Reuters first reported the development, citing comments from WLFI co-founder and CEO Zach Witkoff during Binance Blockchain Week in Dubai.

Witkoff said WLFI will introduce its RWA products at the start of the first quarter, positioning them as a major milestone for the platform. According to the report, the launch centers on tokenizing assets such as oil, gas, and timber, with potential expansion into categories like real estate. Reporters Federico Maccioni and Utkarsh Shetti detailed that USD1, WLFI’s stablecoin, will function as the settlement layer for these onchain transfers.

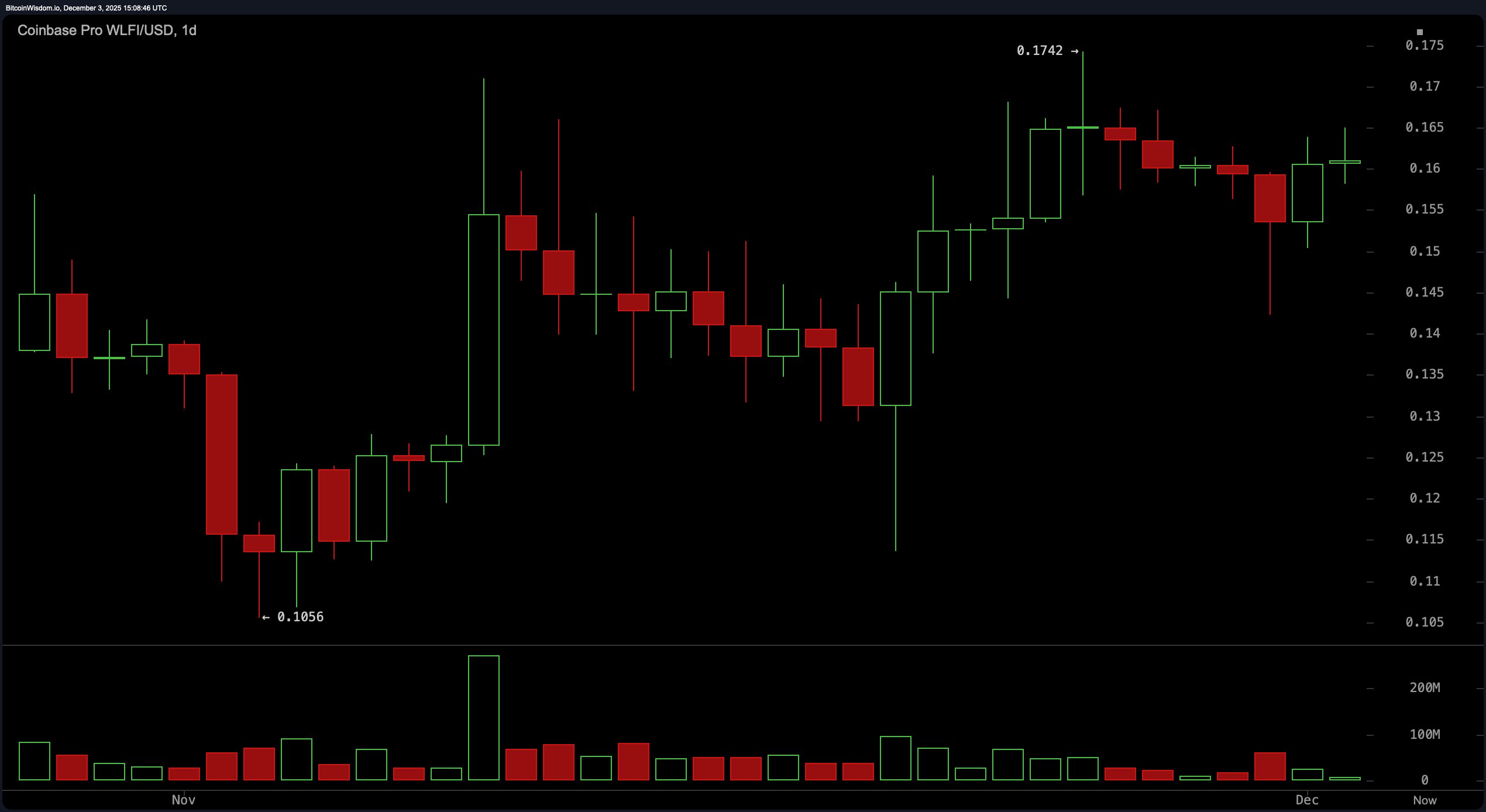

WLFI/USD 1-day chart via Coinbase Pro on Dec. 3, 2025.

The rollout marks a shift from WLFI’s early focus on USD1—a stablecoin that reached a market value of roughly $2.75 billion as of Dec. 3, 2025—to a broader strategy aimed at linking blockchain settlements with traditional finance asset classes. The company is backed by members of President Trump’s family, a dynamic that has attracted public attention and scrutiny.

WLFI also plans to introduce payments-oriented products, including a debit card and a broader transaction ecosystem, as early as 2026. Executives previously teased these features in September, framing them as extensions of the platform’s goal to make tokenized and stablecoin-based payments widely accessible.

Read more: Bitcoin Steadies as Markets Brace for Fed Shake-Up

Market reaction to the announcement has been mixed. The WLFI token climbed as much as 30% over the past 30 days amid token burns and large investor accumulations before retreating alongside broader market softness. Social media commentary reflected both optimism around the RWA initiative and caution about long-term regulatory considerations.

WLFI’s success will depend on liquidity, regulatory clarity, asset selection, and market adoption. While the initiative could accelerate tokenization efforts across the sector, key questions will be focused around custody models, frameworks, and reserve transparency for both USD1 and its upcoming tokenized assets.

- What is WLFI planning to launch in January 2026?

WLFI will introduce tokenized real-world asset products backed by its USD1 stablecoin. - Which assets does WLFI plan to tokenize first?

The initial lineup includes oil, gas, and timber, with potential expansion into other asset classes. - Where was WLFI’s announcement made?

WLFI’s CEO revealed the launch plans during Binance Blockchain Week in Dubai. - How has the market reacted to WLFI’s RWA news?

The WLFI token saw gains before correcting alongside broader market conditions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。