Original | Odaily Planet Daily (@OdailyChina)

In the past 48 hours, the crypto market has once again dramatically reminded everyone: here, "plummets" and "bull returns" are always just a trading day apart. BTC has rebounded strongly to around $93,000, with a 24-hour increase of nearly 7%; ETH has returned above $3,000; and SOL has also re-touched $140.

After the U.S. stock market opened, the crypto sector also showed a broad increase. The stock price of ETH treasury company BitMine rose by 11.6% in 24 hours, while BTC's largest corporate holder, Strategy, saw a 6.2% increase in its stock price over the same period.

In terms of derivatives, the total amount of liquidations across the network in the past 24 hours reached $430 million, with long positions liquidated at $70 million and short positions liquidated at $360 million, primarily short positions. The largest single liquidation occurred on Bybit - BTCUSD, with a position value of $13 million.

Regarding market sentiment, according to Alternative.me data, the cryptocurrency fear and greed index has risen to 28 today. Although it is still in the "fear" range, it has significantly improved compared to yesterday's 23 (extreme fear), indicating a slight warming in the market.

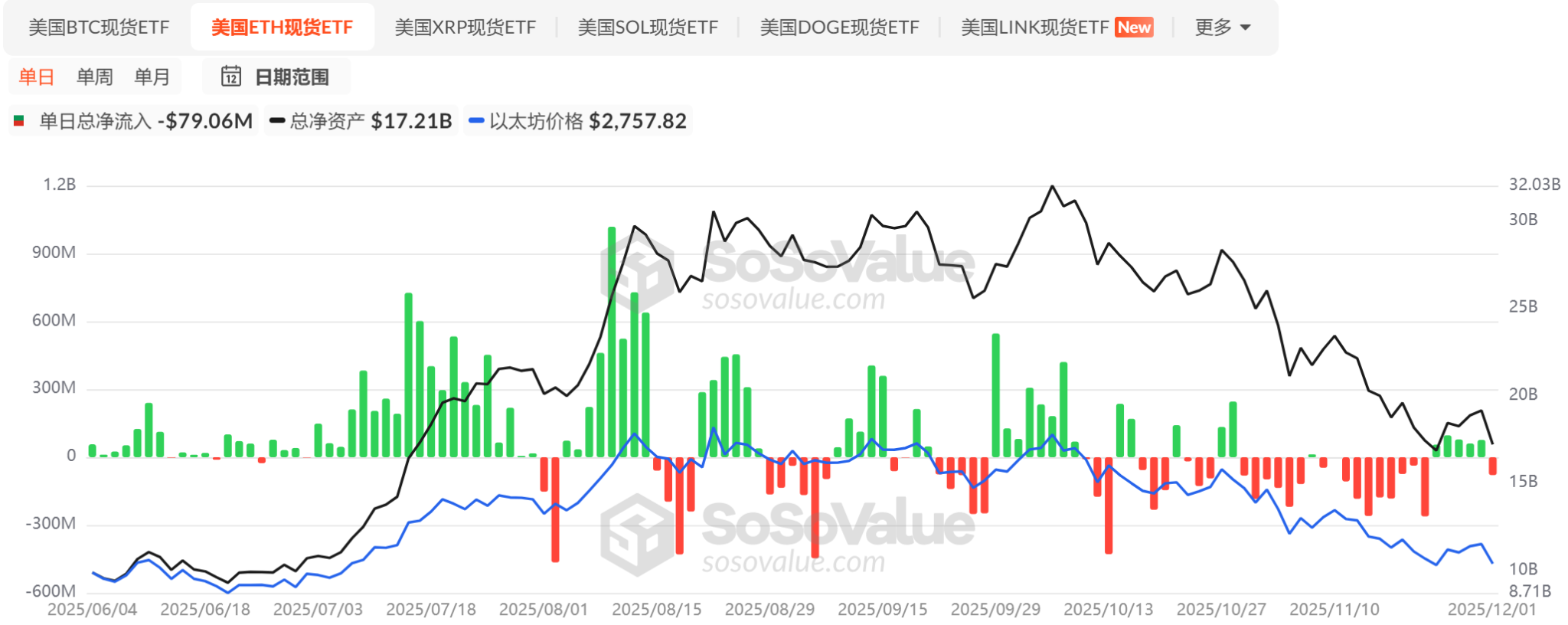

In terms of capital inflow, according to sosovalue.com data, after four weeks of significant outflows, BTC spot ETFs have finally seen a slight inflow for four consecutive trading days; however, ETH spot ETFs have turned into a net outflow of $79 million after five consecutive inflows. Overall, the current capital inflow momentum is still relatively weak.

At the same time, altcoin ETFs are accelerating their approval process under policy incentives, with ETFs for XRP, SOL, LTC, DOGE, and others being listed in quick succession. For more details, read "Altcoin ETFs Welcome a Wave of Listings, How Do the First Batch Perform in the Market?." Among them, the XRP ETF, although listed later than the SOL ETF, has performed even better. Its current total net inflow has reached $824 million, surpassing the SOL ETF, making it a "representative work" of altcoins in the short term.

On the surface, the recent surge in the crypto market seems to lack significant direct benefits, but in fact, the forces beneath the surface are accumulating simultaneously—from interest rate expectations to liquidity shifts, and the restructuring of institutional allocation logic, each of these factors is enough to influence market direction.

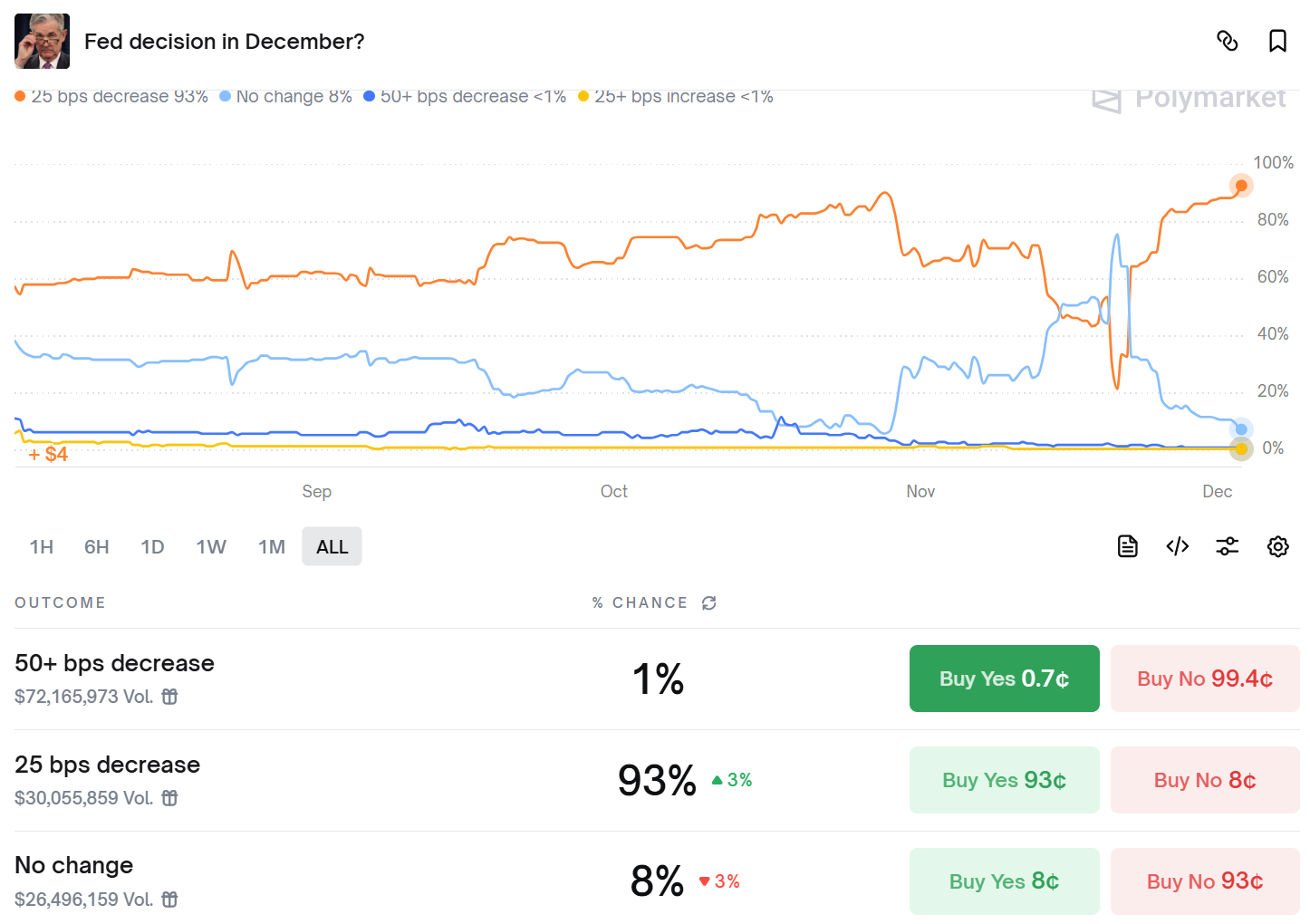

Predicted Reversal: December Rate Cut Almost Certain

Analysts from Goldman Sachs' Fixed Income, Currency, and Commodities (FICC) division believe that a rate cut by the Federal Reserve at the upcoming December meeting has become almost certain. The Global Research Department of Bank of America also stated that given the weak labor market conditions and recent comments from policymakers suggesting an early rate cut, it is now expected that the Federal Reserve will cut rates by 25 basis points at the December meeting. Previously, the bank had expected the Federal Reserve to keep rates unchanged at the December meeting. Meanwhile, the bank currently predicts that there will be further rate cuts of 25 basis points in June and July 2026, with the final rate dropping to the range of 3.00%-3.25%.

Polymarket data shows that the probability of the Federal Reserve cutting rates by 25 basis points next week has risen to 93%, with a total trading volume in the prediction pool reaching $300 million.

Liquidity Shift: End of QT and $13.5 Billion Injection

A more critical signal comes from the Federal Reserve's balance sheet operations. QT (Quantitative Tightening) officially ended on December 1, having previously withdrawn over $2.4 trillion in liquidity from the system, stabilizing the Federal Reserve's balance sheet at around $6.57 trillion.

Notably, on the same day, the Federal Reserve injected $13.5 billion in liquidity into the market through overnight repurchase agreements, marking the second-largest single-day injection since the pandemic, aimed at alleviating short-term funding pressures for banks. However, this is not quantitative easing (QE), but rather temporary liquidity support.

Powell's Successor: Political Variables Before Christmas

In addition to liquidity and interest rates, another clue affecting market sentiment comes from politics. As Powell's term is set to end in May next year, the search for the next Federal Reserve chair has fully commenced, with five candidates vying for what may be the most important position in the U.S. economy. The finalists include Federal Reserve Governor Christopher Waller, Michelle Bowman, former Federal Reserve Governor Kevin Warsh, BlackRock's Rick Rieder, and the Director of the White House National Economic Council, Kevin Hassett. U.S. Treasury Secretary Yellen, who oversees the selection process, stated last week that Trump may announce his nominee before the Christmas holiday.

Insiders indicate that Trump trusts Hassett, believing that he aligns with him on the willingness to push the central bank for more aggressive rate cuts. Hassett has stated that he would accept the position if invited.

Asset Management Giants Shift: Crypto ETFs Officially Enter "Mainstream Wealth Management"

In recent years, traditional giants like Vanguard and Merrill Lynch have kept their distance from crypto ETFs—not because they don't understand, but because they "don't want to take risks." However, this week, as Vanguard and Merrill announced the expansion of customer access to crypto ETFs, and Charles Schwab plans to open Bitcoin trading in the first half of 2026, this landscape has finally begun to shift.

Importantly, the traditional institutions' style has always been "better to miss out than to step on a landmine." Their easing is not a short-term trading signal but a long-term strategic shift. If these institutions allocate just 0.25% of their funds to BTC, it would mean approximately $75 billion in structural incremental buying over the next 12–24 months. Coupled with the easing of monetary conditions, strong growth is expected in 2026.

Moreover, one of the largest financial institutions in the U.S., Bank of America, has allowed wealth advisors to recommend allocating 1%–4% of crypto assets to clients starting January 2025, with the first recommended assets including IBIT, FBTC, BITB, and BTC—this means BTC has officially entered the "standard option" list for traditional wealth management in the U.S. This move aligns Bank of America with major institutions like BlackRock and Morgan Stanley's wealth management platforms. For Wells Fargo and Goldman Sachs, which have been slow to act, industry pressure is rapidly accumulating.

Conclusion

The rebound in this market is not driven by a single positive factor but rather resembles a resonance of multiple macro clues at the same time: clear rate cut expectations, liquidity returning, political variables approaching, and asset management giants shifting. More importantly, crypto assets are moving from "being allowed to trade" to "being recognized for allocation," which will lead crypto assets into a more sustainable capital-driven cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。