypto world. It could become a connector for the new system or a victim hunted by the old order.

The outcome may profoundly influence the flow of global capital and the form of currency in the next decade.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。