撰文:叶桢

来源:华尔街见闻

周二,比特币等加密货币引领风险资产反弹,这背后是全球资产管理巨头先锋集团的一次重大转向。

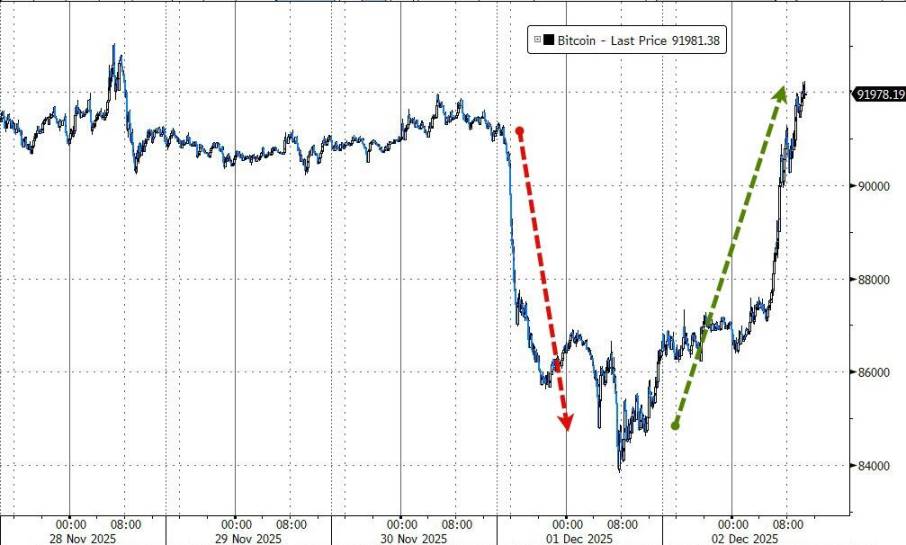

在经历了周一的暴跌后,比特币周二强势收复 9 万美元关口,单日涨幅超 6%,以太坊重回 3000 美元上方。

与此同时,特朗普暗示其经济顾问 Kevin Hassett 为潜在的美联储主席人选,叠加日债拍卖企稳,令美债收益率和美元指数承压微跌,市场流动性焦虑缓解,推动全球风险资产显著反弹。

先锋集团周二确认,客户现可通过其经纪平台购买贝莱德 iShares 比特币信托 ETF 等第三方加密货币 ETF 和共同基金。这是这家以保守投资理念著称的资管巨头首次向 800 万自营经纪客户开放加密货币投资渠道。

彭博分析师 Eric Balchunas 指出,这是典型的「先锋效应」,在先锋转向后的首个交易日,美股开盘时段比特币随即大涨,贝莱德的 IBIT 在开盘 30 分钟内交易量即突破 10 亿美元,显示出即使是保守投资者也希望在投资组合「加点刺激」。

先锋此前坚决拒绝涉足加密货币领域,认为数字资产过于投机且波动性过高,不符合其长期平衡投资组合的核心理念。如今的转向反映出持续的零售和机构需求压力,以及对错失快速增长市场机遇的担忧。

而在贝莱德凭借比特币 ETF 大获成功之际,坚守「博格主义」的先锋在这一新兴资产类别上的松动,将对未来的资金流向产生深远影响。

先锋集团的重大变化:从「抵制」到「开放」

此次市场情绪反转的核心驱动力,源自全球第二大资产管理公司先锋态度的转变。据彭博确认,从周二开始,先锋允许拥有经纪账户的客户购买和交易主要持有加密货币的 ETF 和共同基金(如贝莱德的 IBIT)。

这一决定是一个明显的妥协。自 2024 年 1 月美国批准比特币现货 ETF 上市以来,先锋一直以「数字资产波动性大、投机性强,不适合长期投资组合」为由,禁止在其平台上交易此类产品。然而,随着比特币 ETF 吸引了数十亿美元的资产,且贝莱德的 IBIT 规模即便在回撤后仍高达 700 亿美元,来自客户(无论是散户还是机构)的持续需求迫使先锋改变立场。

此外,先锋现任 CEO Salim Ramji 曾是贝莱德的高管且是区块链技术的长期倡导者,他的上任也被视为此次政策转向的内部因素之一。先锋高管 Andrew Kadjeski 表示,加密货币 ETF 已经经受住了市场波动的考验,且管理流程已经成熟。

不过,先锋仍保持了一定的克制:公司明确表示目前没有计划推出自己的加密货币投资产品,且杠杆类和反向类加密产品仍被排除在平台之外。

双雄争霸格局面临重新洗牌

先锋此举,将其与贝莱德之间长达三十年的「双雄争霸」再次推向台前。据《ETF 全球投资第一课》一书介绍,两家公司代表着截然不同的投资理念和商业模式。

贝莱德代表的是「术」。 创始人 Larry Fink 出身于顶尖债券交易员,贝莱德的初心是「做更好的交易」。其核心竞争力在于强大的风控系统「阿拉丁(Aladdin)」以及全品类的产品体系。贝莱德旗下的 iShares 拥有超过 400 个 ETF,覆盖全球各类资产。对贝莱德而言,ETF 是满足客户交易需求和构建组合的工具,因此它并不排斥任何资产类别。无论是推动 ESG 投资以规避「气候风险」,还是率先推出比特币现货 ETF(IBIT 上市 7 周规模即破百亿美元,不仅远超先锋预期,更打破了黄金 ETF 耗时 3 年的记录),贝莱德始终致力于做市场上最好的「卖铲者」。

先锋坚守的是「道」。 尽管创始人 John Bogle 已逝,但其理念仍是先锋的灵魂:投资者的长期最佳选择是持有覆盖广泛市场的指数,而先锋的使命是极致压低成本。得益于独一无二的「共同所有制」结构,先锋的费率极低,旗下仅有 80 多个 ETF,且主要集中在 VOO、VTI 等宽基指数上。其客户群体主要是对费率敏感的长期投资者和投顾。

两家公司的差异在现货比特币 ETF 上体现得淋漓尽致。贝莱德早在 2023 年 6 月就提交申请,其 IBIT ETF 上市 7 周后资产规模就突破百亿美元,创下比黄金 ETF GLD 快 3 年的纪录。而先锋直到本周才允许客户交易第三方加密货币产品。

市场是现实的。随着先锋在美国 ETF 市场的份额不断逼近甚至有望超越贝莱德,现货比特币 ETF 成为了关键变量。面对贝莱德在加密资产领域取得的巨大先发优势,以及客户对于多元化配置的强烈需求,先锋最终选择在交易渠道上松口。

先锋的加密货币政策调整虽然姗姗来迟,但其 800 万自营客户的潜在需求不容小觑。这一变化不仅可能影响短期资金流向,更可能重塑两大巨头的长期竞争格局。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。